Nonprofit Standard Newsletter - Fall 2021

Table of Contents

- Provider Relief Fund Updated Single Audit Requirements

- OMB Issues the 2021 Compliance Supplement

- Top Considerations for the Nonprofit Sector

- Breaking Down Barriers—and Silos: Addressing Leadership Challenges in a Remote Environment

- Blockchain in Privacy for Nonprofits

- Higher Education in the U.S. – Rising Costs, Enrollment Challenges and the Need for Innovative Solutions

- Accounting for Shuttered Venue Operators Grants

- BDO Professionals in the News

- Nonprofit & Education Webinar Series

Provider Relief Fund UPDATED Single Audit Requirements

By Carla DeMartini, CPA

What is the Provider Relief Fund?

The Provider Relief Fund (PRF) is the federal program issued under the Coronavirus Aid, Relief, and Economic Security (CARES) Act aimed at supporting eligible health care providers in the battle against the COVID-19 pandemic. The PRF is administered by the Health Resources and Services Administration (HRSA). PRF provides relief funds to eligible providers of health care services and support for health care-related expenses or lost revenues attributable to the coronavirus.

There has been considerable time spent by the U.S. Department of Health and Human Services (HHS) in determining how to manage these funds and the timing and nature of audit procedures that would be applicable to these funds. The 2021 Office of Management and Budget Compliance Supplement (Supplement) includes a section on the PRF funds in Part 4, Agency Program Requirements (Assistance Listing 93.498). This section addresses many of the questions related to how and when to report PRF expenditures and lost revenues in both the HRSA reporting portal and on the Schedule of Expenditures of Federal Awards (SEFA).

Key Highlights

Eligible Expenses Timeline

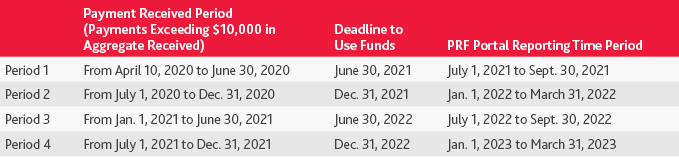

PRF recipients must use payments only for eligible expenses including services rendered, and lost revenues during the period of availability, as outlined in the table below. Providers must use a consistent basis of accounting to determine expenses. PRF recipients may use payments for eligible expenses incurred prior to receipt of those payments (i.e., pre-award costs) dating back to Jan. 1, 2020, so long as they are to prevent, prepare for, and respond to the coronavirus.

SEFA reporting amounts for PRF, including expenditures and lost revenues, are based upon the PRF report that is required to be submitted to the Provider Relief Fund Reporting Portal.

The table below outlines the deadline to use PRF funds and the timing of when to report expenditures on the HRSA portal. This table is excerpted from Part 4 of the Supplement for Assistance Listing 93.498, Provider Relief Fund.

HHS has announced that there is a 60-day grace period.

Single Audit and SEFA Considerations

Since the PRF amounts to be reported on a recipient’s SEFA are based on the PRF report that is required to be submitted to the HRSA reporting portal and, due to the fact that the PRF report must be tested by the auditors as part of their testing on the reporting compliance requirement under the Supplement, the timing of the single audit needs to be based on when the recipient has filed the required HHS PRF report.

Thus, for single audits of fiscal year ends (FYEs) prior to June 29, 2021, PRF expenditures and lost revenues should be excluded from the SEFA. For FYEs on or after June 30, 2021, single audits should be delayed until recipients have completed the reporting in the PRF reporting portal.

Summary of SEFA Reporting of PRF for FYEs Covered by the Supplement

For a FYE of June 30, 2021, and through FYEs of Dec. 30, 2021, recipients should report in the SEFA, the expenditures, and lost revenues from the Period 1 PRF report.

For a FYE of Dec. 31, 2021, and through FYEs of June 29, 2022, recipients should report in the SEFA, the expenditures, and lost revenues from both the Period 1 and Period 2 PRF reports.

For FYEs on or after June 20, 2022, SEFA reporting guidance related to Period 3 and Period 4 is expected to be provided in the 2022 OMB Compliance Supplement.

Defining the Entity to be Audited

The reporting entity required for PRF reporting purposes may not align to the reporting entity as defined for financial reporting purposes. It is important to note that the required PRF level of reporting has no bearing on the application of the requirements of 2 Code of Federal Regulations 200.514 for defining the entity to be audited for single audit purposes. Therefore, for single audits that include PRF, the single audit must cover the entire operations of the auditee, or, at the option of the auditee, such audit must include a series of audits that cover departments, agencies and other organizational units that expended or otherwise administered federal awards during such audit period, provided that each such audit must encompass the financial statements and SEFA for each such department, agency and other organizational unit, which must be considered to be a nonfederal entity.

