2016 BDO RiskFactor Report for REITs

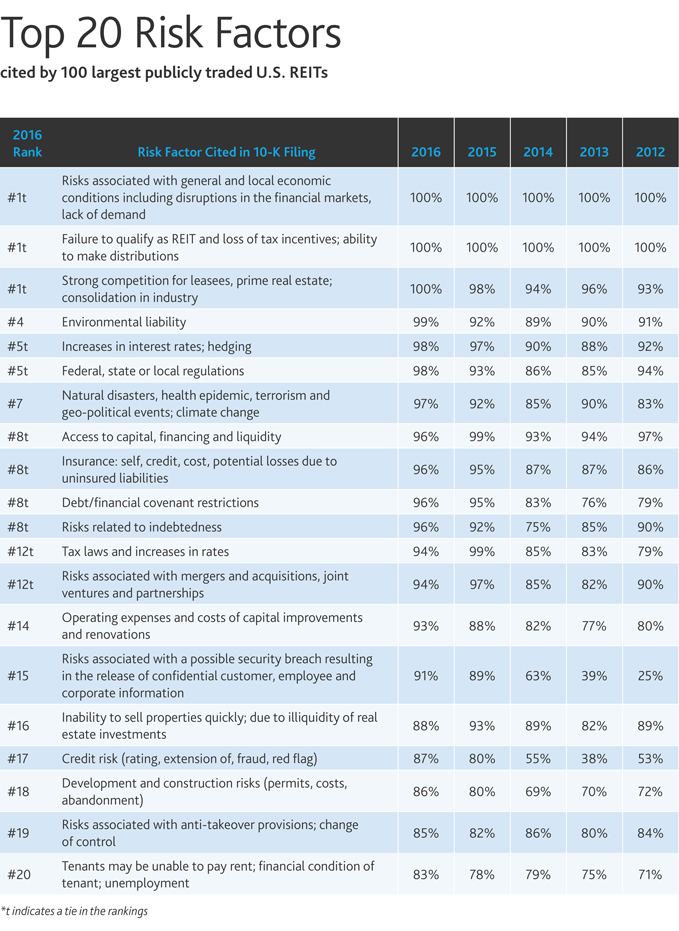

The 2016 BDO RiskFactor Report for REITs examines the risk factors in the most recent 10-K filings of the largest 100 publicly traded U.S. real estate investment trusts; the factors are analyzed and ranked by order of frequency cited.

The real estate industry is poised for expansion. Economic growth continues at a moderate clip and interest rates remain near historical lows, meaning demand for space is on the rise. Some of the biggest gains in the sector have come from real estate investment trusts (REITS), which are trading at multi‑year highs.

After a soft start to the year in January and February, REITs rebounded in March, gaining 10 percent in the month, and continue to outperform the broader market despite a decline of 1.7 percent in April. While 2016 could be a return to normal in many respects, REITs are continuing to face an array of business risks and challenges. Their 10-K disclosures reveal that their top three most-cited risks are competition for assets and leases, general economic and market conditions and failure to maintain REIT status. They also note rising concerns around credit market uncertainty, cybersecurity, tax changes and business interruptions.

