Retail in the Red: BDO Bi-Annual Bankruptcy Update

After July and August 2018—when at least six retailers filed for bankruptcy—the pace of retail bankruptcy filings slowed through the remainder of the year. The retailers that did file, however, were large, long-standing industry players, including Mattress Firm and Sears Holdings. These filings occurred amid a strong U.S. economy with healthy consumer spending, low unemployment levels and controlled inflation rates.

The healthy economy didn’t translate to a strong holiday season for all retailers, though. U.S. retail sales fell 1.2 percent in December 2018 from November 2018, recording the largest drop since September 2009. Still, sales for December were up 2.3 percent from December 2017.

Throughout the second half of the year, the thriving retailers continued to grow and expand while more of the weaker retailers struggled. According to BDO’s 2019 Retail Rationalized survey, 54 percent of retailers say they are just surviving. For the remainder of 2019, we expect to see further dichotomy, with today’s survivors tipping toward either profitability or distress.

BANKRUPTCY UPDATE

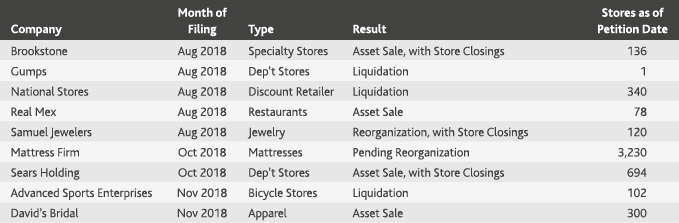

Retailers That Filed for Bankruptcy in the Last Six Months of 2018

Early 2019 Bankruptcy Activity

The first two months of 2019 brought bankruptcy announcements at a faster clip, with eight filings, including Shopko, Gymboree, Charlotte Russe, Things Remembered and Payless ShoeSource. Three of these were “Chapter 22” filings, with Gymboree, Payless ShoeSource and Charlotte Russe filing a second bankruptcy in early 2019 after restructuring following previous bankruptcy filings. These retailers went into their earlier bankruptcy filings with a plan to close some stores and restructure debt. They were able to exit bankruptcy quickly only to find themselves back in bankruptcy shortly thereafter, illustrating that debt reduction alone is not a cure-all if the underlying issues are not addressed. All three retailers are now liquidating their businesses in the second bankruptcies.

In addition to the retail bankruptcy filings, many retailers—and not only bankrupt retailers—announced plans to close stores in the past several months. According to the real estate research group CoStar, retailers announced plans to close more than 145 million square feet of retail space in the U.S. in 2018, well above the 102 million announced in 2017. During the first two months of 2019, retailers announced over 4,300 store closures.

STORE CLOSURE UPDATE

Retailers That Announced Closing 25 or More Stores in Early 2019

BDO’S TAKE: EXPECTATIONS FOR 2019

Overall, the positive economic signs bode well for retailers for the first half of 2019. Nevertheless, the U.S. economy appears to be slowing this year compared to 2018, but consumers are still benefiting from a strong job market and rising wages.

We expect retail sales will continue to rise in 2019, although not at the same levels seen in 2018. Weaker 2018 holiday season results are likely to impact top line sales figures in early 2019, while margins for distressed retailers continue to be under some pressure. In addition, the U.S. remains oversaturated with brick and mortar retail locations, with this excess retail footprint costly to reduce in the short term.

There are potential obstacles, however, that could tip the scales unfavorably for retailers, such as rising uncertainty and interest rates. The stability of the stock market and energy prices likely have the strongest potential to disrupt the U.S. economy in the first half of 2019. Uncertainty over the continuing trade tensions with China and ongoing threat of potential additional tariffs may also hinder sales.

At the same time, the pronounced shift in consumer spending over the past several years will continue to hamstring weaker brick and mortar retailers, particularly those in apparel, department store and specialty merchandise categories. The pattern of consumers prioritizing investments in smart phones and technology products, entertainment and health care costs drives sales away from mall-based retailers that have primarily sold clothing and accessories.

Meanwhile, distressed retailers are still grappling with burdensome levels of debt. The need to service the debt burden reduces the cash flow available. Retailers are also facing higher retail wages for U.S. workers due to a combination of low unemployment and changing minimum wage laws throughout the U.S. Therefore, they do not have the resources to address evolving consumer preferences by going all in on omnichannel—a necessity for survival today—or revamp stores.

We expect to see a steady pace of store closure announcements over the next few months, as well as more retailers file for bankruptcy, particularly those that are distressed and highly leveraged. It’s hard to play ball with onehand tied behind your back and that’s what many retailers are forced to do.

SHARE