BDO Technology CFO Outlook Survey

This survey was conducted in Fall 2019, prior to the global COVID-19 pandemic. We know that every organization—including BDO—is focused on the well-being of families, colleagues, and our communities. The middle market has proven its resilience in times of turbulence, and we believe, with a conscientious business mindset, organizations will manage the situation effectively. For information on how to secure your business in the wake of COVID-19, please visit www.bdo.com/COVID-19.

Innovation with Intent

Table of Contents

Introduction

In the tech industry, the calculus for risk vs. innovation is starting to shift.

It’s not that technology companies are no longer willing to place big bets. It’s not that they won’t invest significantly in research and development. But they are thinking differently about the how, why, where and potential outcomes of those decisions. It’s a fundamental change in the approach to risk.

Why? A spotlight is on the technology industry like never before. Stakeholders don’t just expect new and exciting products and services, they want responsibility and governance.

These demands are coming to a head at a time of turbulence in the economic and political climate despite low unemployment and high consumer confidence.

The good news: tech industry CFOs appear confident and ready to ride this new wave of social responsibility and market volatility.

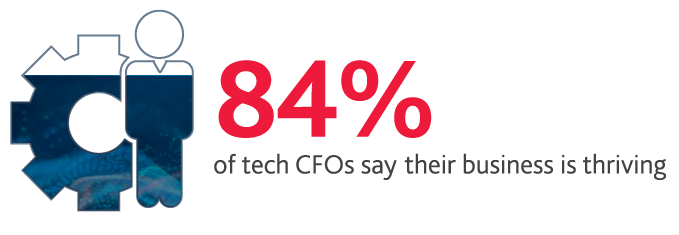

Our 13th annual survey of 100 technology CFOs found that 84% say their business is thriving.

“Move fast and break things’ is the past. Move fast and make things better is the way of the future. Tech companies see ample opportunity ahead but are rethinking their paths to growth. Staying private longer allows companies to avoid focusing on goals driven by short-term market expectations and solidify the business fundamentals and appropriate governance infrastructure they’ll need for long-term success and sustainability on the world’s stage.”

|

AFTAB JAMIL |

Risk vs. Innovation

It’s no secret that the technology industry has been on a tear. Despite volatility, tech remains an investor darling and a top sector for M&A activity and spending. According to Gartner, 2019 global spending hit $4 trillion in the IT sector of the industry alone.

Some industries live and die based on a single economic indicator or growth driver, but the tech industry benefits from several. When asked about the most important factors for growth in 2020, CFOs point to diverse drivers including increased corporate IT budgets (28%), cybersecurity concerns (25%), economic growth (21%), pressure to undergo digital transformation (16%) and consumer demand (10%).

In short, the drivers of tech industry growth are both push and pull: desire and force. Businesses and consumers want to enhance their offerings, experiences and lives, but the pressures and risks of change sometimes force their hand.

For tech companies, too, the balance of risk versus innovation is ever-present in every strategic decision.

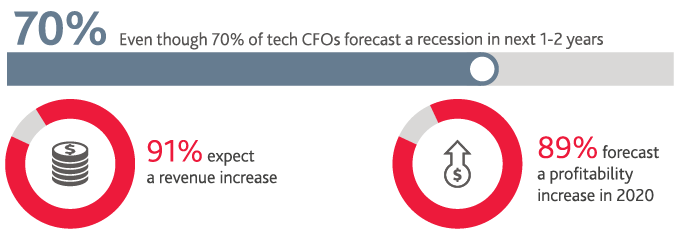

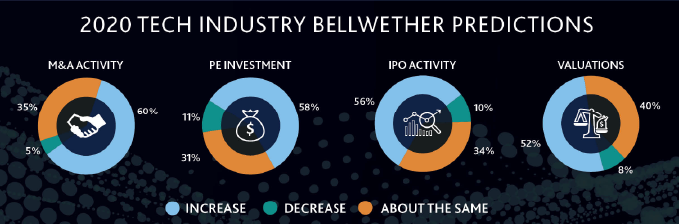

Will the economy be an X-factor? While most CFOs do expect the economy will see a downturn in the not-so-distant future, they largely expect industry growth and transaction activity will continue at this same accelerated pace. More than half of CFOs expect increases in each of the key bellwethers of technology industry growth (M&A, PE investment, IPO activity and valuations), and these forecasts come on top of robust results in 2019. CFOs are notably more optimistic for IPOs in 2020 (56% forecast an increase) compared to 2019 (37% forecasted an increase).

