BDO's Tenth Annual Private Equity PErspective Survey

Bracing for a Market Correction, While Uncovering Value

Preparing for a Market Correction

2019 will mark the 10-year anniversary of BDO’s inaugural Private Equity PErspective Survey, which launched amid the Great Recession in 2009. Ten years later, at the tail-end of the longest bull market on record, we stand at the precipice of the next market downturn. We’re overdue.

Most private equity professionals agree that a bear market correction—typically defined as a 20 percent decline in the broader stock market—is in sight. However, predictions on timing vary. KKR, for example, is predicting a “mild recession” in 2019. Blackstone Group LP’s Jon Gray, meanwhile, has gone on record to say he is “willing to bet no recession in 2019.”

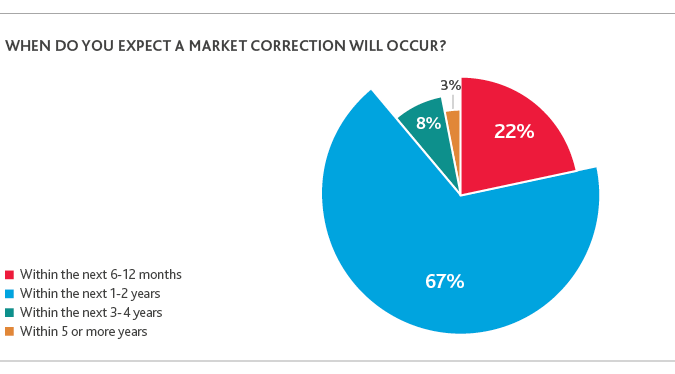

According to BDO’s Tenth Annual Private Equity PErspective Survey, 89 percent of private equity fund managers expect a prolonged downturn sometime in the next two years. Over one-fifth (22 percent) anticipate a market correction in the next 6-12 months. Meanwhile, more than two-thirds (67 percent) anticipate a market correction in the next 1-2 years.

“Data suggests that there’s a shift underway in private equity. Valuations are at historic highs, as heightened competition for a limited number of quality deals continues to drive up purchase prices. However, a confluence of economic factors leads us to believe a market correction may be coming. Expect valuations to be tested as buyers get less aggressive on cyclical assets.”

Scott Hendon

National Private Equity Industry Group Leader, BDO

Some might argue we’re seeing clear signals a recession is already upon us, with weakening economic growth in Europe and China—the latter amplified by the ongoing trade dispute with the U.S.—the collapse of oil prices and tightening monetary policies portending a similar slowdown in the U.S.

What no one can predict, however, is the next recession’s duration and severity. A bear market does not a financial crisis make—and without a major shock to the system, it’s possible the next recession will be shallow and short-lived.

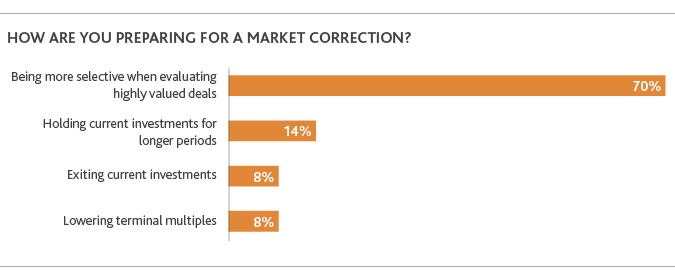

Whether the next recession comes tomorrow or in two years, private equity firms are proactively taking steps to shore up their portfolios for potential economic headwinds. To prepare for a downturn, 70 percent of survey respondents are being more selective when evaluating highly valued deals, although strong deal activity indicates that investors are still eager to deploy capital. Concurrently, 14 percent are holding their current investments for longer periods, and just 8 percent are exiting current investments.

.png)

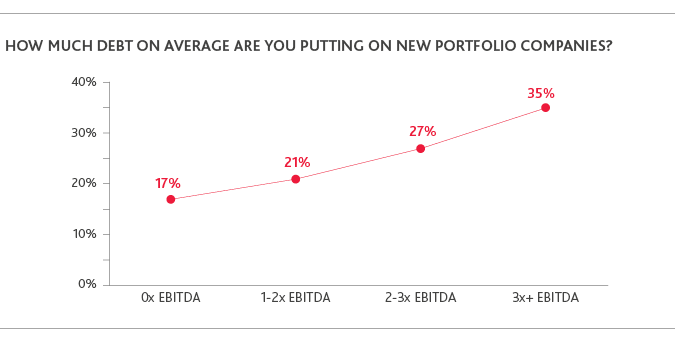

Private equity continues to use leverage consistently, with survey data pointing to typical debt averages. Survey data shows that roughly one-third (35 percent) of PE sponsors are putting somewhat higher amounts of debt on new portfolio companies, to the tune of 3x+ EBITDA. Meanwhile, more than one-quarter (27 percent) of survey respondents report the average debt load on new portfolio companies is 2-3x EBITDA.

