Financial Services and Unclaimed Property – What You Need to Know

The financial services industry faces unique challenges adhering to state unclaimed property requirements. These challenges affect a range of financial services firms, including financial institutions and specialty finance, asset managers, hedge funds, private equity funds, insurance and fintech companies. States continue to aggressively conduct unclaimed property audits and penalize holders that file unclaimed property reports late, inconsistently, incorrectly or not at all. Whether an item may be considered unclaimed property often requires a review of the organization’s books and records along with its policies and procedures.

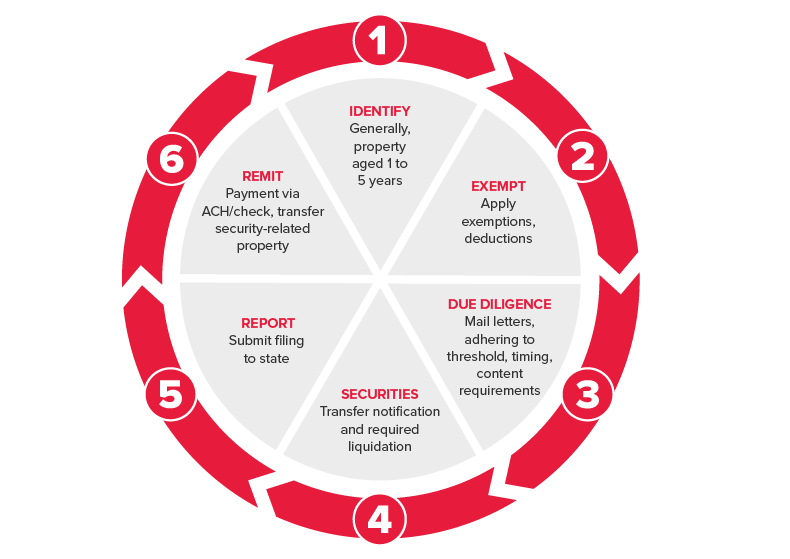

All business types are subject to unclaimed property laws and are required to report unclaimed property to each state.

Here we review what you need to know to comply with state escheat laws and the potential risks you may be facing as a holder within the financial organization industry as a whole.

Download our Unclaimed Property Risk Assessment for Financial Services Organizations to help evaluate the escheatment posture of your organization.

What is Unclaimed Property?

All states have laws governing the reporting and remittance of unclaimed property. Unclaimed property includes items that a business owes to its employees, customers, vendors, creditors or shareholders that have passed certain prescribed periods of abandonment (dormancy periods), typically one to five years in length depending on the state and property types at issue. Items of particular concern for financial services may include:

- Savings/checking accounts

- Accounts payable/client disbursements

- Retirement/tax-deferred accounts

- Stocks

- Mutual funds

- Accounts receivable credits

- Safe deposit box contents

- Residual dividends

- Certificates of deposit

Due Diligence Requirements

When the dormancy period has passed, an organization has the responsibility to attempt to establish contact with the property owner through due diligence efforts.

Securities and Exchange Commission Rule 17Ad-17 requires that transfer agents and broker-dealers conduct thorough efforts to locate lost “securityholders” by conducting two better address database searches. The rule also requires that a written notification is sent to unresponsive payees, i.e., owners who have an uncashed distribution.

Holders must also perform due diligence efforts defined in the state’s unclaimed property statute. There are specific requirements around the timing, mailing and letter verbiage in the state guidelines. In some states, financial organizations have a requirement to send a letter via certified mail if the property value exceeds a certain dollar threshold.

If these efforts are unsuccessful in establishing contact with the owner, the property must then be turned over to the state’s custody.

Common Compliance Challenges & Risks

Correctly identifying the dormancy trigger date is essential for accurate reporting. The date required depends on the last owner-initiated activity date on the account, or a linked account, the date of the owner’s undeliverable mail and/or the date of an uncashed distribution. For some states, holders are required to review a combination of these data points. For retirement accounts, the mandatory distribution date must also be considered. Implementation of date tracking of online activity is also required. Tracking these dates to calculate dormancy can be a challenging issue for organizations that are decentralized, have multiple legal entities, multiple locations or have customers with multiple accounts.

What State Do You Report Unclaimed Property To?

Every state has an unclaimed property law, as well as Washington, D.C., Puerto Rico, U.S. Virgin Islands and Guam. Each state has a unique law that specifies how unclaimed property should be managed and reported by holders. There are established rules that dictate which state’s law applies to a particular property. These are known as priority rules.

First priority rule declares that any property where the owner’s last known name and address is provided is subject to escheatment in that specific state.

Second priority rule comes into effect when the address is unknown, incomplete or international; at which point property is reportable to the company’s state of incorporation (or, generally, the state of commercial domicile for an unincorporated entity).

Why Unclaimed Property Matters

States are enforcing unclaimed property compliance more strictly. As part of this compliance enforcement effort, financial organizations are experiencing an increase in outreach from states, which can come in multiple forms:

- Self-audit programs (Example of Self-Audit Notice from Illinois)

- Invitations to participate in state voluntary compliance/disclosure programs

- (Example of VDA Program Notice From Delaware)

- Multi-state audits, which are typically conducted by third-party auditors, often paid on a contingent fee basis, and can take several years to complete (Example of Audit Notice From Delaware)

- Unclaimed property compliance question on California state income/franchise tax return this year (Read more about what this means)

The programs often have a review period of 10-15 years or more and are heavily dependent on the availability of complete and researchable records. If records are not available, then estimating the liability is typically required. Any unclaimed property notice from a state is time sensitive and should be acted upon immediately. It’s important to note that penalties and interest vary by state. Self-audit and voluntary disclosure agreement (VDA) notices often include a deadline for participation. If a company fails to respond or sign up to participate, it will most likely be referred for audit, which comes with a much more significant process.

How to Mitigate Unclaimed Property Risk

Financial services organizations must take proactive steps to manage potential risks related to unclaimed property to ensure compliance. Here are some steps to better understand and mitigate unclaimed property risk:

- Feasibility Review

- Consider conducting a truncated review of unclaimed property obligations that follows traditional testing methodologies. These reviews arm businesses with a low-to-high range of potential escheat exposures by property type and legal entity. Often, the results of these reviews are used to book ASC 450 accounting reserves and lead to more proactive remediation measures (such as voluntary disclosures, policies and procedures, compliance, etc.).

- Compliance

- All organizations should establish a robust annual filing process, including due diligence efforts to mitigate penalties, interest and audit risks.

- Policies and Procedures

- The absence of unclaimed property policies and procedures is the easiest way for a company to fall out of compliance with state escheatment laws and regulations. With the successful implementation of full global mapping procedures or streamlined unclaimed property policies and procedures, organizations can drive strong escheat compliance reporting.

- Other States

- If an organization hasn’t been meeting its multi-state filing obligations, it should consider voluntary disclosure or amnesty filings with other jurisdictions to mitigate the risk of an audit.

How BDO Can Help

BDO has extensive experience and the comprehensive technical and technology resources required to mitigate unclaimed property exposure, including audit/self-audit defense, feasibility study and risk assessments, VDAs, and compliance report preparation and filing. Visit our state-specific pages for more information on compliance programs in California, Delaware, Florida, Illinois, Minnesota, Massachusetts, New York and Texas.

SHARE