The Supplement notes that as a best practice, recipients of PRF may wish to include a footnote disclosure in the SEFA to identify which providers by Taxpayer Identification Number (TIN) are included in the audit.

Audits of For-Profit Recipients of PRF

The AICPA Governmental Audit Quality Center (GAQC) is still trying to determine the impact and relevance of the above guidance on for-profit recipients related to PRF funding. The GAQC has emphasized to HHS the need for such guidance, and they believe that HHS will be developing additional guidance to address for-profit considerations.

For more information, contact Carla DeMartini, Professional Practice Director – Healthcare & Nonprofit, at [email protected].

OMB Issues the 2021 Compliance Supplement

By Tammy Ricciardella, CPA

- Coronavirus Preparedness and Response Supplemental Appropriations Act

- Families First Coronavirus Response Act

- Coronavirus Aid, Relief, and Economic Security Act (CARES Act)

- Coronavirus Response and Relief Supplemental Appropriations Act (CRRSAA)

- American Rescue Plan (ARP)

Appendix VII also outlines how to reflect donated personal protective equipment (PPE) on the Schedule of Expenditures of Federal Awards (SEFA). If an entity received donations of PPE without any compliance or reporting requirements or Assistance Listings (formerly CFDA) from donors, these should be shown at the fair market value at the time of receipt as a stand-alone footnote accompanying the SEFA. In addition, the amount of donated PPE should not be included for purposes of determining if the entity has met the threshold for a single audit.

However, if an auditee receives funds provided under an Assistance Listing, either from a federal agency directly or a pass-through entity, to purchase PPE these amounts would be included in expenditures on the SEFA.

Appendix VII reminds entities acting as a pass-through entity when awarding COVID-19 funds to subrecipients to be sure they are documenting at the time of the subaward the fact that the funds are COVID-19 funds and providing the Assistance Listing number and the dollar amount of COVID-19 funds.

Subsequent to the release of the Supplement, OMB has announced that they plan to issue two Addenda. The first Addendum is to be issued in early Fall and likely include the Coronavirus State and Local Fiscal Recovery Fund (Assistance Listing 21.027) and updates to the Education Stabilization Fund (Assistance Listing 84.425). The second Addendum is to be issued later in the Fall. The second Addendum is expected to include the following three Treasury programs: Capital Projects Fund (no Assistance Listing yet); Homeownership Assistance Fund (Assistance Listing 21.026); and the Local Assistance and Tribal Consistency Fund (no Assistance Listing yet). The second Addendum may include additional new programs.

OMB will post the Addenda to the CFO.gov website when available. The Addenda will not be posted to the OMB website; however, OMB will be responsible for reviewing the Addenda prior to issuance and they will be considered an official part of the 2021 OMB Compliance Supplement.

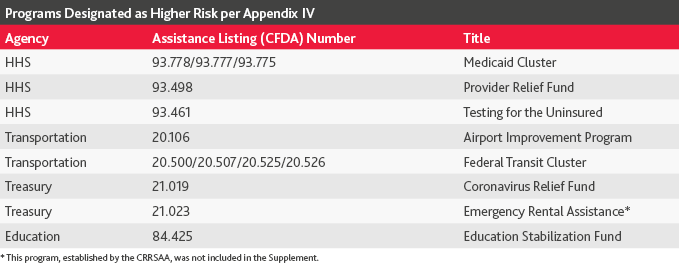

Appendix IV, Internal Reference Tables, lists all COVID-19 programs arising from the COVID-19 funding listed earlier that have been identified as “higher risk.” The designation of “higher risk” programs from the ARP have not been made yet, so stay tuned for any communication of these in the forthcoming Addenda. The Medicaid cluster continues to be designated as “higher risk” as in prior years.

The designation of these new programs as “higher risk” in the Supplement may result in additional programs being identified as major programs by your auditors in the single audit. Auditees should be aware of this effect and be prepared for this reality. This will mean that additional documentation and support may be required by the auditors. .

For more information, contact Tammy Ricciardella, Professional Practice Director – NFP, at [email protected].

Top Considerations for the Nonprofit Sector

By Divya Gadre, CPA

1. COVID-19 Relief Funds

Since the outbreak of the COVID-19 global pandemic, some nonprofit organizations have benefited from different types of federal financial aid. These include the Paycheck Protection Program (PPP), Economic Injury Disaster Loans (EIDL) and the Main Street Lending program advances and loans, the Higher Education Emergency Relief Fund (HEERF), the Employee Retention Credit (ERC), the Families First Coronavirus Response Act (FFCRA) which paid sick and child care leave and related federal tax credits, shuttered venue relief, special relief for hospitals and healthcare providers, and the ability to defer certain federal payroll deposits interest free. To ensure compliance, nonprofits should consider the following questions:

- Is your organization covering the same cost by two sources of stimulus funding?

