BDO Restaurants CFO Outlook Survey

This survey was conducted in Fall 2019, prior to the global COVID-19 pandemic. We know that every organization—including BDO—is focused on the well-being of families, colleagues, and our communities. The middle market has proven its resilience in times of turbulence, and we believe, with a conscientious business mindset, organizations will manage the situation effectively. For information on how to secure your business in the wake of COVID-19, please visit www.bdo.com/COVID-19.

Restaurants Take on 2020 With Resiliency

Table of Contents

- Introduction

- On the Industry's Value (Creation) Menu

- Headwinds Old & New – Labor, Tariffs & an Economic Downturn

Introduction

Is the restaurant industry headed for renaissance or retrograde in 2020? Depends on whom you ask.

In the wake of competition that wasn’t even around a few years ago and a mercurial consumer whose loyalty is up for grabs, the industry has become truly bifurcated.

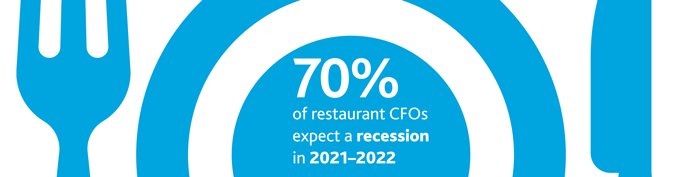

Yet, the majority of restaurant CFOs are optimistic about growth in revenue and profitability, even in the face of overwhelming recession expectations: 66% expect an increase in revenue and 68% expect an increase in profitability in the next 12 months.

Savvy restaurants aren’t putting all of their eggs in one basket. They continue to try to implement strategies that will have a net positive impact on margins—which have seen significant compression from rising labor costs, a decline in foot traffic and continual rent increases. Whether through limited time offers (LTOs), a strengthened digital presence, in-house delivery capabilities or menu price increases, among other initiatives, restaurants are tailoring—or overhauling—their strategies to attract customers and convert them into loyal clients.

On the Industry’s Value (Creation) Menu

The restaurant landscape has changed significantly in just the past few years. New entrants, such as grocery stores that offer their own food courts, are eating into restaurants’ market share and changing the face of the competition. Meanwhile, in tandem with changing consumer preferences, food delivery, a service that had been largely connected with pizza, has become a vital offering for all, from quick serve to fine dining establishments. A business that is projected to grow to $76 billion by 2022, according to Forbes, delivery presents a significant potential revenue stream for restaurants. However, restaurants find themselves competing against—or partnering with, for a price—third-party delivery companies.

.png)

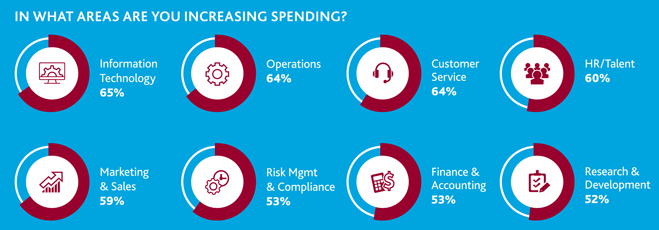

As competition grinds on—23% of CFOs identify competitive pressures as the greatest threat to their business in 2020—restaurants see continued investments in technology, customer service and operations as their main vehicles for value creation and differentiation. Of course, these categories are related: Investments in technology are geared at increasing sales and customer count, an enterprise that also requires a focus on customer service and operational improvements.

