Retail in the Red: BDO Bi-Annual Bankruptcy Update

An Overview of U.S. Retail Bankruptcies and Store Closures in the Second Half of 2019

March is likely to mark a significant turning point in the retail industry. As the COVID-19 outbreak spreads, the industry impact will be widespread and lasting. While some retailers are benefitting in the short-term from consumers who are bulking up on supplies, overall, contractions in travel and tourism—as well as mandates around social distancing and sheltering in place—are leading to significant numbers of store closures and lower foot traffic and hurting the industry.

The Conference Board reported that U.S. consumer confidence increased slightly in February, although we expect significant reductions in consumer spending in the coming months. Some consumers may not have the cash available to spend altogether if a recession hits. Even prior to the COVID-19 outbreak, Americans increased their borrowing for the 22nd straight quarter at the end of 2019, according to the Federal Reserve. Household debt exceeded $14 trillion for the first time—$1.5 trillion above the previous peak in 2008. Auto debt has increased for 35 consecutive quarters and almost 5% of auto loans are now 90 days or more delinquent. Now, many workers may lose jobs or see their businesses close temporarily causing financial distress and increased need for government assistance. We expect this to impact demand for nonessential retail categories from jewelry to furniture.

In addition to the novel coronavirus, intense competition, failure to evolve and excessive debt continue to plague distressed retailers. The reality is that attempting to keep up with changing consumer preferences and reimagining business models is costly, and some simply do not have the capital. Distressed retailers’ debt burdens make it even less likely that they will have the financial flexibility needed to evolve and improve their businesses.

With the impact of the virus, we expect significantly more caution among retail business lenders and investors in 2020, making it extremely difficult for distressed retailers to get the capital they will need to survive.

A Look Back: Pre-Coronavirus Conditions

Despite fears of a recession, trade tensions and other geopolitical issues that defined 2019, it wasn't all bad news for retailers. Rather, it was one of further industry bifurcation, in which underperforming retailers continued to struggle or became distressed and strong retailers either sustained or accelerated growth. Retail trade, excluding food services, gas and auto, ended the year on a positive note with a sales increase of 4.1% for the holiday season.

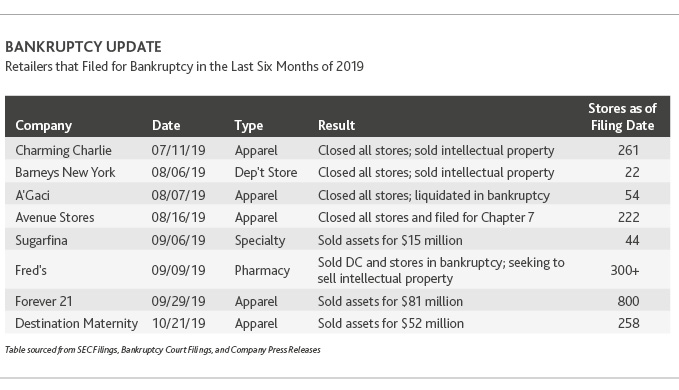

At the same time, the pace of retail bankruptcies slowed slightly in the second half of the year, with eight retailers filing, compared to 14 in the first half of 2019 and nine in the second half of 2018. Specialty apparel companies comprised five of the eight retail bankruptcy filings between July and December, with Charming Charlie, A’Gaci, Avenue Stores, Forever 21 and Destination Maternity all making the list. This represents a jump in bankruptcies for this segment compared to 2018, when just one specialty apparel retailer filed.

In January and February of 2020, there were four retail bankruptcy filings—Papyrus, Lucky’s Market, Earth Fare and Pier 1 Imports—down 50% from the same period last year, when Shopko, Gymboree, Charlotte Russe and Payless ShoeSource filed.

2019 Store Closure Drivers

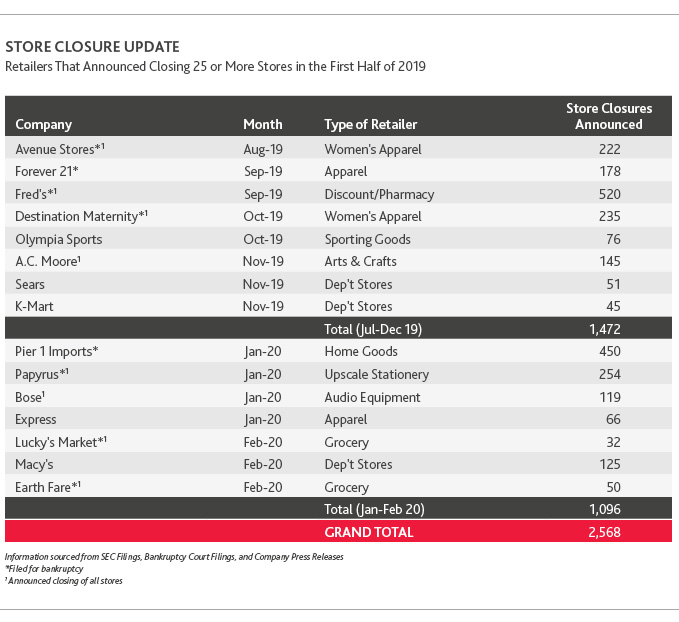

Approximately 9,300 stores closed in 2019—including 2,500 by Payless alone—up 59% from 5,844 in 2018, according to marketing research firm Coresight Research. The 9,300 store closures in 2019 exceeded the previous record of 8,069 closures from 2017, but was lower than overall forecasts for the year.

Coresight also reported around 2,300 store closure announcements in the second half of 2019, a significantly lower rate than the first half of the year. In the first two months of 2020 alone, retailers announced more than 1,200 stores would be closing. However, approximately 4,400 stores also opened in 2019, in line with 2018 figures.

Ongoing store closures in 2019 were a result of a confluence of factors, including the rapid growth of e-commerce and over-storing. U.S. retailers have yet to right-size their store counts to adequately reflect the changes in how consumers shop.

Meanwhile, consumers have changed where they shop, moving from smaller mall-based stores to stand-alone big box stores, including warehouse clubs, supercenters and strip malls. Convenience-driven shopping is significantly reducing mall traffic, though strip malls were relatively spared as grocery store or gym anchors drew regular visits.

Not only have shopping destinations evolved, but also shopping budgets, as Americans spend less on goods and more on services and experiences. For instance, research shows that Americans spend much less on clothing in the 2000s than in the 1900s.

When it comes to budgets overall, the middle class has less wealth than in prior decades. According to the Pew Research Center, the share of income earned by the middle class has fallen from about 65% to 40% since 1970. The retailers that cater to this demographic, many of which are mall-based, are bearing the brunt of this reality. On the other hand, discount and other budget-friendly retailers, as well as luxury and higher-end retailers, have accounted for the vast majority of recent industry sales growth.

SHARE