Retail Reset: Remedies to Rectify a Global Health Pandemic

The novel coronavirus (COVID-19) has disrupted business continuity across all industries, and retail is already feeling the impact. While retailers’ primary concern is the safety and wellbeing of their professionals and customers, this crisis requires specialized urgency and sensitivity given the widespread impact and uncertainty of the pandemic’s duration.

Unlike other industries, retail is an anomaly in that there is a stark difference between how companies in different sectors are absorbing the COVID-19 shock. For grocers and general merchandisers, supply and demand curves have skewed way off the charts and retailers are struggling to keep up with historic demands for soap, disinfectants, paper towels and shelf-stable food. For example, during the week of February 23-29, hand sanitizer revenue sales increased 420% and both Clorox/Lysol wipes and canned food revenue sales experienced a 183% increase from the week prior, according to Bloomreach.

On the contrary, specialty and luxury retailers are experiencing a dip in demand due the fact that their goods are considered “non-essential”. As a result of social distancing mandates and shifting consumer priorities, COVID-19 is brick-and-mortars’ latest impediment, validated by a recent GlobalData study which states that 12.1% of people admitted to visiting malls less in response to the outbreak. In addition, some retailers including Macy’s, Nordstrom, H&M and Ikea have shut their doors across the U.S. until further notice in attempt to help contain the outbreak. These developments only compound the trend of declining foot traffic due to e-commerce growth that retailers have been grappling with in recent years.

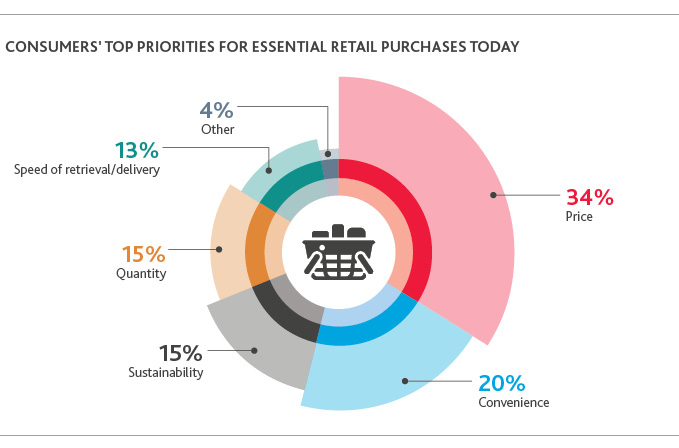

While it may seem natural for transactions to be diverted to online, e-tailers are not necessarily experiencing smooth sailing either. For example, Amazon is seeing huge surges in demand, and yet, the same GlobalData study shows that Amazon is the least cited destination for stocking up (6.0%) compared with Walmart (21.9%), Costco (8.5%) and pharmaceutical convenience stores such as CVS (7.1%). This could perhaps be explained by e-commerce price gouging, and sheds light on the fact that even during dire circumstances, consumers will still look for that perfect balance between high convenience and low cost. In fact, just over one-third (34%) of consumers list price as their top priority for essential retail purchases today, compared with 20% who rate convenience first, according to a recent BDO survey conducted online by The Harris Poll among over 1,000 U.S. adults ages 18+.

Pre-COVID-19, almost three-quarters (73%) of retail CFOs said their business was thriving and just 22% said a potential economic downturn was their business’s greatest threat, according to BDO’s 2020 Retail Rationalized Survey. Now with the reality of COVID-19 and subsequent stock market decline, continued momentum is threatened, and retailers should prepare to pivot under new constraints. With a market that recently entered into bear territory and the economy’s cyclical nature, the looming recession could be upon us sooner than once anticipated.

Here’s what retailers can do in the interim:

-

Reassure and support employees: Retail is one of the most difficult industries to implement remote work policies as so much of its success is reliant on in-person interactions. It’s important to remain empathetic towards your employees, including instilling flexibility when it comes to sick leave requests and payment policies in case of a furloughed status. Many stores initially said they were providing two weeks of additional paid leave for their staff, but longer-term policies remain uncertain.

-

Inform consumer base: Timely communication acknowledging the current environment may help ease consumer confidence in their purchase decisions and confirm that purchases are being handled with care. This may also help to set realistic expectations in terms of consumer access to goods or services, and the welcomed transparency can help to prevent any further reputational harm as a result of the outbreak.

-

Prepare for the short-term and long-term: As the novel coronavirus impacts on global supply chains continue to play out, retailers will likely need to reevaluate their supply chain strategy for Q2 and Q3. From a shopping perspective, the recent economic dip is already impacting Q1 numbers. However, in the immediate future, many retailers have expressed concerns about meeting monthly payments, including rent. They should seek to negotiate with landlords—as well as any vendors—to manage cash flow challenges. When formulating long-term plans, it’s important for retailers to understand whether they can capture lost revenue and income on the back of the unpredictable COVID-19, which is critical to minimizing financial implications. In addition, retailers should review the U.S. stimulus package and assess how they can take advantage of the relief being offered by the federal and state governments.

-

Be cognizant of industry impacts: The effects of the novel coronavirus and a likely recession in 2020 will only make the disparity between strong and weak retailers more pronounced. 2019 marked numerous bankruptcies and store closings and the impact of COVID-19 could push some retailers to the point of no return. Retailers seeking to outlast this period of market volatility will need to practice extreme financial discipline when it comes to both hedging against recession threats and investing in technology and infrastructure to preserve relevance.

-

Evaluate crisis protocols and risk profile: Businesses should scenario plan for future disruptions and shortages. Whether that means dedicating a specific team to crisis management or conducting a business continuity assessment, take proactive approaches to help mitigate future trauma.

Looking ahead, monitoring announcements from the CDC and WHO can help guide the trajectory in which remedial steps should be taken. The retail industry has time and again experienced hardship and proved its resilience above the turbulence.

To learn more about how your organization can navigate immediate disruptions due to the novel coronavirus and prepare for the future, don’t hesitate to reach out.

SHARE