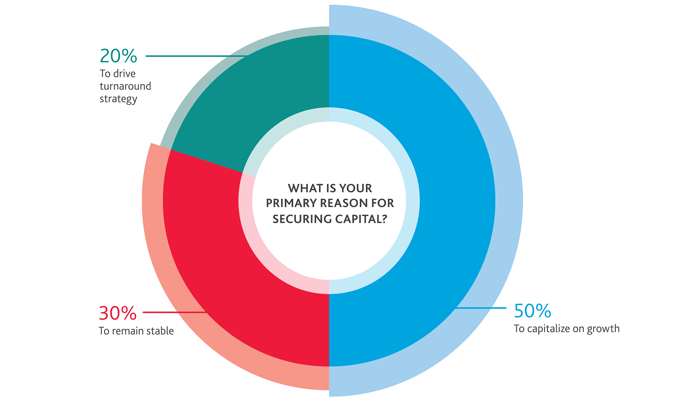

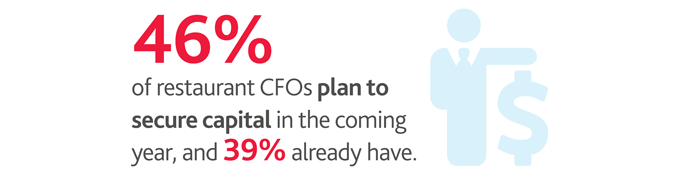

Most restaurants are looking for outside help to raise funds for these critical investments. The good news is that the vast majority of restaurants view seeking outside capital not as a last-ditch lifeline, but as an opportunity to capture more growth or hold on to market share, a sign of stability in the industry.

CFOs are overwhelmingly turning to investments in technology to modernize operations and leverage data to forecast traffic and predict consumer trends. Across the board, 65% of CFOs say they will increase investments in technology significantly or slightly. Few are decreasing spending, and fewer than 30% are keeping spending levels consistent.

Restaurants are using data as both defensive stronghold and offensive play: From menu engineering and demographic and sales analyses to marketing strategies, data is arguably the most effective arrow in the quiver. Restaurants are leveraging data to grow their customer base and retain or regain market share.

“A potential recession will likely widen the already stark split between restaurants that are thriving and those that are just breaking even. The strong get stronger as they embrace disruption and utilize data to inform spending and consumer wants, while the weak players will lose ground as they fight to keep up with the industry leaders.”

|

|

ADAM BEREBITSKY |

EXPANDING CUSTOMER SERVICE

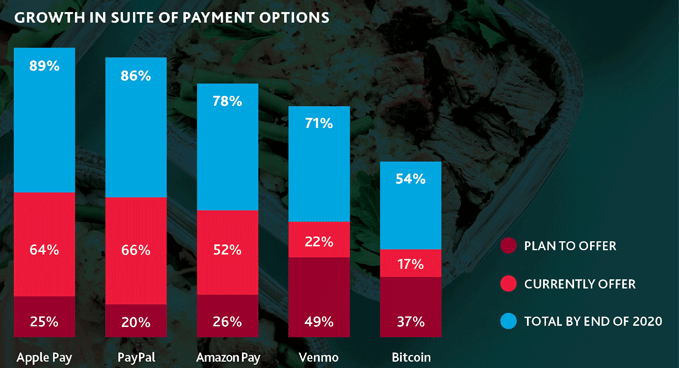

Aligned with the industry’s grand pivot to meet the preferences of digital natives while making sure not to abandon older generations, customer service is also a top priority. Restaurants are investing in making customers’ interactions with their brand—whether dine-in or delivery—seamless and easy. This is evident in the move toward delivery and also in a growing suite of cashless pay options: More payment options translate into greater sales potential, after all.

To that end, the ability to pay for meals through Venmo and even Bitcoin will see the greatest expansion in the coming year, with CFOs indicating a 49% and 37% investment increase, respectively, as restaurants seek to build out payment options for customers.

“While restaurants are expanding their takeout and delivery services, increasing dine-in foot traffic is still a number one priority. Restaurants will extend eye-catching LTOs and sweeten their dine-in-only deals. We will also see a digital push to improve the virtual customer experience from the time the customer hits the restaurant’s website and social media pages.”

|

|

CARRIE SHAGAT |

Further, as Amazon plans its gradual rollout of AmazonGo, a cashierless convenience store that offers the ability to buy grab-and-go meals without stopping to pay for them (instead, shoppers pay with their Amazon apps), restaurants may also see the presence of more frictionless payment options as a way to combat Amazon’s added competition.

BEYOND DIGITAL & DELIVERY

As consumers have flocked to the conveniences provided by technology, restaurants have rushed to meet demand, developing digital customer experiences through apps and/or offering their own delivery or partnering with third-party services like GrubHub or DoorDash.