The key driver of continued interest in technology industry M&A activity? It’s what the industry does best: innovation. A plurality of CFOs (39%) say that technology assets and intellectual property will be the top factor influencing deals this year—more so than revenue growth (32%). The high value placed on innovation tracks with where tech CFOs are investing their own resources: 66% will increase R&D spending this year to help enhance their competitive positioning and market value.

On the IPO front, CFOs expect revenue growth will have the most influence on tech companies pursuing an IPO (34%), but that factor is followed by corporate governance and compliance (20%). Management credibility is cited by another 8% of tech CFOs. Investors are increasingly looking for a sound governance structure, including a mature management team, board of directors and established controls to show stability and confidence in a company.

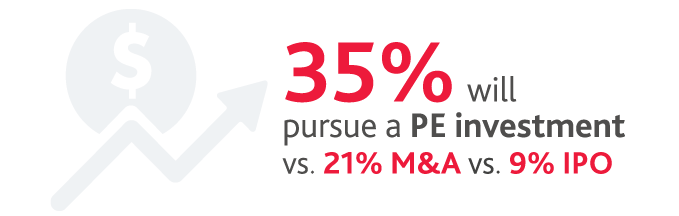

Preferring PE

Private equity, in particular, has been a popular investor in the tech industry. In 2018, there were 1,616 private equity deals in the tech industry, responsible for $223.2 billion in investment, according to Pitchbook. For tech companies, increased PE interest has been a mutually beneficial relationship as it has coincided with slightly tempered interest in the IPO market.

In fact, almost four times more tech CFOs will seek PE investment in 2020 than will pursue an IPO.

More and more, tech companies are opting for the benefits of staying private longer and seeking growth and expansion out of the public eye. There’s also the unicorn factor. While several companies are earning billion dollar valuations and there is still ample available capital to be obtained in the public markets, several high-profile unicorns missed the mark in 2018 and 2019 when private valuations did not hold up to public scrutiny and interest. Tech companies are benefiting from PE infusions to fund growth objectives, while at the same time, holding on to the advantage of navigating missteps or hurdles without the volatility of the public markets which are influenced by short-term expectations.

Looking ahead, PE and venture capital fund managers echo this enthusiasm. Our inaugural U.S. Private Capital Outlook survey found that both PE fund managers and VCs expect to increase deal activity in the tech sector in 2020, with 5G, AI and IoT noted as the top areas of interest.

“Tech has long been an apple of the PE firm’s eye, and it’s increasingly clear why the relationship is a win-win. Tech companies know that private equity investors will expect ROI, but the ability to problem-solve behind closed doors with seasoned counselors, and have products and services reach maturity as a private company, is becoming increasingly attractive in this climate.”

|

SCOTT HENDON |

Trade: Sounding the Alarm on National Security

Innovation has also placed the technology industry in the middle of several high-profile and political issues in the past few years—from immigration to foreign interference and national security—and each of those challenges has come to the table amid ongoing trade tensions.

Like most industries, tech sector executives are deeply concerned about the wide-ranging impact of volatility in trade policies. Across BDO’s poll of 700 CFOs, international trade tensions (19%) is the second most commonly cited geopolitical issue that presents a risk to their business, after a potential economic downturn (29%), and it is the top policy issue for CFOs overall in the 2020 presidential election.

For tech CFOs, however, the issue is both heightened and nuanced. The tech industry’s top concern related to trade policy is not the impact on growth or pricing, it’s the impact on national security and innovation.

