2016 BDO Technology Outlook Survey

Tech CFOs Examine Growth Opportunities for 2016

2015 might have been the year of the unicorn — with an unprecedented 142 companies exceeding the $1 billion threshold — but in 2016, the tech sector may take a breather.

According to the 2016 BDO Technology Outlook Survey of 100 chief financial officers at U.S. technology companies, less than half (48 percent) expect technology business valuations to increase in 2016, down from 62 percent last year. This reflects the more cautious view undertaken by investors in the last quarter of 2015, which saw a number of mutual funds mark down the value of their private technology holdings.

Still, tech companies are fairly bullish on revenue potential for the year ahead. Nearly three-quarters (74 percent) of tech CFOs anticipate higher total revenues in 2016, projecting, on average, an increase of 8.8 percent over last year, on par with 2015 projections (9 percent). Just 2 percent of respondents expect their revenues to decrease.

The question, then, is how tech companies will seek to grow in the year ahead, and where they will look to invest?

Our survey suggests the focus will be on three key areas: mergers and acquisitions (M&A), innovations in consumer technology and cybersecurity.

Tech IPO Interest Slows

Less than half (46 percent) of tech CFOs expect to see an uptick in IPO activity this year, down from 54 percent of respondents last year. This aligns with the results of the 2016 BDO IPO Outlook survey of capital markets executives at investment banks, who reported a flat forecast for IPOs for the first time in seven years.

Also pointing to a more measured year ahead, five of the 12 U.S.-based tech IPOs in 2015 priced their shares at valuations below or nearly the same as their private market value, Reuters found. In addition, technology IPO activity has tapered off, with just 23 companies going public in all of 2015, a 58 percent drop from 2014, according to Renaissance Capital data. We have also seen a slow start to 2016: there was not a single IPO in January.

When looking at factors driving IPO activity in the U.S. market, tech CFOs cite U.S. market volatility as the greatest influence (26 percent), followed closely behind by global political and economic issues (25 percent). The performance of recent technology IPOs and concerns about inflated valuation (both 20 percent) were also cited as significant factors.

VC-Backed IPOs Cool Off

Forty-seven percent of CFOs expect private equity-backed companies will give rise to the most tech IPOs this year, followed by venture capital (42 percent). Only 11 percent expect owner/manager or privately held businesses to drive the most IPO activity, down from 25 percent last year.

In last year’s survey, tech CFOs predicted that venture capital would give rise to the most tech IPOs--with good reason. However, in the last quarter of 2015, venture capital firms invested $17 billion in U.S.-based companies, an 11 percent decline from the previous quarter and a 7 percent decrease year-over-year, according to data from Dow Jones. The pullback in funding may stem from the less-than-stellar performance of venture-capital backed tech IPOs. Research conducted by The Wall Street Journal shows that 11 of the 49 VC-backed U.S. tech companies that went public in the last two years traded below the per-share value, when they last raised money as a private company.

Tech M&A Mercury Rising

Appetite for M&A remains strong on the heels of a record year for tech dealmaking. Technology deal value reached $713.1 billion in 2015, making it the second-most active sector after healthcare, according to data from Dealogic.

Eager to capitalize on that momentum, 40 percent of surveyed CFOs have plans to pursue deals in 2016. Outside of their own plans, the pace of M&A is expected to continue in 2016: nearly all (96 percent) of tech CFOs anticipate M&A activity will stay the same or increase this year, and 72 percent predict acquisitions will be primarily offensive.

Thirty-one percent of tech CFOs believe increased revenue and profitability will be the primary impetus for M&A activity in 2016, followed by improved market share (29 percent) and gaining technology assets and intellectual property (25 percent).

“Investor sentiment toward the technology industry has soured in recent months as a number of IPOs have failed to perform and technology stocks took a hit. However, the chilly IPO environment and share price declines don’t necessarily tell the full story. Finance chiefs are bullish about their company revenues as well as their M&A prospects. Disruption in consumer tech along with data analytics, cyber, cloud computing and the burgeoning Internet of Things market will create opportunities for further growth in 2016.” - Aftab Jamil, partner and leader of the Technology and Life Sciences Practice at BDO

