Private Equity-Backed Retailers Seek to Stage a Comeback via E-Commerce

The retail industry has seen its fair share of turmoil in the past year, with the bankruptcies of well-known private equity-backed chains making headlines. Indeed, the world of retailing faces a do-or-die moment: Figure out how to compete against fast-moving internetbased megacompanies like Amazon, or perish.

As a result, retailers and their private equity owners are in pursuit of strategies to bring luster back to the industry. Fund managers at retail-focused funds who participated in BDO’s Ninth Annual Private Equity PErspective Survey, about 14 percent of all respondents, say they plan to have their portfolio companies invest in human capital (95 percent), diversify products and service offerings (88 percent), implement digital transformation initiatives (83 percent), employ cost cutting measures and adjust their geographic footprint (tied at 72 percent) and evaluate cybersecurity risks (67 percent).

In practice, some of those initiatives entail bolting on e-commerce providers. For example, in April, PetSmart, backed by a consortium led by private equity firm BC Partners, acquired pet food e-retailer Chewy.com for about $3.4 billion. Previously, it had acquired online pet adoption company AllPaws.

That type of activity is likely to continue, with 42 percent of respondents expecting to significantly increase (more than 25 percent) the amount of capital they invest in new and add-on deals in the next 12 months. Another 31 percent expect a moderate increase (less than 25 percent) in capital deployed for this purpose.

But it’s not only private equity-backed retailers adding on online targets to their companies. Walmart, for instance, acquired online menswear company Bonobos for about $310 million in June. Previously, it had acquired Jet.com for more than $3 billion. Jet.com, in turn, acquired online women’s clothes retailer ModCloth.

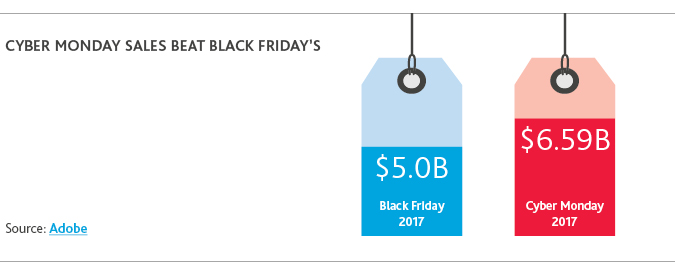

After all, online retailing is enjoying record breaking year-over-year sales, according to a Reuters report. One indicator of this is the growth in so-called “Cyber Monday” holiday sales, which reached $6.6 billion in sales in 2017, up from $5.6 billion in 2016. Meanwhile, in-store traffic was hurt by online discounts.

.jpg)

This does not mean that physical stores are about to go the way of the dinosaurs. In a recent study by Market Track, 80 percent of respondents said they compare prices online before ultimately making a purchase in a brick and mortar store, especially when it comes to higher-priced items such as electronics and major appliances.

SHARE