- Are your costs and stimulus aid accounted for appropriately? Consider whether the funding is a loan or revenue, and investigate potential debt covenant implications. Be mindful of maintaining appropriate controls to process your funding and complying with the specific requirements related to your federal assistance, such as the single audit.

Organizations should involve auditors, bankers and key board members in discussions around managing and abiding by the various requirements of pandemic-related federal financial aid. Nonprofits should be cognizant of any federal program rules (which frequently change) and should be sure to document the organization’s compliance with those requirements.

2. New Accounting Standards

The Financial Accounting Standards Board (FASB) Accounting Standards Update (ASU) 2016-02, Leases, is now effective for many nonprofit organizations. The impacts of adopting ASU 2016-02 include:

- Lease arrangements have to be classified as either finance leases or operating leases.

- The right-of-use asset model, which shifts from the risk-and-reward approach to a control-based approach.

- Lessees will recognize an asset on the statement of financial position, representing their right to use the leased asset over the lease term and recognize a corresponding lease liability to make the lease payments.

- The lease liability is based on the present value of future lease payments using a discount rate to determine the present value based on the rate implicit in the lease, if readily determinable, or the lessee’s incremental borrowing rate.

To prepare, organizations should discuss the new lease standard with their accounting advisors and evaluate the impact the standard will have on all facets of the organization’s leasing activities. Organizations should also identify and classify all leases based on the criteria in the ASU, and prepare financial statements based on the guidance. The organization should determine if the impact of adopting the standard causes any potential issues with meeting current debt covenants. Lastly, organizations should review current lease disclosures and update them to meet the ASU’s criteria.

The FASB issued ASU 2020-07, Presentation and Disclosures by Not-for-Profit Entities for Contributed Nonfinancial Assets, to increase the transparency of the presentation and disclosure of these items. Important items to note are:

- The ASU should be applied retrospectively to all periods presented and is effective for annual reporting periods after June 15, 2021 and interim periods within annual periods after June 15, 2022. Early adoption is permitted.

- The ASU requires that contributed nonfinancial assets be presented as a separate line item in the statement of activities, apart from contributions of cash and other financial assets.

- The ASU outlines specific disclosures related to contributed nonfinancial assets that organizations will have to add to their financial statements.

To prepare, organizations should discuss this new standard with their accounting advisors and evaluate the impact the standard will have on the presentation and disclosure of contributed nonfinancial assets.

3. Cybersecurity and Breaches

As many nonprofits have moved to adopt a fully remote or hybrid work environment, there are significantly more employees working from home, using personal devices, internet providers and cybersecurity practices that likely aren’t as robust as an organization’s systems. As a result, there has been an increase in cybercrime, and these occurrences are only expected to continue to rise as bad actors become more advanced. This is especially harmful to nonprofits because of the sensitive information they may have in their records pertaining to staff and the communities they serve. A breach could present significant reputational risk and damage future fundraising efforts and partnerships.

For this reason, it’s imperative that nonprofits prioritize risk management to implement procedures to safeguard against cyberattacks as well as prepare their organizations to respond to a cyber breach. Organizations should develop a robust plan and implement procedures to guide the steps the organization will undertake if a breach were to occur.

4. Sudden Increased Use of Technology

For some organizations, remote work has highlighted their reliance on manual workflows. Certain internal processes that worked before, such as cross-organization collaboration in communal workspaces and in-person reviews of invoices, are no longer the status quo.

As a result, organizations should reassess systems, controls and processes from a remote work point of view and develop a plan to share with management and board members/committees. The plan should reflect the organization’s goals for adopting technology across departments, a funding plan and actionable steps to facilitate implementation.

5. Diversity, Equity and Inclusion (DEI)

The events of the past year have drawn heightened attention to organizations’ social impact, and nonprofits should carefully consider their organizational approach to DEI. Begin with an exploration of these terms and define what they mean for your organization and its mission. Consider the following questions:

- Is your organization prepared to be transparent about the steps it is taking to become more diverse and encourage inclusive practices? How does your organization communicate its values to the public and new or existing staff and volunteers?

- Does your nonprofit create opportunities to listen to the voices directly from community, grassroots or young leaders in low-income, underserved and/or marginalized populations?