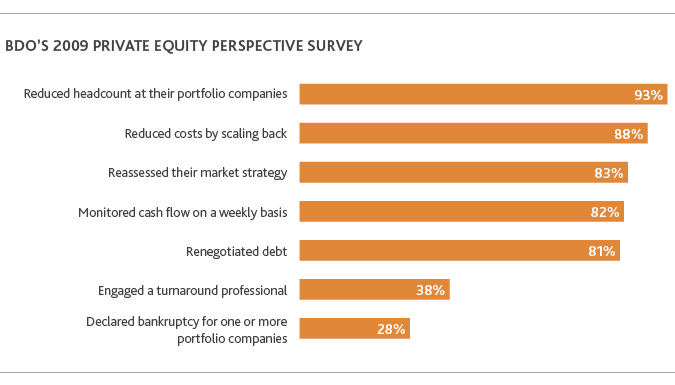

A look back at 2009

Private equity sponsors are in the business of financial stewardship and are often better positioned to navigate a company through economic turbulence. According to a recent study from Harvard, Northwestern and Stanford, PE-backed companies fared better than their non-PE-backed counterparts during the last recession, exhibiting more resilience and faster growth. Here’s what PE execs did to weather the storm:

What we said then:

A lack of available senior debt, pricing concerns and the liquidity crunch forced private equity funds to scramble for ways to deploy capital, while at the same time keeping their portfolio companies afloat and attempting to earn a return for investors. In other words, they were squeezed from all sides.

What we say now:

Debt markets remain strong despite nerves around a recession and leverage is still very much on offer. But to survive the next recession, PE firms will need to take a more conservative approach to structuring deals and sensitize acquisitions towards a recession scenario.

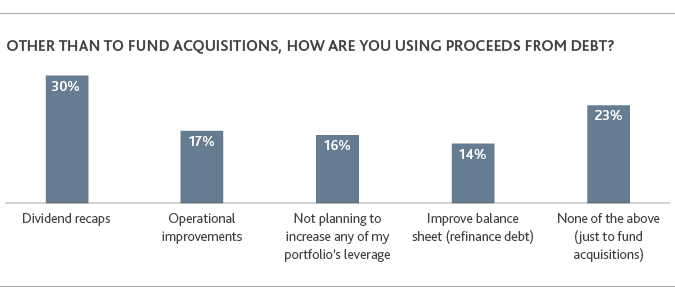

Uses of Proceeds from Debt

Other than to fund acquisitions, nearly a third of survey respondents said they’re using proceeds from debt towards dividend recaps (30 percent). However, fewer are opting to improve the balance sheet by refinancing debt (14 percent) or investing in operational improvements (17 percent). Fifteen percent are not planning to increase any of their portfolio’s leverage. Just under one-quarter of survey respondents (23 percent) say they’re using proceeds from debt to fund add-on acquisitions.

What’s Shaping the 2019 Deal Environment?

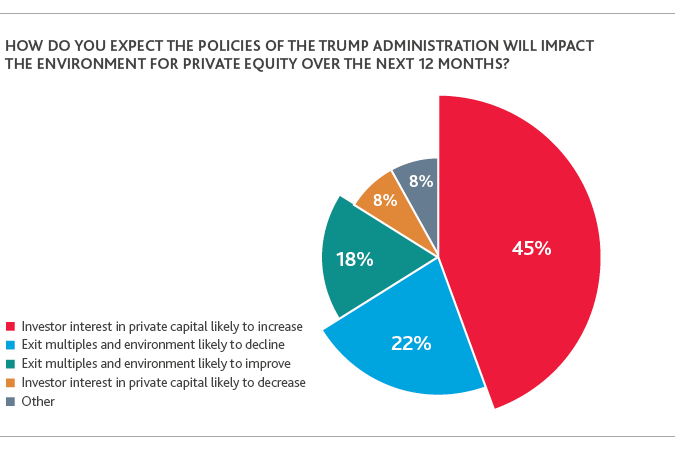

According to survey respondents, the Trump administration’s policies range from mixed to quite positive. To be exact, 45 percent of survey respondents say the policies of the Trump administration are likely to increase investor interest in private capital. Another 22 percent expect exit multiples and the environment to decline due to the Trump administration’s policies, compared to 18 percent anticipating the opposite. This perception has remained consistent: In last year’s survey, 42 percent said the new government could increase investor interest in the asset class and only 9 percent believed the contrary.

.png)

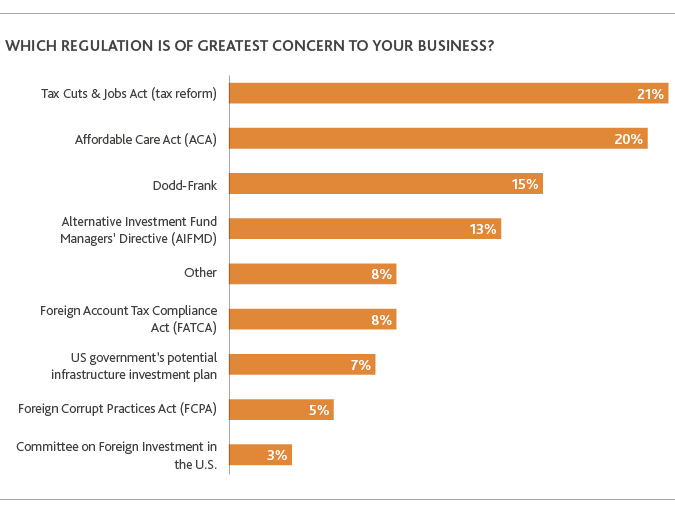

According to last year’s survey, the Trump administration’s decision to tackle tax reform led many private equity firms to take a wait and see position, which constrained deal activity. This year, tax reform is private equity firms’ chief regulatory concern. It’s worth noting that tax reform is often the reason cited for the continued growth of the U.S. economy. However, uncertainty remains as we await additional guidance on implementation of the Tax Cuts & Jobs Act from the IRS. In addition, many firms are only now fully realizing the entire impacts of these changes.

