Impacts of the Final Foreign Tax Credit Regulations: Credit Disallowance and Timing Rules

The 2021 final foreign tax credit (FTC) regulations make significant changes to the FTC rules for U.S. multinationals. In addition to a variety of other modifications, the final regulations overhaul the 2020 proposed regulations regarding the Section 245A dividends received deduction (DRD) to deny a credit or deduction for certain foreign income taxes paid or accrued by domestic corporations, successors, and foreign corporations — with retroactive effect. The final regulations also address the rules regarding the timing of when foreign taxes accrue and in which year taxes may be claimed as a deduction or a credit.

FTC or Deduction Disallowance Under IRC Section 245A

Overview

Subject to certain requirements, Section 245A exempts from federal income tax certain foreign income of a domestic corporation1 through a 100% DRD for the foreign source portion of dividends received from specified 10%-owned foreign corporations (SFCs).2 Under this form of participation exemption, if a Section 245A DRD can be claimed in the U.S. for a foreign dividend received, no FTC or deduction is permitted for any foreign taxes, including withholding taxes, that are paid or accrued in the foreign jurisdiction with respect to that same dividend.

FTC or Deduction Disallowance in General

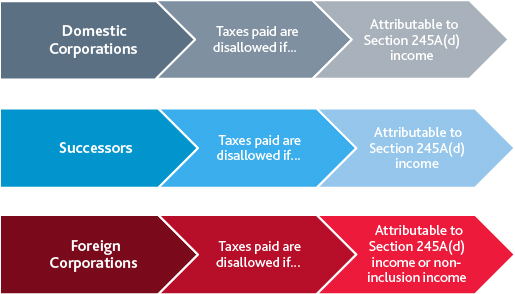

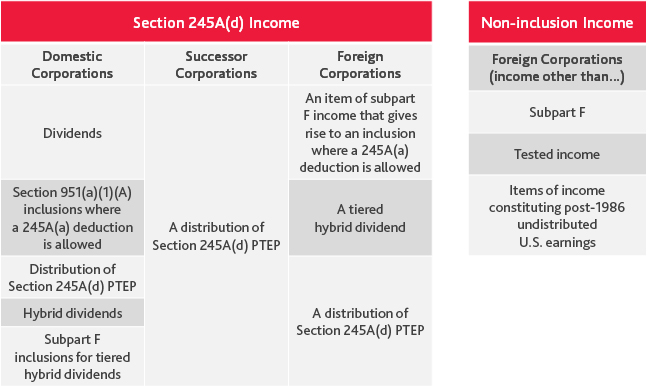

The final regulations disallow an FTC or deduction for foreign income taxes attributable to “Section 245A(d) income” and “non-inclusion income.” The category of income, as well as the types of income – whether Section 245A(d) or non-inclusion income – depend on the profile of the taxpayer, as outlined in Figures 1 and 2:

Figure 1

Figure 2

.jpg)

Section 245A(d) previously taxed earnings and profits (PTEP) include PTEP resulting from a dividend (including a Section 1248 dividend) that gave rise to a Section 245A DRD, or as a result of a tiered-hybrid dividend that gave rise to a U.S. inclusion of a U.S. shareholder.

Examples

The following are three basic examples illustrating the potential effects of the Section 245A(d) FTC and deduction disallowance rules as a result of the final regulations:

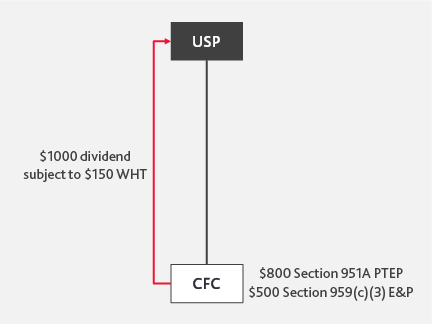

Example 1

- The $1000 “foreign dividend amount” is assigned to the statutory and residual groupings to which the $1000 “U.S. dividend amount” is assigned under Treas. Reg. Section 1.861-20(d)

- The $1000 U.S. dividend amount comprises $200 Section 245A(d) income and $800 Section 951A PTEP

- The $150 WHT is therefore apportioned $30 (200/1000 * $150) to the Section 245A(d) income group, and the remaining $120 (800/1000 * $150) to the residual grouping

- Result: no credit or deduction is allowed for the $30 WHT attributable to Section 245A(d) income of USP

- Variation: same result if $1000 dividend is a stock distribution that is treated as a dividend for foreign tax purposes but is not recognized for U.S. purposes

- See Treas. Reg. Section 1.245A(d)-1(d)(2), Example 2

Example 2

- Facts: $1000 dividend subject to $150 of WHT. CFC has $500 of (c)(3) E&P, which is all non-inclusion income