Capital Markets Uncertainty Spurs Borrowing Blues

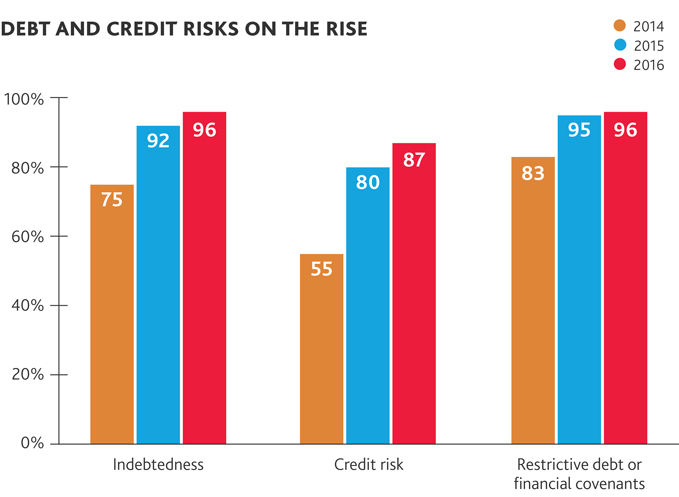

While the Fed continues to delay instituting significant raises in interest rates, REITs, considered to be high-yield investments, are wary of the potential impact on distributable cash flows and property values. Risks related to indebtedness are cited by 96 percent of REITs, up from 92 percent in 2015 and 75 percent the year prior. REITs also worry they may not be able to raise the capital required to finance assets and drive business growth. Despite strong property fundamentals, the challenging capital markets environment is weighing on their minds, according to analysis from Fitch Ratings. And their disclosures mirror that: access to capital, financing and liquidity remains a top concern this year, cited by 96 percent of REITs.

This trend is driven by a large portion of the REIT market continuing to trade at a discount to net asset value and volatility in the CMBS market, as well as conservatism in the public bond markets. Moreover, credit risk, including credit rating and ability to secure credit, is cited by 87 percent of REITs, up from 80 percent in 2015 and 55 percent the year prior. While many REITs are navigating the capital markets landscape with caution, some are taking a riskier approach, taking on more leverage to pursue aggressive growth strategies now. Many, though, are facing business challenges around restrictive debt or financing conventions, evidenced by 96 percent of REITs mentioning such risks in their disclosures.

Market Forces Could Fuel Reshuffling

Competition and industry consolidation is a top concern this year, cited by 100 percent of REITs, up from 98 percent last year and 94 percent in 2014. In some sectors crowded with smaller players, an uptick in M&A could be helping to restore balance. The single-family home area, for instance, is undergoing a wave of consolidation, including the deal between Starwood Waypoint Residential Trust and Colony American Homes that closed at the start of this year. This trend could continue as prices stay soft and companies look to achieve scale benefits.

Fewer REITs this year (88 percent) cite concerns around an inability to sell properties quickly in response to market shifts, down from 93 percent in 2015—reflecting a healthier seller’s market. REITs’ aggressive net-seller strategy during the first quarter of 2016 mirrored this trend, as they sold more than $15 billion and bought less than $6 billion, according to CoStar.

Market supply could, however, be driving concerns around value and the potential for REITs to experience asset impairment. Seventy-nine percent highlight concerns around potential declines or stagnation in the value of business or real estate assets.

“The industry is watching warily as ongoing turmoil dominates the domestic and global markets—paying special attention to the Federal Reserve and hints as to when it may raise interest rates further. REITs worry about the potential impact of a rate hike on the value of income-producing real estate or that it might spur lenders to seek out higher loan-to-value ratios or debt yield requirements. Overall, REITs are eyeing the credit markets with a heavy dose of caution.” - Stuart Eisenberg, partner and national leader of BDO’s Real Estate practice

“Businesses are housing more sensitive data than ever before, leading cyber criminals to explore countless new avenues for breaching companies’ defenses. It’s critical that companies stay abreast of both emerging threats and risk management solutions. However, even organizations with the most sophisticated cybersecurity technology remain vulnerable to attack if they don’t account for the human element. Organizations need to put as much emphasis on cyber policies and procedures—as well as training their employees on how to follow them—as they do on cyber technology.” - Shahryar Shaghaghi, BDO Consulting national practice leader, Technology Advisory Services,

