BDO Energy CFO Outlook Survey

This survey was conducted in Fall 2019, prior to the global COVID-19 pandemic. We know that every organization—including BDO—is focused on the well-being of families, colleagues, and our communities. The middle market has proven its resilience in times of turbulence, and we believe, with a conscientious business mindset, organizations will manage the situation effectively. For information on how to secure your business in the wake of COVID-19, please visit www.bdo.com/COVID-19.

Energy Goes Green

Table of Contents

- Introduction

- Recession & Regulatory Uncertainty Driving 2020 Fears

- The Legacy of the Oil Crash: Tighter Financing, Disputes, Looming Bankruptcies

- Surfing the Green Wave

Introduction

In 2020, the industry will contend with fierce competition, regulatory uncertainty, low oil prices and a lack of available new capital amid increased market volatility and a potential economic downturn. Energy companies will be forced to live within their means, either by cutting costs or discovering new operational efficiencies—or else, risk insolvency.

The biggest long-term threat is existential and goes beyond industry and country borders: climate change. Climate change isn’t just a business issue; it’s a national security emergency that requires a long-term commitment to reducing human impact on the environment and ensuring the earth is livable for generations to come.

The transition to alternative forms of energy will impact all industries, but for energy organizations, it requires rethinking their entire business models. And they can’t wait to get started—or they may be outpaced by disruptive new entrants or established players that build their renewables business faster and structure it more efficiently.

The good news? Many energy executives are focused on striking the right balance between mitigating short-term pressures and uncertainty with planning for their greener futures.

.jpg)

“The energy industry needs to meet the climate change challenge head-on. Our decisions today will impact the world our children and grandchildren grow up in. But doom and gloom aside, energy companies should view climate change as a surmountable challenge—one that provides significant business opportunity for growth and transformation.”

|

CLARK SACKSCHEWSKY |

Recession & Regulatory Uncertainty Driving 2020 Fears

Federal policy shines favorably on energy—for now

While most energy CFOs (71%) say their businesses are thriving today, they’re more cautious about 2020.

They’re most worried about regulatory uncertainty (21%), which is in large part due to continued trade policy turbulence and the 2020 presidential election—the outcome of which will determine how the industry is regulated for the next four years.

U.S. government policy has been good for the industry over the last two years—for the most part. Across nearly all the most significant regulatory areas that impact the industry, most energy CFOs say that U.S. government policies have been favorable to their businesses over the last two years.

This is largely due to the federal government’s strategy of promoting business growth through deregulation and policy changes across industries.

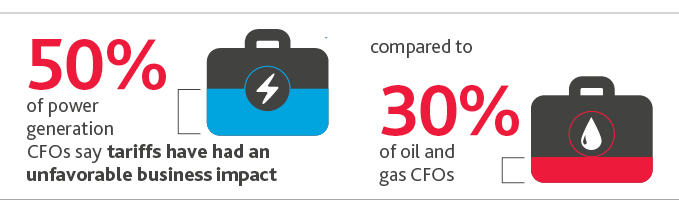

The notable outlier: trade policy—primarily among power generation CFOs. While tariffs impact most industries in at least some way, power generation companies have been hit hard by tariffs—particularly the tariffs on steel, aluminum and solar imports.

Taxes & tariffs top power gen concerns

While the stated objective of the tariffs is to level the playing field for American manufacturers, many U.S. businesses—including energy companies—rely on imported materials, machinery or components that either aren’t produced in the U.S. or are too costly to source domestically. Tariffs translate to higher input costs for U.S. businesses. Power generation companies—particularly solar companies—are seeing increased costs from tariffs for needed machinery or materials to repair or replace equipment or increase operational capacity. They may not be able to pass the higher costs to their customers, especially if they’re locked into a pre-determined pricing agreement for the cost of the power they produce.