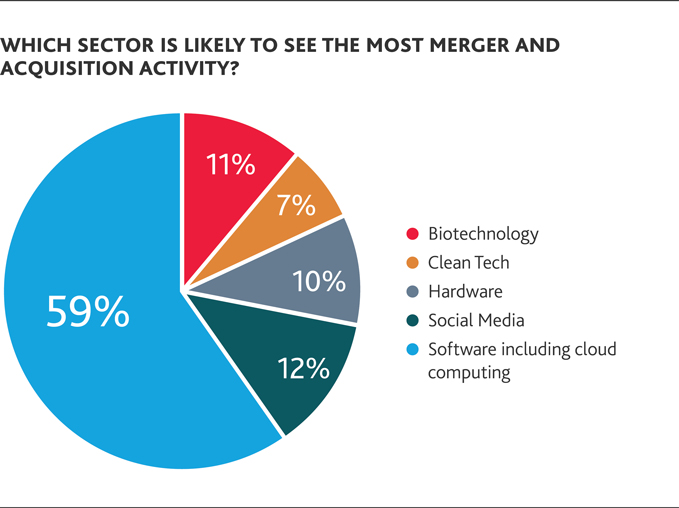

Software to Dominate Deals Again

In last year’s survey, tech CFOs predicted that the software subsector would drive the bulk of M&A activity — and the sector didn’t disappoint, with total transaction volume increasing by 9 percent over 2014 and total value increasing by a whopping 72 percent to $213.2 billion. Additionally, the $67 billion deal between Dell and data storage provider EMC, announced in October of last year, is the biggest tech deal on record.

In line with last year’s outlook, 59 percent of tech CFOs believe software, including cloud computing, will generate the most deal activity. Forrester Research concurs with their assessment, predicting consolidation of the cloud will accelerate in 2016, as the major public cloud providers like Google and Amazon snap up smaller players or force them to retreat or exit the cloud entirely. Just 12 percent of CFOs say the social media sector will trigger the most deal activity this year (down from 22 percent), closely followed by biotechnology (11 percent) and hardware (10 percent).

Hardware M&A, however, shouldn’t be underestimated. In the first three quarters of the year, global semiconductor deal value reached $103.64 billion, compared to $37.7 billion over the same period in 2014, according to Dealogic. Consolidation in the chip industry shows no signs of slowing down, with the $16.7 billion Intel-Altera deal announced at the end of December and the $3.56 billion Microchip-Amtel deal announced in January.

“Cloud adoption has become mainstream, but the market is far from reaching maturity. Faster deployment, along with a recurring revenue business model and higher ROI, make software-as-a-service providers an attractive M&A target from both a strategic and financial perspective. Burgeoning interest in the Internet of Things is also driving deal activity, as the industry looks to software for solutions to manage and analyze IoT-generated data.” - Hank Galligan, leader of the Software Practice at BDO

“In a mature market like hardware, investors penalize companies if they can’t improve their profit margins. As a result, many semiconductor companies are turning to creative dealmaking to boost profits and slash their operating expenses.” - Slade Fester, leader of the Hardware Practice at BDO.

Fewer Companies Seek Financing

Seventeen percent of surveyed CFOs say they anticipate seeking additional capital this year — a significant decrease from last year’s number of respondents (38 percent). Of those planning to access capital, turning to a strategic partner is the most popular choice, at 36 percent of respondents. Twenty-three percent of CFOs plan to seek additional capital through private equity, up from 16 percent in 2015, while 21 percent will rely on the private debt market, up from just 3 percent last year. In what may be a response to signals of slowing IPO activity and significant market volatility, CFOs have shied away from the public markets, with only 10 percent seeking capital from either public debt or public equity. Last year, technology companies engaged in private funding rounds totaling $51 billion — six times the $8.26 billion raised in U.S. tech and Internet public offerings, according to CB Insights.

“As the IPO market has cooled off, technology companies are looking to the private sector to increase their cash and liquidity in today’s uncertain environment. We’re seeing some companies using more debt financing when available in lieu of private equity capital. However, while lofty valuations and a murky forecast for the sector have PE firms carefully scrutinizing investments, the lower middle market continues to see robust M&A activity.” - Lee Duran, partner and leader of BDO’s Private Equity Practice

