Top 7 Risks Facing The TMT Industry

We asked executives in the technology, media and telecom (TMT) industry which risks their companies are most unprepared for. Here’s what they had to say:

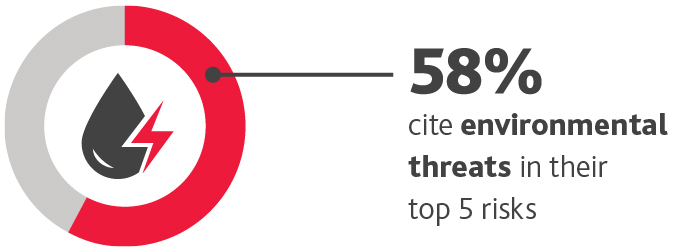

RISK #1: ENVIRONMENT

TMT companies seeking investor and customer favor need to demonstrate their commitment to carbon neutrality. With Google setting the record as the first company to achieve net-zero emissions, the pressure is on other TMT companies to reach that critical benchmark.

.jpg)

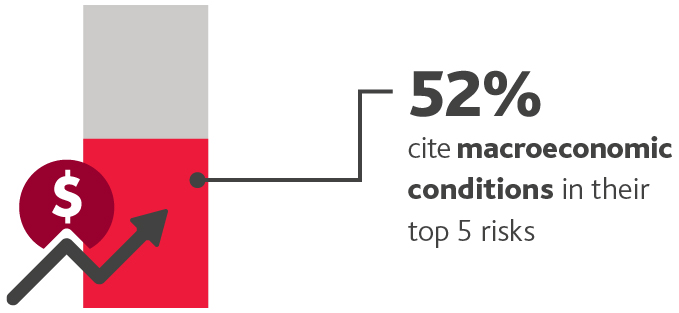

RISK #2: RISING INFLATION & INTEREST RATES

The combination of inflation and interest rate hikes have sent TMT valuations into a tailspin. Inflation may force TMT companies to rein in spending, while rising interest rates may turn investors away from high-growth stocks to steadier investments with higher dividends.

.jpg)

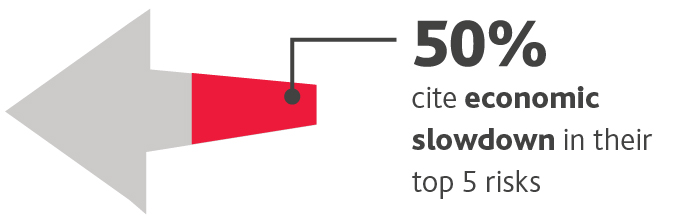

RISK #3: RECESSION

With most economists predicting a recession in 2023, many TMT companies are recalibrating now. Savvy executives are focused on building a financial cushion, reducing their debt and wooing their highest value customers to preempt losses.

.jpg)

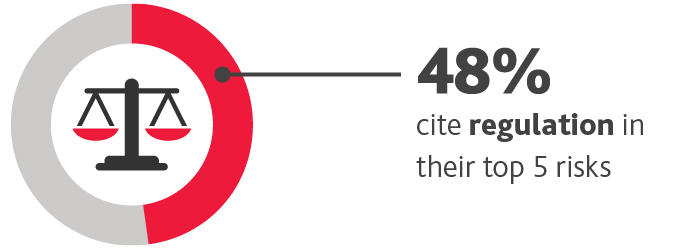

RISK #4 (TIE): REGULATORY COMPLIANCE

From antitrust investigations to global tax reform to new limitations on online advertising, the TMT industry is in regulators’ crosshairs. TMT risk leaders should expect their remits to grow and reassess their regulatory risk profiles.

.jpg)

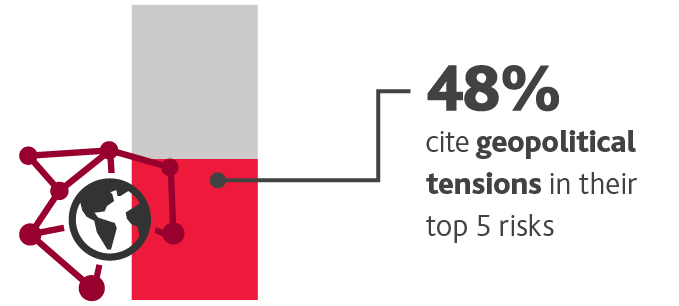

RISK #4 (TIE): GEOPOLITICS

The Russia-Ukraine war has created worldwide upheaval—and increased the risk of Russian cyber retaliation against the U.S. 62% of TMT executives ramped up cybersecurity because of the conflict. And 54% report severing ties with Russian partners and suppliers.

.jpg)

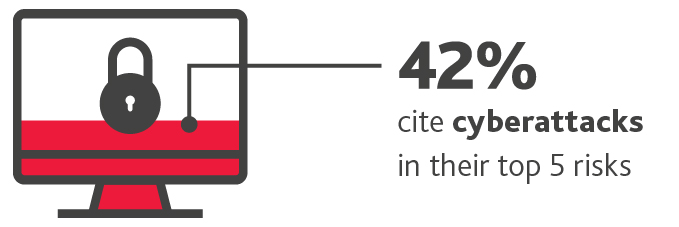

RISK #6: CYBERATTACKS

Already under fire for data collection and handling practices, TMT companies experience outsized consequences from a successful breach. Their view of cyber risk extends to their vendors, as TMT executives are more concerned about cyberattacks on the supply chain than they are raw material shortages.

.jpg)

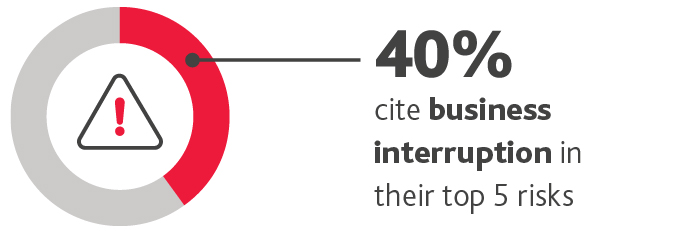

RISK #7: BUSINESS INTERRUPTION

Two-thirds of TMT executives expect supply chain disruption to last for at least another 1-2 years. The focus of their supply chain investments over the next 5 years will be on optimizing for resilience.

.jpg)

SHARE