- How can your nonprofit open its board recruitment and staff hiring pipeline to talented candidates from underrepresented groups?

- How can your organization work with existing and future collaborative and community partners to ensure they share similar values and approaches to DEI? Are you having these conversations at the onset of new partnerships?

- How will your nonprofit assess the progress you are making toward your goals? What will success look like?

No matter what stage your organization is in with regard to a DEI strategy, you should ensure that it’s ingrained seamlessly in all processes. Organizations can broaden their view by relying on experts, board members and external consultants, to brainstorm the most impactful approach.

As we emerge from the pandemic, the nonprofit landscape will continue to evolve. To support operational sustainability and social justice work, it’s imperative for organizations to monitor how these considerations impact their mission and processes, and their ability to remain agile enough to adapt to change.

Article reprinted from BDO Nonprofit Standard blog.

For more information, contact Divya Gadre, assurance partner, at [email protected].

Breaking Down Barriers—and Silos: Addressing Leadership Challenges in a Remote Environment

By Barbara Finke, CPA

Be intentional

In a remote environment, there isn’t an opportunity to run into someone in the breakroom or other communal areas and spark a conversation. In the past, inter-department communication often depended on those chance encounters. A fund development officer might start telling the chief financial officer (CFO) about a great art piece that was part of the most recent bequest. This offhanded comment would allow the CFO to discuss how this should be accounted for and if any tax forms would be required. Without this chance meeting, would the CFO ever know about the gift? Maybe not. To avoid these potential gaps and others in a remote environment, communication needs to be intentional. Create a virtual “meeting space” where, on a recurring basis, team leaders meet to discuss what is happening. Create an agenda to discuss wins, challenges and other developments that allows each department to catch everyone up on what is happening. This meeting should be frequent enough so that it’s not too long and relevant information is shared in a timely manner. Consider making these video meetings so you can still maintain face-to-face interaction.

Leaders also need to be intentional about reaching out to their team members. Pulse of HR, a website partnership between Josh Bersin Academy, CultureX and Waggl, maintained several surveys during the pandemic asking employees and human resource professionals questions about policies and procedures during the last year. One of the questions was “What is one thing your organization has done in response to COVID-19 that has positively impacted employee engagement?” The top three answers all included increases in communication. So, how can management communicate more in a virtual environment? Be cautious about sending more and more emails. Inboxes are full, and group-wide emails are often ignored. Try building a strong intra-network page as the landing page for your team members when they start the day. This is a great way to pass out key information to all staff. Some offices may want to start a monthly newsletter to keep the team informed of exciting personal or professional happenings. This is also a great place to keep up personal interactions between colleagues with games and other virtual hangouts.

Leaders must be responsible for driving intentional communication, but should also think about how to involve the whole team in helping write and circulate the information. This could be a great project for an intern who was hired remotely to help teach them about the corporate values and culture.

Be adaptive

In addition to intentional, well-planned communication, a remote leader needs to drive organizational adaptation. Remote work requires evaluating and updating potentially antiquated or “office-biased” policies and perceptions.

For example, how has the organization adapted to providing the tools and equipment needed for teams to work remotely? Do you have a checklist of what equipment team members need at home to complete their work tasks? Have you created a policy on how much the organization will provide and how much may be at the expense of the employee? Some organizations provided stipends during the year to assist with working-from-home requirements. Is this something that needs to be budgeted now for new hires? What onboarding or training procedures will need to be revamped to equip your team members for success?

Does the organization need to consider updating or revamping how to measure employee success? Oftentimes, organizations are focused on time inputs. An employee’s time is tracked and those who show up and stay at their desk are often labeled successful. What if the organization created more output metrics? Track project assignments and completions. Eliminate the need for tracking keystrokes or checking to see if the team is online during the old “office hours.” If you remain focused on intentional communication, it may be possible for remote teams to set their own working hours while still coordinating group projects.

Be flexible

Another concept prevalent for embracing a remote workforce is asynchronous communication, which allows teams to communicate through applications, such as Teams, Slack, email and others, without an expectation for an immediate response. The traditional in-person meeting can still take place through these chat room functions at the convenience of the team. Allowing a shift to more asynchronous communication empowers employees to work efficiently with fewer interruptions and on their own schedule. It can even foster more honest communication, as employees are given the time and space to formulate a response. In addition, employees sometimes feel they can be more direct through the written word in a chat room than face to face. Consider how many meetings could be shifted to this model to encourage productivity, honesty and breaking down silos.

It's likely that the shift to remote work settings for most organizations will change the way employees work forever. By being intentional, adaptive and flexible, organizational leaders can help ensure that the current workforce is both productive and satisfied while continuing to recruit and retain top talent.