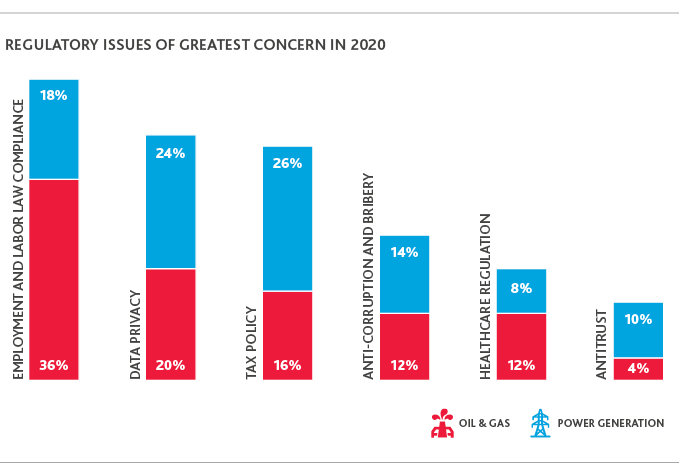

Power generation CFOs say they’re most concerned with tax policy in 2020—most likely due to uncertainty around the fate of highly valued tax credits and incentives.

In November, House Democrats introduced a bill to renew and extend credits for solar and wind power as well as incentives for energy storage and electric vehicles. Extending these credits and incentives would be essential for power generation companies’ continued growth, especially amid increased costs due to tariffs that are weighing on their bottom lines.

Oil and gas CFOs are mostly concerned with labor regulation, which is likely to be a focal point of the 2020 election and a main plank of candidates’ campaigns as they try to woo voters. The outcome of the 2020 presidential election will determine the regulatory environment the energy industry will need to navigate for the foreseeable future—whether that means a continuation of the trends of the last two years or a shift to more stringent regulation.

Regardless of shifts in policy or a change of regime, the industry is preparing to meet increased regulatory challenges head-on: 72% of energy CFOs say they are planning to increase budgets in their risk management and compliance departments next year.

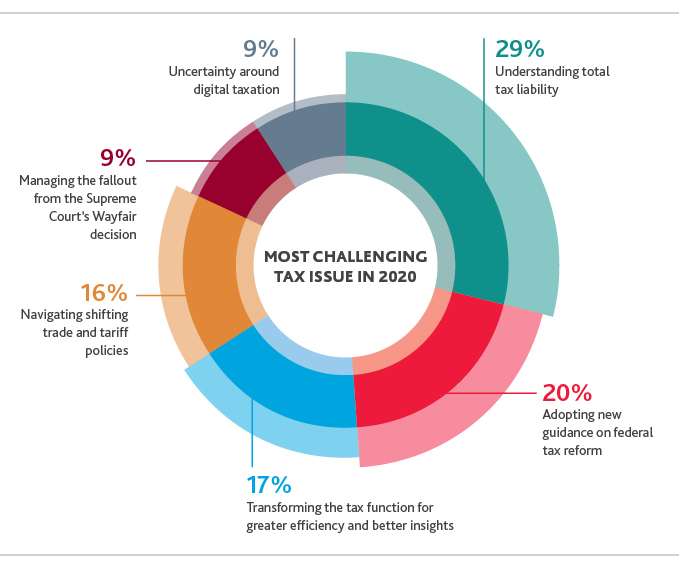

Total Tax Liability Tops Energy Companies’ 2020 Tax Challenges

Amid trade turbulence, continued fallout from the Tax Cuts and Jobs Act of 2017 and increased scrutiny from global bodies like the Organization of Economic Cooperation and Development (OECD), it’s no surprise that energy companies say that understanding their total tax liability will be their primary tax challenge in 2020.

Total tax liability is more than calculating tax in one area of business. It is the sum of all taxes owed at a given point in time—factoring in income, indirect, property, payroll, excise and other taxes, as well as customs and duties. It also includes the credits, incentives and deductions at the international, federal, state and local levels.

Tax is also likely to play a role in the global shift towards renewables. We predict that by 2023, taxation of oil-derived products as a means of controlling demand to address environmental and oil and gas security issues will increase—especially among countries belonging to the OECD. Such a tax would aim to bridge the gap in price between petroleum-derived and non-oil derived products to incentivize demand for sustainably sourced goods.

