The Resilience Playbook for Manufacturers: Maintaining Your Business in A Recession

We are now several months into a pandemic-recession, and although the path to reopening is proving bumpier than hoped, the initial turmoil of the crisis has faded—though much remains uncertain. By and large, businesses have checked the boxes on most of, if not all, the basic action items in the crisis playbook and have stabilized their operations. Businesses in the most distressed sectors of the economy may have needed to go a step farther and file for bankruptcy. But for the rest, the immediate crunch is over—for now, at least.

The hope is that the overall economy will rebound as the infection curve is suppressed, but there are currently too many variables at play to predict the course of the pandemic or recession. Continued uncertainty around the economy and the course of the pandemic mean the road ahead is full of unknowns for manufacturers. And if past downturns are any indicator about what is to come, the aftereffects of COVID-19 and the recession may be felt for years.

Navigating the recession requires more than just running down the clock until the economy improves. Manufacturers need to take proactive measures to ensure their business not only weathers the storm but is poised to reenter growth mode. While the road to recovery will look different for every manufacturer depending on their subsector, financial standing and supplier and customer base, among other factors, many of the strategic considerations and key actions will be similar. The manufacturers that will thrive in the tumultuous months ahead are those that move quickly to seize these emerging opportunities. Doing so can feel risky, but the alternative—letting opportunities pass you by—is far riskier.

Weathering an Economic Crisis, in Four Stages

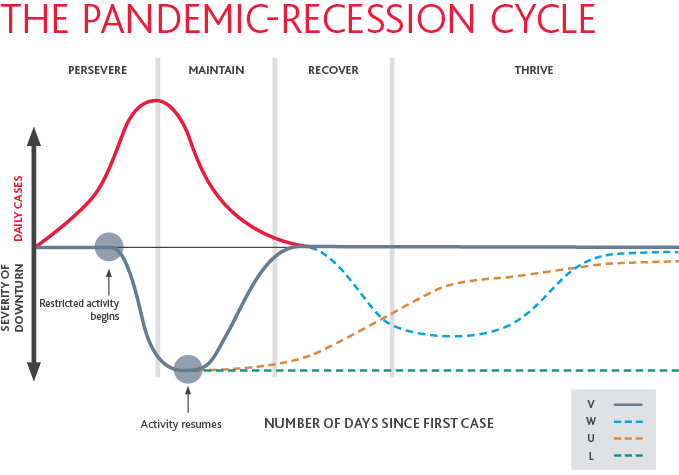

Though we don’t know what precise shape the path to recovery will take (whether V-, W-, U- or L-shaped), we can break down the current recession into four general stages based on the behavior of past recessions and past pandemics. The duration of each stage will vary based on the course of the virus, the trajectory of the economy, and the severity of the financial impact on the individual manufacturer. Some manufacturers—especially those nonessential manufacturers that may have reopened their doors only recently—may be in maintenance mode for a while longer. They may even need to revert to the “persevere” stage as many states pause or roll back their reopening plans.

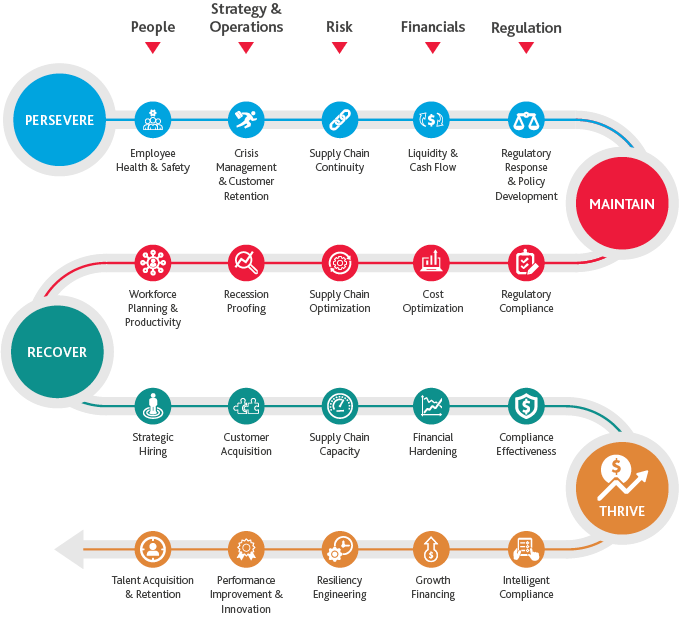

In the figure below, we outline the practical levers manufacturers should consider pulling to expedite recovery and gain competitive advantage at each stage of the pandemic-recession cycle.