and Head of International BDO Cybersecurity

Cybersecurity Threats Push REITs to Protect Their Assets

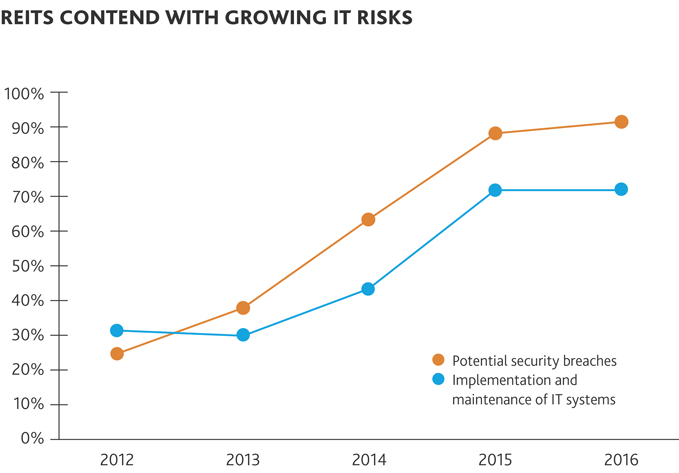

With security breaches at major companies becoming more commonplace across industries, REITs seem to be feeling the pressure to secure their systems. This year, 91 percent of REITs cite security breaches as a risk, up from 89 percent last year and 63 percent the year prior. According to a report released by PhishLabs, Business Email Compromise/Correspondence (BEC) attacks, a form of phishing, grew significantly in 2015. REITs could be especially susceptible to wire transfer fraud via BEC attacks, in which fraudulent emails trick controllers or employees into sending funds to bank accounts set up for such purposes.

Such scams are growing increasingly prevalent in the REIT industry as cyber criminals use new tools and tactics to create authentic-looking emails. To the average computer user, it is difficult to determine if a message is authentic without conscious scrutiny. The scams rely on human error and can be difficult to identify and block using anti-phishing software or services without any additional controls or employee training in place. If an organization falls victim to a phishing scheme, the impact is often severe: initial scams resulting in wire transfers in the hundreds of thousands of dollars are not uncommon. These types of attacks can result in significant financial loss if the transaction is not blocked, and could contribute to an increase in mentions of uninsured liabilities, cited by 96 percent of REITs, up from 95 percent last year and 86 percent the year prior.

Because they don’t collect or store significant amounts of personally identifiable information or credit card data from consumers, REITs face notably different information technology risks than their tenants. However, operational risks associated with implementation or maintenance of information technology systems are mentioned by 72 percent of REITs for the second year in a row. Since 2012, mentions of IT operational risks have grown by 225 percent.

Tax Reform Takes Center Stage

The Protecting Americans from Tax Hikes Act of 2015 (PATH Act) was signed into law on Dec. 18, 2015, and contains a number of provisions likely to have a significant impact on REITs. While some of these changes will be favorable for REITs, all will add to the complexity of maintaining REIT status and satisfying the various compliance and reporting obligations.

All things considered, the tax and compliance environment as a whole continues to grow more complex, and REIT disclosures reflect these complexities. Failure to maintain REIT status or loss of tax incentives remains a top concern, with 100 percent citing it for the fifth year running. Moreover, 69 percent of REIT executives this year cite worries around accounting rule changes and financial reporting risks. These findings are echoed by BDO’s second annual Tax Outlook Study, which found that 63 percent of tax directors believe the cost of compliance within the tax and financial regulatory environment has increased in the last year.

Foreign Investment Eats a Bigger Slice of the Pie

Sixty-three percent of REITs cite impediments to their U.S. expansion and growth, including risks related to operations, strategy execution and securing real estate. The number of companies citing these concerns has more than doubled since 2014. Significant capital inflow from wealthy foreign investors drawn to the safety and prestige U.S. real estate assets offer could be squeezing the marketplace. According to REITCafe, foreign investors purchased a record $91.1 billion in U.S. properties last year, more than double the amount they purchased in 2014. Chinese investors alone poured $8.6 billion into U.S. commercial real estate in 2015, and CBRE analysts assert that instability in their home markets has encouraged capital to flow toward perceived safe havens like New York City and London.

This trend isn’t set to reverse anytime soon, especially thanks to the tax changes included in the PATH Act with respect to the Foreign Investment in Real Property Tax Act (FIRPTA). Certain provisions of the PATH Act include waiving taxes imposed on foreign pension funds, making global companies and funds better suited to compete with their U.S. counterparts by reducing barriers for non-U.S. investors, who have shown a particular interest in office and hotel assets in gateway markets, as well as industrial properties.