Tech is the only industry to sound the alarm, so to speak, on the impact of trade on national security, which is also their top policy issue of concern in the 2020 election (unlike their peers in other industries).

As a truly global industry, tech CFOs have a unique vantage on the United States’ role and reputation in the international marketplace. They have also long faced challenges with intellectual property protection and friction with global competitors who seek to undercut major U.S. players. For U.S. tech CFOs, the impact could come not solely on their bottom line, but in U.S. tech industry leadership that is connected to the safety and the security of the government it contracts with and supports.

Challenging China

The elephant in the room and the trade war is, of course, China. China has long been perceived as a threat to the U.S. tech industry, and CFOs make it clear that the threat is now at their door. Seventy one percent of CFOs say they think it’s a matter of time before China will surpass the U.S. tech market, and 41% think it will happen as soon as 2025. Chinese tech innovations have, in some cases, started to eclipse those of the West. Thanks to Alipay and others, China has a significant hold on the fintech industry, and Beijing has aspirations for becoming the world leader in artificial intelligence by 2030, as reported by CNBC.

At the end of 2018, Silicon Valley held just a $6 billion lead in venture capital investing over China, according to Prequin.

Certainly the stated goal of the tariffs and trade discussions with China are to help improve the position of U.S. companies, including the critical tech industry. But the path has been rocky at best, and the outcomes are uncertain.

Trade tensions and national security concerns are unlikely to abate in the near future, and we could be entering a new normal of the U.S.-China relationship. Even with a phase one deal announced, China has its sights set on becoming a tech superpower, and tech CFOs appear to be readying their plans now for that reality.

Getting Resourceful: Tech’s Talent Challenge

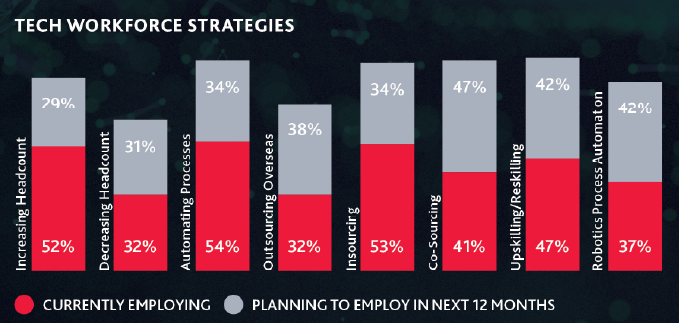

Whether it’s an innovation showcased at trade shows or the growth highlighted at investment road shows, people power the technology industry. Competition for talent has been fierce for decades, and with companies continuing to grow at a fast clip, compensation and benefits packages are expanding to attract and retain skilled workers as well. A vast majority of tech CFOs (81%) say they are currently increasing or plan to increase their headcount in the next 12 months.

The talent challenge is truly hitting tech companies from every angle. It’s getting harder to attract talent, afford talent, train talent and retain talent. The risk is clear: find the right talent and nurture them, or fall behind. Nearly three in four (71%) CFOs say they are increasing spend in their HR/talent department to help manage their strategy and processes.

But HR can’t solve for the tech talent challenge alone. Tech companies are increasingly looking to numerous alternative staffing solutions to fill their pipeline and growth needs. In addition to traditional outsourcing, many tech companies are turning to co-sourcing arrangements with other companies and one vendor to achieve efficiencies and streamline their supply chain. Reskilling workers and insourcing work that is no longer viable for outsourcing are also popular strategies. Tech companies are also looking to digitally enable their workforces through automating processes and leveraging robotics process automation, where possible, to streamline workflows.

Regulation, Reinvented

Another reality tech companies are preparing for: more regulation is ahead. In fact, they are not just expecting it, they are—in some cases—advocating for it.

While it’s rare for industries to call for more regulation, the tech industry has faced significant challenges over the lack of guardrails and lack of consistency around laws related to digital business and data. The reality is it can be more challenging to comply with dozens of disparate rules than one overarching rule.