Energy companies must constantly recalculate their liabilities and update their tax and business strategies to navigate the fluid tax environment. Tax professionals who understand the massive web of changing laws, as well as the economic forces that interplay with them, will be well positioned to guide their companies through the maze of uncertainty.

The Legacy of the Oil Crash: Tighter Financing, Disputes, Looming Bankruptcies

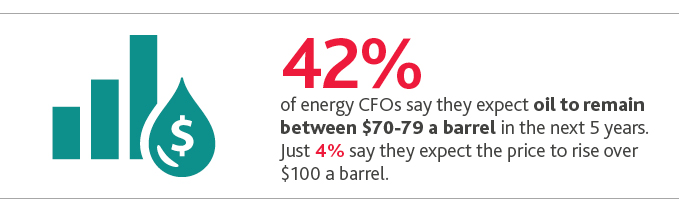

Even though new technologies and innovations in production techniques have dramatically lowered the breakeven barrel price and led to a record boom in U.S. oil production, chronic low oil prices and mounting debt obligations are slimming profit margins, reducing investor returns and even forcing companies into bankruptcy.

As a result, the oil and gas sector is losing some of its shine for investors—who are growing less willing to provide oil and gas companies with new capital and instead want them to focus on delivering returns rather than drilling new wells. Many companies can’t navigate these pressures and are beginning to miss debt payments. As of November, about 30 oil and gas companies have declared bankruptcy in 2019 alone, amounting to almost $20 billion in debt.

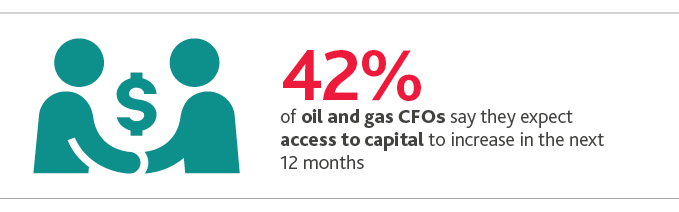

Gone are the days when finding or drilling new wells or mines would be enough to improve natural resources organizations’ bottom lines. Instead, companies need to focus on lowering costs and improving efficiencies through technology to navigate these conditions. And while 40% of oil and gas CFOs say they plan to undergo some digital transformation in 2020, this may not be feasible for companies without the available capital to fund digital initiatives. In these cases, companies either need an injection of outside capital, or need to pivot strategies and restructure their business to reduce costs. Despite the slew of high-profile bankruptcies in 2019, however, oil and gas CFOs have a surprisingly positive outlook on their access to capital in the next 12 months.

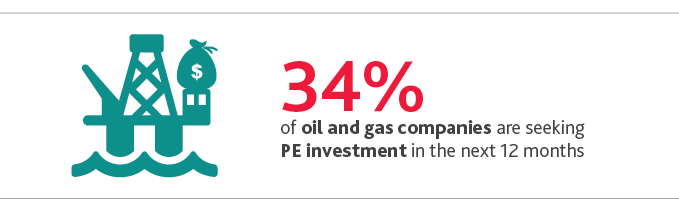

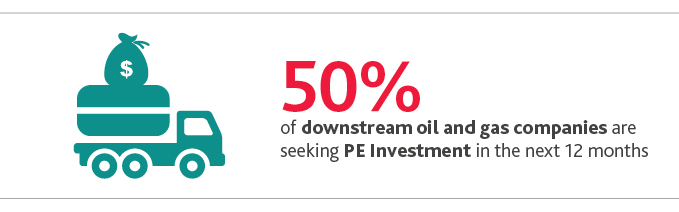

Investors penalized the oil and gas sector—and E&P companies in particular—for low oil prices between 2014 and 2016, resulting in a significant decrease in valuations, as well as equity raises and follow-on offerings drying up. But while oil and gas producers may have lost favor in the public markets, private equity’s coffers are overflowing and there is appetite to buy “cheap” while valuations are still depressed. According to BDO’s inaugural U.S. Private Capital Outlook, the energy sector is anticipated to see an increase in deal activity by both private equity and venture capital investors.