Article reprinted from Nonprofit Standard blog.

For more information, contact Barbara Finke, assurance director, at [email protected].

Blockchain in Privacy for Nonprofits

By Karen A. Schuler, CIPM, CIPP/E, CIPP/US, FIP, CDPSE, CFE, and Taryn Crane, PMP, FIP, CIPM, CIPP/E, CIPP/US

General purpose technology (GPT) is “technological progress that drives long-term economic growth.”[1] GPTs apply to almost any activity and have the ability to ”transform those activities by improving efficiency or creating opportunities for new ways of doing things."[2] Distributed ledger technologies (DLTs) are databases that are shared and synchronized across multiple sites, institutions, or geographies.[3] They are accessible by numerous people, and transactions can be public in certain situations. Blockchains are DLTs, so they are databases that store information in blockchains that are chained together.[4] Nonprofits can store different types of information in blockchains, but the most common type is for transactions.

The terms “digital assets,” “cryptocurrency” and “tokens” are often interchangeable. However, there are notable differences. Digital assets are non-tangible assets, such as non-fungible tokens (NFT), created, traded and stored digitally. Cryptocurrency is a medium of exchange or the digital equivalent of fiat currency (e.g., USD, Euro) that allows organizations to trade them for goods or services. Tokens, on the other hand, are built on the platform on top of blockchains. They are programmable, permissionless, trustless and transparent. They are composed of smart contracts that provide the rules of engagement of the token.

The goal of blockchain technologies is to give organizations complete control of their data and manage the flow of information.

Nonprofits' Blockchain Use Cases

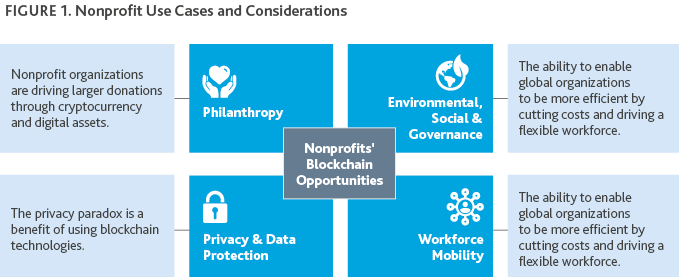

Philanthropy is driving blockchain use for nonprofits. Because charities, nonprofits, and non-governmental organizations (NGOs) can find it challenging to reach suitable donors, they build blockchain solutions to help change that. However, opportunities exist for nonprofits to expand their use of blockchain solutions to support Environmental, Social and Governance (ESG) efforts. Additionally, nonprofits have an opportunity to develop a digital asset, NFTs, to support their philanthropic initiatives. The entertainment industry sells NFTs to provide unique features such as meeting the artist, engaging with filmmakers or obtaining ownership rights.

Below is a matrix that introduces opportunities for nonprofits to leverage blockchain technology.

Philanthropy

Philanthropy will continue to lead nonprofits’ blockchain use. Still, the ability to drive efficiencies, privacy and data protection, transparent reporting and global workforce flexibility presents a unique opportunity for this sector.

Environmental, Social & Governance

Initial versions of cryptocurrency platforms consume large amounts of energy and are not environmentally conscious; however, recent advancements in the technology drive energy-efficient options for blockchain operators. From a social perspective, blockchains aid in humanitarian efforts by providing distributed and shared records that are immutable and tamper-proof. Finally, blockchain data management allows for transparency and trust, contributing to the governance pillar of ESG.

Workforce Mobility

Nonprofits at times find it challenging to attract new talent. However, blockchain technologies allow:

- Organizations to verify education, evaluate skills and assess performance of candidates in a timely manner.

- Candidates to manage and share their credentials more efficiently.

- Nonprofit organizations to handle cross-border payments, tax liabilities and create their own corporate currencies.

Privacy and Data Protection

Blockchain protects personal information and the benefits for nonprofits are endless. Organizations outsource aspects of their business to drive marketing, philanthropy, awareness and operational management. In many cases, organizations benefit from outsourcing IT, data storage and security operations. However, copies of data reside throughout the organization’s network, and many organizations have developed custom databases and applications or shadow technologies, creating additional risk.

Data privacy is the relationship between the collection and dissemination of data and the public’s expectation of keeping that information private. As the enforcement of domestic and global regulations continues to rise, organizations are challenged to meet strict and evolving obligations.

Blockchain can both negatively and positively impact an organization’s privacy operations. Below is a chart that provides an overview of common privacy principles[5] and blockchain’s impact on each of them.

