The Counter: Restaurant Industry Scorecard

Q2 2018

Same-Store Sales

After a somewhat promising first quarter, restaurant same-store sales experienced a much-needed lift through the second quarter, with the industry reporting an overall 1.1 percent same-store sales increase. Strong consumer spending coupled with increased menu prices and restaurants’ growing delivery, catering and digital capabilities ensured the industry’s progress.

However, restaurants should not rely too heavily on this renewed economic optimism for sales growth. While media reports boasted record spending at restaurants, many of these stories overlooked a key nuance in the industry’s current state: While restaurants overall experienced growth in Q2, heightened consumer spending hasn’t necessarily distributed evenly amongst restaurants. Many markets across the country are becoming saturated with chain and independent restaurants, meaning consumers have more options than ever, but restaurants simultaneously face a growing list of competitors. Restaurants that struggle to capture this spending amid evolving market dynamics may face larger hurdles than simply keeping up with the latest trends.

For franchisors, over-saturation has yet to pose as big of a problem. Quick service, fast casual and even casual franchises continue to expand into new markets, particularly in rural areas. Since less-populated markets often present less competition compared to urban areas, franchised restaurants are able to quickly capture rural markets’ spending as recognizable name brands.

While traffic declined 1 percent in Q2, according to Nation’s Restaurant News, restaurants fared relatively better compared to the 2.3 percent traffic decline in Q1. Delivery continues to capture more spending, but this slight traffic increase is encouraging for restaurants that rely on in-store business.

Fast casual restaurants led the pack this past quarter, posting a 1.6 percent average sales increase through June. Chipotle’s sales rose 3.3 percent, slightly higher than last quarter’s 2.2 percent boost, indicating the company is slowly recovering from its previous sales dip. The chain’s free guacamole promotions and new delivery partnership with DoorDash can be credited for its gradual rebound. Wingstop also continued its growth streak, although its 3.5 percent sales uptick was significantly lower than the 12.5 percent hike reported in Q1. Stabilized wing prices, growing online ordering and deliveries, and successful discount initiatives all helped boost the company’s sales. Noodles & Company also reported its most successful quarter in six years, with sales rising 5 percent in Q2. The company’s newly-launched zucchini noodles option, Zoodles, as well as branding enhancements and online delivery options drove sales. Meanwhile, Zoe’s Kitchen (-2.5 percent) and Potbelly Corporation (-0.2 percent) reported slight sales dips.

Closely following fast casual, the casual dining segment posted average sales growth of 1.4 percent through Q2. Applebee’s new promotion and branding strategy helped lift the company’s same-store sales by 5.7 percent. The chain’s popular discounted drink promotions, like the $1 Dollarita, and its renewed focus on staple, affordable menu options has buoyed sales despite store closures in some regions. Same-store sales at Texas Roadhouse also rose 5.7 percent thanks to higher traffic counts and longer hours of operation, yet the company says it’s keeping a close eye on rising labor costs. BJ’s Restaurants (+5.6 percent), Olive Garden (+2.4 percent), Longhorn Steakhouse (+2.4 percent) and Bahama Breeze (+0.6 percent) also experienced healthy growth. Facing steep price competition, Denny’s sales declined 0.1 percent after strong growth through the first quarter while Red Robin’s (-2.6 percent) sales continued to fall.

Quick service restaurants’ overall same-store sales landed slightly behind fast-casual and casual’s growth, reporting a 1.3 percent average sales increase. Regional, all-natural burger and custard chain Good Times Burgers saw sales rise 3.8 percent due to its “better burger” initiatives, strong foot traffic and new store openings. Carrol’s Restaurant Group, the nation’s largest Burger King franchisor, similarly experienced 5 percent sales growth. Sales at Taco Bell, KFC, and Wendy’s all rose 2 percent following new menu offerings, remodeling efforts, promotions and operational enhancements. Meanwhile, Steak n Shake’s sales decline continued through the second quarter, with sales dropping 3.4 percent.

After last quarter’s 0.5 percent sales dip, the upscale casual segment reported a 0.7 percent same-store average sales uptick. Interestingly, two steakhouse chains occupied both sides of the spectrum, with Stoney River Steakhouse’s sales up by 6.2 percent and Sullivan’s Steakhouse’s sales down 6 percent. The Cheesecake Factory (1.4 percent), J. Alexander’s (1.9 percent), Capital Grille (2.6 percent), Eddie V’s (3.6 percent) and Yard House (1.4 percent) all reported moderate but stable sales increases.

Surprisingly, the pizza segment’s overall same-store sales dipped 0.3 percent through the second quarter. Domino’s continued sales streak, up 5.1 percent, was not enough to raise the overall segment. Papa John’s 7.2 percent sales decline, along with Pizza Hut’s 1 percent sales dip, contributed to the segment’s decrease. While Domino’s successful digital and delivery strategy continues to outperform its competitors, Pizza Hut remains focused on improving its delivery services while Papa John’s works through its recent reputational challenges.

