Considerations for a Successful PE Exit

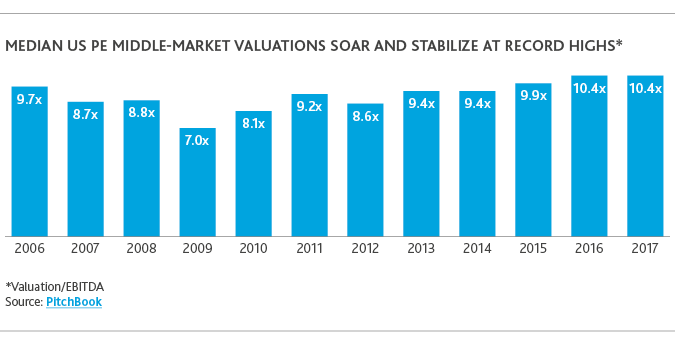

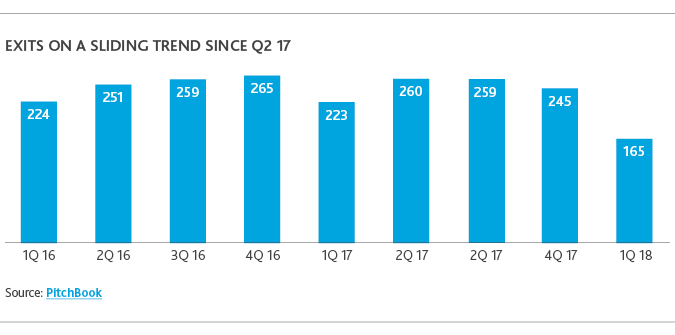

As median valuations for deals in the US middle market soar to highs of over 10x EBITDA, there has never been a better time for private equity firms to unload portfolio companies–at least in theory. After totaling at least $20 billion each quarter for about two years, PE exit values in the first quarter of 2018 dipped to $11.9 billion, according to PitchBook.

This dip could very well be the result of a mismatch between buyer and seller price expectations. But this is only one in a myriad of factors that can derail an exit.

Some of the most common reasons for deals to fall apart include political and economic turbulence, poor strategic planning, non-disclosure of material changes or events, inconsistent internal controls, and cultural disparities between the buyer and the target.

That said, it is important for private equity firms to begin preparing their portfolio companies for an exit well before the sale process starts. After all, it can take a long time, sometimes years, to pull off a successful exit, making thorough preparation a critical step to ensure a close.

Here are a few factors to keep in mind when preparing a portfolio company for exit:

Sell-side Due Diligence

Assessing the operational and financial position of a portfolio company in advance of the sale process is of utmost importance to maximizing value and minimizing risk in the transaction. Identifying and remediating issues that could negatively impact or delay the deal while seizing opportunities to strengthen operational and financial controls and processes generally increases the attractiveness of the company from the buyer’s perspective. Not only does sell-side due diligence typically shorten the sale process, it also helps management anticipate buyer objections and provides insights on how to effectively diffuse them.

Quality of Earnings

A Quality of Earnings (QofE) report is an integral part of any sell-side due diligence process. Unlike an audit, which focuses on the balance sheet, a QofE analysis focuses on the income statement and is designed to present the sustainable earnings of a company. A sell side QofE also provides an objective analysis of the company’s EBITDA, helping to position add-backs and avoid misunderstandings around application of accounting principles that may have an impact on the valuation of the company.

Budgets and Projections

PE firms should instill discipline into the planning process by formalizing detailed monthly and annual budgeting as well as annually updated three-year projections. When the time to sell comes, these tools will need to be finely-tuned, routine, and substantiated by comparisons to actuals so that they can be relied upon. In doing so, a disciplined process and approach to budgeting and forecasting will provide prospective buyers with a greater degree of comfort as to the accuracy and reliability of managements’ estimates.

Reps and Warranties (R&W) Insurance

Reps and warranties insurance is becoming a must-have for both buyers and sellers in the middle market. This type of insurance typically lessens or eliminates the need for purchase price escrows and other holdbacks. With sellers having to wait typically one or two years before proceeds are released, R&W insurance is a welcome development in the deal world.

R&W insurance also caps sellers’ exposure to post-close issues. In addition, the insurance premium is relatively small compared to the purchase price and is often paid for by the buyer. With R&W insurance, sellers can rest easier at night.

For private equity firms selling portfolio companies, this insurance provides two additional, important benefits: It provides a cleaner exit and the opportunity to maximize the proceeds distributed to limited partners at closing. It also reduces the risk of post-closing clawbacks by shifting indemnification risk from the seller to the insurer.

It is worth noting that R&W insurance has its limits and is not a substitute for due diligence. For example, it will often provide for a blanket exclusion from coverage when due diligence is not performed at all (i.e., tax representation breaches). Even when sufficient due diligence is performed by a reputable firm, specific exclusions are still made for any known issues that are discovered in due diligence.

These exclusions from insurance coverage force buyers and sellers to negotiate risks through different mechanisms such as purchase price adjustments or escrows. For this reason, it is recommended that financial and tax due diligence is performed by sellers to identify those items which are expected to be excluded from coverage. Sellers will then be better positioned to point out any mitigating factors or remediation options which could help them retain as much value as possible.

Structuring a Tax Review and a Tax‑Efficient Exit Strategy

While it is important to review and disclose any potential tax liabilities the portfolio company may have, it is also crucial to study the tax implications of various exit possibilities and how they may impact the private equity owner’s returns upon sale. This review should include state and federal tax considerations and should be conducted well in advance of the anticipated exit.

In conclusion, it’s never too early to begin preparing portfolio companies for sale. The earlier firms begin the process, the better prepared the company will be for an exit, and the greater the opportunity to maximize returns and distributions for both limited partners and general partners alike.

CONTACT:

SCOTT HENDON

National Private Equity Industry Group Leader

SHARE