IRS Issues Final Section 355(e) Regulations Regarding Predecessors, Successors, and Limitation on Gain Recognition

Summary

On December 18, 2019, Treasury and the IRS published in the Federal Register final regulations under Section 355(e) (T.D. 9888), which provide guidance in determining whether a corporation is a predecessor or successor of a distributing or controlled corporation for purposes of the exception under Section 355(e) to the nonrecognition treatment afforded qualifying distributions. The final regulations also provide certain limitations on the recognition of gain in certain cases involving a predecessor of a distributing corporation. In addition, the final regulations also provide rules regarding the extent to which Section 355(f) causes a distributing corporation (and in certain cases its shareholders) to recognize income or gain on the distribution of stock or securities of a controlled corporation.

In general, the final regulations under Section 355(e) follow the approach of the temporary regulations issued in 2016, while incorporating certain requested clarifications and minor revisions.

Background: Section 355 Tax-Free Spin-Off and Section 355(e)

Section 355 provides a limited exception to the general rule that a distribution of appreciated property from a corporation is taxed at both the corporate and shareholder levels. Under Section 355, if certain requirements are met, a corporation (Distributing) may distribute stock of a controlled corporation (Controlled) to Distributing’s shareholders without recognition of gain or loss by both Distributing and its shareholders upon such distribution (Distribution). Taxpayers also may carry out a Distribution as part of a “divisive reorganization” under Section 368(a)(1)(D). A divisive reorganization is a transfer by Distributing of part of its assets to Controlled if, immediately after the transfer, the transferor has control, as defined in Section 368(c), of Controlled, but only if, in pursuance of the plan, stock or securities of Controlled are distributed in a Distribution. Absent anti-abuse rules, tax-free spin-offs are easily exploited by taxpayers if, as part of a pre-determined plan, the shareholders dispose of the stock of Controlled or Distributing shortly after the Distribution. This arrangement would allow Distributing to avoid its corporate-level tax on the Distribution when Controlled stock is a built-in gain asset. Permitting the tax-free transfer of corporate built-in gain assets directly or indirectly to new shareholders is viewed by the government as an impermissible use of Section 355.

Section 355(e), which serves as one of the anti-abuse rules, requires recognition of corporate-level gain by Distributing if a Distribution is part of a plan or series of related transactions (Plan) pursuant to which one or more persons acquire directly or indirectly a 50-percent or greater interest in the stock (Planned 50-percent Acquisition) of Distributing or Controlled. One of the more difficult aspects of Section 355(e) is determining when an impermissible Plan exists. In general, Treas. Regs. Section 1.355-7 provides that a spin-off and an acquisition are treated as part of a plan only if there was an agreement, understanding, arrangement, or substantial negotiations regarding the acquisition (or a similar transaction) during the two years preceding the distribution. Section 355(e)(4)(D) provides that, for purposes of Section 355(e), any reference to Controlled or Distributing shall include a reference to any predecessor or successor of such corporation. However, Section 355(e) does not define the terms “predecessor” and “successor.”

2004 and 2016 Regulations

To provide definitions for the terms “predecessor” and “successor” for purposes of Section 355(e), as well as guidance regarding their application, Treasury and the IRS issued proposed regulations in 2004 (REG–145535–02)(2004 Proposed Regulations) and both proposed and temporary regulations in 2016 (T.D. 9805)(2016 Regulations).

The general theory of the 2016 Regulations, which modified the 2004 Proposed Regulations, was that Section 355(e) should apply if a Distribution is used to combine a tax-free division of the assets of a corporation other than Distributing or Controlled (Divided Corporation) with a Planned 50-percent Acquisition of the Divided Corporation. Treasury and the IRS view this type of transaction as a “synthetic spin-off” of the assets that are transferred by the Divided Corporation to Distributing and then to Controlled.