In this second of a four‑part series, we will focus on the moves that manufacturers should make during the “maintain” stage to navigate a recession and weather the storm as we move toward recovery.

Workforce Planning & Productivity

Although most if not all manufacturers have resumed in-person operations, COVID-19 remains an ever-present threat to our nation’s health and economy. Manufacturers will need to keep social distancing guidelines and other protective measures in place for the foreseeable future, likely until a viable vaccine is widely distributed. While all “essential” manufacturers should have implemented these protective measures early in the persevere stage, some “nonessential” manufacturers may have only recently resumed in-person operations and are dealing with the challenge of protecting their frontline workers’ health for the first time. Fortunately, they can take a page from manufacturers who have remained in operation throughout this crisis for best practices.

With social distancing measures in place for the foreseeable future, manufacturers will need to evaluate the impact on operations and labor processes and determine how they may need to adjust to new operating procedures on a more permanent basis. Maintaining six feet of distance between frontline workers and limiting the amount of staff that can be on site at any one time may disrupt routine processes, hinder regular communication and collaboration and hamper overall production capacity.

While safety is paramount, manufacturers should also assess their staffing from a broader financial and operational standpoint. Ongoing infection control activities may have driven up labor costs significantly. Demand forecasting may indicate product sales (or sales of specific product categories) will be suppressed—or abnormally heightened—for a sustained period of time, and resource allocation may be suboptimal.

To maintain adequate productivity levels and scale capacity while minimizing new labor costs, manufacturers will need to rethink their production workflows, taking into account all the people, processes and technology involved. Lean principles around speed, efficiency and quality should inform your action plan. Digital tools will also play a critical role not only in increasing speed and efficiency but in enabling physical distancing. Some manufacturers may find, for example, a need to implement remote project monitoring capabilities or to incorporate handheld devices with instant message and video conference functions to maintain constant communication across the production line. Now is also the time to consider permanent automation solutions that reduce the number of workers needed on the factory floor and result in substantial cost reduction.

Continued agility in staffing will likely be necessary, given how much uncertainty and volatility is on the horizon. That means intentionally adopting resource flexibility measures now. Each manufacturer must determine what resourcing strategies will work best for them on a case-by-case basis. You may want to revisit your outsourcing strategy to adjust which activities you opt to outsource and to whom you outsource them. You may want to hire a pool of contingent workers or adjust your overall ratio of contingent to permanent workers. Or you may want to cross-train current employees for critical roles as a precautionary measure against unplanned outages.

The Offensive Play

Embracing automation is a no-brainer: it solves for the now and the next. You can start with the lowest-hanging fruit—but the more strategic manufacturer will take the time to crystallize their ideal automation “end state.” Will some aspect of your assembly process always be manual, or is the end-goal full automation? What is the ideal number of operators on the assembly line? Does automation involve machine data capture—and if so, what systems must it integrate with to enable automation projects down the line? By aligning current projects with an overarching strategy, automation investments can deliver quick wins and pay long-term dividends.

Demand Recalibration

In a normal recession, the worst would already be behind us at this stage. In this pandemic-recession, hard-won stability may be fleeting. The current plateau could just be a pitstop before the economy dips into another steep contraction. Demand may lag behind production capacity as manufacturing facilities reopen. There is good reason for caution. On the other hand, if the economy has already bottomed out, overly cautious manufacturers will be ill-prepared to ramp back up. Where do you go from here?

The specific plans manufacturers make to chart their courses forward will differ depending on their individual financial standing and customer base, but there are questions all manufacturers should consider:

-

How have COVID-19 and the recession impacted not just your business, but your customers and suppliers?

-

What factors are currently reshaping demand patterns?

-

What changes to customer behavior has COVID-19 introduced that are likely to become permanent post‑pandemic?

Examine the performance of your products since COVID-19 and, if applicable, during previous recessions. Which were most impacted, and which were least affected? Which are likely to continue underperforming if the economy does not soon recover? The answer to these questions will help you recalibrate demand forecasts, prioritize for the near term and start planning for permanent shifts.

