Right-sizing Compensation Programs for Carve-outs to Stand-alone Companies: Resisting the Urge to Cut and Paste

The Role of Human Resources and Total Rewards in Sell-side Transactions

Transactions can be a time of uncertainty and stress for leaders, as they are called upon to provide guidance and make decisions in accelerated timeframes based on limited information and support. Take it a step further for the Human Resources (HR) leader, who must perform these activities while wearing two hats: one for the HR function and another for the entire company. As one of the company’s largest expenses, total rewards programs contribute to the HR Leader playing a significant role throughout the transaction process and can sometimes even be a transaction dealbreaker without proper HR due diligence. Accordingly, HR leadership can benefit from an advisor knowledgeable and experienced in deal-related compensation structures and issues.

The extent to which compensation programs are impacted in a sell-side transaction typically depends on the post-separation strategy: Sale to another company or private equity (PE) firm? Operate as a stand-alone private company? Go public via an Initial Public Offering (IPO)? If the strategy is to sell to another company or be integrated with another PE portfolio company, the primary focus for compensation is typically retaining and managing talent between the announcement and the transaction close. However, if the strategy is for the separated entity to function as a stand-alone company (public or private), the role for the Total Rewards leader should include formulating the go-forward compensation strategy and programs for the new company.

Why “Copy and Paste” Is Not a Good Approach to Total Rewards Strategy for a Stand-alone

A common inclination for sellers during the separation planning process is to simply replicate the existing compensation programs and practices for the newly separating entity (NewCo). Whereas this approach may be appropriate when integrating into a buyer, it may lead to broader challenges for a stand-alone company that could ultimately inhibit NewCo’s achievement of deal objectives and potentially erode value.

A stand-alone NewCo will have different business priorities and strategy than the parent company, which may require different types of skills and expertise to successfully execute that strategy. The markets for that specific talent – which could be a combination of geographic-, industry- and/or skill-based – may also be different than the parent company. Accordingly, a stand-alone NewCo will need to develop its HR strategy and programs to successfully attract, retain and motivate that specific workforce vis-à-vis the markets in which it competes for talent. That strategy carries down through the types of compensation programs which are compelling to the employees.

Furthermore, a stand-alone NewCo, which may be smaller in scale than the parent company, may not have the infrastructure or resources to maintain the parent company compensation programs. Technology and/or human resources that were available at the parent company may not be affordable for the stand-alone company to manage complex compensation structures or processes. Some examples may include:

- If NewCo would no longer have access to the parent company’s equity administration platform and would need to acquire and implement its own solution to manage an equity incentive plan or employee stock purchase program.

- If NewCo does not have sufficient budget for internal headcount to manage complex compensation structures, systems or processes that were routinely managed in the parent company and may find that outsourcing or simplifying are more effective alternatives.

Since these challenges will not be unique to compensation, Total Rewards should coordinate with the other HR workstreams to identify post-close resources and solutions that align with the overall stand-alone NewCo HR strategy and operating model.