The energy sector, meanwhile, is really a tale of two different industries: oil & gas and renewables. The latter has several secular trends behind it: climate change, responsible investing, increasing power capacity, and greater affordability, to name a few. For the former, the paradoxical environment of production growth but market challenge may have depressed activity in recent years, but the sector is now ripe for consolidation.

Workforce woes

New technology is nothing without the right people to wield it, however, and companies need to match their investments in technology with investments in their workforce. This means either retraining the existing workforce to use new tools or hiring higher skilled workers with different skillsets than energy companies have historically sought.

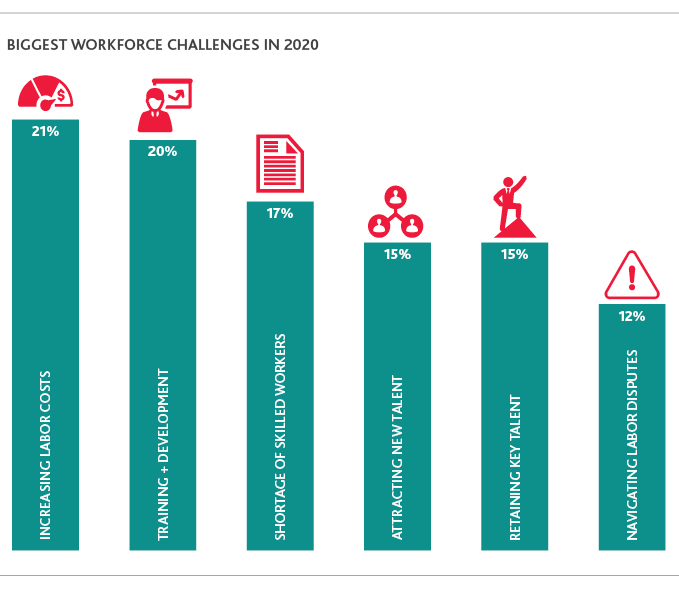

Amid these needs, it’s no surprise that increasing labor costs, training and development, and a skilled worker shortage rank as energy companies’ top workforce challenges for 2020. Technologically skilled workers are in higher demand than lower-skilled labor and are generally more costly. Additionally, increased overall demand for labor in high-production regions like the Permian drives up salaries for workers across the supply chain, which can lead to substantial cost increases for businesses operating in those areas.

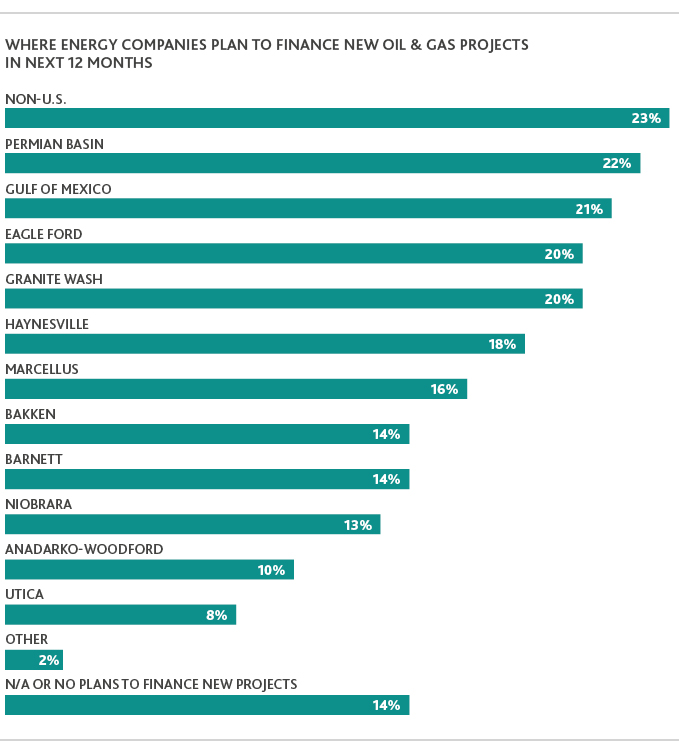

Prospecting beyond the Permian

The Permian Basin has dominated news headlines as the posterchild for the U.S. shale boom—and while the Permian has led the way in the U.S. production surge, it isn’t the only game in town.