Your updated demand forecast should not just influence your inventory levels; it should influence your product strategy. Resources should be reallocated to the products that are in highest demand. If demand for a product category, or a specific variant in your product mix, is down significantly and expected to stay down, it may make sense to temporarily—or even permanently—cease production. Simplifying your product portfolio can also help streamline supply chains, leading to new efficiencies and lower costs.

At the same time, emerging demand signals may inspire opportunities for product or service innovation. While bigger pivots may require more capital than you’re willing to spend, you may be able to leverage your existing resources in new ways to augment your current product suite or expand into new aftermarket services. For example, could an equipment manufacturer that already makes sensor-enabled machines offer predictive maintenance—or better yet, remote maintenance—as a service? Could a maker of school supplies shift from packaging items individually to offering preset bundles that cover all at-home learning needs?

Boosting supply chain agility can also help you weather this period of uncertain and volatile demand. For instance, if you focus in-house capacity on top customers and products, can outside manufacturing capacity and logistics providers be positioned to respond to opportunities and demand shifts more quickly and with greater variability? Can new supplier relationships be established to allow for quick adjustments in capacity, or to provide redundancy in the case of supplier disruption? This may be an opportune time to focus on developing flexibility and agility in the supply chain for short-term and long-term benefits.

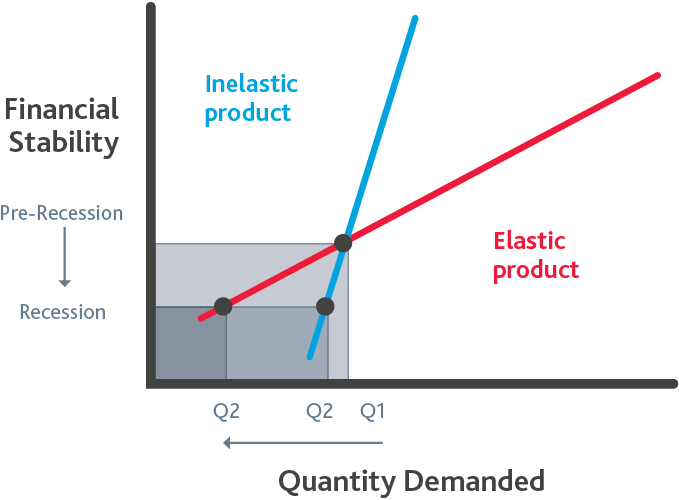

Inelastic vs. Elastic Demand

Demand elasticity is an economic concept commonly used to measure the degree to which demand shifts for any given product or type of product due to changes in price or income levels. If demand for a product is relatively static amid price or income changes, demand for that good is said to be inelastic. If demand for a product is sensitive to price or consumer income changes, demand for that good is said to be elastic.

In a recession, consumer spending generally falls for nonessential items like some luxury consumer products, as consumers grow concerned about their own financial stability. Demand for more “essential” products like cleaning supplies and groceries will likely hold steady, as these are a necessity regardless of economic or financial circumstances.

Complicating this relatively simple concept is another phenomenon known as the bullwhip effect. Unless manufacturers are selling to consumers directly, their demand levels derive from consumer demand. The further away the manufacturer is from the end customer, the harder it is to accurately forecast demand. Demand shifts at the point of sale are increasingly amplified and distorted the more upstream you go. So while point-of-sale customer data is a critical demand signal, it doesn’t necessarily tell the whole story.

Offensive Play:

Don’t overlook any changes to the purchasing patterns of your customers by channel. Buyers that have historically relied on factory visits to qualify a potential supplier may no longer have that option. Shipping samples to overseas buyers may also be unviable while cross-border logistics remain snarled. At a bare minimum, manufacturers will need an online order form, if they don’t have one already, and ideally an online store. Savvy manufacturers will get innovative: They’ll create virtual factory tours—or use holoportation to provide the traditional factory visit experience remotely. Products in their online stores will be rendered in 3D visuals. They’ll participate in manufacturing ecosystem platforms to tap into existing customer networks and gain broader exposure. In short, they’re getting serious about e-commerce.

Cost Optimization & Capital Efficiency

At this point in the pandemic-recession, the immediate liquidity crisis is over, for most. Businesses have already revised cashflow forecasts, halted nonessential purchases, renegotiated payment terms, drawn down on existing credit lines or applied for new loans. Now the goal should be to strike the right balance between targeted, sustainable cost-reduction initiatives and smart spending to fuel strategic growth.

