General Welfare Exclusion Q&A

Providing financial assistance to shareholders and relatives for their general welfare has been a long-standing policy for many Alaska Native Corporations (ANCs). Although ANCs are required to issue Form 1099 reporting income to the recipients as well as filing with the IRS, further IRS guidance on taxability of benefits to recipients is slight.

The following questions and answers address the treatment and exclusion of income and income tax reporting of general welfare benefit payments based on IRS procedures.

What types of entities are eligible to make payments that can be excluded from recipients’ income?

Indian tribal governments, which under Internal Revenue Code Section 139E(c)(1) specifically include any agencies or instrumentalities of an Indian tribal government and any Alaska Native Regional or Village Corporation.

What qualifications must individual recipients meet to be eligible to exclude payments from income?

An individual must be a qualified member of an Indian tribe or a qualified non-member. Qualified members of Indian tribes are defined as individuals who meet the requirements established by applicable tribal law for enrollment in the tribe. Federally recognized tribes can be found in the Federal Register (see page 2). Qualified non-members include anyone who is a spouse, former spouse, legally recognized domestic partner or former domestic partner, ancestor, descendant, or dependent of a member of a tribe.

What are the requirements on the eligible entities for establishing a qualified program related to benefit payments?

To qualify for exclusion, the programs must meet the following criteria:

- Be provided pursuant to a specific tribal government program.

- Have written guidelines specifying how individuals may qualify for the benefit.

- Be available to any tribal member, qualified nonmember, or identified group of tribal members or nonmembers (for example, veterans) who satisfy the program guidelines, subject to budgetary restraints.

- Ensure that the distribution of benefits from the program not discriminate in favor of members of the governing body of the tribe.

- Provide that the benefit is not compensation for services.

- Make certain that the benefit is not lavish or extravagant.

What benefits can be provided under a program?

Benefits can include, but are not exclusively limited to:

- Housing programs, including payment assistance, enhancing habitability, basic repairs or rehabilitation, and utility assistance.

- Educational and jobs programs, including transportation to school, tuition payments, child care, job counseling, and appropriate clothing for a job interview or training.

- Elder and disabled programs, including meals, home care assistance, transportation, and special needs home improvements.

- Other programs, including transportation to essential public facilities such as grocery stores or medical facilities, transportation and lodging while away from home for medical care, assistance in urgent circumstances such as for victims of abuse, relocation for individuals displaced from their homes, transportation emergencies, and payment for nonprescription drugs.

- Cultural and religious programs, including expenses to attend or participate in community activities and ceremonies, expenses to visit cultural and historical sites, and funeral and burial expenses.

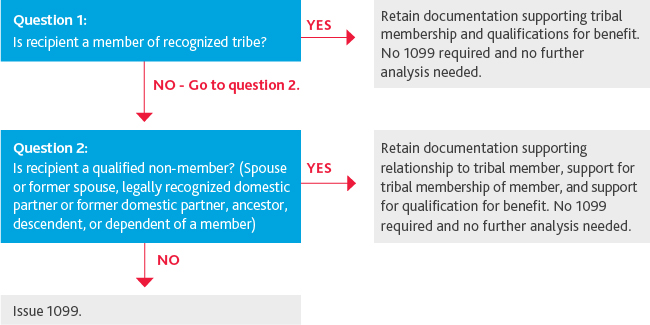

Are there general guidelines that can be used to determine when a Form 1099 need not be issued?

Yes. This decision tree explains the process.

.jpg)

SHARE