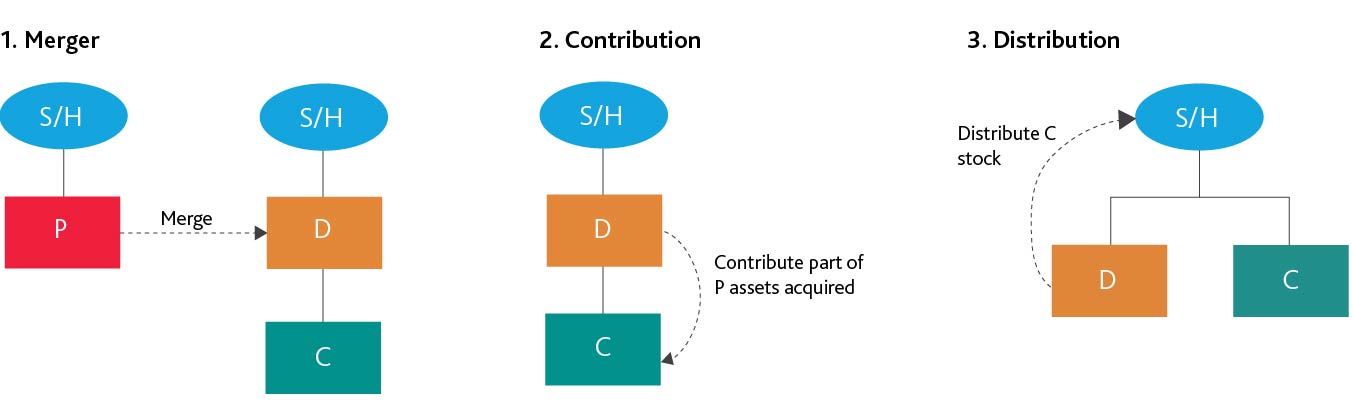

The diagram below illustrates an example (Base Case Example) of a synthetic spin-off to which Section 355(e) is intended to apply. In the example, pursuant to a Plan, (1) P merges into Distributing in a reorganization described in Section 368(a)(1)(A), (2) Distributing contributes some (but not all) of P’s assets to Controlled in a reorganization described in Section 368(a)(1)(D), and (3) Distributing distributes all of the stock of Controlled in a Distribution.

.jpg)

In the Base Case Example, P could have separated its assets in its own Distribution. In that case, P would have been a Distributing itself, and Section 355(e) clearly would have applied to the Distribution if it were combined with a Planned 50-percent Acquisition of P. However, Treasury and the IRS observed that if a Distribution by a Distributing is used as the vehicle for a synthetic spin-off by the Divided Corporation (that is, P), the synthetic spin-off would not be subject to Section 355(e) unless the Divided Corporation is treated as a predecessor of Distributing under Section 355(e)(4)(D) (Predecessor of Distributing, or POD). Accordingly, Treasury and the IRS issued the 2004 Proposed Regulations and the 2016 Regulations to treat the Divided Corporation in the Base Case Example as a POD.

The 2004 Proposed Regulations defined a POD as any corporation the assets of which a Distributing has acquired in a transaction to which Section 381(a) applies (Section 381 Transaction) and then divided tax-free through a Distribution. Although the 2016 Regulations generally retained the synthetic spin-off theory underlying the 2004 Proposed Regulations, Treasury and the IRS significantly broadened the scope of the POD definition but also significantly narrowed its potential application. Contrary to the 2004 Proposed Regulations, which focused on the form of a transaction (that is, synthetic spin-offs effectuated through Section 381 Transactions), the 2016 Regulations focused on the tax-free division of the POD’s property (however effected and regardless of form). Importantly, the 2016 Regulations significantly limited POD treatment to transactions in which all of the steps involved in the tax-free division of property of the POD occur as part of a Plan which is described in Section 355(e) and relevant regulations.

2019 Final Regulations Under Section 355(e)

Predecessor of Distributing Definition

The 2016 Regulations introduced the term “Potential Predecessor.” Under the POD definition in the 2016 Regulations, only a Potential Predecessor could be a POD. Thus, if a corporation were not a Potential Predecessor, it could not have been a POD under the 2016 Regulations. The 2016 Regulations defined a Potential Predecessor as any corporation other than Distributing or Controlled.

The final regulations have narrowed the overly broad definition of POD by limiting the definition of Potential Predecessor, providing that a corporation cannot qualify as a POD unless the corporation’s assets are divided through a Distribution (that is, unless the corporation is a Divided Corporation). Specifically, the final regulations now define the term Potential Predecessor as any corporation other than Distributing or Controlled, but only if either (i) as part of a Plan, the corporation transfers property to a Potential Predecessor, Distributing, or a member of the same Expanded Affiliated Group (defined term in the final regulations) as Distributing in a Section 381 Transaction (as in the Base Case Example), or (ii) immediately after completion of the Plan, the corporation is a member of the same Expanded Affiliated Group as Distributing.

