BDO & Pitchbook Report: Disruption Further Drives Private Equity's Desire for SAAS

Until the global pandemic, the ability to work and conduct business remotely was considered a perk. Today, it’s table stakes across every industry.

In a year that made us redefine what was truly essential vs. non-essential, software as a service (SaaS) earned its essential status. Companies that implemented new software and cloud services to enhance collaboration, create efficiency and automate processes over the past several months were able to turn plans into action, accelerating and deploying technology at lightspeed. The organizations that have survived or even thrived this year no doubt owe their success, at least in part, to SaaS.

Now, with new use cases and user need emerging, and ROI proven at a critical time, SaaS companies are poised for continued success. In fact, Gartner reports that as global technology spend declined 8%, SaaS revenues will increase to $105 billion this year. As a result, SaaS companies maintain healthy interest from investors and will have ample opportunities for growth.

Overperforming in Down Year

.png)

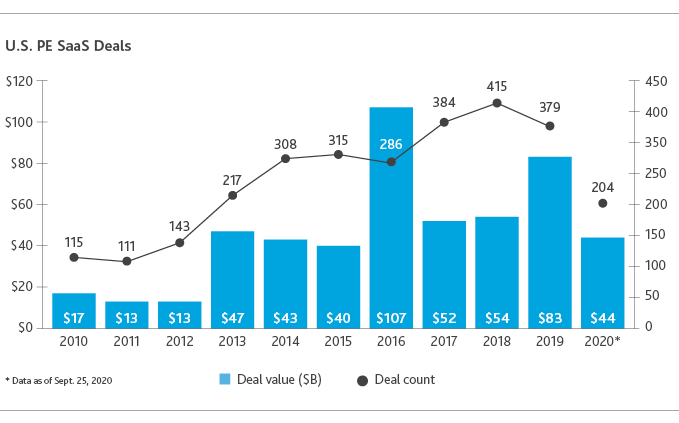

When the crisis hit, the deal pipeline understandably slowed as companies and investors alike braced for impact. Q2 2020 U.S. PE deal activity delivered the lowest deal volume since 2015, according to PitchBook, but Q3 2020 started a slow rebound.

While 2020 is unlikely to break any records for volume, software and SaaS have been relative bright spots. U.S. private equity software deals overall fell by about 40% compared to 2019, but even with the decline in volume due to the headwinds of the crisis and market volatility, software remained a top sector for investment, comparatively. SaaS deals comprised the lion’s share of software activity. Of the 369 software deals, 55% were of SaaS companies.

SaaS companies raised $44.1 billion, or 76% of the total software deal value.

PitchBook reports that high software valuations are also the driving force behind continued increases in the median buyout multiples in 2020, which are at all-time highs even in the midst of a crisis.

Looking ahead, with private equity firms still stocked with plenty of dry powder, 2021 could be a record-breaking year for PE-SaaS deal value and volume.

SaaS Sway in PE

.png)

