How to Benefit from Total Tax Transparency

In April 2021, the Institute on Taxation and Economic Policy published a report naming 55 corporations it said paid no federal income tax and “collectively drained $12 billion from the U.S. government,” prompting swift backlash. Similar reports from groups including Pew Research and Public Citizen have brought unprecedented scrutiny of corporate tax contributions. The debate about whether companies pay their fair share has led to mistrust and criticism, as well as a corporate minimum tax requirement in the recently passed Inflation Reduction Act (IRA).

Total tax transparency is an approach to tax reporting that offers stakeholders comprehensive and timely access to a company’s total tax contribution. Total tax transparency brings visibility to how — and to what extent — an organization complies with tax regulations and supports society through taxes borne and collected. By applying total tax transparency principles to tax reporting processes, tax leaders can build trust, support ESG programs and educate stakeholders about the broader range of tax contributions a corporation makes beyond federal and state income tax.

“The time to elevate total tax transparency reporting is now. Not only can these reports mitigate widespread misconceptions about corporate tax contributions, they are important opportunities to educate stakeholders about an organization’s approach to tax and total tax contribution.”

- Jonathon Geisen, BDO Tax Managing Director

Challenge #1: Disparate Data Systems Create Chaos

BDO’s 2022 Tax Outlook Survey found that most companies (62%) cite data collection and analysis as the greatest challenges to understanding and reporting an enterprise’s total tax contribution. Because companies often partner with several compliance firms to manage different kinds of taxes across jurisdictions, tax data tends to be fragmented across various systems. In turn, these compliance firms work with a variety of software vendors, each of which uses its own metadata, further hindering the centralization and automation of data aggregation and analysis.

Additional analysis challenges arise with indirect taxes, as these charges are often buried in a wide variety of general accounts and dispersed over several line items in financial statements. Required tax reporting is only part of the challenge; by taking advantage of opportunities to automate data aggregation, companies can streamline processes and reduce the risk of incomplete or inaccurate reporting.

The Solution: Assess Gaps and Promote the Benefits of Total Tax Transparency

Companies should consider adopting a comprehensive approach to total tax transparency that integrates data, people, processes and technology. Tax leaders can ask the following questions to assess gaps and identify their organization’s next steps:

Companies must also use a robust tax risk management and governance framework with checks and balances — internal controls and compliance processes — to ensure complete and accurate disclosures. Without strong controls, reporting challenges may persist and tax departments will not maximize the outputs from data, people, processes and technology.

Implementing a tax risk management approach and governance framework is easier said than done. Tax leaders can incentivize collaboration by engaging tax departments and executive leadership in conversations about the business benefits of data gathering, analysis and controls, including:

-

Greater visibility into total tax contributions and cash flows across all tax categories

-

Enhanced understanding of the total tax landscape that leads to additional tax planning opportunities

-

Insights into year-over-year tax performance and multi-year trends

-

Improved benchmarking of tax performance

-

Ability to address new reporting requirements

-

Confidence that disclosures are complete and accurate

Challenge #2: Lack of Standardized ESG Reporting Frameworks

Given the abundance of reporting frameworks and standards, total tax transparency disclosures are left to a company’s discretion, while broader tax regulations vary by jurisdiction and industry. Businesses must balance transparent reporting principles with maintaining their competitive edge. Meanwhile, regulatory proposals and potential requirements are evolving daily.

The potential for shifts in the regulatory landscape makes companies reluctant to adopt any given reporting framework. Tax departments must also submit disclosures that are subject to audit and regulatory review, such as those included in Form 10-K annual reports. These disclosures organize data differently from total tax transparency reports and may lead to confusion among consumers or other external stakeholders regarding perceived discrepancies between filings.

The Solution: Leverage BDO’s ABCDs of Reporting

Assess: Companies can review existing frameworks such as GRI 207—a global ESG and sustainability reporting standard from the Global Reporting Initiative focused on tax—and work with external advisors to assess which works best for their business. As companies think through the components that underlie tax reporting, they can leverage tools such as BDO’s Tax ESG Cypher to craft their approach to tax, tax governance, risk management and total tax contribution.