This narrowing of the definition of POD is intended to further the policy of Section 355(e) while continuing to permit tax-free divisions of existing business arrangements among existing shareholders. Stated another way, the intent is to apply Section 355(e) only to transactions that resemble sales. A notable consequence of the modified definition of POD in the final regulations is that the conclusion associated with Example 5 of the 2016 Regulations has changed. Contrary to the 2016 Regulations, it is concluded in the final regulations that P in Example 5 is no longer a Potential Predecessor (and thus is not a POD for that reason).

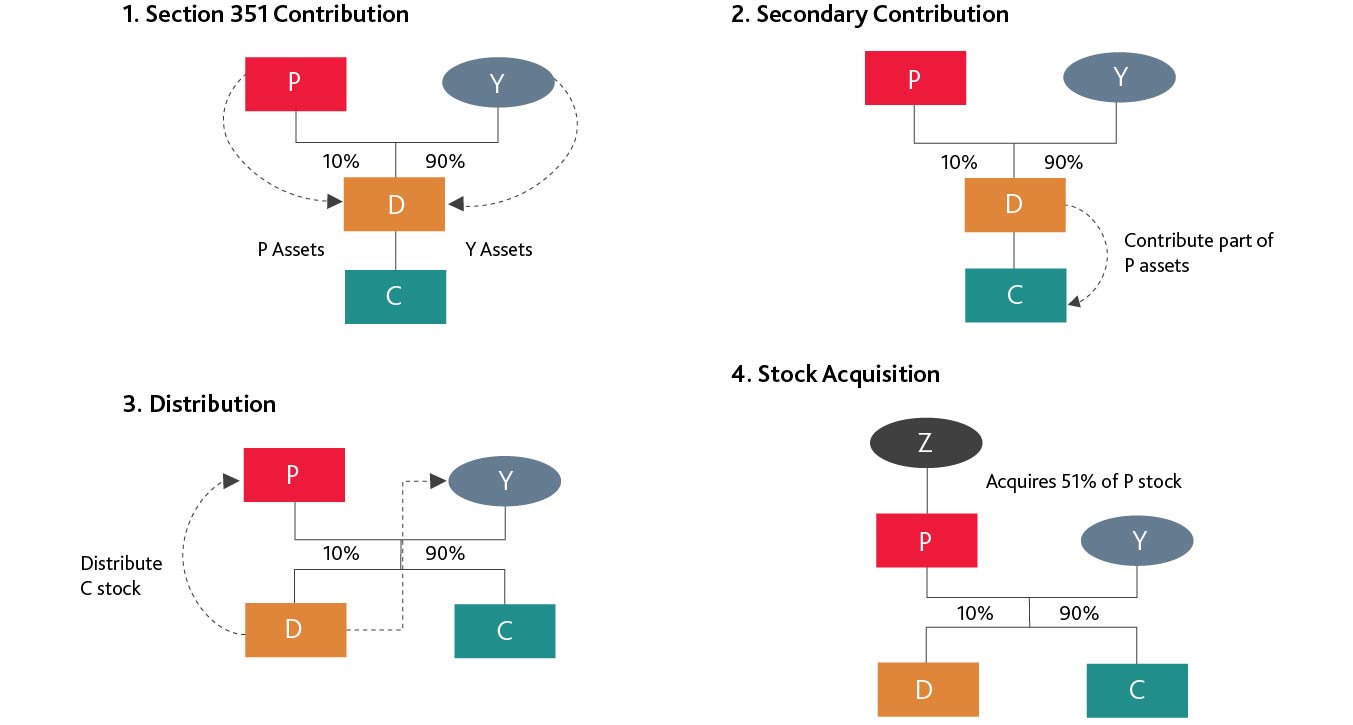

In Example 5, pursuant to a Plan, (1) P first transfers some (but not all) of its assets to Distributing in exchange for 10 percent of the stock of Distributing in a transaction to which Section 351 applies (leaving Distributing’s other shareholder, Y, with 90 percent of Distributing’s stock). Then (2), Distributing contributes some (but not all) of the P assets to Controlled in a reorganization described in Section 368(a)(1)(D), and (3) distributes all of the stock of Controlled to P and Y pro rata. Finally (4), individual Z acquires 51 percent of the P stock. The diagram below depicts the transactions of Example 5.