The basic principles of cost optimization at the maintain stage are: 1) eliminate activities that don’t add value; 2) consolidate similar activities; 3) simplify unnecessary complexity; and 4) reallocate resources from lower-value activities to support the business activities of highest value. No historical costs are sacred; every budget line item can and should be challenged and justified. Take the time to address any redundancies or negative return on investment (ROI) incidences that may have previously flown under the radar. Look for the tell-tale signs of margin erosion and address the culprits behind them. Bumps in procurement costs over the years—minimal when viewed in isolation—may have added up. Marginal products and service lines may be brought to light by decreases in sales volumes. Tactical pricing decisions in the form of aggressive discounting offered to less-than-ideal target customers may have taken a substantial bite out of profits. Pricing strategy may not be optimized based on value or competitive benchmarks. Scope creep may be leading to frequent cost overruns. Reining in margin erosion by rationalizing both marginal products and customers while revenues are weaker is critical at this juncture to avoiding unrecoverable business value destruction.

There are also tax strategies that manufacturers should consider for improving cash flow, such as net operating loss (NOL) carrybacks. NOL carrybacks can play a significant role in reducing a manufacturer’s total tax liability, and the CARES Act made changes to the tax treatment of NOLs to expand their use and help businesses improve liquidity. Final regulations were issued on July 28, 2020 under Section 163(j) that favorably affect a manufacturer’s ability to deduct interest expense, which could potentially increase an NOL. Interest expense is allowable to the extent of adjusted taxable income (ATI) x 50% (up from 30% as a result of the CARES Act). As a result of the final regulations, ATI can now be increased by allowing depreciation, amortization or depletion deductions that are capitalized into inventory property under Section 263A for all tax years from 2018 through 2021, regardless of the period in which the capitalized amount is recovered through cost of goods sold.

Manufacturers should also focus on improving capital efficiency and maximizing the working capital available to invest in new initiatives. Working capital functions according to the Goldilocks principle: too much creates waste and an unproductive use of capital, while too little creates friction on growth and customer service and can prevent you from being able to capitalize on new opportunities. For manufacturers, improving inventory management is often the primary lever for freeing up cash, but addressing customer-to-cash (accounts receivable) and procure-to-pay (accounts payable) processes can also prove fruitful areas of focus in tight times. Working capital improvement starts with an assessment of the end-to-end working capital cycle to pinpoint gaps in best practices and identify additional areas of process optimization opportunity. At this stage, the focus may be primarily on quick wins—like tracking down outstanding client invoices and ensuring compliance with contractual agreements. Eliminating slow-moving or obsolete inventory can also free up significant cash, as can resetting the parameters for safety and cycle stock. The cash generated from these improvement initiatives can increase balance sheet flexibility or be used to fund the next big strategic opportunity.

Offensive Play:

In a recession, fixed costs are a liability. By reducing fixed costs and shifting to a more variable cost base, you can significantly increase your capital efficiency and financial flexibility. There are two primary levers for moving to a more variable cost base: 1) large-scale cost reduction initiatives, where fixed costs are rationalized; and 2) cost transformation, where fixed costs are converted into variable ones. The former typically involves the elimination of low-value activities and overhead—familiar territory to most businesses. The latter, on the other hand, can involve anything from outsourcing and contract manufacturing to new contract financing agreements and operating model changes.

Supply Chain Optimization

In the persevere stage, manufacturers took immediate action to blunt the impact of COVID-19 on their supply chains and began taking steps to minimize future risk. Now, they must move from risk mitigation and reacting to immediate disruption to looking farther ahead. They should consider more holistic shifts to their network strategy and global footprint to de-risk their supply chains and introduce resiliency to position themselves for long-term success.

Resiliency can be introduced or improved through a variety of strategies. It could involve developing alternate sources of supply in case of unexpected disruptions, increasing stockpiles of critical materials or products, and even considering shifting some inventory to be closer to key customers or markets. The goal should be to prepare your supply chain for disruption before it happens, so that you are better prepared to weather negative external forces with minimal impact to your business.

Another strategy for introducing greater supply chain resiliency is through geographic diversification. By shifting supply sources to a variety of countries, manufacturers can reduce the impact of natural disasters or government regulations on their businesses. When evaluating changes to supply chain operations, manufacturers will need to assess potential exit charges, permanent establishment status, and the preservation of tax attributes on the movement of functions, assets and risks. They will also need to consider proximity to key suppliers and customers, access to transportation resources, quality of the labor pool, environmental risk and geotechnical status, real estate and business costs, and available incentives.