Shaping the Debate on Data Privacy

The CCPA—California Consumer Privacy Act—and several other state-wide laws have made data governance and management a challenge. Today, all 50 states have some type of data privacy law, from basic data privacy notification obligations to cybersecurity and monitoring requirements for companies, and the General Data Protection Regulation (GDPR) has been in effect since May 2018 for tech companies who offer products or services to the European Union.

Privacy has become a complex puzzle where different jurisdictions seem to have legislative pieces of varying shape and size. Amid changing regulations, sophisticated attacks and growing consumer advocacy, data privacy is the biggest pain point for CFOs in 2020. It’s their top regulatory concern, their top business threat and one of their biggest business priorities.

In September, the Business Roundtable group, which includes several of the largest tech company CEOs, called on Congress to pass a “comprehensive consumer privacy law.” The group notes that a Federal law would create more consistency and stability for consumers and companies alike and published a framework for consideration. Critics of the framework suggest that the industry can’t effectively write rules to regulate itself. If a Federal law is to move forward, consensus will likely require collaboration between Congress and the technology industry. Key priorities will be meeting a high standard for consumer protections, establishing effective governance standards, understanding the technical realities of any regulation and avoiding stifling innovation unnecessarily.

Outside of the regulatory front, tech companies are increasingly taking a proactive stance to data privacy internally as a result of consumer and stakeholder demand. The new normal? Building in privacy and security into the product development strategy from the prototype and taking an ethical approach to data. Data ethics means going beyond compliance and the law when scoping projects and developing transparent, accountable programs that collect, store and use data that’s proportionate to the project, and no more.

“2020 is likely to kickstart another huge wave of regulatory change in the technology industry, and data privacy may be the first domino. Tech companies are wise to lead the charge here and be proactive about developing sound data protection practices.”

|

KAREN SCHULER |

Heralding Tax Transformation

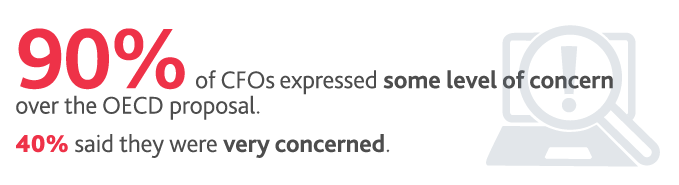

The digital economy is also redefining the global tax landscape. In October, the Organization for Economic Cooperation and Development (OECD) released a draft proposal to create a framework for an international digital services tax. The goal is to get consensus on a unified global approach by the end of 2020. As noted in a recent BDO alert, among the proposed rules is a requirement that multinational enterprises pay taxes in countries in which their customers buy and use their products and services, regardless of whether the company has a “permanent establishment” (generally established by physical activities) under traditional tax rules.

Countries including France and the United Kingdom have already created their own digital tax rules, and the risk is that if dozens or hundreds of these discrete digital tax systems are created it could create a significant compliance challenge, as well as the potential for rampant instances of double-taxation. The OECD’s plan is to get ahead of this with a unifying, consensus approach. Recently, the U.S. opened another front in the trade and tariff battleground when it announced its intention to impose a 100% duty on French wine, cheese and luxury goods in retaliation for the French digital tax, which the U.S. believes unfairly targets U.S. tech companies.

“With the advent of social media and the monetization of digital consumption, many nations believe that the current tax system, created to address an old economic model as it existed a century ago, no longer reflects the business realities of today. They are intent on creating new tax rules to monetize these activities themselves. Tech companies must be aware that their tax planning and cross-border strategies will be fundamentally reshaped in the coming years.”