After further analysis, Treasury and the IRS concluded that the acquisition of 51 percent of the P stock by Z reduces neither the total value nor the total built-in gain inside P, because P’s basis in the stock of Distributing and Controlled (equal to P’s basis in the assets contributed to Distributing) has not changed as a result of the acquisition. In this regard, P merely has exchanged one asset for another and Z’s acquisition does not cause a division of P’s assets contributed to Distributing. In addition, the value of P’s assets has not changed solely due to such acquisition. As a result, Treasury and the IRS have determined that the series of transactions set forth in Example 5 does not resemble an actual Distribution by P and should not be viewed as a synthetic spin-off.

Pre-Distribution and Post-Distribution Requirements When Determining POD

Under the 2016 Regulations, a Potential Predecessor qualified as a POD only if two pre-Distribution requirements and one post-Distribution requirement were satisfied. Treasury and the IRS intended that these requirements, taken together, (i) composed a technical description of a synthetic spin-off, and (ii) limited POD treatment to Potential Predecessors the assets of which are divided tax-free through a Distribution by Distributing. The final regulations follow the same requirements but provide much-needed clarifications.

To satisfy the first pre-Distribution requirement, any Controlled stock distributed in the Distribution must have been (i) Relevant Property, the gain on which was not recognized in full as part of a Plan, or (ii) acquired by Distributing for Relevant Property, the gain on which was not recognized in full as part of a Plan, and that was held by Controlled immediately before the Distribution (Relevant Property Requirement). The term “Relevant Property” generally referred to any property held by the Potential Predecessor at any point during the Plan Period (that is, the period that ends immediately after the Distribution and begins on the earliest date on which any part of the Plan is agreed to or understood, arranged, or substantially negotiated). The final regulations clarify that the Relevant Property Requirement is not satisfied if gain in the Relevant Property is fully recognized at some point during the Plan Period, but the Relevant Property subsequently appreciates in value, resulting in unrecognized built-in gain at the time of the distribution.

To satisfy the second pre-Distribution requirement, any Controlled stock distributed in the Distribution must have reflected the basis of any Separated Property (Reflection of Basis Requirement). In general, the 2016 Regulations defined the term “Separated Property” as any Relevant Property relied on to satisfy the Relevant Property Requirement. However, the 2016 Regulations did not define the phrase “reflect the basis.” The final regulations clarify that the Reflection of Basis Requirement is satisfied only if any Controlled stock that satisfies the Relevant Property Requirement had a basis prior to the Distribution that was determined, in whole or in part, by reference to the basis of Separated Property. In addition, the final regulations clarify that the Reflection of Basis Requirement is satisfied only if, during the Plan Period prior to the Distribution, any Controlled stock that satisfies the Relevant Property Requirement was neither distributed in a Section 355(e) distribution nor transferred in a transaction in which the gain (if any) on that Controlled stock was recognized in full.

To satisfy the post-Distribution requirement, immediately following the Distribution, ownership of Relevant Property must have been divided between Controlled, on the one hand, and Distributing or the Potential Predecessor, on the other hand. This requirement is retained in the final regulations.

Implicit Permission

The 2016 Regulations generally refer to Treas. Reg. Section 1.355–7 for the determination of whether a Distribution and an acquisition of a 50-percent or greater interest in a POD have occurred as part of the same Plan, but with special rules. Pursuant to Treas. Reg. Section 1.355–7, a Distribution and a 50-percent or greater acquisition are generally treated as part of a plan only if there was an agreement, understanding, arrangement, or substantial negotiations regarding the acquisition (or a similar transaction) between Distributing, Controlled, or their controlling shareholders during the two years preceding the distribution.

In general, the 2016 Regulations’ references to Distributing in Treas. Reg. Section 1.355–7 included references to a POD. However, any agreement, understanding, arrangement, or substantial negotiations regarding the acquisition of the stock of a POD were analyzed under Treas. Reg. Section 1.355–7 with respect to the actions of officers or directors of Distributing or Controlled, controlling shareholders of Distributing or Controlled, or a person acting with permission of one of those persons. For that purpose, the references in Treas. Reg. Section 1.355–7 to Distributing did not include references to a POD. Therefore, the actions of officers, directors, or controlling shareholders of a POD, or of a person acting with the implicit or explicit permission of one of those persons, would not have been considered for this purpose unless those persons otherwise would have been treated as acting on behalf of Distributing or Controlled under Treas. Reg. Section 1.355–7. The final regulations retain these rules.

