There’s No Such Thing as a Perfect IPO Window

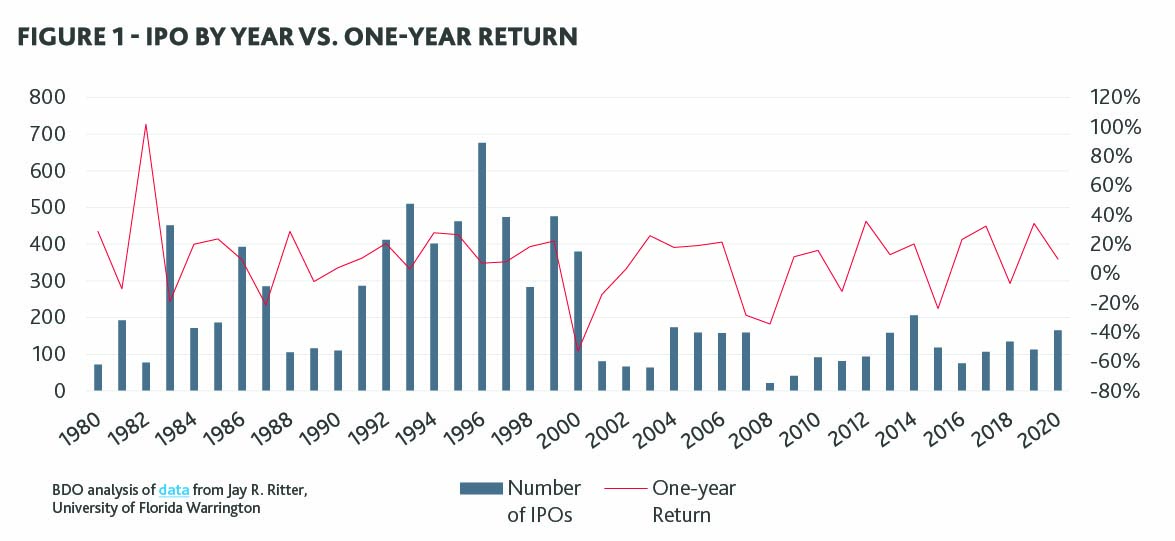

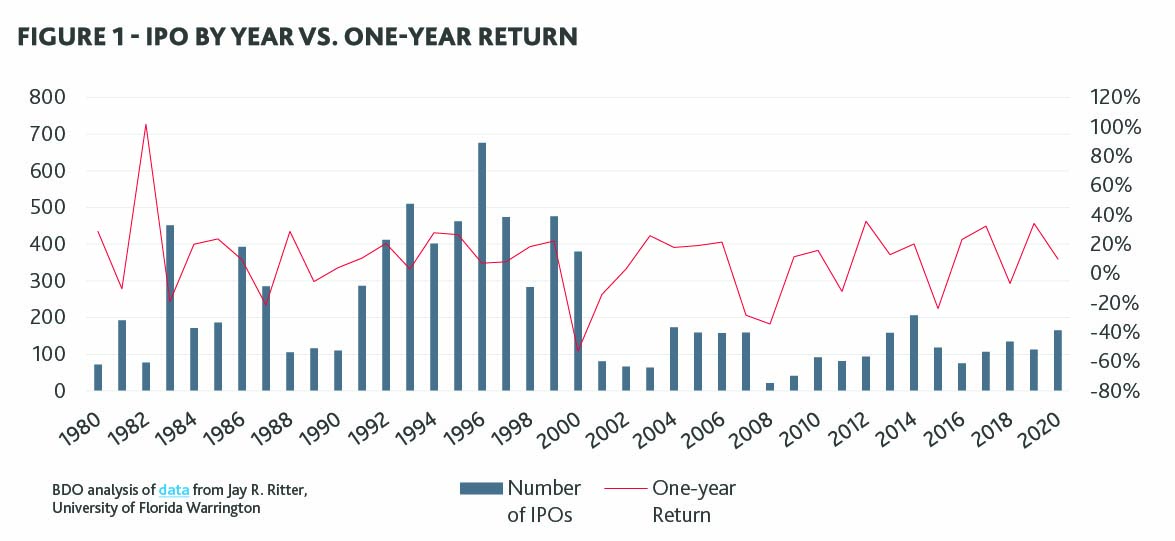

The ideal IPO window is different for every company and industry. Although the timing of an IPO can impact valuation, long-term IPO performance is not correlated, as demonstrated in Figure 1.

