How ASC 606 Impacts Franchisors’ Advertising Funds

Last year, BDO’s Restaurant practice presented a deep dive into Topic 606, Revenue from Contracts with Customers, to discuss the new FASB guidance’s impact on the restaurant industry. This article will take an even closer look into how Topic 606 is affecting franchisors’ advertising funds, which are also known as marketing funds or brand funds. Topic 606 was enacted to enhance the transparency and clarity around the recognition of revenue.

Per the terms of many franchise agreements, franchisees are often required to remit a percentage of gross sales into an advertising fund. This pool of advertising fund dollars is then spent on advertising for the franchise’s concept system as a whole.

Under current GAAP standards, this advertising fund is often shown as a net of advertising fees paid into the fund by franchisees (i.e. income) and advertising fees expended (i.e. expenses). If advertising fees collected exceed expenditures, the unspent balance would usually be reported as a net liability on the franchisor balance sheet. However, if advertising fees collected (i.e. revenue) were less than expenditures (i.e. expenses), the franchisor would normally recognize the overspend as an advertising expense on the franchisor income statement, unless the franchise agreement specifically allowed the franchisor to collect incremental funds in future periods to offset the overspend.

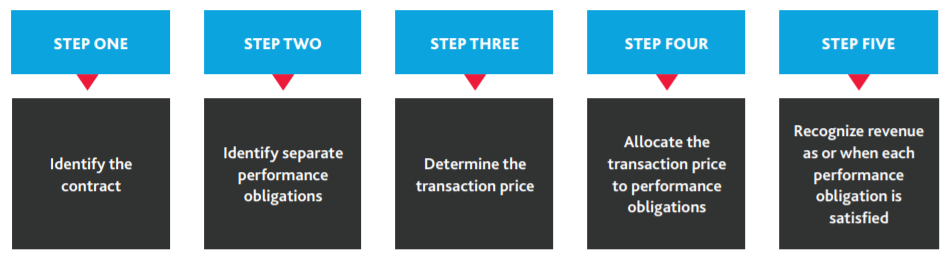

Now that restaurants are implementing Topic 606, the recognition of advertising fund dollars received and expended is changing. In order to appropriately apply the guidance, franchisors should follow the five steps below:

As a result of applying this five-step process, a franchisor will generally (depending on the verbiage used in the franchise agreements) conclude that the promise to provide advertising services is not distinct from the franchise right itself, because that advertising benefits the system as a whole rather than any specific franchisee. In addition, because the franchisor is typically the entity that controls the advertising spend, including selecting vendors, designing the advertisements, and determining timing and venue of running the ads, the franchisor would be considered the principal in the arrangement. As a result, a franchisor will include gross presentation of advertising fund income of amounts collected from franchisees and related marketing expenses on their income statement.

When franchisors apply the above guidance, the process could have a material impact on their financial statements, particularly if the franchisor presents interim financials. In addition to franchisors’ revenue and expenses increasing, if the advertising spend is not incurred evenly throughout the year, the timing of expenses recognition may not match the timing of revenue recognition, which would occur as the ad funds are due to the franchisor. If the franchisor does not fully spend all advertising funds collected during the year, they will need to carefully consider whether the franchise agreement requires them to spend those funds in future periods, resulting in the recognition of a liability.

The Topic 606 requirements will also significantly expand the amount and type of information that must be disclosed in the footnotes of franchisor’s financial statements. The FASB guidance discusses the level of detail required to satisfy these new disclosure objectives. For example, under this guidance, advertising fund income is now presented as revenue for the entity, thus warranting additional policy note disclosures and public companies’ disaggregation of revenue types.

In terms of compliance deadlines, public business entities have adopted the standard for annual reporting periods beginning after December 15, 2017, including interim periods within that year. All other entities will adopt the standard for annual reporting periods beginning after December 15, 2018, and interim periods within annual reporting periods beginning after December 15, 2019. Of course, early adoption is permitted as of the beginning of an annual period.

For additional information on applying ASC 606 to your organization, visit BDO’s Revenue Recognition Resource Center.

Be sure to keep up with the Restaurant Practice’s latest insights by subscribing to our blog on the Selections homepage here and following us on Twitter at @BDORestaurant.

SHARE