The determination of whether a Plan exists could be crucial in practice, because Treasury and the IRS intend to apply Section 355(e) and the final regulations only if such a Plan exists. If there’s a series of transactions that occurred in the same sequence as in the Base Case Example except that the merger of P into D occurred before the existence of a Plan, it would appear that Section 355(e) and the final regulations would not require Distributing to recognize any corporate-level gain. So, the existence of (or conversely, the absence of) a Plan could significantly shift the result of these transactions.

Successors

Consistent with the 2004 Proposed Regulations, the 2016 Regulations limited the definition of the term Successor to a corporation to which Distributing or Controlled transfers property in a Section 381 Transaction after the Distribution. A partnership cannot receive assets in a Section 381 Transaction. Accordingly, a partnership could not have been a Successor under either the 2004 Proposed Regulations or the 2016 Regulations. In addition, if the assets of Distributing or any POD are acquired by another corporation in a Section 381 Transaction, then any subsequent acquisition of the stock of the acquiring corporation is treated also as an acquisition of the stock of Distributing or the POD. The final regulations retain this approach.

As a result of these rules, a corporation’s status as a Successor of Distributing or Controlled matters only insofar as an acquisition of its stock is treated as an acquisition of the stock of Distributing or Controlled, respectively, which could result in a Planned 50-percent Acquisition of Distributing or Controlled. Therefore, the only significance of a Planned 50-percent Acquisition of a Successor is its treatment as a deemed Planned 50-percent Acquisition of Distributing or Controlled. Accordingly, if any of the stock of Distributing or Controlled has been acquired in, or prior to, a Section 381 Transaction, the application of Section 355(e) will turn on whether a Planned 50-percent Acquisition of Distributing or Controlled has occurred, taking into account acquisitions of the stock of Distributing or Controlled in, and prior to, the Section 381 Transaction, as well as any acquisitions of the stock of the Successor following the Section 381 Transaction.

Modified Gain Limitation Rules

Distributing is generally required to recognize any gain in Controlled stock and securities distributed in a Distribution that is part of the same Plan as a Planned 50-percent Acquisition of a POD, Distributing, or Controlled (the Statutory Recognition Amount). However, in cases involving a Planned 50-percent Acquisition of a POD, the POD Gain Limitation Rule under the 2016 Regulations generally limited the amount of gain Distributing was required to recognize to any built-in gain in the POD’s Separated Property (generally, POD assets held by Controlled). Similarly, in cases involving a Planned 50-percent Acquisition of Distributing as the result of a transfer by a POD to Distributing in a Section 381 Transaction, the Distributing Gain Limitation Rule under the 2016 Regulations generally would reduce the amount of gain Distributing was required to recognize by the built-in gain in the POD’s Separated Property. In cases of multiple Planned 50-percent Acquisitions, the 2016 Regulations generally provided that the total gain limitation applicable is determined by adding the Statutory Recognition Amount (subject to the POD Gain Limitation Rule and the Distributing Gain Limitation Rule) with respect to each Planned 50-percent Acquisition.

To illustrate these gain limitation rules under the 2016 Regulations, assume the same facts as in the Base Case Example. Further assume that the P assets contributed by Distributing to Controlled had basis of $40 and fair value of $100. In addition, assume that immediately before the distribution by Distributing, Controlled stock had basis of $100 and fair value of $200. As discussed above, the Base Case Example is a synthetic spin-off to which Section 355(e) and the final regulations are intended to apply. Accordingly, Distributing would be required to recognize $100 of gain ($200 of fair value minus $100 of basis of Controlled stock held by Distributing), the Statutory Recognition Amount. However, under the POD Gain Limitation Rule described above, Distributing’s gain recognized by reason of the Planned 50-percent Acquisition of P will not exceed $60, an amount equal to the built-in gain associated with the P assets contributed by Distributing to Controlled ($100 of fair value minus $40 of basis of such assets).