All of this is to say: the best time for an organization to IPO is subjective, dictated by what investors believe about the long-term performance of the company, as reflected in company valuations.

The Downsides of Delay

With a rushed IPO, mistakes along the way will likely damage market confidence. Similarly, if a company drags out the readiness process, it could miss the opportunity to attain the best possible valuation. Starting the process sooner rather than later allows for speed when it is necessary without sacrificing quality.

Pay now, or potentially pay more later

Preparing for an IPO is an expensive process. By preparing during market uncertainty, companies can spread costs out over a longer time period, as opposed to consolidating costs into a shorter timeline when the economy begins to recover. As the market improves, competition will also increase.

When more companies are looking to go public, finding consultants, auditors and additional in-house staff to help with the readiness process may prove challenging. As a result, these services may come at a premium—and an even higher premium if you’re working on an accelerated timeline.

Restatements of financial information and unidentified material weaknesses can be costly mistakes

Restatements of historical financial statements, after they have been filed with the Securities and Exchange Commission (SEC) in conjunction with Form S-1 or as part of subsequent periodic reporting requirements, often have a significant impact to a company’s stock price and investor confidence and typically result in significant additional audit, legal and other advisory costs. Restatements can also affect previous assertions made by management around debt covenants

and could potentially trigger events of default. Similarly, remediation efforts of broad-spanning material weaknesses in internal control over financial reporting are usually much more time-consuming and costly when done as an existing public company. During the readiness process, performing a risk assessment on internal control over financial reporting can reveal material weaknesses, significant deficiencies, and

other control deficiencies. From these findings, a company can develop a remediation plan to implement internal controls to prevent or detect and correct misstatements on a timely basis.

Delaying the evaluation of Form S-1 requirements can compromise IPO readiness

Filing Form S-1 with the SEC is much more than a formality. Leadership should perform a preliminary evaluation of information needed to be filed in conjunction with Form

S-1 relatively early in the IPO readiness process, as certain requirements might become roadblocks to a company’s ability to go public. Companies need at least two to three years of financial statements audited in accordance with the standards of the Public Company Auditing Oversight Board (PCAOB), which often involves engaging new external auditors who meet SEC and PCAOB independence requirements. Companies should perform a preliminary evaluation of their expected

filer status and disclosure requirements triggered by the respective filer status. For example, an entity that qualifies as an emerging growth company (EGC) under the JOBS Act of 2012 is exempt from certain reporting requirements otherwise applicable in Form S-1 and may adopt accounting standards following the effective date established for private companies. Additionally, if a company has had recent M&A activity, certain significance tests related to those acquisitions will need to be evaluated, to determine whether audited financial statements of the acquiree(s) are required, among many other reporting considerations.

Left Turn at the Exit

During a period of market downturn, companies are often well advised to pursue dual-track opportunities for liquidity events, including IPO readiness and other private M&A readiness opportunities. Other opportunities can prove a worthy alternative when circumstances change such that a public debut loses its luster. Under any scenario, IPO readiness efforts are expected to support organizational value creation and open up the company for other deal opportunities, such as acquisition by an existing public company, overall M&A diligence readiness, and private equity secondaries market opportunities.

BDO’s Take

Among the key elements of a successful IPO is taking the time to prepare and being ready for life as a public company. A market downturn is an excellent opportunity to perform a readiness assessment and build the muscle to operate like a public company. By preparing now, private equity firms can ensure their portfolio companies are ready to IPO when the market turns around and create the conditions for a successful exit.

SHARE