However, large deals can raise a number of regulatory flags, both stateside and abroad. The Committee on Foreign Investment in the U.S. (CFIUS) is an inter-agency committee tasked with reviewing, investigating and, if necessary, blocking any transaction or investment that could result in foreign control of U.S. businesses or assets that would raise national security concerns or involve critical infrastructure. In recent years, the scope of “national security” has expanded to include a much broader definition of critical infrastructure, leading to an uptick in reviews and voluntary filings from foreign investors. And these reviews can obstruct the sale of a property; for example, Chinese-owned Ralls Corp. was ordered by the White House in late 2012 to divest a wind farm in Oregon due to its proximity to a naval base.

Business Interruption Risks on the Rise

Geopolitical tension and uncertainty, along with a number of high-profile terrorism events in the U.S. and major cities across the globe, could be contributing to REITs’ growing concerns around business interruption risks. Other incidents like natural disasters can also threaten demand and slow market activity, as well as impede the use of certain properties. Business interruption risks are highlighted by 97 percent of REITs this year, up from 92 percent last year and 85 percent in 2014. As extreme weather events grow more common, REITs may be increasingly factoring seasonal volatility into their business plans. In fact, cyclical or seasonal results are mentioned by 74 percent of REITs this year, up notably from 60 percent in 2015.

In the event of a significant business disruption, REITs worry not only that their operations will suffer, but also that they may not have adequate insurance and could face potential uninsured losses. Business interruption could also be adding to REITs’ concerns around completing development and construction initiatives. Eighty-six percent cite concerns around costs, permits and project abandonment, up from 80 percent in 2015 and 69 percent the year prior. Ninety-six percent of REITs cite uncovered insurance liabilities this year, and the business interruption risk may be a significant contributor. These types of attacks can result in significant financial loss—whether from theft of funds or disruption of business operations—if funds are not recovered.

“Foreign investors’ appetite for major deals will likely continue to outweigh any unease U.S. businesses could be feeling around the regulatory hurdles, political consequences or tax implications associated with selling to foreign investors. They have proven that they’ll pay top dollar for long-term assets and, as a result, we’ll likely see more foreign real estate investors proactively filing notices with CFIUS as a precautionary measure.” - Mike Barba, national leader of BDO’s National Security Compliance practice

Hospitality REITs Adjust to Online Entrants

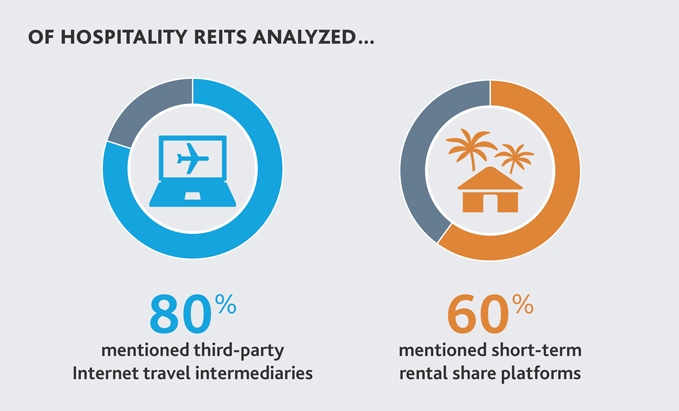

The rise of technology in the hospitality industry benefits guests—who can seek out information and check rates with a few swipes—as well as operators—who are better able to track guests and respond to data in real time. Managers and franchisors contract with platforms like Travelocity, Expedia and others to increase bookings, but these platforms could also divert business. Eighty percent of hotel/hospitality REITs in our analysis cite disruption by third-party Internet travel intermediaries, including revenue threats like commissions and transaction fees as well as marketing risks, including the erosion of brand loyalty toward a more amenities-based model based on pricing and star ratings.

Hotel businesses are also competing with alternative lodging sources, including short-term rental properties and home-sharing platforms like Airbnb and HomeAway, cited by 60 percent of hospitality REITs. According to a study conducted by Pennsylvania State University’s hospitality school, more than $500 million, or 39 percent, of the revenue generated by Airbnb in 12 major metro areas nationwide during a 13-month period went to hosts operating more than one unit.