Early Planning Makes for Smoother Execution

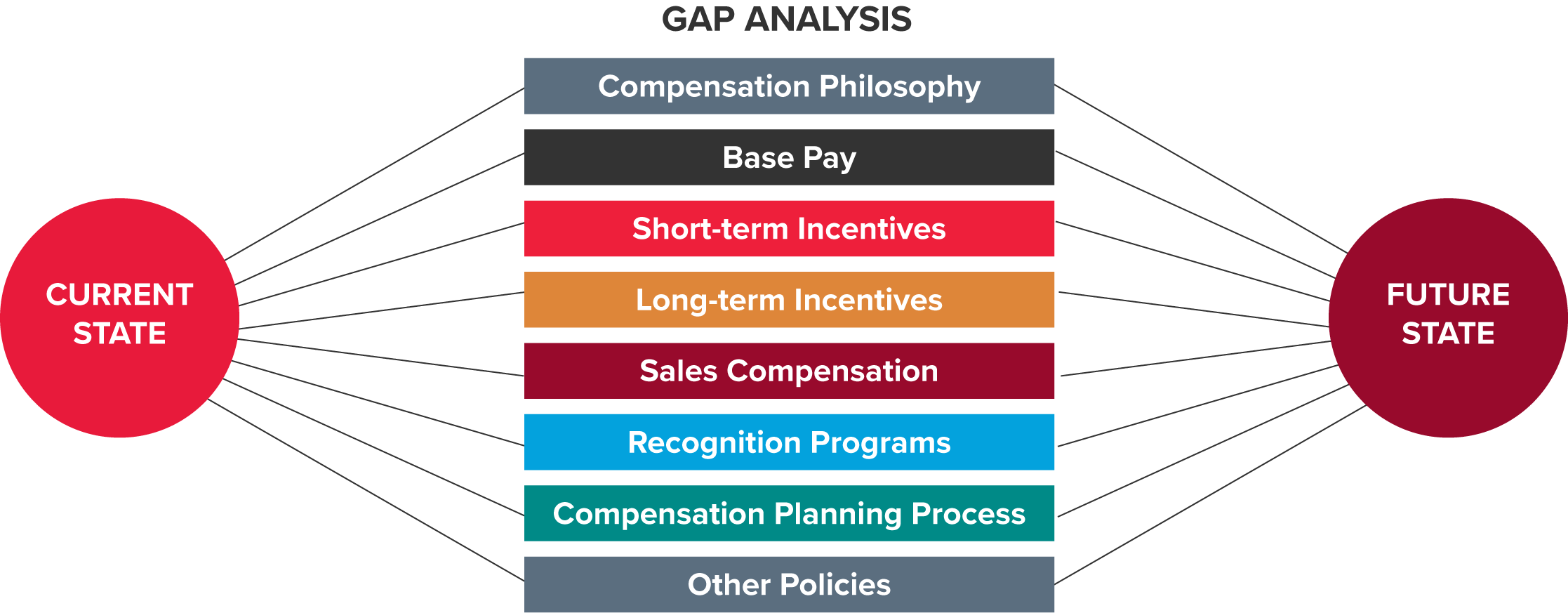

An initial step in the separation planning phase should be to catalog and evaluate current compensation programs against primary separation objectives and identify potential issues. This process should also include the infrastructure associated with current compensation programs from a people, technology and process perspective. The current state can then be compared against desired future state compensation strategy and structure to identify gaps and specific recommendations/actions to address those gaps – including marketplace benchmarking, plan (re)design and associated transition strategies to align employees to the future state structure.

Once future state and transitional decisions are finalized, the Total Rewards leader should develop a roadmap of activities, milestones, and timelines to implement the new compensation structure. The roadmap is also the primary tool for the Total Rewards leader to manage (and course correct, where needed) expectations, resources and impacts associated with the major compensation related decisions for the stand-alone company.

Don’t Forget the Employees

Human capital is a fundamental piece to most transactions. Once the transaction is announced, employees will be concerned about how their job and their compensation will be impacted by the transaction. Separation planning for the Total Rewards leader should include a communication strategy for any compensation related actions, including:

- Any changes to job architecture associated with the new organization structure.

- Overview of compensation strategy and how it ties to business objectives.

- Summaries of new/revised compensation plans (salary ranges, incentive plans, etc.).

- Changes to impacted employees and timing.

- Where to find additional information (e.g., HR Business Partners, employee portal, etc.).

Touchpoints with employees can go a long way to retaining and engaging the workforce, even if just to say the company is currently working through the post-close programs, policies and practices and will continue to share information as decisions are finalized. Compensation and benefits are a few of the topics of highest concern among employees, so more communication (even if the company does not have all the answers) is better than not communicating.

How Total Rewards Leaders Can Support a Successful Transaction

Thoughtful planning and communication can position the Total Rewards team for smoother compensation plan administration upon transaction close. Below are several critical success factors for the Total Rewards leader during the separation process:

- Clarify primary short- and long-term business objectives and line of sight to those objectives among stand-alone employee groups.

- Identify the market(s) for talent in NewCo to inform compensation strategy and plan design.

- Prioritize talent segments and the need for retention bonuses to “lock in” critical stand-alone company roles/individuals through the transaction.

- Connect with other HR, Finance, Legal, and Separation Management Office (SMO) colleagues regularly to socialize and gain buy-in on compensation-related milestones, decisions, costs and risks as part of the overall separation planning process.

- Communicate, communicate, communicate to employees.

BDO’s Global Employer Services practice can support companies with compensation advisory services as part of the separation planning process. We help companies conduct separation compensation assessments, understand competitive pay levels and practices in new talent markets and perform stand-alone company compensation plan design (salary structures, incentive plans, compensation administration guidelines, etc.).

SHARE