Most energy CFOs (86%) say they plan to finance new projects in 2020, and while the Permian remains a focus, nearly a fourth of energy companies (23%) are looking elsewhere to break new ground—even outside of the U.S.

While the Permian isn’t going anywhere, companies are clearly looking elsewhere for new opportunities—and there isn’t a clear frontrunner among other major U.S. shale plays. If companies can replicate their Permian successes in the Gulf of Mexico, Marcellus or other plays, we could see U.S. oil production boom to even further heights.

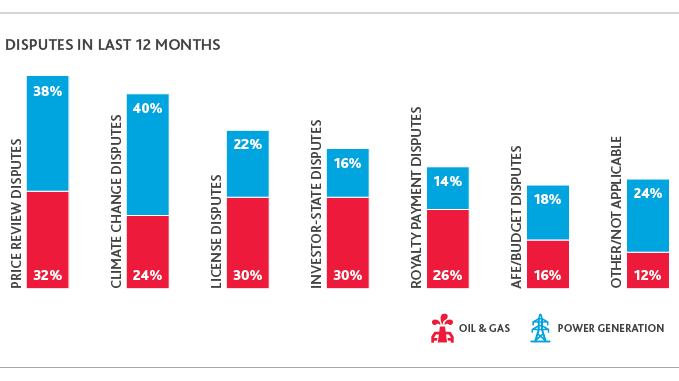

Disputes: A potential roadblock to growth

Expansion may not be all smooth sailing—companies are running into hurdles when trying to build new infrastructure. They’re facing opposition to construction, particularly around the potential environmental impacts of projects.

For the oil and gas sector, as demand for U.S. liquid natural gas (LNG) continues to rise, it is likely that disputes will increase in frequency—particularly in the midstream. Companies engaged in transporting, refining, processing and storing all forms of hydrocarbons find themselves at the center of disputes for several reasons. Chief among them is the reality that U.S. production has and is continuing to increase exponentially, heightening demand for midstream services and placing stress on the nation’s existing infrastructure. A Rystad Energy report from November predicts that the U.S. will be fully energy independent by early 2020 and that domestic production will continue to rise steadily through 2030.

As production volume increases and transportation capacity remains relatively fixed, many midstream energy companies are still charging fees set years ago—in contracts reached either before or during the oil downturn. This dichotomy forms the basis of many energy disputes. The majority of infrastructure owners, investors and private equity fund managers have contested that fees should increase as demand for midstream services intensifies prior to the construction of additional capacity.

Disputes may involve just a few thousand dollars or may be valued in the billions. The time required to resolve disputes may span years, and cripple both the contractor’s and owner’s financial resources.

While disputes may not be enough to stop projects entirely, they may slow construction or weigh on companies’ resources as they battle in court. In some cases, disputes may even force companies into bankruptcy if a settlement doesn’t fall in their favor or if legal proceedings dry up their available capital.

Trade disruptions, low oil prices hindering growth

Trade tensions and tariffs are exacerbating the negative financial headwinds facing energy companies. Specifically, oil and gas companies have been adversely impacted by China’s 25% tariff on LNG, which went into effect on September 1, 2019. Both oil and gas and power generation companies are negatively impacted by U.S. tariffs on steel, aluminum and other machinery and high‑tech imports.

Since the tariffs were implemented, predictably, Chinese imports of U.S. LNG have fallen and imported steel prices have increased. Unless the trade war abates, Chinese imports of U.S. LNG will likely continue to remain at lower levels or decrease further, which means U.S. exporters will need to find other markets for their product. Increased steel and aluminum prices make building new pipelines or other infrastructure more expensive, and even if companies aren’t directly importing materials, they may be paying higher prices to suppliers who are subject to tariffs.