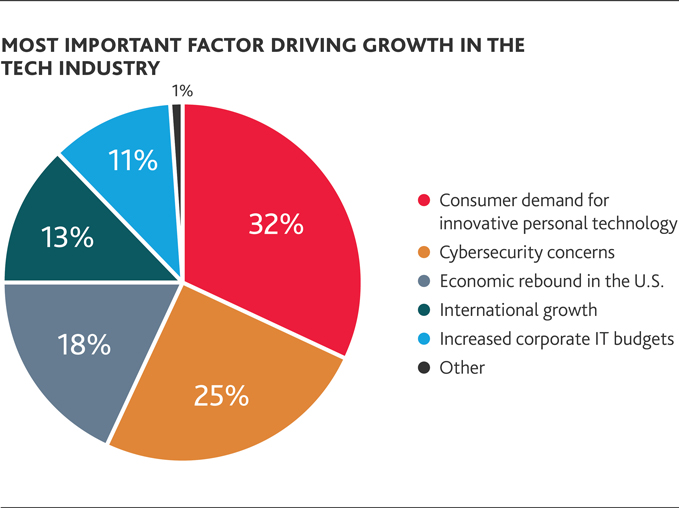

Consumers Move the Needle on Industry Innovation

Consumer demand for more innovative personal technology will power the tech industry in 2016, selected by one-in-three CFOs as the most important factor driving growth. Smart devices can never be smart enough — and consumers’ growing expectations for technology to be context-aware and attuned to their unique demands have given rise to the much-hyped Internet of Things (IoT). McKinsey & Company puts IoT’s potential economic impact at $3.9 trillion to $11.1 trillion by 2025.

“In spite of its name, the Internet of Things is as much an opportunity for software providers as it is for chip and device makers,” added Galligan. “The value of connecting devices is in the ability to analyze the massive amounts of data generated into actionable insights and intelligence. That same data also gives rise to data privacy and security considerations that will ultimately bring providers of cyber solutions into play.”

Advances in artificial intelligence (AI), from speech recognition to product or location-based recommendations, are another significant area of investment as the industry develops tools and technologies to anticipate users’ wants and needs. The AI market is expected to grow at a CAGR of 53.65 percent over the next four years to reach $5.05 billion by 2020, according to a recent report from MarketsandMarkets.

Cybersecurity Driving Industry Growth

Cybersecurity will be one of the biggest growth engines for the technology sector in 2016. One-in-four tech CFOs view cybersecurity concerns as the primary driver of industry growth this year, outflanked only by consumer demand for innovative personal technology. Researchers estimate the cybersecurity market will grow 9.8 percent annually to $170 billion by 2020.

Cybersecurity is not only fueling innovation within the industry, but also driving tech companies to shore up their own defenses. More than half (57 percent) of respondents increased spending on cybersecurity during the past year in response to the growth of cloud services, mobile devices and the proliferation of sophisticated cyber attacks.

“The tech industry is responding to rising concerns about cybersecurity across all industries, making tremendous progress in advanced analytics and artificial intelligence to anticipate and respond to cyber threats earlier. It’s reassuring to see that tech companies are practicing what they preach; the industry is prioritizing cybersecurity internally and embedding cyber principles and machine learning techniques into their product and service offerings.” - Shahryar Shaghaghi, National Practice Leader for Technology Advisory at BDO

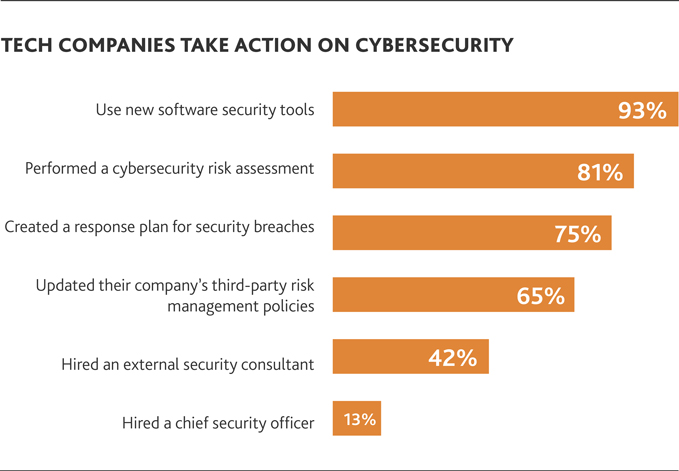

Tightening Security Measures

To address growing cybersecurity concerns, respondents report their organizations have taken a number of actions over the past year including using new software security tools (93 percent), performing a cybersecurity risk assessment (81 percent) and creating a response plan for security breaches. Regulators are placing more scrutiny on security breaches stemming from vendor relationships, so tech companies are tightening policies in response, with 65 percent of tech CFOs reporting that their company has updated third-party risk management policies.

CFOs Say U.S. Tax System Hinders Global Competitiveness

Several macroeconomic issues are expected to weigh heavily on tech companies this year. When asked to weigh in on the biggest challenge, tech CFOs were nearly equally divided between policy and tax changes (26 percent), healthcare reform (25 percent), domestic and global political issues (24 percent) and the lack of a qualified workforce (24 percent).

