Manufacturers are grappling with adjustments to U.S. tax policies, including a volatile tariff environment, that will considerably impact tax and business strategy in the months ahead. The One Big Beautiful Bill Act (OBBBA), in particular, has spurred key tax changes that require manufacturers to take swift action.

According to the 2025 BDO Tax Strategist Survey, 40% of manufacturing tax leaders rank customs and trade rules as their most significant challenge over the next 12 months.

As manufacturers adapt to changing tariffs imposed by Executive Orders and new tax rules introduced by the OBBBA , they are turning to the tax function for guidance. With 88% of manufacturing respondents noting that their tax teams are increasingly involved in strategic conversations, maintaining collaborative partnerships between tax and other firm functions will be critical for achieving business goals moving forward.

BDO research illustrates that CFOs are fostering greater collaboration not only between themselves and tax, but also with the broader organization by ensuring tax leaders have a seat at the decision-making table. For manufacturers to pivot effectively in the face of policy changes and build resilience, it will be essential to keep tax involved in these strategic conversations, both now and in the future. The manufacturers that elevate tax teams to contribute to business and finance decisions will be better prepared to mitigate risks and remain agile, particularly in today’s environment where resilience stands out as a core competency and competitive advantage.

60% of manufacturers report that the tax function is very involved in strategic discussions around supply chain management.

Key Changes Under the OBBBA

Several tax law changes introduced by the OBBBA have implications manufacturers need to incorporate into planning, including:

- Restoration of 100% Bonus Depreciation: The OBBBA permanently restores 100% bonus depreciation, which will allow taxpayers to immediately deduct the full cost of most business assets placed in service after January 19, 2025. The legislation also creates a new category of expensing for building property used in production activities. For manufacturers, this change effectively reduces the after-tax costs of capital investments in equipment or facility upgrades.

- Changes to Research Expensing: The bill permanently restores the expensing of domestic research costs, beginning in tax year 2025. For many manufacturing companies, these changes restore important capital efficiencies and could incentivize innovation.

- Restoration of More Favorable Calculation of ATI for Purposes of the Interest Deduction Limit: The bill permanently removes amortization and depreciation from the calculation of adjusted taxable income (ATI) for purposes of Section 163(j), which limits the deduction for interest expense to 30% of ATI. Since manufacturers often finance expansion plans via debt, this change allows more interest to be deducted, thereby reducing taxable income.

- Changes to Clean Energy Subsidies: The OBBBA eliminated or accelerated the phaseout of many clean energy credits, which may impact whether manufacturers pursue clean energy initiatives going forward. Solar and wind projects that qualify for the production tax credit under Section 45Y and the investment tax credit under Section 48E must begin construction before July 4, 2026, or be placed in service before December 31, 2027. There are also new sourcing rules to qualify for the credit under Section 45X for manufacturing battery, wind, solar, and other energy components.

- Increase in tax credit for eligible chipmakers: Semiconductor manufacturers may look to take advantage of the Section 48D advanced manufacturing investment credit, which increased from 25% to 35% under the new legislation. To be eligible, semiconductor manufacturers must break ground on new U.S. chip facilities before the end of 2026.

BDO’s Take

Depending on their business strategy and needs, manufacturers can use any savings realized to fund capital investments, fuel research and development spending, or just shore up balance sheets. Because manufacturers’ bottom lines have been hit especially hard this year due to tariff changes, some may eschew aggressive capital investments and instead use cost savings to preserve profitability.

