Effective Governance Strengthens Family Unity and Builds a Lasting Legacy

Imagine a cherished family holiday home that faces an idyllic beachfront, its wraparound porch dappled by sunlight through mature trees. Now imagine that every sibling – along with their spouses, children and close friends – wants to use the holiday getaway at the same time, and space is limited. The resulting arguments could last for hours; the resentment could endure for years. If only there were a set of protocols understood by all about how to communicate and share the family’s resources, then all that family strife could be avoided.

On a much larger scale, for a family with multiple homes in multiple locations, an operating business, family trusts, a charitable foundation and more, the complexity and number of obligations are significantly more difficult to manage. And all too often, family wealth is lost due to a lack of harmony, misaligned priorities, lack of communication and poor preparation.

Governance is a word often misunderstood by families and family offices – organizations that handle wealth management and the administration of family affairs – but it is essential for a long-lasting family legacy. Strong governance establishes a process for decision-making and conformity within a multi-generational family to promote communication and strengthen unity, helping to preserve wealth and solidarity for future generations.

Understanding and Preserving All Forms of Family Wealth

An old proverb (often attributed to Andrew Carnegie) says families go from “shirtsleeves to shirtsleeves in three generations,” suggesting that family wealth is lost before it reaches the great-grandchildren. Unfortunately, data supports that there is truth behind this proverb: nine out of ten families lose their wealth by the end of the third generation.

This underlines the importance of preparing future generations to sustain the family legacy, which is needed now more than ever. According to a 2019 report from Wealth-X, individuals with a net worth of more than $5 million will transfer a total of $15.4 trillion by 2030. With so much money set to transfer in the next decade, the urgent need for more robust succession planning and proactive decision-making is clear.

Managing and preserving family wealth encompasses more than just monetary considerations. In fact, every family possesses five forms of wealth: human capital (the family individuals themselves and their personalities, skills and experience); financial capital (money and assets); intellectual capital (knowledge, ideas and perspectives); social capital (professional relationships, social relationships, community involvement and philanthropic endeavors); and ethical capital (values, philosophies and responsible practices that improve the lives of others).

Effective governance practices address all of these areas. They can help heirs embrace their family identity and become thoughtful and competent stewards to enhance the family legacy going forward. Through this, they can inherit much more than just financial capital and pass that on to the next generation as well.

Governance of the Family, by the Family, for the Family

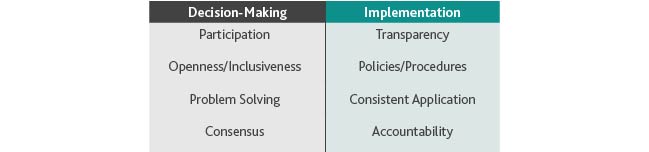

Governance provides a process for making decisions, implementing those decisions and communicating effectively. It can also identify problems, anticipate issues and prevent disputes. Most importantly, these practices help maintain family harmony by providing stability to the family wealth enterprise and facilitating the transition of wealth to future generations.

Governance Simplified

- A process for decision-making

- The process by which decisions are implemented

Strong Governance Practices

Although high-net-worth families and individuals increasingly recognize the importance of instituting formal governance structures, doing so presents a complex task, and it can be difficult to know where to start. A family office not only manages the family assets, it can also provide the framework for efficient and harmonious interactions among family members regarding a myriad matters.

Even when a family office does have a governance structure in place, it is often focused primarily (or solely) on the investment strategy, and often reflective of one strong personality. More robust governance practices – such as a statement of values; consistent communication and routine family meetings; a core family council for decision-making; policies for employment, ownership and liquidity; and a succession plan that includes educating heirs – are typically introduced later, if ever. Without comprehensive governance, the family legacy is jeopardized and could be lost altogether.

Keys to Successful Governance: The Three C’S

When governance has been instituted successfully, it encourages family unity by establishing shared identity and a common vision for the family. Each family is unique, so there is no one-size-fits-all solution. But it is foundational to family unity and identity to ascertain the values that all embrace, appreciate the family history and source of wealth, identify the family’s future aspirations, and agree on the initiatives and priorities to achieve those aspirations. The family decisions in furtherance of its aspirations and mission should reflect the values and philosophies that define the family.

Governance that helps align all parties can be summarized by the three C’s: consensus, communication and consistency.

- Consensus: Agree on the family’s vision and shared values, including about charitable causes that are important to the family.

- Communication: Gain buy-in from all stakeholders, encourage their participation and reassure them through a regular schedule of communication and interaction.

- Consistency: Follow through on consensus and communication, put those shared values into practice and ensure decision-making adheres to the family’s mission, as well as its prescribed policies and practices.

Establishing a shared understanding about rules for decision- making helps maintain practices that adhere to the three C’s. However, the question of who can provide input to reach consensus should be reviewed in detail first.

Certain family members may be better equipped than others to navigate the complexities of a family office, and some people may not be willing to participate.

Ideally, all family members would give their input to build consensus and promote consistency. This also helps avoid disagreements that can stem from some family members feeling that their point of view is not represented.

