Global Tax Outlook Survey – Americas Regional Analysis

Top 5 Takeaways

The BDO Global Tax Outlook is a new international research program spanning more than fifty countries, which touches on the most common issues business leaders are grappling with in tax. The Global Tax Outlook points to consistent themes that face international tax leaders, as well as specific trends in key regions of the world.

The Americas (North, Central and South America) represent 33% of the Global Tax Outlook 2020 research sample. The typical profile of respondents are tax leaders in privately held, large organizations. Of those organizations reporting their revenues, 50% have revenues above $500m. The research also includes subsidiaries of international businesses, listed and private equity-backed businesses. Half of the Americas respondents are from OECD countries, which will be in the process of implementing the ongoing standards and recommended actions in the OECD’s BEPS initiatives, alongside any national tax reforms, in their domestic legislation.

These are the top takeaways from the Americas Regional Analysis.

Takeaway #1

The Americas has a particularly high level of uncertainty around the development of tax legislation.

Takeaway #2

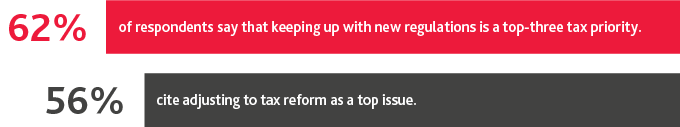

Maintaining compliance is the most significant tax issue in the Americas.

More than half (51%) of respondents say their Board has spent more time than average on tax compliance and planning issues over the last 12 months.

Takeaway #3

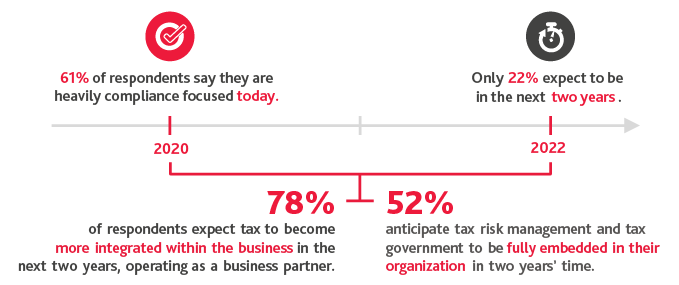

Tax leaders in the Americas anticipate the tax function evolving from a supportive role to focus on value-add activities.

Takeaway #4

Total tax liability is expected to grow significantly more in application in the Americas.

Two thirds of respondents said they expect to be able to calculate total tax liability across the business using automated tools and factor it into business decisions within the next two years.

Takeaway #5

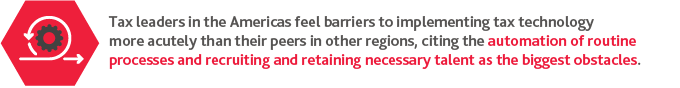

The Americas are investing in tax technology, but perceive significant challenges to its implementation.

The Americas are more likely to have designed and documented a tax technology strategy than their global counterparts, and while tax technology spend is currently low, it is expected to grow more quickly relative to other regions.

About the Global Tax Outlook

The Global Tax Outlook represents a new programme of International Research in Tax. In this 2020 study we look at the most important issues business leaders are grappling with in tax, both present and near future. The report shares consistent themes globally and points to where findings vary, whether this be by region, or the size and type of business.

To explore the results in more depth, visit the BDO Global Tax Outlook hub.

Use the opportunity to discuss the findings and how they relate to your business with a member of the local BDO team.

SHARE