Commodities & Cost of Sales

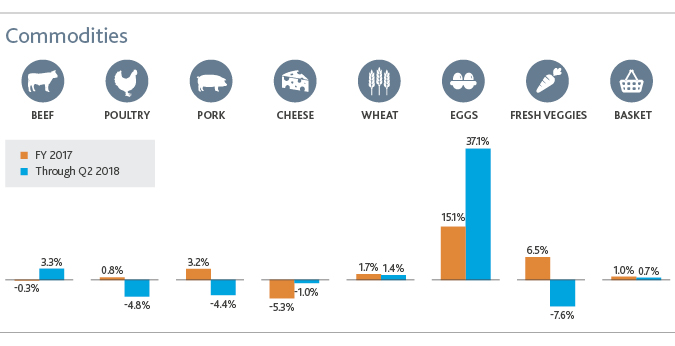

Through June, beef and wheat prices rose 3.3 percent and 1.4 percent, respectively. At the same time, poultry prices dipped 4.8 percent, pork prices dropped 4.4 percent and fresh veggie costs decreased 7.6 percent. Cheese costs also declined by 1 percent, a positive for pizza restaurants and others that incorporate cheese into a good portion of their menu options. Egg prices also spiked 37.1 percent in the second quarter. As noted in our previous benchmarking report, this figure points to egg price stabilization rather than volatility considering egg prices’ extreme cost decline in 2016.

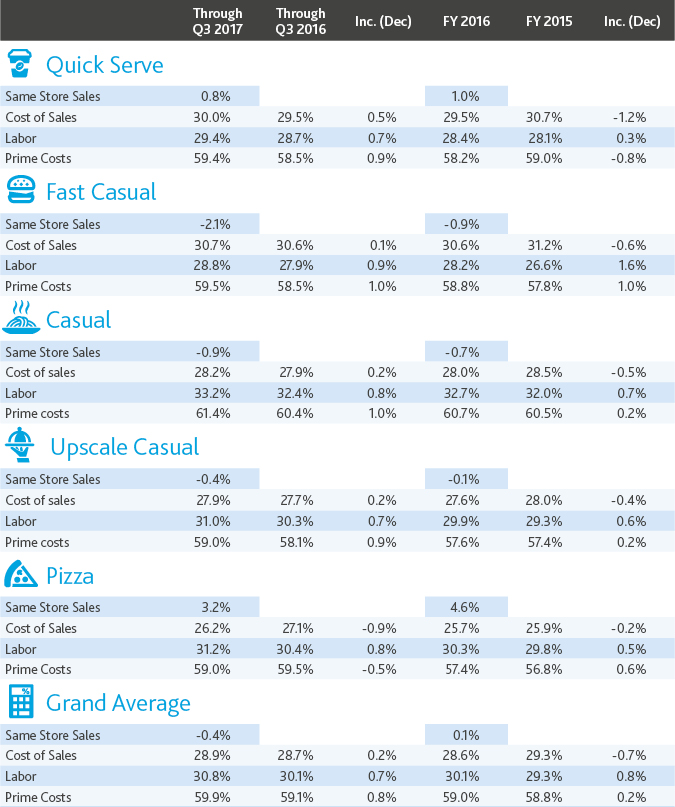

Meanwhile, restaurants’ average cost of sales though Q2 2018 remained flat compared to the same time period last year. This cost stability allowed many businesses to dedicate more capital toward delivery services, digital capabilities, marketing and promotions.

Labor Costs

Various states’ minimum wage hikes, combined with high turnover rates, led to a continued labor cost incline across the industry of 0.4 percent over Q2 2018. This is consistent with the past several years’ changes in labor costs, as regulatory, wage and employment shifts shake out across the country. As restaurants grapple with high turnover rates, strategic tech investments will help restaurants manage pressure in the labor market.

What’s Next for Restaurants

While restaurants continue to work through the ripple effects of tax reform, a few key issues stand at the industry’s horizon.

First, several significant M&A deals may materialize in the coming months, including an ongoing bid for Yum Brands, which operates KFC, Taco Bell and Pizza Hut. Private investors continue to turn to the restaurant industry because of the investment class’s relatively low post-acquisition general and administrative expenses. Therefore, efficient operators find it fairly easy to expand their restaurant portfolio and boost their bottom lines without adding more overhead costs. Private equity, loaded with dry powder, may also take a note from venture capital and soon deploy more capital in the restaurant tech space.

Separately, while the effects of both Chinese tariffs and increased trade tensions remain to be seen, restaurants should keep a close eye on how these trade shifts will impact commodity prices.

Going forward, a strong economy will continue to help strengthen consumer spending at restaurants, yet each business will need to successfully capture these dollars amid increased competition. Strategic delivery and tech investments, promotions, and measured expansion plans are just a few of the measures restaurants can take to sustain growth, and even stand above the crowd.

SHARE