Why Energy Infrastructure is at the Center of Disputes

By Bob Broxson

When forging contracts in the energy industry, buyers and sellers make an agreement rooted in uncertainty. Throughout a contract’s lifetime, oil prices rise and fall, benefiting producer and consumer in ebbs and flows.

In a marketplace characterized by volatile commodity prices, when do contracting parties have grounds to terminate a contract, change the terms, or renegotiate the fee structure? This question is the basis of energy disputes—both arbitrations and litigations—facing many corporations around the globe.

In today’s environment, a large portion of disputes are concentrated in the midstream. Companies engaged in transporting, refining, processing and storing all forms of hydrocarbons find themselves at the center of disputes for a number of reasons. Chief among them is the reality that US supply has and is continuing to increase exponentially, heightening demand for midstream services and placing stress on the nation’s existing infrastructure.

In June testimony to the U.S. House of Representatives Committee on Transportation and Infrastructure, an American Petroleum Institute (API) director addressed the necessity of investing in the midstream to support increased production. “Ensuring we have a robust energy infrastructure system that keeps pace with growing production and demand is essential to helping provide American families and businesses with reliable access to affordable energy,” director Robin Rorick said. In his statement, Rorick also cited an API study forecasting a need for $1.3 trillion in investments in U.S. energy infrastructure through 2035.

The U.S. shale boom, which catapulted the U.S. onto the map as a global energy supplier, has led to increased demand for infrastructure across all commodity types, including natural gas, crude oil and natural gas liquids. For example in June, Bloomberg reported natural gas pipelines in the Permian Basin reached 98 percent capacity. There has also been a recent uptick in drilled but uncompleted (DUC) wells. At the U.S. Energy Information Agency’s (EIA) last count, there were 3,368 DUCs in the Permian Basin alone. The bottleneck caused by a lack of takeaway capacity is expected to continue. By late 2019, the International Energy Agency (IEA) forecasts that crude oil production in the southern U.S. shale belt will exceed takeaway capacity by as much as 290,000 barrels per day.

As production volume increases and transportation capacity remains relatively fixed, many midstream energy companies are still charging fees set years ago—in contracts reached either before or during the downturn. This dichotomy forms the basis of many energy disputes. Majority infrastructure owners, investors and private equity fund managers have contested that fees should increase as demand for midstream services intensifies prior to the construction of additional capacity. An August RBN Energy article discusses the “big push” underway to mitigate capacity constraints in the Permian Basin.

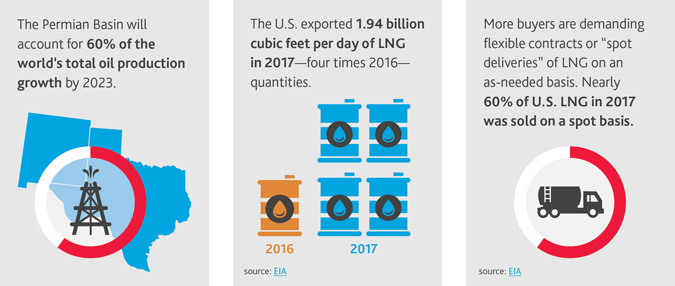

U.S. production of crude oil shows no signs of slowing. IHS Markit forecasts the Permian Basin—the unsurprising backdrop for many energy disputes—will account for 60 percent of the world’s total oil production growth by 2023. Oil & gas majors are adjusting their portfolios to capitalize on the rampant growth from shale plays. BP announced a $10.5 billion acquisition of U.S. shale properties from BHP Billiton, and Chevron is doubling its current spending on shale drilling, according to The New York Times. To maintain profitability and continue this growth, E&P companies have a laser focus on becoming lean machines: investing in new technology to improve processes and achieve operational efficiency, increasing production while limiting expenditures. But their success also hinges on the midstream, and the continued ability to transport crude oil and gas to the end-consumer.

Outside of the Permian, the next frontier of midstream energy disputes is the liquefied natural gas (LNG) industry. In the two years since the ban on LNG exports was lifted, production has multiplied. The U.S. exported 1.94 billion cubic feet per day of LNG in 2017—four times 2016 quantities, according to the EIA. To accommodate the outpouring of production, midstream players are eyeing opportunities to construct export facilities and terminals. A recent BDO prediction forecasts that by 2020, 30 percent of LNG export capacity will be built in the U.S. According to the EIA, four more LNG export projects are expected to come online in the U.S. By 2021, the EIA expects significant growth in U.S. LNG export capacity, so that it exceeds 9 billion cubic feet of gas per day (Bcf/d).

As demand increases for LNG export facilities and the U.S. becomes a larger exporter, it is likely that energy disputes around long-term leasing agreements and purchase and sale agreements will increase. The complexity and changing nature of LNG contracts adds to the likelihood they will be subject to future disputes. In the past, the majority were long-term contracts, but that’s starting to change. CNBC reported on the evolution of LNG contracts, noting that more buyers are demanding flexible contracts or “spot deliveries” of LNG on an as-needed basis. According to the EIA, nearly 60 percent of U.S. LNG in 2017 was sold on a spot basis. Spot pricing benefits the buyer because they can adjust their purchases based on price fluctuations and may increase the number of sellers pursuing contract renegotiations or disputes down the line.

Short-term LNG contracts are here to stay, and LNG spot indices are being pursued to support the changing model. The Wall Street Journal reported earlier this year that the Singapore Exchange is set to launch an index that will track the price of LNG in the Middle East and Indian markets, and has already launched a spot index for Asian LNG.

In addition to an evolution of the types of energy disputes taking place, the nature of the proceedings themselves are changing as well, particularly in domestic cases. While most domestic energy disputes have historically gone through litigation, very few cases make it to the court room on a timely basis today. As a result, arbitration has become more popular, typically because it allows parties to reach a resolution more quickly.

Micronomics, an economic research and consulting group, conducted an analysis to determine the efficiency and economic benefits of arbitration versus litigation. The study found that reaching a resolution through litigation took an average of one year longer than arbitration. Micronomics also quantified the economic opportunity cost to the parties in a dispute due to litigation delays compared to reaching a faster resolution through arbitration. Over a four-year period, the opportunity costs—based on lost resources due to a delay—were approximately $10.9 billion. With the intent of saving time and money, many energy companies include language in their contracts that dictate a dispute will be resolved through arbitration, if it arises.

Both energy dispute proceedings and energy market conditions are changing at a rapid pace, and the types of disputes will continue to evolve. With the future in view and further volatility on the horizon, the expansion and continued investment in energy infrastructure will be critical to the U.S.’s energy independence and prominence in the global market. One thing is for sure; the midstream will remain at the center of it all.

Bob Broxson is a managing director in BDO’s Forensics Investigation & Litigation Services practice, specializing in energy disputes. He can be reached at [email protected].

SHARE