“Short-term rental platforms like Airbnb are dragging down hotel rates in major markets like San Francisco, New York and Miami. Questions around legality aside, they’re likely here to stay, so we’re seeing REITs increasingly adjust their tactics toward working with them—not against them.” - Stuart Eisenberg, partner and national leader of BDO’s Real Estate practice

How does the PATH Act impact REITs?

In terms of favorable changes, the PATH Act expands the 10 percent tax basis safe harbor for the prohibited transaction tax by increasing the limitation to 20 percent of aggregate tax basis, provided the REIT doesn’t sell property with a tax basis or fair market value exceeding 10 percent of the REIT’s aggregate tax basis or fair market value over a three-year period.

Additionally, the PATH Act repeals the preferential dividend rule for publicly traded REITs, and provides the Treasury the authority to develop remedies for inadvertent preferential dividends or preferential dividends that were due to reasonable cause and not willful neglect.

The PATH Act also modifies treatment relating to certain debt instruments by allowing debt instruments of publicly traded REITs and interests in mortgages on interest in real property to be considered qualifying real estate for purposes of the 75 percent asset test. Income from such assets qualifies for purposes of the 95 percent income test. Qualification of income from debt instruments of publicly traded REITs will not qualify under the 75 percent income test, unless the income qualified under existing law and does not exceed 25 percent of the REIT’s assets based on value.

Under the PATH Act, income generated from personal property will be considered qualifying income for purposes of the 75 percent income test to the extent the personal property is treated as a real property for purposes of the 75 percent asset test. REITs will also be allowed to exclude from their income test calculations income generated on a hedge of an originally qualifying hedge entered into after disposition of the underlying property.

Conversely, the PATH Act prevents tax-free spinoffs in most cases when either the distributed or distributing entity is a REIT, unless both entities qualify for REIT status immediately after the spinoff or the REIT spins off a Taxable REIT Subsidiary (TRS). Further, beginning after Dec. 31, 2017, the PATH Act also returns the limitation on the value of TRS shares a REIT is allowed to own to 20 percent, reducing the limitation from 25 percent back to its pre‑2008 level.

The PATH Act also limits the amount of REIT dividends that can be designated as “capital gains dividends” to the lesser of the capital gain recognized by the REIT or total dividends paid by the REIT. Finally, the PATH Act repeals the partnership audit rules under the Tax Equity and Fiscal Responsibility Act (TEFRA) and replaces it with a new entity-level audit regime that may create an entity-level tax liability that will need to be considered for purposes of ASC 740—Income Taxes.

Lease Accounting

The FASB’s new lease accounting standard, ASU 2016-02, Leases (Topic 842), was issued on Feb. 25, 2016, and is designed to bring greater transparency to companies’ lease assets and liabilities.

The new standard, which is effective for public companies for fiscal years beginning after Dec. 15, 2018, and for private companies for fiscal years beginning after Dec. 15, 2019, including interim periods within those fiscal years, requires:

Lessees: to record a right of use (ROU) asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available.

Lessors: to classify leases as either sales-type, finance or operating. A lease will be treated as a sale if it transfers all of the risks and rewards, as well as control of the underlying asset, to the lessee. If risks and rewards are conveyed without the transfer of control, the lease is treated as a financing. If the lessor doesn’t convey risks and rewards or control, an operating lease results. A modified retrospective transition approach is required for lessors for sales-type, direct financing and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available.

REITs could be facing heightened uncertainty as a result of the new lease accounting standard, as it will likely impact the dynamic between landlords and tenants. The lease accounting standard is expected to influence key performance metrics and real estate strategy for businesses—retailers in particular—that occupy significant amounts of space. Businesses might be inclined to buy properties over leasing, which could create hurdles for REITs and other lessors of real estate.

The 2016 RiskFactor Report for REITs reveals that while REITs are recovering from a slow start to 2016 and enjoying healthy gains, the industry is contending with not only familiar risks but also new threats. As their operational and competitive landscape evolves at a steady clip, REITs will need to maintain vigilance around taxes, industry consolidation and market fluctuations, while also incorporating new risk management activities into their strategies to adjust to emerging business threats.

SHARE