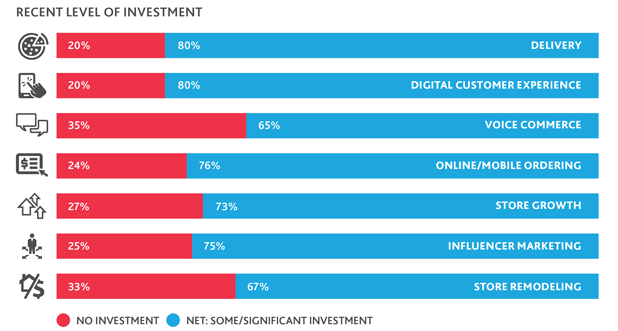

Their efforts already have resulted in a fair amount of penetration: 61% currently offer delivery and 51% currently offer mobile ordering. This reflects heavy investment in these channels: 80% of CFOs report having recently invested “some” to a “significant” amount in both in digital customer experience and in delivery, and 76% report having invested “some” to a “significant” amount in online and mobile ordering.

“Can restaurants have too much of a good thing? If you look at some recent bankruptcy filings citing the financial pressure of third-party delivery growth, the clear answer is yes. There is no silver bullet to increasing sales or improving margins; restaurants need to be taking a holistic and strategic approach to solving the specific issues they are contending with, including customer service, retaining talent, and providing sustainable products.”

|

|

LISA HAFFER |

While the industry has wholeheartedly chased delivery, Houlihan’s recent Chapter 11 filing, in which it partially attributed its bankruptcy to the financial pressures of third-party delivery growth, underscores the careful balance restaurants must strike between keeping their hand in the game and sound fiscal policy in order to stay afloat.

WHERE'S THE BEEF?

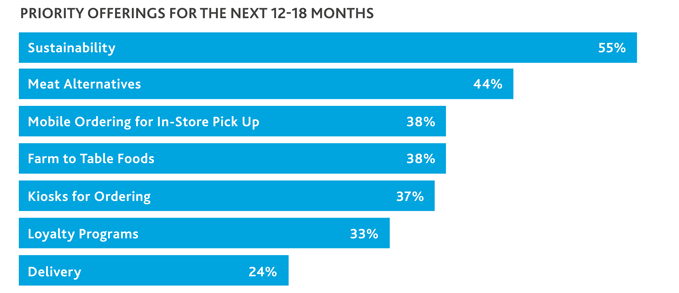

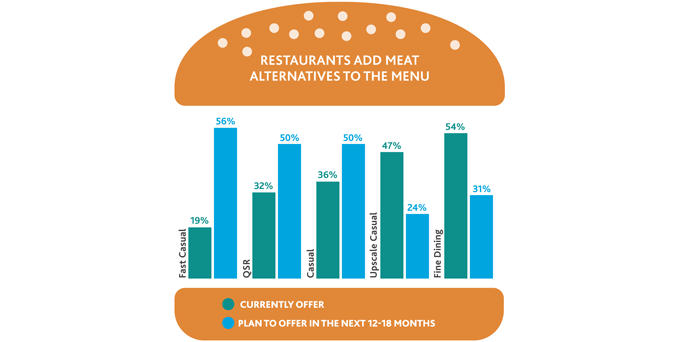

In 2018 and 2019, restaurants leaned heavily into third-party delivery partnerships. In 2020, their efforts will take on a greener tint: sustainability and meat alternatives top their expected offerings.

In harmony with growing consumer environmental awareness, sustainability tops restaurants’ planned offerings for the next 12-18 months. Sustainability has the dual benefit of meeting consumers’ desire for environmentally friendly options while reducing costs, over the long run, to the company.

Offering plant-based meat alternatives is another means to a greener end: Beyond Meat and Impossible Foods, makers of plant-based foods engineered to mimic the taste and texture of real meat, have been added to the menus of upscale dining establishments—like Momofuku in New York City—to quick-serve restaurants

(QSRs) like Burger King, Dunkin’ Donuts, Taco Bell and Denny’s. Currently, 36% of restaurants offer a plant-based meat alternative.

