Dimensionality of Incentive Metrics

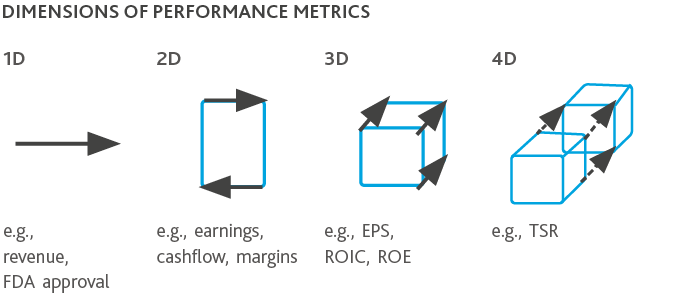

An ongoing challenge for compensation committees lies in aligning the interests of executives with shareholders and other stakeholders. Incentive pay, including both short-term incentives (STI) and long-term incentives (LTI), is generally considered an effective approach for linking the financial interests of the top executives to that of the company and other stakeholders. However, the development of metrics and the goal setting process can be incredibly challenging. There are hundreds of potential metrics for both STI and LTI programs to choose from, and some are much more challenging than others. To help our clients understand and visualize incentive plans, BDO has categorized performance metrics into five potential dimensions:

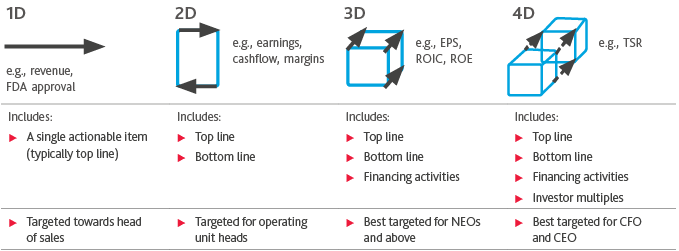

- 1st Dimension: Represents metrics that focus on top line revenue, sales, or market share.

- 2nd Dimension: Represents metrics that focus on not only top line, but also includes the consideration of expenses. The most prevalent 2nd Dimension metrics are EBITDA, cashflow, net income, or operating margin.

- 3rd Dimension: Represents metrics that focus on top and bottom line, but also includes finance, investment, and capital funding metrics. The most prevalent 3rd Dimension metrics are earnings per share (EPS) growth, return on invested capital (ROIC), return on equity (ROE), and return on assets (ROA).

- 4th Dimension: Represents the prior dimensions (top line, bottom line, and financing activity), but also includes future expectations. By future expectations, we mean that the metric measures what the future expected growth will be, and that the company maintains or grows investors’ multiples. Largely, the only measure that incorporates future expectations is the fair market value of the stock, and therefore total shareholder return (TSR) is the most prevalent 4th Dimension measure.

- Strategic: As a final catch-all, there are some other KPIs or strategic goals that don’t focus on the financials or stock prices. These important measures are sometimes seen with environmental, social, and governance (ESG) goals, discretion, and other specific business outcomes.

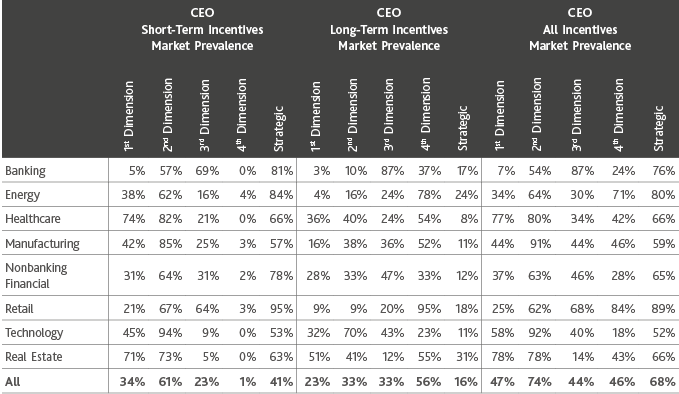

In the research for the BDO 600 Study, we collected and analyzed the short and long-term metrics for companies that comprise the eight industries included in the study. ESGAUGE has supplied the data of performance metrics to BDO for analysis.