- Result: $75, which is 50% ($500/$1000) of the $150, is attributable to Section 245A(d) income and disallowed. The remaining $75 is attributable to non-inclusion income and disallowed

Example 3

- Facts: $1500 of passthrough income is earned and taxed in CFC’s country. $500 is services income and $500 is royalty income – both non-inclusion income. $500 is royalty income that is gross tested income

- Result: $100, which is appx 67% ($1000/$1500) of the $150 is attributable to non-inclusion income and disallowed. The remaining $50 is attributable to the residual grouping

Figure 3

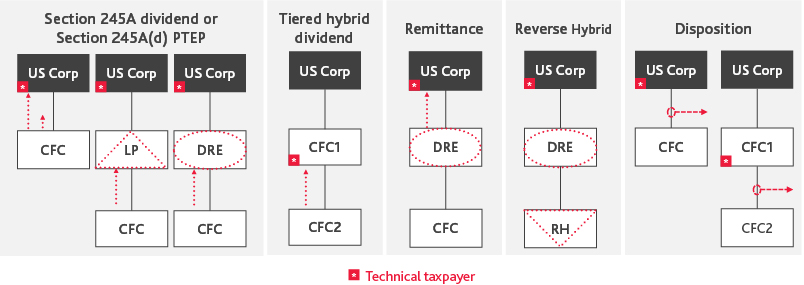

Additionally, the final regulations expand the range of transactions to which the FTC or disallowance rules under Section 245A(d) apply to include not only foreign income taxes that are paid or accrued with respect to certain distributions or inclusions, but also other transactions as illustrated in Figure 3:

Effective Date

The final regulations pertaining to FTC or deduction disallowance under Section 245A(d) apply to tax years beginning after December 31, 2019 and ending on or after November 2, 2020.

FTC Timing Rules

Accrual and Cash-Method Taxpayers

Under the Section 901 regulations,3 an accrual-method taxpayer is permitted to deduct additional taxes paid (as a result of a foreign tax redetermination) in the year in which the taxpayer has elected to claim a credit for foreign income taxes, even though the additional taxes relate back and accrue in a prior year in which the taxpayer deducted foreign income taxes. The final regulations require a taxpayer to elect to claim an FTC within a 10-year statute of limitations (SOL), as well as decide to deduct foreign taxes in lieu of a credit within a three-year SOL. The final regulations also confirm the applicability of the “relation-back doctrine,” which treats foreign income taxes as accruing at the end of the year to which the tax relates once the “all events test” is met. Lastly, contested foreign income taxes do not accrue until the dispute is resolved, even if the taxpayer remits the contested taxes in an earlier year – subject to an election to claim a provisional credit.

For cash-method taxpayers, a foreign income tax is generally creditable when paid. However, the final regulations allow a cash-method taxpayer to make a Section 905(a) election to claim FTCs on the accrual basis – even for taxes paid during the year but that relate back to prior years. This is a one-time, irrevocable election that must be made on a timely-filed original Form 1116 or Form 1118. The Section 905(a) election can be made on an amended return only by a taxpayer that has never claimed an FTC.

Correcting Improper Methods of Accounting

Taxpayers are required to file Form 3115 to obtain permission to change from an improper method to a proper method of accruing foreign income taxes. The final regulations provide that the modified cut-off approach is used for adjusting foreign income taxes that can be claimed as a credit or deduction in the year of the change.

Foreign Tax Redeterminations

The final regulations expand the definition of a foreign tax redetermination to include changes to the foreign income tax liability that affect a taxpayer’s U.S. tax liability, even if such changes do not affect the amount of FTCs claimed by the taxpayer. Additionally, a change from deducting to crediting foreign income taxes (and vice versa) is treated as a foreign tax redetermination under Section 905(c), and the IRS is permitted to assess and collect any tax deficiencies in intervening years resulting from a change in election, even if the three-year statute of limitations has expired.

Effective Date

The final regulations pertaining to FTC timing rules generally apply to tax years beginning on or after December 28, 2021. However, the election to claim a provisional credit for contested taxes remitted before a dispute is resolved may be made with respect to amounts of contested tax that are remitted in taxable years beginning on or after December 28, 2021, and that relate to a tax year beginning before December 28, 2021.

How BDO Can Help

BDO can assist multinational taxpayers with a comprehensive review of their global tax liabilities and U.S. foreign tax credit calculations to help assess and plan for the impact of the final regulations on their overall effective tax rate. For more information, contact BDO.

[1] Not including a real estate investment trust or a regulated investment company. A one-year holding period under Section 246(c) is also required to be met.

[2] An SFC means any foreign corporation with respect to which any domestic corporation is a U.S. shareholder.

[3] Treas. Reg. §1.901-1(c)(3).

SHARE