For the next year, the fast casual, quick serve and casual segments will lead the charge on plant-based offerings, but the upscale casual and fine dining segments are not to be excluded: From the 1% to the 99%, this is a trend that tracks an expanding global environmental consciousness.

INGENUITY IN MENU ENGINEERING

To offset cost pressures and give a little more padding to margins, restaurants across the board have been raising menu prices. But these increases must be carried out incrementally and strategically so as not to alienate the customer base.

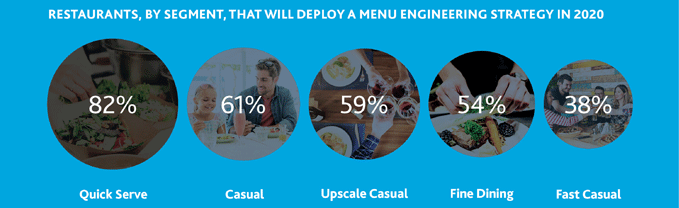

Menu engineering can be a more strategic way to manage costs. Ridding menus of unpopular items simultaneously cuts costs and lifts profits while giving the menu a fresher, lighter look. This past year saw restaurants taking a heavy hand with their menus. Employing data analytics, QSRs, like Taco Bell and El Pollo Loco, have eliminated menu items that were a drag on profits or took too much time to assemble and created logjams in the kitchen or lines at the counter.

These efforts can help to right the ship—correctly done, menu engineering adds cushion back to margins as it has the potential to increase profits by up to 20%, according to restaurant software developer Eat —and CFOs are bullish on deploying menu engineering strategies: Overall, 62% of CFOs say they plan to deploy a menu engineering strategy in 2020.

Quick-serve restaurants overwhelmingly lead the other segments on this initiative. Fast-food restaurants have not been immune to the decline in foot traffic and have used LTOs to generate appetite. But successful LTOs sometimes become permanent staples on the menu, driving up the number of menu items and overwhelming the diner. Menu engineering helps to refocus what’s on the menu, prioritizing items that perform well and cutting the fat.

Store Count to Swell in 2020

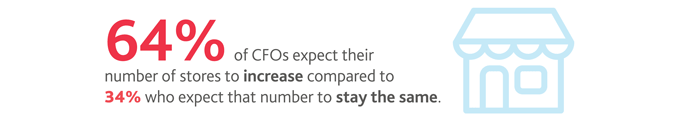

In line with CFOs’ expectations for profits and revenues to grow in the next year, nearly two-thirds of respondents indicate their restaurants are pursuing expansion strategies.

In total, 64% of CFOs say they expect their number of stores to increase, compared to 34% who say they expect that number to stay the same (just 2% said they expect store numbers will decline).

Expect to see QSR store count to rise the most: 86% of QSR respondents say they plan to open more stores, compared to 57% of casual and 50% of fast casual respondents.

Headwinds Old & New – Labor, Tariffs & an Economic Downturn

LABOR ISSUES NOT RETREATING

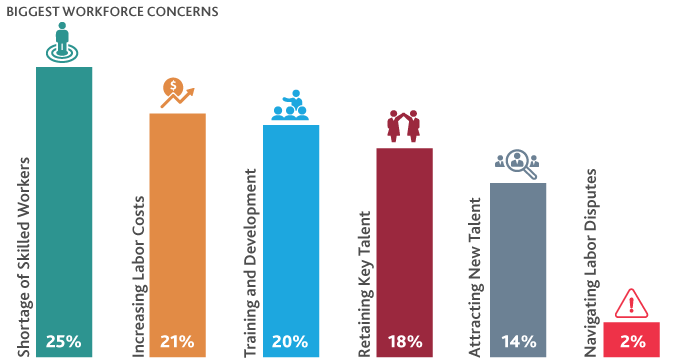

Restaurants are looking to grow store count despite one of the biggest industry challenges: labor. National unemployment sits at 3.7%, a hair off the lowest rate in nearly half a century, 3.6%, and restaurants have been struggling to fill jobs.