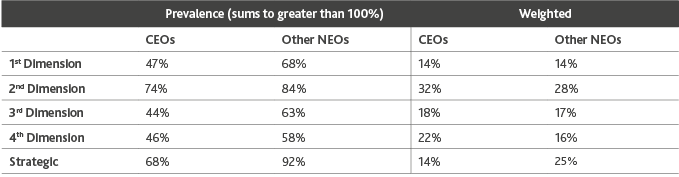

Note that the prevalence data above will add to more than 100%, as it is only indicative of the existence of that dimension. Most companies have multiple metrics. Further, note that the prevalent practice for STI plans is to leverage 2nd Dimension metrics, and the prevalent performance metrics for LTI plans are 4th Dimension.

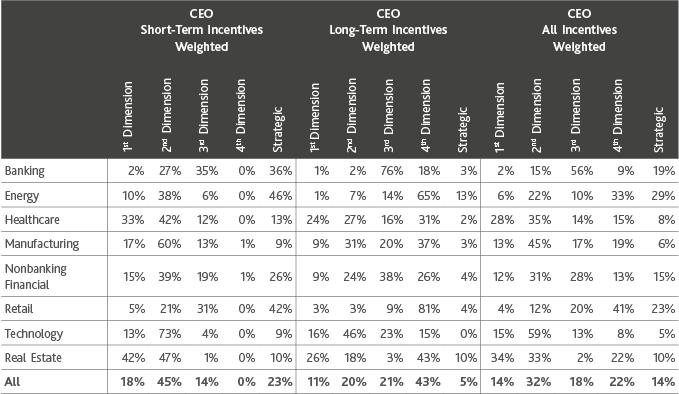

We have also summarized the incentives weighted by the percentage of base pay to understand the emphasis put on each dimension, all normalized to 100% of your total incentives.

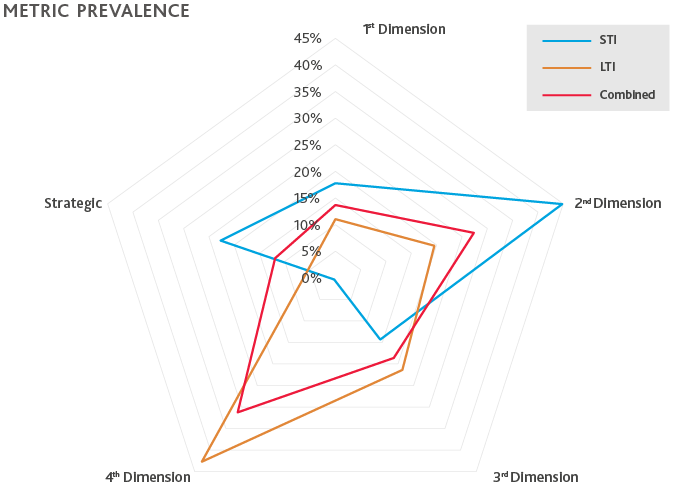

When summarizing by weight, you can better visualize that STI tends to be 2nd Dimension, while LTI tends to be 4th Dimension. However, the BDO 600 Study does a reasonable job of incorporating all dimensions into their incentive programs when combining STI and LTI. Visually, the weights can be illustrated as follows:

Impact to Goal Setting for Positions Beneath the CEO

Broadly speaking, incentive measures should have line of sight for the executives. When thinking about the four primary Dimensions of incentive metrics, it becomes easier to view what types of measures are most important for different executives.

Leveraging data from ESGAUGE, we have also analyzed the prevalence and weighting of each Dimension for the other Named Executive Officers (NEOs).

As expected, CEOs have a greater weighting on the 4th Dimension while other NEOs have a higher weighting on Strategic, which includes strategic and other non-financial metrics.

Conclusion

The determination of incentive metrics can be very challenging, as it is critical that they meet several objectives for the employee, the company, the investor, and other stakeholders. When designing incentive plans, each measure should be viewed in the dimension that it is serving, ranging from the 1st Dimension to the 4th Dimension, and the total dimensional weighting should be balanced. Some closing thoughts are summarized below:

- Short-term incentive plans should have an emphasis on 2D metrics, with support from 1D, 3D, and other strategic metrics that help drive a companies’ short and long-term goals.

- Long-term incentive plans should have a focus on 4D metrics with support from 3D metrics and potentially 2D metrics.

- The portfolio of incentive metrics should be balanced, ranging from 1D to 4D to other strategic goals.

- To optimize line of sight for your employees, lower dimensionality metrics should be leveraged as you move lower in the organization. Similarly, higher dimensionality metrics should be applied for the most senior executives.

SHARE