Next Steps for Navigating Trade Uncertainty

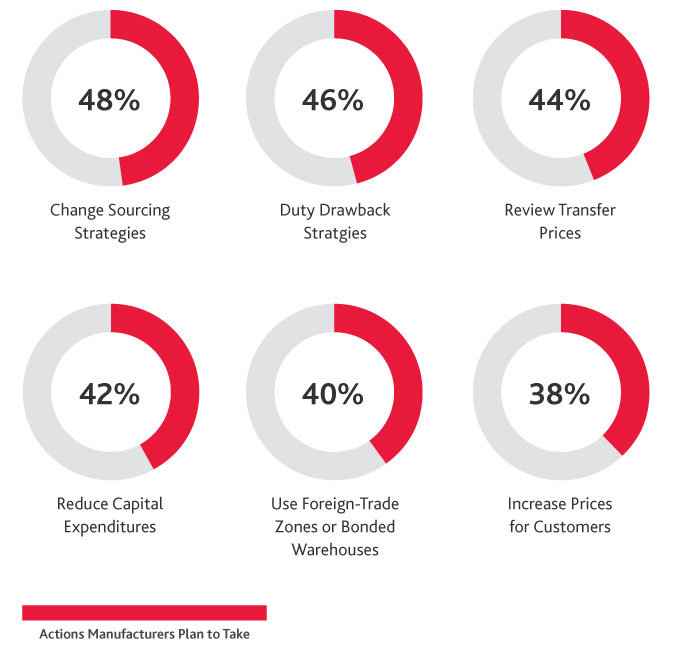

In the months ahead, manufacturers plan to deploy a variety of tactics to respond to shifting tariff policies.

Trade tensions and shifting economic alliances are motivating manufacturers to reassess their transfer pricing policies because the cost of the new tariffs has significantly decreased profit margins. As companies update their transfer pricing protocols, they must keep strong documentation and be prepared to respond to audits from global tax authorities, which 38% of survey respondents predict will be a significant challenge in the next 12 months.

Sourcing remains top of mind, with manufacturers shifting suppliers and even working with suppliers to adjust their own sourcing strategies to mitigate tariffs’ impact. Because tariffs and their effect on global supply chains remain in flux, manufacturers are making less intensive moves within their supply chain — whether by reviewing transfer prices, identifying alternative suppliers, or locking in competitive costs — rather than taking costly action to overhaul their network. However, importers are universally working with every player in their global supply chains – including vendors and customers – to “share the cost” of the new tariffs in the form of price surcharges or rebates.

Onshoring operations, for example, was a common strategy some manufacturers deployed in the past 12 months. However, because the tariff environment continues to change so quickly, manufacturers have refocused their efforts on smaller actions, such as innovative routing options, to optimize supply chain operations.

To navigate evolving policies, manufacturers should develop strategic and adaptive frameworks that can accommodate multiple tariff scenarios. To do so, elevating tax and customs leadership to C-suite conversations is key. These teams should be at the table to offer real-time intelligence on policy developments and strengthen risk management capabilities, particularly as the Department of Justice plans to increase enforcement on tariff violations.

Tax Technology

Using technology within the tax function, particularly to forecast scenarios and the ramifications of different decisions, remains critical for success. According to this year’s Tax Strategist Survey, 48% of the tax leaders surveyed say they are deploying artificial intelligence (AI) in the tax function, but 56% say they are not deploying data management systems.

While there is an eagerness to integrate AI tools into tax processes, a data management maturity gap still exists. Many organizations still lack the necessary data foundation for their AI investments to generate ROI. Closing this gap is imperative because establishing foundational technologies and data systems first positions organizations to capture critical cost efficiencies. Building a strong data foundation includes cleaning and preparing data, establishing formal data governance processes, and putting cybersecurity parameters in place.

Paving the Way for Continued Collaboration with Tax Teams

As a result of recent changes under the OBBBA and ongoing tariff variability, tax functions have gained significant visibility in manufacturing organizations. While this shift represents positive progress, manufacturing leaders should continue to think about how to maintain the tax team involved in broader business conversations, beyond tariff-related issues, to build long-term resilience.

Rather than enlisting the tax department to reactively identify the tax consequences of decisions already made, organizations should integrate their tax teams into the initial stages of strategic planning, particularly when navigating new tax legislation. By involving tax teams early in the decision-making process, manufacturing CFOs can better anticipate complex tax and compliance requirements and prepare for any business fallout.

For organizations that are unsure how to encourage collaboration with their tax teams, working with a third-party advisor may help. BDO professionals can help manufacturers strategically align internal functions and prepare for new tax policy changes. BDO can also support organizations across a range of technology needs, from AI adoption to building robust data foundations, as manufacturers look to streamline compliance and tax operations going forward.

Want to get started on integrating your tax and finance functions? Contact BDO.