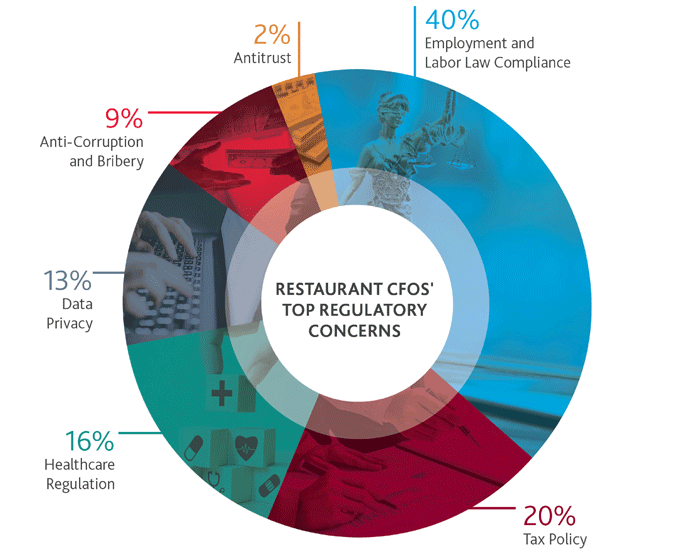

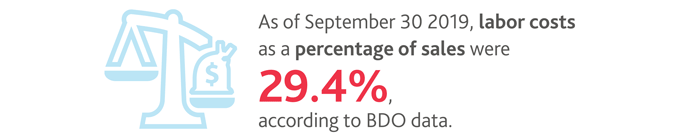

To entice and retain employees, restaurants have been raising hourly wages. Movement toward a federal $15 minimum is again making headlines in the runup to the 2020 U.S. presidential election, but many companies already were paying that or more in order to retain employees. Other wage pressures come from the state level: some states have raised their minimum salary requirements for exempt employees (i.e., managers). As a result, 40% of CFOs identified employment and labor law compliance as their chief regulatory concern.

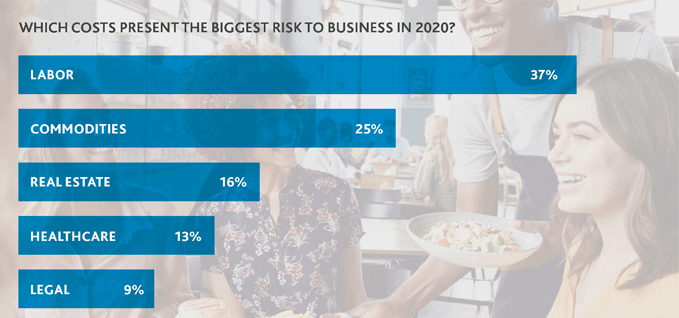

If labor issues are simmering now, they’ll be sizzling when the economy turns. Restaurants are already engaged in a delicate balancing act of luring foot traffic and raising menu prices. Consumer discretionary spending—for restaurants that means dining out or ordering takeout—is one of the first luxuries to go during a recession, and reduced sales will bring margins, already narrowed by the high cost of labor, even further under pressure. Labor is a formidable antagonist to companies that don’t have a lot of room for error, and in terms of costs is seen as the biggest risk to business in 2020.

TAX REFORM SERVES UP A COMBO PLATTER

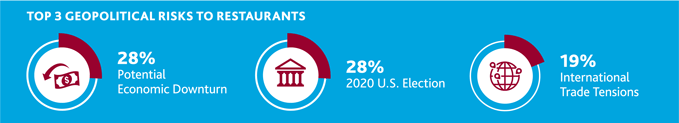

Labor is just one of the many headwinds the industry expects to continue to see. Tax Reform (24%) registered as one of the biggest policy priorities of the upcoming election that concern CFOs with trade and tariffs neck and neck at (26%).