Half of all respondents believe the tax system hinders their global competitiveness. Taking a closer look at specific tax reform issues, 49 percent of tech CFOs rank the U.S. corporate tax rate—currently sitting at 35 percent, and one of the highest rates in the industrialized world—as their biggest concern. However, only 16 percent of tech CFOs are increasing their level of tax planning activities over the next year to reduce the organization’s global effective tax rate; most (80 percent) are keeping activities on par with last year.

Rounding out respondents’ top three tax issues for 2016 are aggressive state tax laws (19 percent) and taxation of overseas activities (17 percent). Looking abroad, several countries, such as Ireland and the U.K., have recently announced tax law changes largely aimed at technology companies, and the OECD has commenced with implementation of its recommendations on Base Erosion and Profit Shifting (BEPS), which may change the global tax landscape. These international tax developments, along with the upcoming elections, may present unsteady footing for long-range planning.

“The presidential election this year will likely put corporate tax issues on center stage, with much hanging in the balance until voters make their decision in November. Tech CFOs will also be watching for changes in tax policy at the state and local level, as the states continue to take a patchwork approach to taxing the cloud.” - David Yasukochi, partner and leader of the Technology & Life Sciences Practice at BDO

CFOs Stress Over Talent

When tech CFOs weighed in on their organization’s greatest challenge in 2016, recruiting or retaining workforce talent (32 percent) was cited nearly as often as competition (39 percent).The talent issue has become an increasingly pressing priority, at its highest proportion in the past nine years, after rising fairly steadily from 11 percent in 2008. More than half (55 percent) of tech CFOs said that staffing would remain level with last year, while 44 percent expect their organization will hire more employees. Sales and marketing positions are the primary focus area for hiring, according to 52 percent of respondents, followed by research and development positions (21 percent).

Outsourcing Continues to Decline

Even as talent needs challenge tech companies, fewer and fewer are looking outside of the U.S. to fill their needs. Among those who do offshore or outsource, manufacturing (71 percent), research and development (43 percent), and IT services and programming (38 percent) are the most frequently provided services. Among those who do not currently offshore or outsource, a mere 2 percent say they are likely to consider doing so in the future.

Revenue Recognition on the Radar

Tech CFOs have become more aware of the new revenue recognition standards that the Financial Accounting Standards Board and the International Accounting Standards Board issued in 2014. Sixty-three percent said they were familiar with the new standards, up from 43 percent last year. However, CFOs are still largely indecisive about how they will adopt the standards, with 31 percent still trying to understand the changes. Nearly half (45 percent) haven’t decided whether they will choose the prospective or full retrospective option, although prospective is the more popular choice among those who have decided (21 percent). Implementation of the standard has been delayed until 2017, and some clarifying changes have yet to be resolved. For now, 77 percent believe the standards won’t have any impact on their organization.

Still, the majority (57 percent) of tech CFOs cited financial reporting as their most serious compliance concern in the year ahead, followed by general fraud and corruption (19 percent) and export controls (11 percent).

Spotlight on M&A

What Are Tech Acquirers Looking For in 2016?

Mergers and acquisitions again look to be a popular vehicle for growth among tech companies this year. If your company is considering pursuing an acquisition or seeking a buyout in 2016, keep these four fundamentals in mind.

People and Property Assets

Tech companies say M&A deals will be offensive in nature this year, as companies seek the best and brightest in talent, research and IP. Consider if you have open opportunities or needs in your portfolio or, if you’re a niche player, where you might increase the value proposition of a bigger player with a need.

Financials

Are your financials strong and liabilities manageable? Can you demonstrate cash flow and a positive trajectory for growth?

Valuations

Fewer tech CFOs are expecting valuations to increase this year and, in early February, too-high valuations were blamed for a tech stock slide. While lower valuations are good news for potential buyers, companies on both the buy-side and sell-side would be wise to think critically about the right valuation metrics and multiples.

Integration

The success of an acquisition often comes down to the integration after the ink has dried. Acquirers and acquirees should be looking closely at the two firms’ systems, controls, processes and culture to determine fit, needed transitions and any hidden liabilities. Proper due diligence and planning ahead of the deal helps minimize post-acquisition disputes.

Spotlight on Cybersecurity

At a recent Quarterly CFO Roundtable conducted by BDO, Manish Gupta, Senior Vice President of Products at FireEye, presented data from FireEye’s study on real-world cyber defense deployments.