In previous years, PE firms cited Dodd-Frank as the most impactful regulation, ranked as a top concern by 39 percent of respondents in 2016 and 29 percent last year. Private equity firms may view Dodd-Frank as old news in light of the Trump administration’s efforts to roll it back. Concerns may rebound depending on the agenda of the new Congress.

The Affordable Care Act also ranks high on the list of regulatory concerns. The pressure to retain talent with competitive healthcare programs and the political uncertainty around mandatory benefits coverage by employers are also dominating the regulatory landscape for PE executives.

“Between the TCJA, Wayfair, and international-level reform, the new normal of tax is that change is constant. Tax minimization is a critical value creation lever. Fund managers need a holistic, real-time view of their portfolio’s total tax liability to maximize tax savings opportunities.”

Matthew Becker

National Tax Office Managing Partner, BDO

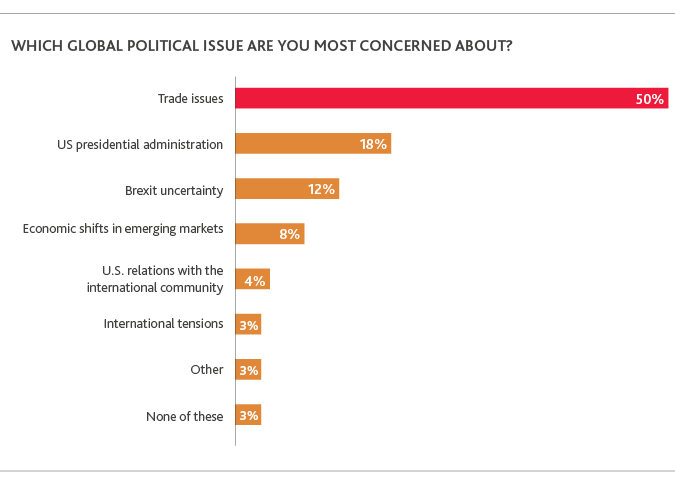

Trade Tensions Are the Biggest Political Concern in 2019

Reflecting the major impact of tariffs and the proposed USMCA to replace NAFTA, trade is overwhelmingly (50 percent) the biggest concern among global political issues for private equity fund managers. Trailing far behind is the US presidential administration (18 percent) and Brexit uncertainty (12 percent).

As the Trump administration continues to work towards “leveling the playing field” for United States’ manufacturing, private equity firms with stakes in domestic and foreign manufacturing alike are finding the predictability and calculation of future cash flows less certain. Private equity firms should consider how these regulatory shifts affect the manufacturing and distribution channels of businesses in their portfolios before engaging in any transactions. BDO regularly produces insights to help keep you informed about developments that could impact your business, including this content piece on how tariffs and escalating trade tensions are affecting the private equity industry: Private Equity Navigates International Trade Tensions.

“When it comes to tariffs, there are always winners and losers. The latest rounds of tariffs between the U.S. and China are increasing production costs, eroding margins, and raising prices for U.S. consumers. These “section 301” tariffs are impacting a range of goods from raw materials to electronics and machinery. Previously, prospective buyers paid comparatively less attention to a potential target’s spot in the overall supply chain and rarely considered the tariff impact of a potential transaction. Recent uncertainty around the future of U.S. trade policy has made prospective buyers wary of a target’s exposure to tariffs and the potential impact to margins and operations.”

Damon V. Pike

Principal, International Tax – Customs & Int’l Trade, BDO

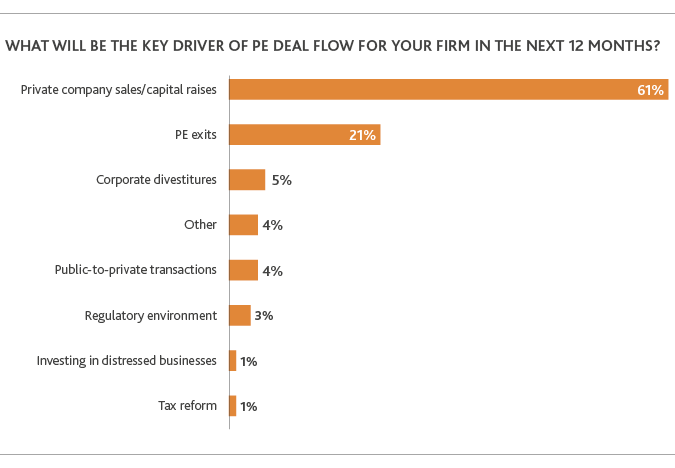

Top Drivers of Deal Flow

In a competitive environment, dependable sources of deal flow are more vital than ever before. Private company sales/capital raises are the most cited drivers of deal flow in the next 12 months, noted by almost two-thirds of respondents (61 percent)—a seven percentage point decrease from last year (68 percent) but up substantially from the year prior. PE exits are the second-most-cited at 21 percent, relatively consistent with projections from the past two years.