The industry in many ways is still adjusting to the Tax Cuts and Jobs Act of 2017 (TCJA), the impact of which has been mixed. The reduced corporate tax rate, a new qualified business income (QBI) deduction, bonus depreciation, and increased Section 179 spending, among other positives, have served to counter some of the negatives: limitations on interest deductibility, the repeal of domestic production activities deduction (section 199) and the elimination of the ability to carry back net operating losses and the limitation on using NOLs against future income. However, continued uncertainty around how certain elements of the new tax

code play out create operational uncertainties.

By now, readers are likely aware of the “QIP glitch.”

Due to an inadvertent drafting error in the TCJA related to the depreciation of restaurant improvements, restaurant owners who invest in interior improvements from 2018 on may be hit with higher than expected tax liabilities. Before the TCJA, tax law provided rules for multiple categories of restaurant property assets, many of which were eligible for favorable tax depreciation benefits. To simplify the rules, tax reform consolidated the categories applicable to interior improvements into the single category of Qualified Improvement Property (QIP). If drafted correctly, QIP would be eligible for a 15-year recovery period, and hence eligible for 100% bonus depreciation. Instead, as drafted, interior improvements placed in service in tax years beginning in 2018 must be depreciated over a 39-year life without bonus depreciation. Workarounds to this include cost segregation studies and the Remodel-Refresh Safe Harbor.

On the topic of trade and tariffs, restaurants are concerned that higher duties on wines sourced from European countries could potentially limit their customers' choices. The tariffs' impact has not been greatly felt yet, but the ability to pass along price increases to the customer is limited, so restaurants should be monitoring for developments and preparing for higher duties.

Looking Forward to 2020

.png)

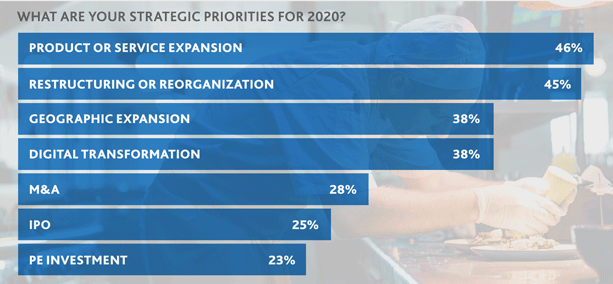

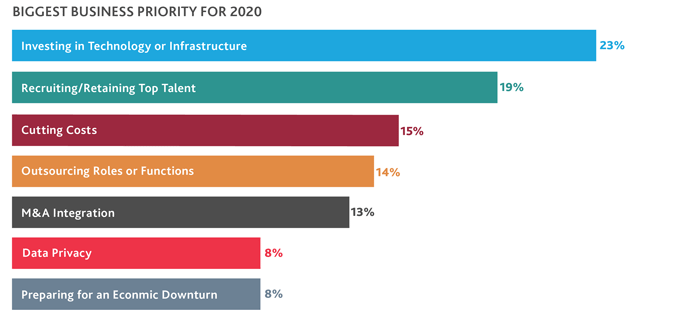

For years, restaurants have been contending with the steady increase in labor costs, declining foot traffic and rising rents. Now they have competitors who weren’t in the dictionary a few years ago, and grocery stores that have become more foe than friend. Already an industry that operates on thin margins, restaurants have been turning to technology to help keep those margins healthy. Indeed, investing in technology is CFOs’ biggest business priority in 2020. Behind that, CFOs say their biggest priority in 2020 is recruiting and retaining top talent.

Necessity has bred innovation throughout restaurant operations—from making the back office more efficient to adopting new ways of connecting with the customer. Underlying much of this is data: Restaurants are leveraging analytics in order to more accurately predict and meet consumer demand, as well as to gain an edge on the competition.

Indeed, technology has forever changed the face of the industry: How it will ultimately look is still to be seen, as it is arguably at the beginning of a massive and unprecedented transformation.

The 2020 BDO Restaurant Outlook Survey polled 100 CFOs at U.S. restaurants with revenues ranging from $250 million to $3 billion in October and November 2019. The survey was conducted by Rabin Research Company, an independent marketing research firm, using Op4G’s panel of executives.

.jpg)

.jpg)

.jpg)

SHARE