Table 1. Blockchain Impact on Privacy

Other obligations that an organization should consider are cross-border data transfers and whether the blockchain solution meets the legal requirements of each jurisdiction where data resides. Additionally, the roles of each entity using the blockchain data must consider whether it is the owner of the data or a participant processing the data.

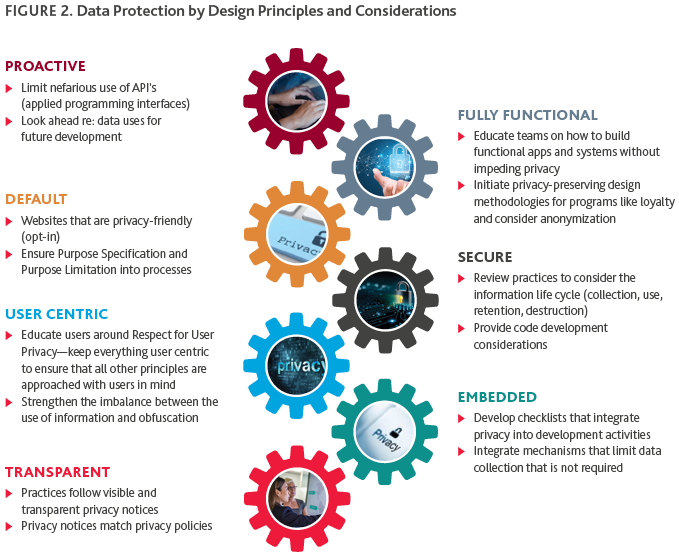

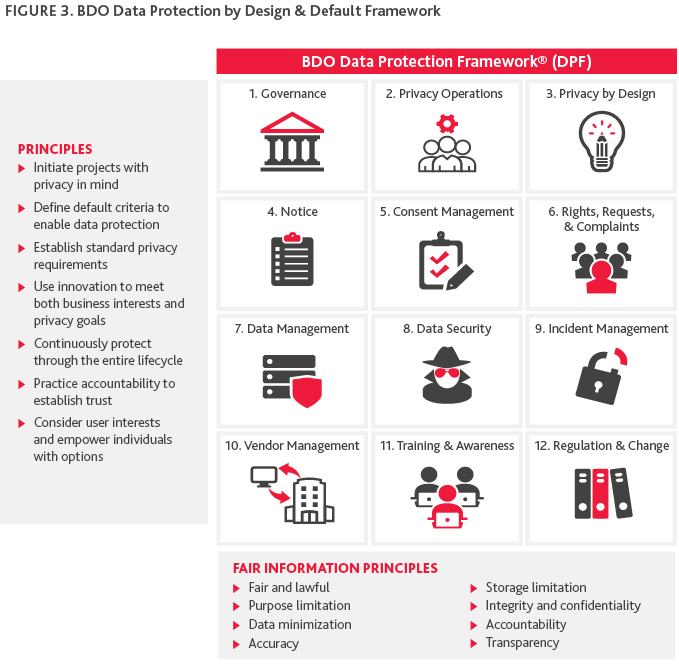

It is essential to evaluate any technology’s regulatory, legal, security and privacy implications and obligations. Organizations can do this by taking a Data Protection by Design & Default approach. Data Protection by Design allows an organization to “embed data privacy features and data privacy-enhancing technology into the design of projects at an early stage”[6]. To get started with Data Protection by Design, there are seven fundamental principles that should be followed.

The development of a Data Protection by Design program is a challenge for many organizations. So, BDO developed a Data Protection by Design & Default Framework® to help organizations build this program. See related article entitled, “How Nonprofits Can Protect Their Data and Reputation in the New Era of Data Privacy” in the Winter 2020 newsletter.

The benefits of blockchain for nonprofits are countless and the opportunity exists for organizations to embed these technologies into business operations. However, before embarking on the development of a DLT, organizations must first consider and weigh the benefits, risks, data protection implications and legal obligations. It is essential to follow the principles outlined in this article and ensure that data protection and data privacy are considered at the start of an organization’s journey with blockchain.

For more information, contact Karen Schuler, Practice Leader, Governance, Risk & Compliance, and Global Privacy Practice Co-Leader at [email protected], or Taryn Crane, Director, Governance, Risk & Compliance, and Data Protection Managed Services Leader at [email protected].

