New Reporting Requirements for 2021 Partnership and S Corporation Returns

Beginning with the 2021 tax year, certain partnerships and S corporations must use Schedules K-2 and K-3 to report items of international tax relevance to their partners and shareholders. Generally, Schedules K-2 and K-3 replace reporting that was previously done on Box 16 of Schedule K and K-1 and streamline reporting of certain items that historically would have been represented on footnotes or attachments to Schedule K-1.

Based on initial IRS guidance, partnerships and S corporations that had “items of international tax relevance (typically, international activities or foreign partners)” would be required to file the Schedules K-2 and K-3. The Schedules K-2 and K-3 are divided into multiple “Parts,” each of which have their own filing instructions and guidance on how to determine whether that particular “Part” is relevant or required to be completed. Generally, in most cases, the presumptions in the IRS guidance favors filing the schedules where there is any uncertainty, e.g., when the identity or status of certain direct or indirect partners cannot be determined.

On January 18, the IRS released additional instructions and clarifications for Schedules K-2 and K-3, specifically in relation to who must file:

- “A partnership with no foreign source income, no assets generating foreign source income, and no foreign taxes paid or accrued may still need to report information on Schedules K-2 and K-3. For example, if the partner claims a credit for foreign taxes paid by the partner, the partner may need certain information from the partnership to complete Form 1116. Also, a partnership that has only domestic partners may still be required to complete Part IX when the partnership makes certain deductible payments to foreign related parties of its domestic partners. The information reported in Part IX will assist any domestic corporate partner in determining the amount of base erosion payments made through the partnership, and in determining if the partners are subject to the Base Erosion and Anti-Abuse Tax.”

Therefore, many partnerships and S corporations that have only domestic activities, or only domestic activities and domestic partners, may be required to file Schedules K-2 and K-3 for the 2021 tax year. Unless the reporting partnership can establish with certainty that it does not have direct or indirect foreign partners, direct or indirect corporate partners, or domestic partners who may file Form 1116 or 1118, the reporting partnership will be required to presume their partners have a filing requirement and therefore should complete the relevant Parts of Schedules K-2 and K-3.

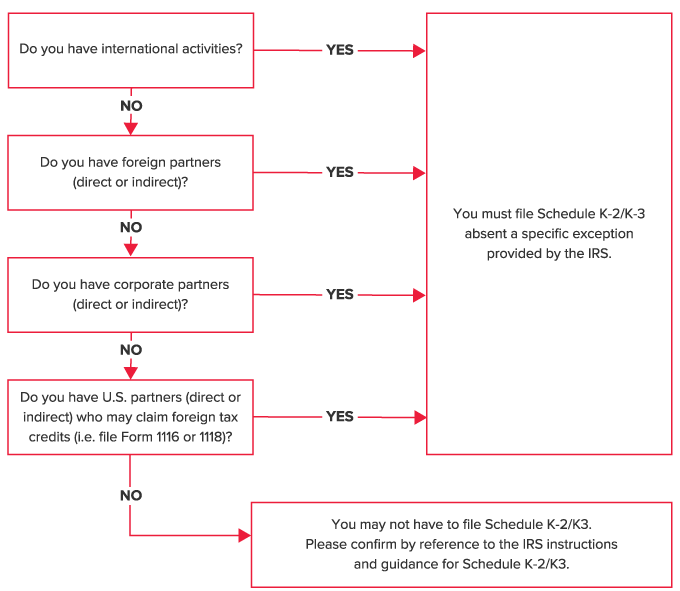

Schedules K-2 and K-3: Who Must File

This decision tree can be used as a general guide for determining whether you meet the Schedules K-2 and K-3 filing requirements:

Generally, a partnership or S corporation would need to meet an exception to specific Parts of the form to be relieved of filing those Parts of Schedules K-2 and K-3. Accordingly, such taxpayers may wish to plan to file Schedules K-2 and K-3, unless it can be affirmatively confirmed whether a specific exception to filing for the relevant Parts of Schedules K-2 and K-3 has been met.

On February 16, 2022, the IRS released several FAQs providing some additional guidance in relation to Schedules K-2 and K-3. The FAQs confirm that in many instances, a partnership or S corporation with no foreign partners, foreign source income, no assets generating foreign source income and no foreign taxes paid or accrued may still need to report information on Schedules K-2 and K-3.

The IRS FAQs also provide an additional exception for tax year 2021 to filing the Schedules K-2 and K-3 for certain domestic partnerships and S corporations. To qualify for this exception, the following must be met:

- In tax year 2021, the direct partners in the domestic partnership are not foreign partnerships, foreign corporations, foreign individuals, foreign estates, or foreign trusts.

- In tax year 2021, the domestic partnership or S corporation has no foreign activity, including foreign taxes paid or accrued or ownership of assets that generate, have generated, or may reasonably expected to generate foreign source income (see Section 1.861-9(g)(3)).

- In tax year 2020, the domestic partnership or S corporation did not provide to its partners or shareholders nor did the partners or shareholders request the information regarding (on the form or attachments thereto):

- Line 16, Form 1065, Schedules K and K-1 (line 14 for Form 1120-S), and

- Line 20c, Form 1065, Schedules K and K-1 (Controlled Foreign Corporations, Passive Foreign Investment Companies, 1120-F, Section 250, Section 864(c)(8), Section 721(c) partnerships, and Section 7874) (line 17d for Form 1120-S).

- The domestic partnership or S corporation has no knowledge that the partners or shareholders are requesting such information for tax year 2021.

If a partnership or S corporation qualifies for this exception, the domestic partnership or S corporation does not need to file Schedules K-2 and K-3 with the IRS or with its partners or shareholders. However, if the partnership or S corporation is subsequently notified by a partner or shareholder that all or part of the information contained on Schedule K-3 is needed to complete their tax return, then the partnership or S corporation must provide the information to the partner or shareholder. If a partner or shareholder notifies the partnership or S corporation before the partnership or S corporation files its return, the conditions for the exception are not met and the partnership or S corporation must provide the Schedule K-3 to the partner or shareholder and file the Schedules K-2 and K-3 with the IRS.

Preparing for Reporting

Heading into the filing season for 2021 tax returns, it is important to note the following:

- Unless an entity filing a 1065, 1120-S or 8865 meets an exception, assume it will be required to prepare the Schedules K-2 and K-3.

- Expect a substantial amount of additional time needed to determine the parts of the schedules required, the information needed, and if that information is available.

Further, e-filing requirements for Schedules K-2 and K-3 will not be available until late March. Please note, on January 18 the IRS released additional instructions for the Schedules K-2 and K-3. Those updates are not incorporated into the 2021 instructions.

SHARE