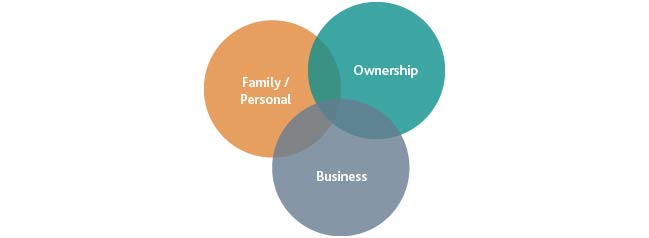

The Overlapping Involvement of Family, Business and Ownership

Whenever family and money coincide, things can become complicated very quickly. In a family office, this effect is compounded further by the high stakes of each decision, which can lead to feelings of resentment over perceived unfairness. Without effective governance structures, serious problems can arise that cause a breakdown in communication and misalignment of priorities. When key stakeholders are at cross purposes, everyone suffers.

The family enterprise has three circles of involvement – family, business and ownership. There can be family members and non-family members with a role in each circle. Where these circles intersect, there is a person who has multiple roles in these areas.

- A family member who is also an owner and is involved in the business day-to-day

- A family member who works in the business but has no ownership

- Family members who own shares in the company but are not involved in the day-to-day business

- Family members who have no ownership and are not involved in the day-to-day business

- Non-family employees

- Non-family employees who own shares in the business

- External investors

The three overlapping roles intersect the daily lives of family members, often in different ways and at different times, and they can expose conflicts and competing priorities. This can lead to confusion and disagreement over how to best resolve a wide range of issues, both seen and unseen. For example, consider a family patriarch who is the founder and CEO of the family business. He owns most of the business, but his children are beneficiaries of trusts that own some equity, and he is the trustee of those trusts. It is very possible that a decision about the company may conflict with his role as trustee and his children’s interests.

Clearly defined policies and processes for governance, in line with the formal mission statement, can address many of these issues and reduce the potential for conflict. And when family conflicts do intrude, seeking counsel from trusted non-family advisors can also help lend objectivity to the process and encourage amicable resolution, which preserves harmony.

Because the short-term needs and goals of a business may be distinct from those of the family, each circle of involvement can have its own operating strategy and philosophy, but it should remain consistent with the family’s overall mission. This helps establish a shared vision and culture of engagement that benefits family members, employees, investors and clients alike.

No decision gets made in isolation, and it’s important to remember the interrelation of the family enterprise. Decisions that benefit certain family members, such as one person borrowing against their equity interest in the business, could unexpectedly impact the stability of the business. Potentially, it could even make other family members unexpected creditors to the borrowing family member. Formalized policies to address such matters around ownership and liquidity can take all relevant issues into consideration. This provides appropriate safeguards that benefit the whole family.

Communication and the Family Council

Determining who makes decisions about the family enterprise can be one of the most challenging matters to navigate. Typically, a family council (also sometimes called a “board” or “committee”) is made up of several key members and serves as the chief decision-making body. It should be representative of the various branches of the family while still small enough to remain adaptable to varying conditions. If certain people have a professional background, for example in law or finance, they may be preferred for a role on the council, although this may not always be the case.

There should also be mechanisms for reviewing the governing body itself to assess how membership is determined and whether any changes or updates may be required. The ideal composition of a family council represents a range of skills, experiences, expertise, ages and perspectives throughout the family. Depending on size, some families may choose to have a sub-committee of next-generation members, but a key objective is to have intergenerational representation on the family council.

With a clear mission statement and a core decision-making body in place, communication practices can be standardized and implemented. It helps to specify a recurring timeline for the frequency of communication, and the family should also outline the intended content of these communications. Depending on the size of the family and the nature of business activities, the rhythm of communications will vary, but it is essential to have a gathering of all family members at least once per year. The families should also consider whether children can participate in portions of the family meeting to help equip heirs to be stewards of family wealth in the future.

Preparing Your Heirs and Theirs

Death cannot be avoided, but many people put off all preparations for this eventuality. To maintain generational wealth, the importance of formal succession planning cannot be overlooked as a part of effective governance – and the sooner this begins, the better. Senior family members must lay the groundwork for transferring control of the family assets and, if applicable, the business operations as well. Ideally, this should start at least five or even 10 years in advance of when the planned transfer will occur.

All too often, the delicate work of educating heirs does not get prioritized, to the detriment of all involved. If a crisis occurs, it could be too late to make informed decisions or impart critical knowledge in an effective manner. Addressing these issues proactively helps build muscle memory for younger family members and future generations about how to steward wealth and occupy a leadership role in the family. It sets up the continued success of the enterprise and guarantees the financial independence of retiring and future generations alike. Otherwise, the family’s legacy can become one of quarrels, litigation and in the worst cases reckless spending.

Families should formalize this training for the next generation to provide heirs with increasing responsibilities as they get older. Practices can include managing an allowance; participating in an investment club; serving as members on a family council subcommittee; having a voting role on the family council; interning or working in a business; and volunteering at charitable organizations to build a service mentality for philanthropy.

Being able to manage these responsibilities helps maintain alignment with the family’s overall goals and values. Within a framework of governance that embodies consensus, communication and consistency, formal training for the next generation helps limit risk and ensure future transitional success.

Paving the Way Forward

Installing robust governance structures in the family office helps preserve and protect family unity, wealth and legacy for current and future generations. By increasing family member engagement and aligning priorities, a governance program that matures as the family evolves will help protect wealth and prevent family discord, as well as help pave the way for continued family and business success. Through this, a family can share a future of cherished memories and togetherness.

Learn more about how BDO’s Family Office Services can address the specific needs of each high-net-worth family and the individuals within it.

We welcome you to subscribe to our Family Office Newsletter.

SHARE