Higher Education in the U.S. – Rising Costs, Enrollment Challenges and the Need for Innovative Solutions

By David Clark, CIA, CFE, CRMA, Seth Miller Gabriel, Umer Yaqub

Rising costs for colleges and universities

The downturn in higher education enrollment has been forecast for many years. Lower birth rates have been driving down the overall student applicant pool by 2.6 million, or 13 percent, for a decade. The number of college-aged students is expected to drop even more as American families get smaller and the full impact of COVID-19 on the nation’s birth rate is realized. At the same time, the number of international students attending U.S. institutions has also decreased, as tighter visa polices have been established and universities around the world have become increasingly competitive. Lastly, increasing costs of attendance and ballooning levels of student loan debt have many potential applicants questioning the value and need for a “traditional” college education, especially in the face of evolving norms around virtual learning.

As the number of tuition-paying students has decreased, the cost of attracting those students and operating a college campus has increased. Over the last few decades, many colleges have invested in new dormitory, athletic and student center facilities in hopes of enrolling more students. This has come at a cost, not only in terms of construction but also in terms of redirecting investments (such as the maintenance of existing buildings) to these new facilities. Other costs have also increased—including salaries for professors and other staff and the bill for healthcare and other benefits—all while institutions are faced with the very real need to lower tuition costs to support access to higher education.

COVID-19 accelerated these negative economic factors for many schools. Having students attend courses online rather than in person resulted in dormitory rent incomes falling, meal plan cancellations and bookstores closing. Other high-dollar revenue centers like ticket sales for sports events and parent spending during campus visits dried up. This lack of income did not stop personnel costs, building costs (even a closed building costs money to maintain) and debt service costs (as many colleges took loans for those buildings) from continuing.

How public-private partnerships can help

Innovative project delivery, including public-private partnerships (P3s), have the potential to provide institutions with more options when facing changing financial needs, especially related to physical infrastructure. These partnership options can range from changing lightbulbs to relocation of campuses. Energy savings performance contracts (ESPCs), such as one with a private partner designing, installing, financing and maintaining the move to energy efficient LEDs, are one of the easiest solutions for a college to lower its annual expenses. Building maintenance can be transferred to a private partner for decades based on a set availability payment, or an entire campus can be transferred via a sale-leaseback agreement. These structures allow a college or university to address its maintenance backlog (or the maintenance that should have been done to campus buildings and is now a major financial liability) and return its focus to the core mission – education.

The involvement of private investment can also allow for a focus on new, non-education direct revenue for colleges or universities. A P3 structure could allow a college or university to activate unused or underused real estate to generate needed income. Possible projects include developing and operating data centers and lifelong learning communities on campus. These new facilities can also have the added benefit of providing needed internship and career opportunities for students, as well as engaging alumni.

Hope for the future of higher education

From lower enrollment to higher costs, the landscape of higher education is evolving and presenting financial pressures that many institutions have struggled to contend with. While the near and long term remain uncertain, innovative project delivery, optimized long-term facility management and public-private partnerships offer a clear and brighter path forward.

Article reprinted from Nonprofit Standard blog.

For more information, contact David Clark, managing director, Higher Education Advisory Services, at [email protected], Seth Miller Gabriel, director, Valuation and Business Analytics – Public-Private Partnerships team, at [email protected], or Umer Yaqub, director, Valuation and Business Analytics – Public-Private Partnerships team, at [email protected].

Accounting for Shuttered Venue Operators Grants

By Tammy Ricciardella, CPA

Background

On Dec. 27, 2020, the Economic Aid to Hard-Hit Small Businesses, Nonprofits and Venues Act (the Act) became law as a part of the Consolidated Appropriations Act, 2021 (CAA). The American Rescue Plan Act also provides $16 billion in grants to shuttered venues, to be administered directly by the Small Business Administration’s (SBA) Office of Disaster Assistance.

The SBA has issued guidance that is available on its site as of July 22, 2021. Recipients of this funding should refer to the site often as additional information is expected to be released as the program is developed. Included in the SBA information is a very extensive list of Frequently Asked Questions related to the Shuttered Venue Operators Grant (SVOG) (last updated July 22, 2021 as of the date of this article). Please refer to the SBA Frequently Asked Questions (FAQs) and other information for more detailed answers to questions about the program.

Under the terms of the SVOG recipients are not required to repay the funding as long as funds are used for eligible uses as defined in the guidance by the dates specified by the program.

Nonprofit Accounting for an SVOG

The AICPA recently issued nonauthoritative guidance that recipients should consider in determining the accounting treatment for an SVOG. This Technical Question and Answer (TQA) applies to both nonprofit entities and private business entities.

The TQA notes that nonprofit entities should account for the SVOG as a government grant in accordance with the “contributions received” subsections of the Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 958-605, Not-for-Profit Entities – Revenue Recognition. Under this guidance, an entity must first determine if a contribution is conditional or unconditional. If a recipient is required to meet conditions imposed by the government to be entitled to receive or keep the funds, then the contribution is conditional. The recognition of contribution revenue is then deferred until the conditions are substantially met or explicitly waived. As a reminder, an entity cannot factor in the likelihood that the condition will be met in determining whether a grant is conditional or unconditional.

