4 Key Compensation Considerations for SPACs

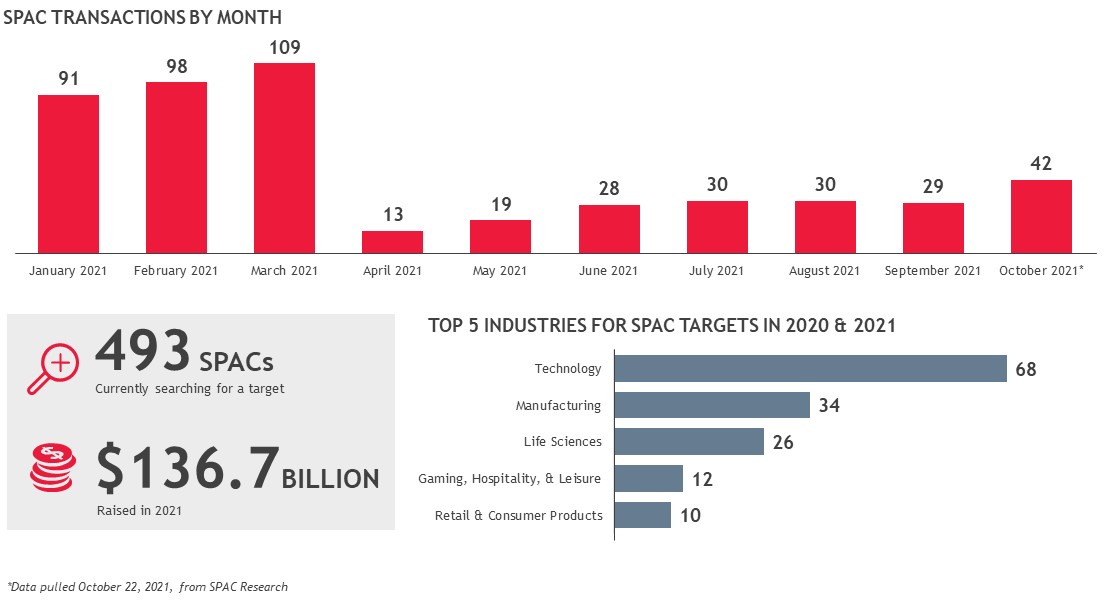

Special purpose acquisition companies (SPACs), also known as “blank check companies,” are companies with no commercial operations that are created to raise capital through an initial public offering (IPO) in order to acquire an existing company. They have been around for a long time, but their popularity has surged recently. In 2020, SPACs ended the year with 248 IPOs raising $83 billion—year-over-year increases of 320% and 513%, respectively. Through October 2021, there were already more than 471 SPACs raising more than $133 billion.

While there is significant potential upside with SPACs, these highly regulated, complex transactions require experience and intensive preparation. In particular, there are a number of considerations for target companies in preparing for the De-SPAC transaction, when the SPAC sponsor acquires a target company as intended and completes the merger. Through the De-SPAC transaction, the target company becomes the operational public company. As the organization moves from privately held to public, several areas should be reviewed from a compensation perspective, including change-in-control (CIC) payouts and transaction agreements, go-forward compensation philosophy and benchmarks, and regulatory reporting requirements.

In this article, we focus on four key areas:

- Executive Compensation: Understanding how executives will be compensated for their role in the De-SPAC transaction is critical, because a De-SPAC is similar to a public company merger. This includes confirming if any executive agreements have CIC clauses that will be triggered by the transaction, as these can result in significant payouts and adverse tax consequences. Significant payouts could present a retention risk for key employees at a critical time. Companies may need to renegotiate employment agreements well in advance of the De-SPAC closing to avoid the need for additional approvals by the SPAC and/or reporting requirements. Alternatively, the company may wish to provide staking (the initial equity granted when the company becomes public) or retention awards to executives to encourage them to stay post-transaction. Any awards to executive officers may need to be publicly disclosed, so companies should consider the shareholders’ perception of the total rewards package.

- Compensation Philosophy: The company will also need to establish a compensation philosophy for the target once it becomes public. The compensation philosophy will form the basis for compensation committee decisions, as well as shareholder communications. The company will often identify a peer group of other public companies to benchmark its compensation plan and compensation packages to ensure pay decisions are aligned with market practices. Compensation packages at public companies are usually different from those at private companies--both from an overall compensation standpoint and in the way compensation is structured--and companies will need to address these changes with their executives. Companies may use a multi-year plan to transition compensation to the new philosophy. Staking and/or retention awards can be a tool to bridge any compensation gaps.

- Competitive Compensation: Generally, total annual compensation for executives at private companies is lower than compensation at public companies. One of the biggest drivers behind the compensation gap is the use of long-term incentives. Public companies usually utilize annual long-term incentive grants, whereas long-term incentive awards at private companies are often less structured and more sporadic. The ability to readily monetize and liquidate awards is another benefit of the public markets. Employees at private companies may have limited ability, if any, to monetize their long-term incentive awards. Conversely, in the public markets, employees can readily buy/sell awards as they choose (aside from blackout windows and any other customary exclusions), which often increases the perceived value of the long-term incentive program to employees. As companies prepare for a SPAC transaction, one important decision that should be made prior to the transaction close is the structure of the go-forward long-term incentive plan. The equity plan document, including the size of the equity pool, is one of the many matters SPAC shareholders are asked to approve to effectuate the transaction. Early long-term incentive planning (e.g., award structure, eligibility) can help inform equity pool decisions.

The following highlights some of the typical differences between pre- and post-close compensation programs, based on our experience. - Reporting Requirements: Reporting requirements for public companies are substantial. Disclosures range from the Compensation Discussion & Analysis and related Proxy Statement disclosures to equity-related disclosures in the financial statements. As a result, companies often need to build additional capabilities to properly measure, track and report both cash compensation and all equity-related transactions (e.g., grant, vest, exercise, sale). Many organizations will realize their current methods of tracking equity are inadequate for the new public disclosure requirements. A number of service providers offer solutions in the form of software and/or services for this purpose.

Overall, proactive consideration of executive compensation is essential to achieving the long-term value of going public via a SPAC. Early focus on developing the right compensation strategy--one that rewards executives and drives shareholder value--will help set the foundation for a successful public company.

SHARE