This finding seems to indicate a trend that PE firms are sourcing most of their deals from founder-owners, not other PE firms or corporate divestitures. Founder-owner buyouts are likely to become more active in coming years as baby boomers continue to retire.

The New Battleground for Deals: Heightened Competition at a Time of Seismic Shifts

For PE firms, it is a constant battle between competing forces - wanting to put money to work, finding good businesses and paying reasonable prices—a real Catch-22 when multiples continue to be high. There are early signs that valuations are moderating however. The public stock market is surely indicating so.

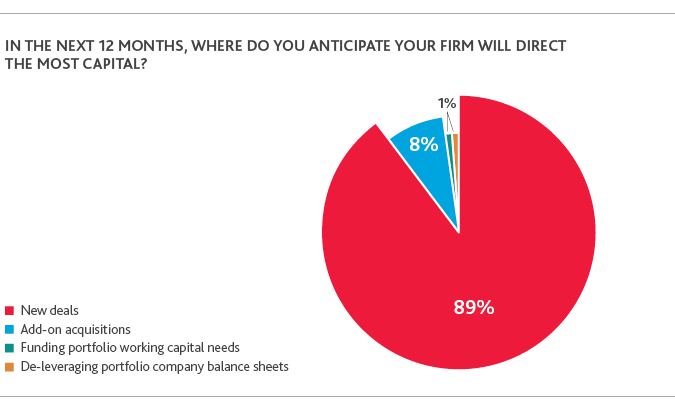

Coffers overflowing, PE’s hunt for new deals goes on: Focus largely remains on new deals (versus add-ons, de-leveraging, or funding portfolio working capital needs), which is consistent with prior years. Over the next 12 months, the overwhelming majority (89 percent) of firms will direct the most capital toward new deals, putting on the backburner add-on acquisitions and de-leveraging portfolio company balance sheets. Funding portfolio working capital needs is also not a top priority compared to the hunt for new deals.

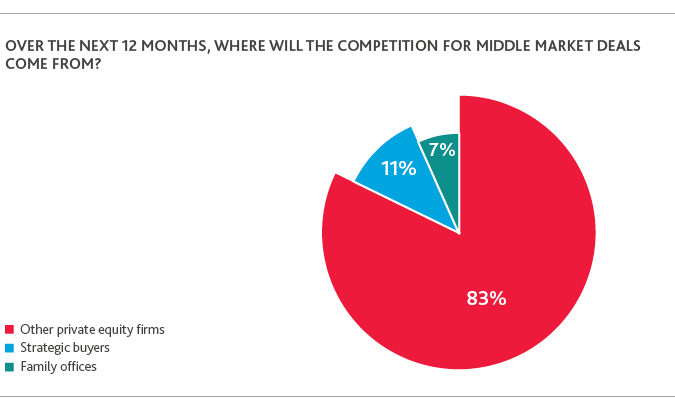

Competition for new deals in middle market private equity is fiercer than ever. Over the next 12 months, survey respondents said the most competition for middle market deals will come from other private equity firms (83 percent), followed by strategics (11 percent), surprisingly lower than expected. While strategic buyers continue to bid up prices, middle market PE peers are multiplying and, at the same time, bulge-bracket PE firms are moving downward.

.png)

.png)

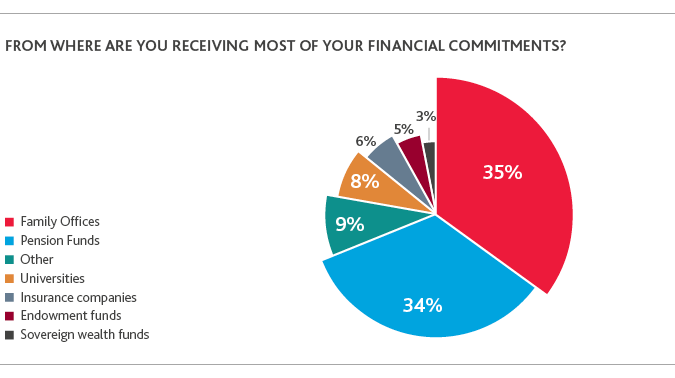

Understanding Evolving GP/LP Dynamics

PE as a provider of superior ROI is under threat. Limited partners, especially family offices and pension funds, are increasingly investing directly, cutting out the PE middleman. While only seven percent of PE execs say the most competition comes from family offices, it’s a small but growing number.

Family offices may be the top source of commitments, but they’re declining while pension funds are pulling ahead of them. This may signal the growing trend of disintermediation among family office investments.

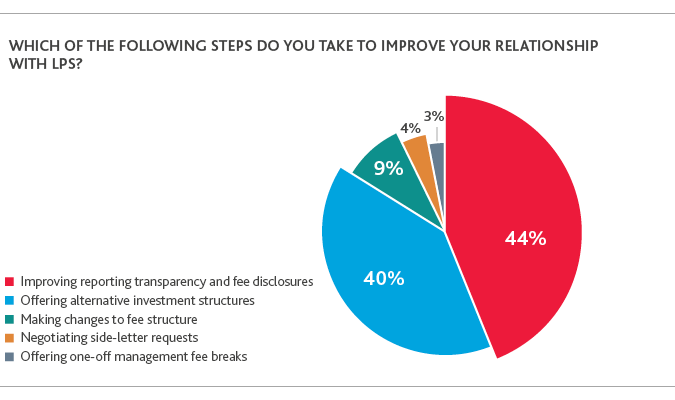

To improve their relationships with LPs, most general partners surveyed report taking steps to improve reporting transparency and fee disclosures (44 percent) or offering alternative investment structures (e.g. co-investments or separate managed accounts) (40 percent).