Key insights include:

205 days: Average time it takes to detect a data breach

$3.5M: Average cost of a breach

69%: Percentage of companies notified of a breach by an external entity

Frank Teruel, CFO at ThreatMetrix, also weighed in on the growing threat of cyber attack:

“Cybercrime is truly a global phenomenon with fraudsters targeting businesses in every country with high online and mobile penetration. These businesses represent attractive targets for fraudsters who are primarily looking to hijack an individual’s digital identity. Armed with that identity, the fraudsters immediately unleash a frenetic assault on bank accounts, corporate networks, e commerce sites - and the list goes on. In fact, Threatmetrix noted an 80 percent increase in cyber attacks in Q4 2015 compared to Q4 2014. The problem is exacerbated because web attackers are becoming more sophisticated in evading existing security controls. Undoubtedly, as businesses become more and more connected, less location-centric, operate globally and rely on remote workforces, the cyber risk will continue to proliferate. Understanding the customer’s digital identity is the only way to stem the tide of attacks and preserve the trust of connected consumers.”

BDO’s take:

Tech CFOs are wise to pay close attention to cybersecurity for two reasons: they are increasingly being held accountable for internal security, and the cybersecurity industry is growing fast and ripe with opportunity. The U.S. government and regulators have their eye on cybersescurity, which brings both opportunity and risk. In his final budget proposal to Congress, President Obama included a $19 billion cybersecurity request — which, if passed, would be a 35 percent increase in cyber spending.

The proposed budget increase reflects demand for more sophisticated technology and compliance solutions to respond to more frequent and sophisticated attacks. According to IDC, the hottest areas for growth are security analytics, threat intelligence, and mobile and cloud security.

Regulators are also taking a closer look at companies’ cyber preparedness across all industries, including tech. Many technology companies are in the business of monetizing data — and that valuable information is a draw for cyber criminals. As tech-enabled industries like manufacturing and financial services increasingly rely on third-party technology service providers to manage their data and payments, the risk of a cyber attack becomes even greater. The technology company may not be the intended target but instead serves as a conduit to another organization’s network access.

As FireEye’s data shows, every organization either has or will experience a data breach. The question is not whether a data breach could happen, but how to respond and mitigate the consequences when it happens.

Technology Cyber Checklist:

-

Escalate to senior management and the board. Just 13 percent of tech companies report hiring a Chief Security Officer in the past year.

-

Perform a comprehensive risk assessment. A risk assessment should be performed, beginning with identifying which of the critical assets must be protected, followed by evaluating the adequacy of the policies and procedures in place.

-

Define a security strategy. Technology organizations need a formal security strategy and implementation plan to mitigate internal and external threats, including the development of a complete and regularly tested incident-response plan.

-

Prepare for future environments. New product and service development should consider and incorporate security components during the R&D phase.

-

Train employees. Employees should be made aware of risks specific to a particular job function as well as the company overall.

Spotlight on Tax

At the end of 2015, the House and Senate passed the Protecting Americans from Tax Hikes Act of 2015 (PATH Act). President Obama signed the Act and an FY 2016 omnibus on Dec. 18. The Act does considerably more than enact the typical year-end “tax extenders” legislation seen in the past, making perma¬nent over 20 key tax provisions.

Notably for tech companies, it made the R&D tax credit permanent and introduced new elements that will benefit technology startups and small businesses. For taxable years beginning after 2015, companies may now claim credits against their alternative minimum tax and up to $250,000 of their payroll taxes.

Many businesses had complained that temporary extensions, oftentimes passed retroactively months after the R&D credit had expired, were counterproductive to the aim of encouraging research activities. The permanency comes as good news to tech companies who are, in large part, intended beneficiaries of the R&D tax credit.

The Internet Tax Freedom Act (ITFA), another provision with a similar history of “band-aid” extensions was also recently granted permanent status when signed into law by President Obama on February 24, 2016. The ITFA places a ban on state and local taxation of Internet access.

Looking ahead to 2016 and beyond, the prospect of tax reform remains top of mind, including potential changes that might alter the way offshore activities are taxed by the United States. The technology industry is also closely watching for changes in tax policy at the state and local level, as taxation of the cloud and Internet services continues to evolve. As sales tax revenue from the sale of physical goods declines, a number of states and cities are looking to recoup their losses by taxing cloud-based and streaming services. However, the decision to tax the cloud and how to tax the cloud varies from state to state and city to city, resulting in an inconsistent and complex tax environment.

The 2016 BDO Technology Outlook Survey is a national telephone survey conducted by Market Measurement, Inc., an independent market research consulting firm, whose executive interviewers spoke directly to chief financial officers. Market Measurement used a telephone survey performed within a scientifically developed, pure random sample of U.S. technology companies in the software, hardware, telecommunications, Internet and information technology services subsectors.

SHARE