Under the SVOG, since entitlement to the payments from the SBA is conditioned upon having incurred eligible expenses there is deemed to be a barrier to entitlement. Also, under the SVOG noncompliance with the terms and conditions is grounds for the SBA to recoup the funds so there is deemed to be a right of return. Based on these two facts, the SVOG would be considered a conditional contribution under FASB ASC 958-605. Therefore, contribution revenue would be recognized only to the extent that eligible expenses have been incurred at that date.

Each nonprofit that receives an SVOG will need to evaluate its individual facts and circumstances in determining the extent to which conditions have been substantially met at a given reporting date. Payment amounts received that exceed recognizable contribution revenue would be reported as a refundable advance in the liability section of the statement of financial position. This is based on the fact that entitlement to the funds is conditioned on eligible expenses that are expected to be incurred in subsequent accounting periods.

To the extent a nonprofit determines that conditions have been met and have recognized contribution revenue it will also need to consider whether there are restrictions imposed by the government on the use of these funds. Since under the SVOG, payments can only be used for eligible expenses as defined by the SBA, these funds would also be considered to be donor restricted. Due to the relationship of the conditions and the restrictions, meaning both are hinged on eligible expenses being incurred as defined by the SBA, these would likely be satisfied simultaneously. However, each nonprofit entity has to make this assessment for its specific facts and circumstances.

If a nonprofit entity deems that the condition and restriction are satisfied simultaneously, the entity would record the contribution revenue in net assets with donor restrictions with a reclassification to net assets without restrictions to reflect the satisfaction of the donor restriction in its statement of activities. If the nonprofit entity has elected and disclosed one of the simultaneous release accounting policy options as outlined in FASB ASC 958-605-45, it could report contribution revenue directly in net assets without donor restrictions.

If a for-profit business entity receives an SVOG it should refer to the TQA for the guidance options that are outlined specifically for business entities for more information.

Single Audit Impact

Per the Sam.gov website, Assistance Listing 59.075, an SVOG is subject to a single audit under the Uniform Guidance if the nonprofit entity receiving the funds has total federal expenditures in the fiscal year under audit in excess of the $750,000 threshold.

The Sam.gov website also notes “that if the awardee is a for-profit entity, subparts A through E of the Uniform Guidance are not required and will not be applied. SBA will, however, comply with any audit requirements in subpart F that apply to the for-profit community.” The AICPA Governmental Audit Quality Center currently has an inquiry into the Office of Management and Budget (OMB) and the SBA about the meaning of this statement as it relates to for-profit entities. Stay tuned for more information on this topic on both the OMB and SBA websites.

For more information, contact Tammy Ricciardella, Professional Practice Director – NFP, at [email protected].

BDO Professionals in the News

BDO professionals are regularly asked to speak at various conferences due to their recognized experience in the industry. You can hear BDO professionals speak at these upcoming events:

November

Michaela Kay is part of a panel discussing single audits at the Not-For-Profit & Health Care Conference hosted by the Washington Society of CPAs on Nov. 18. The conference will be hybrid with both online sessions and in person sessions in Lynnwood, WA.

Sam Thompson will be presenting a session titled, "2021 GASB Update" at the Alaska Government Finance Officers Association 2021 Fall Conference on Nov. 19 in Anchorage, AK.

Nonprofit & Education Webinar Series

The BDO Institute for Nonprofit ExcellenceSM provides a complimentary educational series designed specifically for busy professionals in nonprofit and educational institutions.

Our 2021 BDO KNOWLEDGE Nonprofit and Education Webinar Series will keep you abreast of trends, timely topics and challenges that are impacting the nonprofit environment and provide you with key takeaways relevant for busy professionals working in and with nonprofit and educational organizations. We invite you to take part in this program with members of your organization, including board members.

Stay tuned to the Nonprofit Standard blog or refer to www.bdo.com/events for further details and registration information.

2021 OMB Compliance Supplement Overview

October 6, 2021 / 1:00PM - 2:00PM EST

[1] The IT Law Wiki

[2] Ibid.

[3] Investopedia, Jake Frankenfield Distributed Ledger Technology, August 27, 2021

[4] Investopedia, Luke Conway, Blockchain Explained, June 1, 2021

[5] International Association of Privacy Professionals, Resource Center, Fair Information Privacy Principles

[6] Irish Data Protection Commission, Data protection by Design and by Default

SHARE