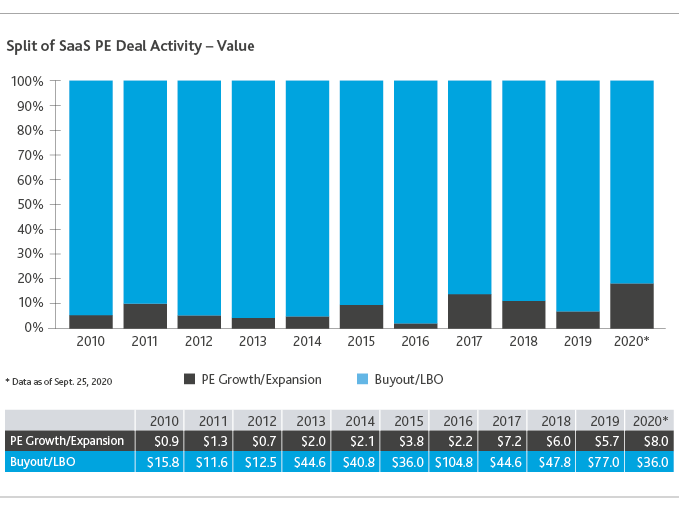

With the pandemic rapidly accelerating adoption, businesses have only grown more reliant on SaaS to deliver core services from sales and marketing to collaboration and communication—so much so that Gartner expects SaaS revenues will reach $141 billion by 2022. But it’s not just revenue growth potential that is attractive to PE investors, it’s also the revenue model itself. Subscription-based, predictable, repeatable and scalable without huge investments in capital expenditures have helped make SaaS a darling for PE investors and a success story of the PE lifecycle. In context of the economic downturn, predictable revenue is even more crucial with investors having fewer options and banks more willing to lend at a higher leverage on SaaS deals with high retention rates.

When it comes to the type of deals, with debt financing more constrained, private equity is starting to shift from leveraged buyouts (LBOs) toward growth investments or add‑on acquisitions to existing portfolio companies. Indeed, even with the tough climate, bolt-ons and growth investments are up year-over-year and reached the highest value to date at $8 billion.

Surprising Exits

.png)

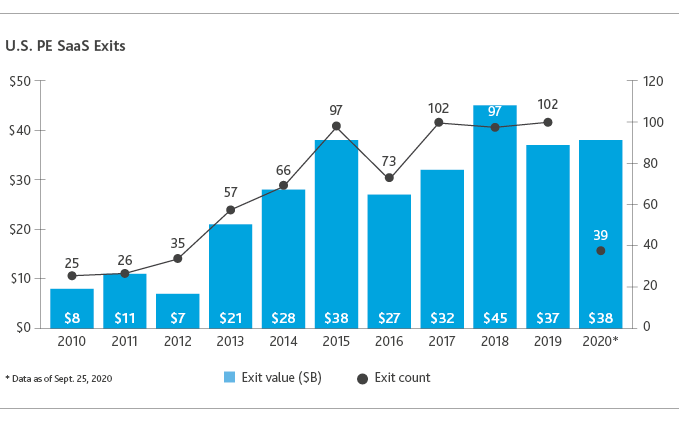

After a banner year in 2019, which saw $10.3 billion of deal activity across 46 deals—the highest recorded in the last 14 years—deal activity among SaaS business/productivity software and automation/workflow companies slowed in 2020. But the tides are turning as businesses and the market slowly regain confidence. In BDO’s Fall Private Capital Pulse Survey, 74.5% of fund managers said they expect the economy will perform better in 2021.

Some business-focused SaaS companies haven’t needed to wait for more favorable market conditions. Snowflake’s IPO in mid-September was the biggest software IPO in history.

The cloud-based data warehouse SaaS company more than doubled its $120 per share IPO price on the day it started trading. Workplace collaboration SaaS company Asana’s IPO also had a strong performance.

The success of Snowflake and Asana’s IPOs signals significant appetite for smart solutions that address the pain points so many companies are experiencing today, and continued opportunity in the public markets. In just 39 exits, SaaS deal value in 2020 has already exceeded the value raised in 102 exits last year.

SaaS is one of the few success stories of PE investment and exits in a year of historic lows and challenges. It powered both resilience in business and in the PE deal environment.

Looking ahead, PE and software continue to be a strong match, and companies looking to scale may find more than a few suitors at their doors. Another success story of 2020 has been the rise of special purpose acquisition companies (SPACs) that offer another path to going public that involves one-on-one due diligence with an acquirer, rather than a traditional investor roadshow. SaaS company Porch.com announced in August it would go public through a SPAC, and several other SPAC/SaaS IPOs are in the works before the end of 2020.

For SaaS companies considering the right path and partner to help them scale and meet the growing and evolving needs of the new marketplace, the number of options is an embarrassment of riches in the current climate, but also presents a clear responsibility to choose carefully.

When considering a private equity deal, SaaS companies should understand the pros and cons of entering into an agreement with any investor and ensure they are presenting an accurate picture of their financials, outlook and governance that will align with an investor’s deal thesis and strategy.

Demand is surging, revenues are at record highs, and signs point to 2021 being a record-breaking year for SaaS.

SHARE