Define: Before reporting, a company should clearly define what total tax transparency means in the context of its broader corporate purpose and ESG strategy. For both internal and external reporting purposes, it is critical to provide clear context about the data included in total tax transparency reports and how such reporting aligns with other ESG communications and tax disclosures.

Consider Internal First: Tax leaders should consider starting with internal disclosures as they establish reporting processes, data collection mechanisms and analysis methods. Beginning internally allows tax leaders to reap the benefits of data gathering, identify issues, test control frameworks and mitigate risks or deficiencies before reporting externally.

Benchmark: Companies can look to peers who are leading the way in transparent tax reporting to model best practices for disclosure. Peer reporting may also provide helpful direction on the qualitative information needed to contextualize tax strategy and values alongside raw tax data.

Challenge #3: Tax Departments are Stretched Thin

Given the extensive work required by traditional tax disclosures, compliance and staying abreast of regulatory changes, tax departments often lack the capacity to focus on tax transparency. Without regulatory mandates, such reporting is further deprioritized. In a tight and highly competitive talent market, tax departments also struggle to attract and retain employees — one of the top four challenges facing tax leaders, according to BDO’s 2022 Tax Outlook Survey Report.

The Solution: Develop Outsource Strategy and Invest in Automation

Reassessing the division of tax responsibilities and developing an outsourcing strategy can alleviate resource constraints. By reallocating work, tax departments will gain additional bandwidth to focus on creating sustainable value for the company, such as developing expertise in total tax transparency and ESG. Engaged third-party resources can also bring valuable experience to in-house teams, especially when working collaboratively to drive a total tax approach. Similarly, investing in technology and the automation of tax processes can help the department operate more efficiently.

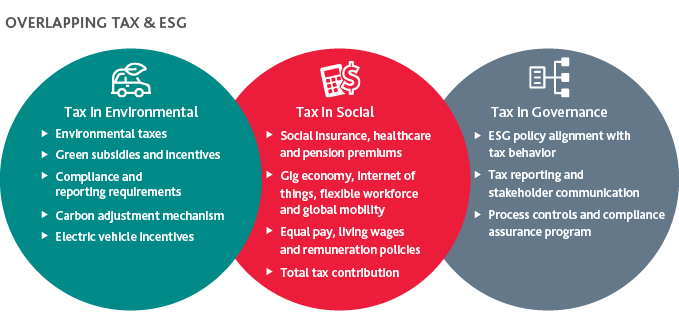

Challenge #4: Lack of Tax Alignment in ESG Strategy

Every business decision has a tax implication. Minimizing tax’s role in ESG is a losing strategy, given tax transparency’s increasing importance to stakeholders. BDO’s 2022 Tax Outlook Survey revealed a 20% decrease over the past year in tax leaders who said they were always included in strategic planning and decision-making. The failure to include a tax perspective in ESG strategy can result in missed opportunities to bring awareness to tax risk or maximize value through tax incentives and credits.

When total tax contributions are perceived to be at odds with ESG commitments — such as accusations that an organization does not pay its fair share due to low corporate effective tax rates — reputational issues can arise. Including tax leaders in ESG strategy and reporting can help mitigate these challenges by sharing more information about the company’s approach to tax and quantifying its total tax contribution.

The Solution: Conversations with Leadership Early and Often

Tax leaders should inform executive leadership of tax’s importance in ESG strategy. Executive leadership may be unaware of the many ESG credits, incentives, investments and partnerships that exist across tax categories and jurisdictions. Including tax leaders early in ESG strategy can help educate senior personnel about the value that tax departments bring to ESG efforts by taking a transparent total tax approach.

While there is no one-size-fits-all approach to total tax transparency, organizations can realize financial, operational and reputational benefits from more transparent reporting. By focusing on data gathering, frameworks design and selection, resource constraints and ESG strategy alignment, companies have an opportunity to overcome common challenges and gain a competitive advantage over peers.

How BDO Can Help

With decades of advisory experience, BDO is focused on leveraging a total tax mindset to help businesses meet the challenge of a new era of ESG. Talk to one of our Tax professionals for help understanding how your business can overcome obstacles to tax transparency.

SHARE