.png)

.png)

“It’s necessary to take a holistic view focusing on both portco and fund level operations to improve decision-making, reduce risk, and streamline business processes to drive operational excellence and enhanced profitability. A GP’s track record reflects its ability to validate its investment thesis and execute on its value creation strategy to drive ROI for each investment. We are seeing more significant enterprise level cost containment efforts as GPs continue to consolidate and/or outsource a widening spectrum of back office functions across the portfolio. In addition, GPs are introducing innovative customer experience, supply chain and broader digital transformation strategies as disruptive technologies continue to redefine the rules of engagement across the landscape of traditional businesses.”

Karen Baum

Partner, National Advisory Services, BDO

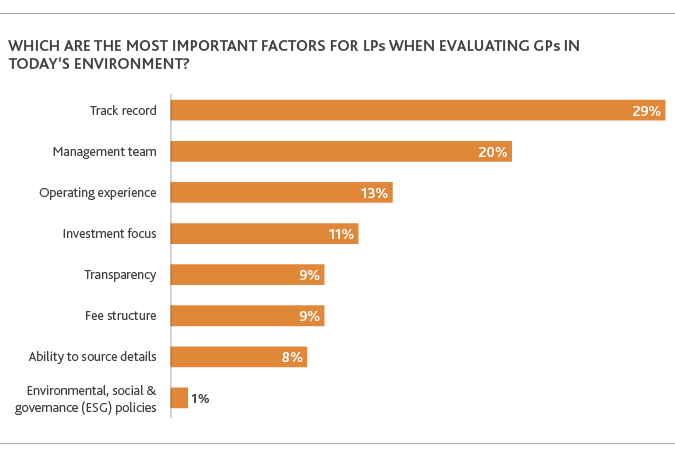

GPs’ Track Records and Management Teams Are Most Valuable to LPs

The management team (20 percent) and track record (29 percent) are the most important factors for LPs when evaluating GPs in today’s environment. Operating experience (13 percent) and investment focus (11 percent) are also important, but slightly less so.

.png)

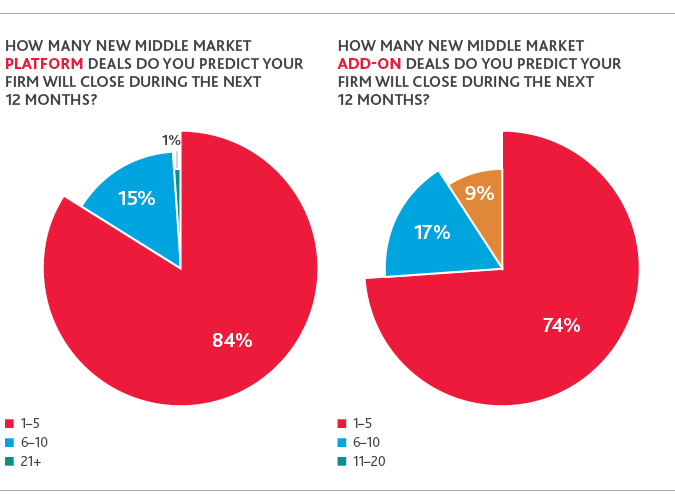

Consistent with prior years, a plurality of fund managers said they plan to close 1-5 new middle market platform deals (84 percent) and 1-5 new middle market add-on deals (74 percent) in the next 12 months. The middle market was the most resilient sector during the last economic crisis and continues to be the biggest driver of sustained growth.

While Some Industries Are Leading the Way, Others Have Been Lagging

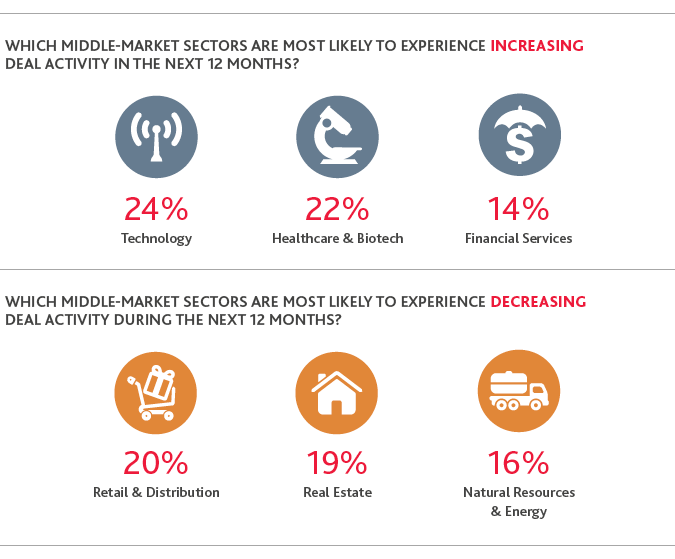

Healthcare & biotech (22 percent) and tech (24 percent) are the middle-market sectors are most likely to experience increasing deal activity during the next 12 months, according to survey respondents. However, retail & distribution (20 percent) and real estate (19 percent) are the middle-market sectors most likely to experience decreasingly deal activity during the next 12 months.