50% of power generation CFOs say tariffs have had an unfavorable business impact, compared to 30% of oil and gas CFOs. Another major, persistent issue for the industry: low oil prices. Aside from a short lift following the drone attacks on Saudi oilfields, oil prices have hovered between $50-70 per barrel in the last few years—and energy CFOs aren’t confident they’ll rise much higher any time soon.

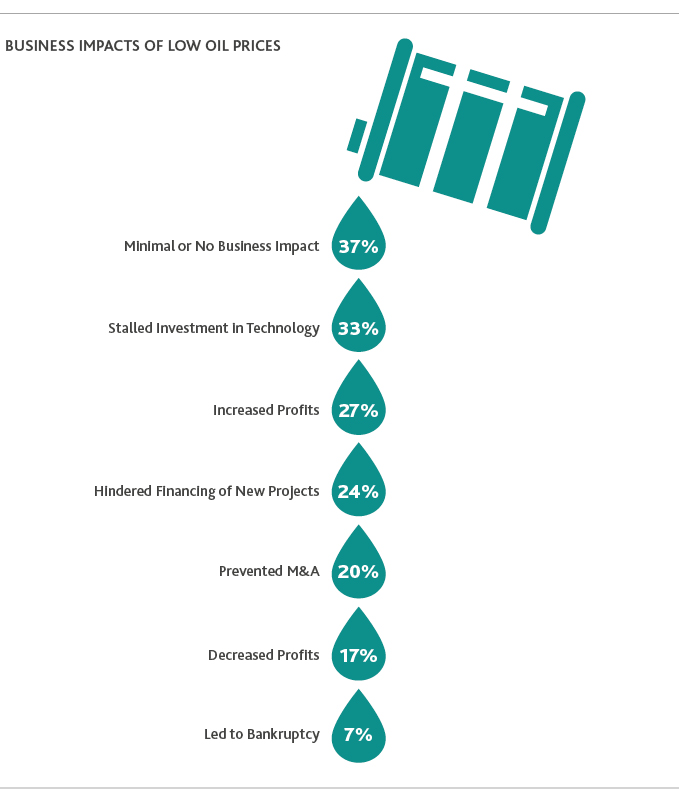

Low oil prices projected to persist

Most oil & gas CFOs say that low oil prices are having at least some impact on their business—including stalling technology investments, hindering financing of new projects, preventing M&A and decreasing profits. Unless oil prices rise—and remain at a higher level—these conditions are unlikely to abate.

While low oil prices are generally bad news for oil and gas companies—and to a lesser extent, power generation companies—they’re beneficial for consumers. Consumers pay less at the pump, on their monthly heating bills and for other petroleum-derived products.

As the outlook for oil and gas and traditional power generation becomes less sunny, many investors are looking elsewhere in energy for new opportunities.

Surfing the Green Wave

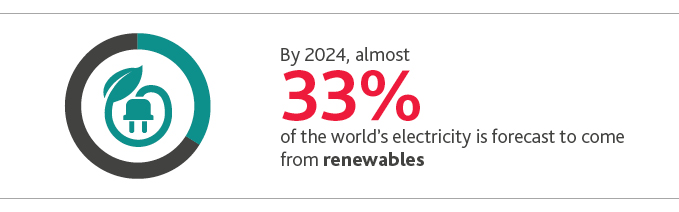

The future of energy is green. Drastically lower production costs, growing concern around climate change, evolving global energy policies and increased pressure from investors on companies to adopt environmental social governance (ESG) polices are pushing renewables into the mainstream. By 2024, almost 33% of the world’s electricity is forecast to come from renewables according to Renewables 2019, a report from the International Energy Agency.

Private equity and venture capital will catalyze this shift, which we predict will return to the cleantech space in full force. Whether called cleantech or climate-tech, the regulatory, economic and scientific impetus for these technologies will see $600 billion in global private investment by 2023.