|

DAVID YASUKOCHI |

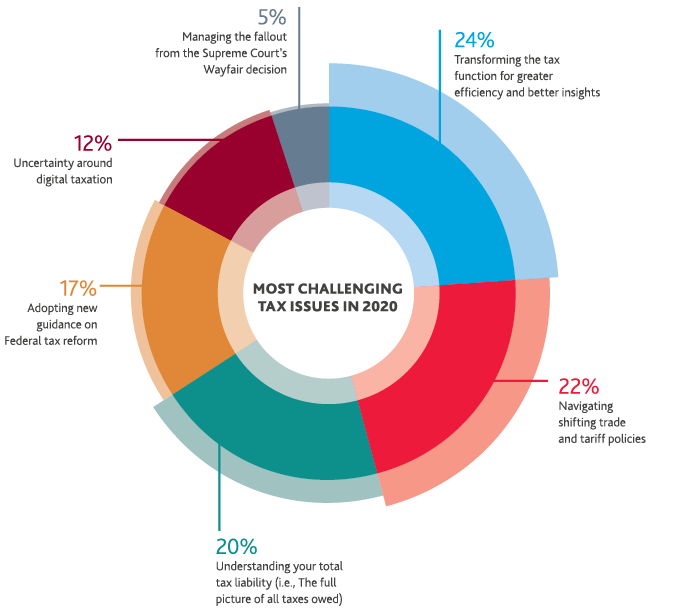

Even with these potentially fundamental shifts in the digital tax landscape in the background, only 12% of CFOs said that uncertainty around digital taxation would be their most challenging tax issue in 2020. Instead, in light of contending with significant change from new rules, many CFOs are focusing internally on transforming their internal tax function to be more efficient and provide more valued insights for their own company (cited as top tax challenge by 24%). Viewing the tax function through this lens and leveraging the powerful business intelligence that comes from understanding your organization’s total tax liability is essential, particularly during times of turbulence. One seemingly small change in your tax posture can have a chain reaction-type impact throughout your business.

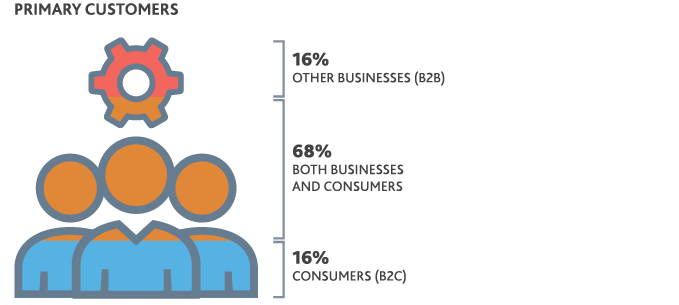

Respondent Profile

Day in the Life

Contending with the key issues reported, the revenue and growth expected from boards and shareholders, and the transparency demanded by stakeholders, tech CFOs bear tremendous responsibility. One in four tech CFOs say the biggest challenge for them personally is the increasing volume of work and higher expectations. For many, the pace and demands can feel relentless.

Technology is often promised as an enabler or strategic solution, but in transition or adoption phases, it can prove challenging. Sixteen percent of CFOs say using new technology, tools and techniques is their top personal challenge, and this is expanded when CFOs look at the finance department holistically.

When asked to cite the biggest operational challenge for the organization’s finance department, and when asked what their biggest concern related to internal controls over finance reporting, the top response to both ties back to information technology and data management.

Many tech CFOs are in the process of going through internal digital transformation to optimize their own systems and processes in order to create efficiencies and establish the infrastructure that can support a digitally-enabled service or product offering. The result is deeper business insight and access to better information in real-time, but the road to get there is not always smooth.

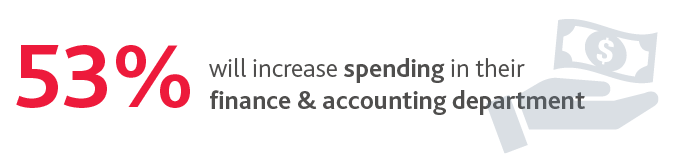

The good news is that most tech companies understand the importance of the finance function both as a strategic partner and tech-enabled insights center of the business: 53% will increase spending in their finance & accounting department this year.

Survey Demographics

SHARE