Whether or not it comes as soon as 2019, most dealmakers would agree that a market correction is impending. As such, we can also expect an increased focus over the next year on investments in the consumer staples and essential services sectors – those that fulfill constant, irreplaceable consumer needs. Consumer staples have beat the S&P 500 by 49 percent in the last 25 years and experienced most of its outperformance during periods of economic recession.

“The rise of economic nationalism and populism around the world is shifting the dynamic for cross-border investments, data, and people. Changes to international trade policies are also starting to have a profound impact on private equity investments. Also, adding to this complexity, new U.S. regulations are changing how international entities are taxed.”

Lee Duran

Tax Office Managing Partner, Japan Desk Leader, BDO

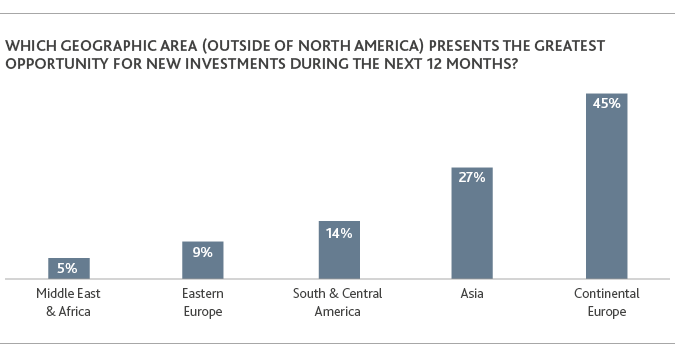

International Investment Remains Strong Around the World

Outside of North America, continental Europe is considered the most attractive region for investment (45 percent) in the next 12 months, with Asia coming in second (27 percent). South and Central America is projected in a distant next place at 14 percent, with Eastern Europe (9 percent) and the Middle East and Africa (5 percent) trailing behind as key regions for investment in the next year.

In last year's survey, Western Europe (37 percent), Asia (29 percent), and South & Central America (18 percent) were the key regions projected to present the greatest opportunity for new investments, perhaps suggesting Asia is beginning to fall out of favor slightly given geopolitical concerns and more investors are flocking to Europe instead.

The survey indicates that investors’ optimism for Continental Europe is healthy, despite the tumultuous pending split between the UK and the EU. Though it is worth noting that a possible Brexit has led to a major decline in investors’ appetite for UK-dedicated funds in the last year.

Opportunities for Unlocking Digital Potential in Private Equity

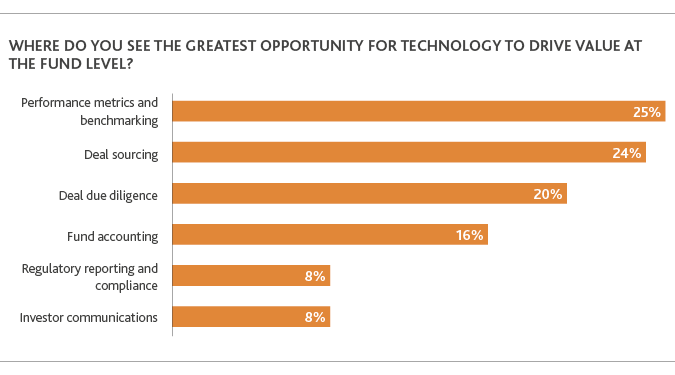

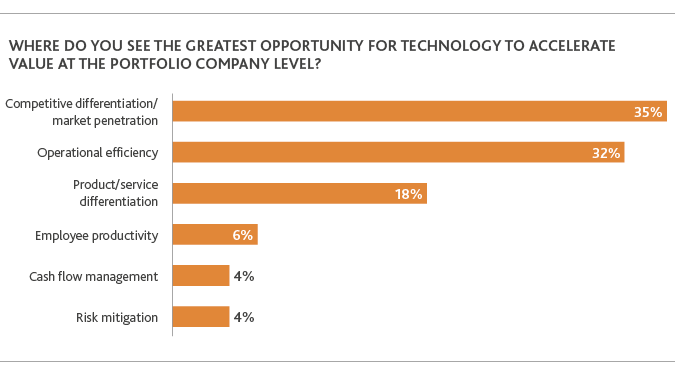

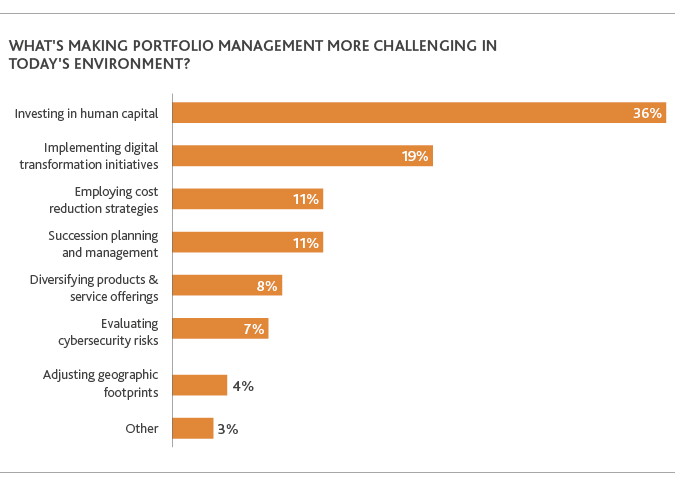

As competition intensifies for deals and PE talent, compliance demands are straining resources. At the fund level, private equity is looking inward, focusing on leveraging data in new ways to lower management fees and provide investors with more transparency without cutting into profit margins. That said, private equity firms are prioritizing digitization efforts at the portfolio company level (82 percent) over the fund level (8 percent).