Commenters questioned why the 2016 Regulations, in part, limited the gain recognitions to Section 381 Transactions, and recommended expanding the gain limitation rule so that it applies to any Planned 50-Percent Acquisition of Distributing (however effected and regardless of form). In light of these comments, Treasury and the IRS expanded the application of the gain limitation rule to transfers by a POD to Distributing in any Planned 50-percent Acquisition of Distributing whether or not involving a Section 381 Transaction. In addition, Treasury and the IRS have refined the calculation of the gain limitation to account for the possibility of more than one POD with respect to a single Distribution and clarified that both built-in gain and built-in loss assets are taken into account in computing any applicable gain limitation.

Section 355(f)

The final regulations provide a general rule that Section 355(f) does not apply to a Distribution if there is a Planned 50-percent Acquisition of a POD (but not of Distributing, Controlled, or their Successors). Therefore, Section 355 and its regulations apply to a Distribution within an affiliated group if the Distribution and the Planned 50-percent Acquisition of the POD are part of a Plan.

Alternatively, Distributing may choose not to apply the general rule described above. In doing so, Distributing may apply Section 355(f) to all such Distributions according to its terms, but only if all members of the same Expanded Affiliated Group report consistently the Federal income tax consequences of the Distributions that are part of the Plan. In such a case, however, the gain limitation rules are not available with regard to any applicable Distribution.

Distributing indicates its choice to apply Section 355(f) consistently to all applicable Distributions by reporting the Federal income tax consequences of each Distribution in accordance with Section 355(f) on its Federal income tax return for the year of the Distribution.

Section 336(e) Election

The 2016 Regulations prohibited a Section 336(e) election if the amount of gain required to be recognized by Distributing with respect to the Distribution was less than the Statutory Recognition Amount due to the gain limitation rules. Although the final regulations retain this prohibition, Treasury and the IRS continue to study and request comments on the following issues: (1) Whether permitting a Section 336(e) election in this context would be consistent with the policy of Section 336(e), (2) whether permitting a Section 336(e) election in this context could give rise to inappropriate planning opportunities, (3) whether permitting a Section 336(e) election in this context only if the Separated Property accounts for a certain minimum percentage of Controlled’s value or built-in gain would be appropriate, and (4) whether limiting the deemed asset disposition that results from a Section 336(e) election in this context to a deemed disposition of the Separated Property would be appropriate.

Effective Date and Transition Rule

The final regulations, the substance of which is generally the same as that of the 2016 Regulations, apply to Distributions that occur after December 15, 2019, the day before the expiration date of the 2016 Temporary Regulations. Moreover, the final regulations do not contain a transition rule.

BDO Insights

In general, the final regulations under Section 355(e) follow the approach of the 2016 Regulations while incorporating certain requested clarifications and minor revisions. It is clear that Treasury and the IRS are still not fans of synthetic spin-offs and intend to have Section 355(e) apply to those transactions. Without the predecessor rules retained in the final regulations, taxpayers can easily structure a tax-free spin-off without triggering any Section 355(e) gain if a Distribution by Distributing is used as the vehicle for a synthetic spin-off of another corporation’s assets which have been acquired by Distributing.

The 2016 Regulations were instrumental in laying out the operating rules for the determination of predecessors and successors of Distributing and Controlled. However, comments received by Treasury and the IRS indicate that the application of the 2016 Regulations was unnecessarily broad as a result of how POD was defined. In addition, commenters criticized the 2016 Regulations as overly complex and difficult to understand and requested additional clarification of certain terms that were not defined in the proposed and temporary regulations. The final regulations strive to resolve these concerns.

The broad definition of POD in the 2016 Regulations caused Section 355(e) to apply to transactions that do not resemble sales, a result inconsistent with the legislative intent and the policy of Section 355(e). Accordingly, the final regulations limit the scope of POD to a corporation the assets of which are divided through a Distribution. The final regulations achieved this goal, which not only is favorable to taxpayers but also furthers the policy of Section 355(e) while continuing to permit tax-free divisions of existing business arrangements among existing shareholders.

Finally, as much needed, Treasury and the IRS clarified terms and phrases in the final regulations that were not clear in the 2016 Regulations. For instance, the final regulations provide additional guidance on the two pre-Distribution requirements for purposes of determining whether a Potential Predecessor qualifies as a POD.

SHARE