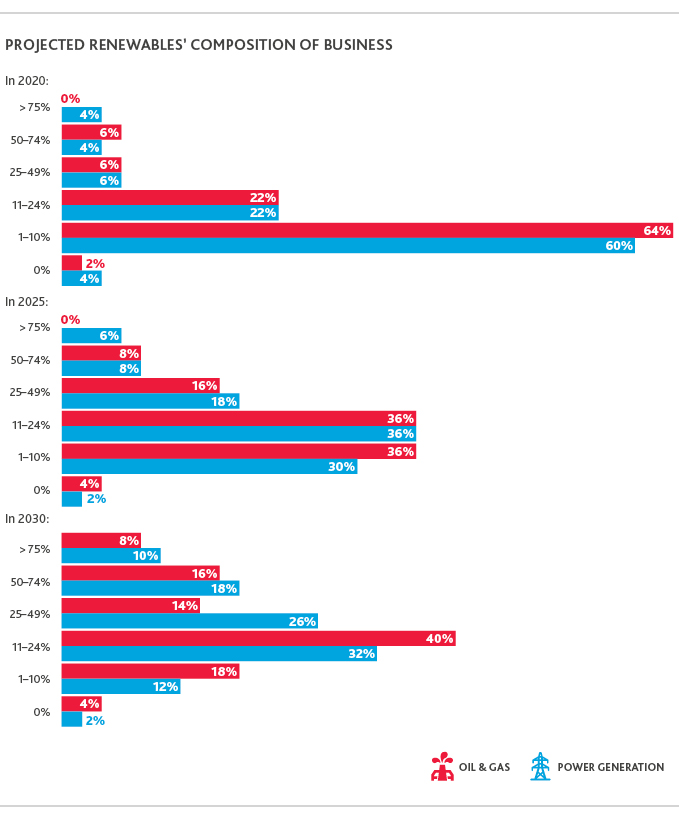

But the industry has a long way to go—according to energy CFOs, renewables aren’t projected to make up a significant part of their businesses for a few years. Additionally, many power generation companies already identify themselves as renewables companies—even if they still have significant portions of their business dedicated to traditional forms of power generation. It will be some time before their actual business operations catch up with their NAICS classification.

“Renewables used to be too expensive to make good business sense, but now—driven by consumer and investor demand along with lower production costs—there is more opportunity in the renewables space than ever before. As investors sour on traditional energy assets, energy companies have the chance to scoop up significant renewable market share—but they have to act fast.”

|

ED HIRS |

Breaking down the energy transition

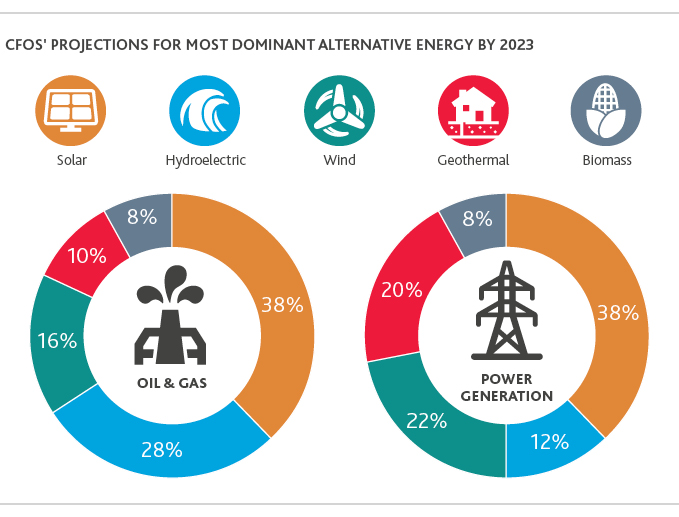

Power generation and oil and gas CFOs agreed that solar will be the most dominant type of alternative energy in the U.S. by 2023—and they aren’t alone. According to the same International Energy Agency report, solar photovoltaic (PV) is expected to account for at least 60% (or at least 697 gigawatts) of the expected growth of the global renewables market by 2024.

If their opinions here are any indicator of their planned investments, we may see a diverse array of renewable markets grow—including solar, wind, hydroelectric, geothermal, and more.

SHARE