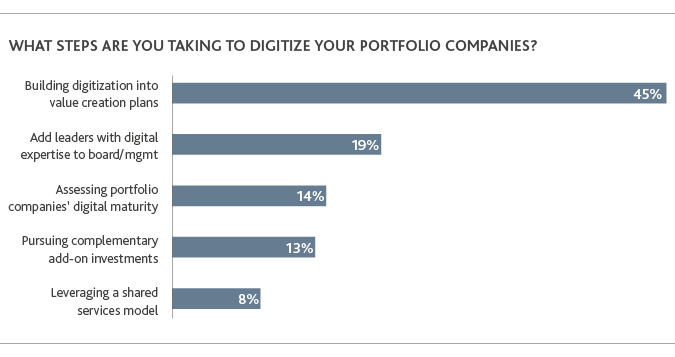

However, challenges abound in today’s environment. Investing in human capital (36 percent) and implementing digital transformation initiatives (20 percent) are the top issues making portfolio management difficult in the current climate. Also significant, but slightly less so, are employing cost reduction strategies (11 percent) and succession planning and management (11 percent).

.png)

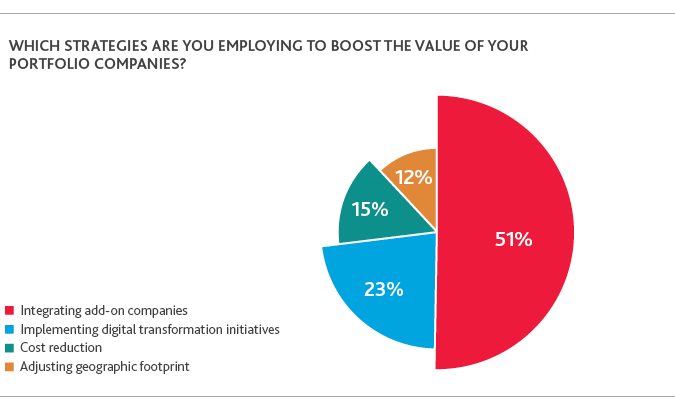

Portfolio Management Driving Value

Integrating add-on companies is the top strategy employed by PE firms to boost the value of their portfolio companies, cited by over half of private equity firms that were surveyed. And while traditional cost-cutting and operational measures aren’t going anywhere, digital transformation is emerging as a critical strategy to accelerating top-line growth post-acquisition and unlocking hidden value across the portfolio. Twenty-three percent of survey respondents are currently employing digital transformation as a value creation strategy, and forty-five percent of survey respondents say they are intentionally building digitization into their value creation plans.

.png)

.png)

.png)

“Digital transformation is all about re-imagining your business and operations for the digital economy. The process of digital transformation is one of a series of deliberate steps to mature the digital capabilities underpinning the desired future state of the business. Once you understand where you need to go, it’s a matter of working backwards.”

Malcolm Cohron

Managing Director, National Digital Transformation Services Leader, BDO

How Digital Potential Gets Calculated in Investment Decision‑Making

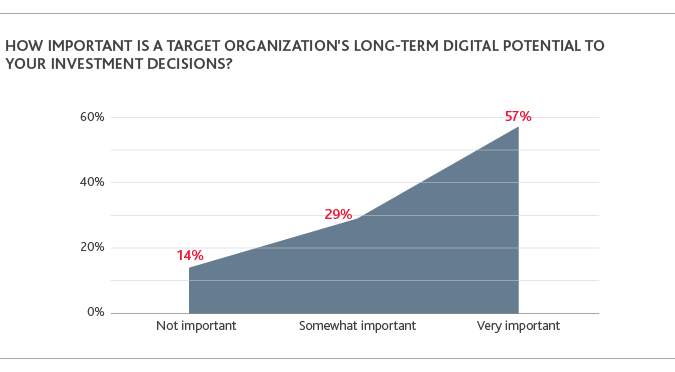

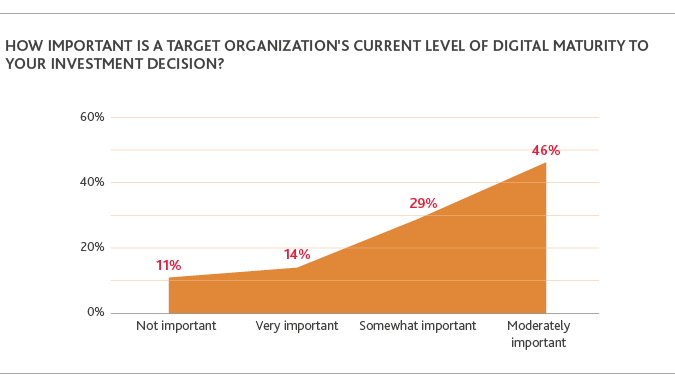

Long-term digital “potential”—the estimated bottom-line and top-line growth that can be achieved through digitization and digitalization strategies—is an increasingly important part of the deal calculus for a target investment. The majority (57 percent) of PE firms say digital potential is very important to their investment decisions. Survey respondents are less concerned with a target organization's current level of digital maturity—as long as they can see the potential.

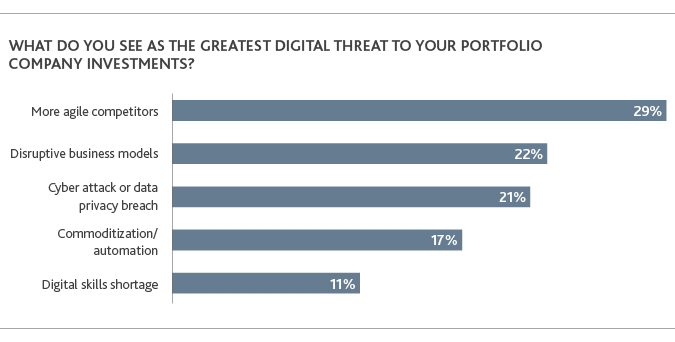

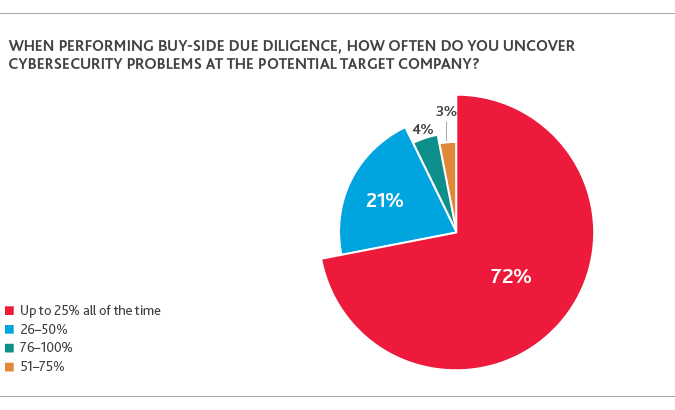

While effectively harnessing disruptive technologies can drive significant portfolio growth, it also poses new challenges. Cyberattacks are the obvious threat—but a subtler and more insidious threat is that of inaction in the face of disruption. To stay on the right side of disruption, PE sponsors need to anticipate the signals of change and help their portfolio companies adapt for a more digital future.

.png)

.png)

A data breach, of course, is nothing to sneeze at; the financial and reputational fallout is significant. For a prime example of how cybersecurity can affect value, we can look to Verizon’s acquisition of Yahoo. Following revelations that more than a billion user accounts had been compromised in a massive data breach, Yahoo had to slice $350 million off its asking price.

Too often in the deal-making process, cyber is viewed as a check-the-box compliance issue and given lower priority. But with the escalating impact, scale and complexities of cyber issues, potential buyers can no longer afford to breeze over it.

.png)

Private equity firms can use this checklist to ensure they are taking appropriate actions before, during, and after the deal to mitigate the potential negative impacts of cyberattacks and optimize the financial aspects of the deal.

Before the Deal |

During the Deal

|

After the Deal is Done

|

|

|

|

BDO’s Closer Look:

The transformation opportunity in the middle market can be boiled down to three foundational areas of future value creation: Digital Business, Digital Process, and Digital Backbone.

At the heart of digital transformation is Digital Adoption by the business and the people behind it. Operational change requires behavioral change in order to truly become integrated into the fabric of the business. You need your people to understand why they need to leave the status quo behind, believe in the strategic vision, and feel engaged in the process. Most importantly, they need to understand what’s expected of them and have the resources and training in place to get there. These fundamental value drivers are interconnected—and will become even more intertwined as your organization becomes increasingly digital. BDO regularly produces resources to keep you informed about the latest developments that may impact your business, including this article on how middle market organizations are re-imagining business and operations for the future digital economy: The Middle Market Goes “Back to the Future”: THE DIGITAL TRANSFORMATION JOURNEY.

For the private equity industry, it’s becoming increasingly complex to close deals at attractive prices in a highly competitive market while also navigating a shifting economic, regulatory, and digital environment. Success in this challenging environment requires an approach rooted in business model improvements, realignment of strategies, specialization, and deep industry expertise.

What’s more, as the industry anticipates a market correction, the battleground for deals is transforming. In addition, geopolitical changes and emerging investor challenges are further muddying up rough waters ahead. The current situation demands nimble yet bold actions. Adapting swiftly to unlock digital potential as competition intensifies is key to success. Those that keep their focus on innovative ways to evolve are the players that will, in the long run, eclipse their peers.

CONTACT

Scott Hendon

National Leader of BDO's Private Equity practice

About the Study

The BDO Tenth Annual Private Equity PErspective Survey is an international survey of more than 76 senior executives at private equity firms in the U.S. and internationally. The survey is administered by PitchBook, an independent and impartial research firm dedicated to providing premium data, news and analysis to the private equity industry.

SHARE