As manufacturers consider strategies for de-risking their supply chains and increasing resiliency, they should not leave cost out of the conversation. With the right strategy, supply chains can be reconfigured to reduce both risk and costs—one does not have to come at the expense of the other.

There is a confluence of factors to evaluate as you reevaluate your supply chain—though the primary areas are overall risk, cost and impact to customer service. A smart strategy for supply chain optimization will account for these factors and involve stakeholders from across your business that represent these different areas.

Offensive Play:

Manufacturers should consider how they might reengineer their supply chain to be resilient and agile by design, factoring in increased complexity and uncertainty as constants. Truly agile supply chains require end-to-end visibility across the entire supplier ecosystem, relying on real-time data to identify shifts in demand or disruptions and adapt to sudden changes faster. The first step is to break down internal data silos so that information can be collected and shared from across the entire business. Ultimately, the goal is to have transparency across the entire value chain, with data consolidated and shared between customers and suppliers in addition to upstream and downstream within your own organization.

Regulatory Response

Economic Relief

Manufacturers that received government relief via the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) or the Federal Reserve’s Main Street Lending Program (MSLP) need to make sure they are compliant with the requirements for how those loans can be spent. Otherwise, there is a risk of losing forgiveness eligibility for PPP funds or facing penalties for misused MSLP loans. For instance, if you received any PPP monies under the CARES Act, reducing either the number of employees or rate of employee wages by 25% or more will reduce the loan forgiveness.

Additional guidance has been issued for these programs that provides more clarity on how the programs operate. For example, on June 26, the Federal Reserve released new guidance for MSLP borrowers, which provides details around the executive compensation restrictions for loan recipients and updates the financial information a borrower must submit to the lender and government during the MSLP loan underwriting period and after the loan is funded.

On June 5, the Paycheck Protection Plan Flexibility Act of 2020 was enacted, which expanded the time period for borrowers to use their PPP loans from eight weeks to up to 24 weeks, so long as the covered period does not extend beyond Dec. 31, 2020. Manufacturers who received a PPP loan can now stretch out the funds for a longer period, which could provide them with a critical lifeline through the remainder of 2020.

OSHA Compliance

The Occupational Safety and Health Administration (OSHA) has released subsector-specific guidance for manufacturers to reduce infection spread in their facilities, which can be found here. By now, all manufacturers have or are currently implementing measures to protect their employees from infection, and will need to keep them in place until guidance from OSHA, the Centers for Disease Control and Prevention and state and local authorities changes. OSHA has also announced it will exercise enforcement discretion regarding the completion of training and guideline implementation. Per an April 16 memorandum, OSHA will evaluate whether an employer has made “good faith efforts to comply with applicable OSHA standards and, in situations where compliance was not possible, to ensure that employees were not exposed to hazards from tasks, processes, or equipment for which they were not prepared or trained.” If an employer cannot demonstrate its efforts to comply, they may be issued a citation under existing enforcement policies.

The USMCA

Starting on July 1, the USMCA replaced NAFTA as the governing trade agreement between the United States, Mexico and Canada, but its official implementation is not like flipping a switch. Some of the requirements laid out in the USMCA have yet to be further detailed in the form of implementing regulations and will be phased in over the coming months—or even require additional guidance.

One major change is the elimination of the NAFTA Certificate of Origin, which was a uniform document used in the U.S., Mexico, and Canada, to certify that products qualified for tariff exemptions based on their compliance with NAFTA’s specific rules of origin. The USMCA eliminates the official NAFTA form and instead allows companies to claim preferential tariff treatment through any format so long as the format includes certain data elements, including product description and applicable origin criteria. Since importers are responsible for maintaining records that substantiate the duty exemptions they claim, importers will need to carefully review each product’s rule of origin and, whenever possible, obtain information from the producer/exporter that the item to be imported qualifies under the USMCA’s rules of origin. Maintaining supporting documentation will be key to withstanding any verification (audit) by the importer’s customs authority. If an importer does not believe it can substantiate the duty claim at the point of entry—regardless of whether they are importing from a related party or external supplier—they can choose to pay the full duties up front and claim a duty refund retroactively if the merchandise ultimately is determined to be USMCA-originating. Importers that are not fully prepared for the USMCA may chose this route to allow them more time to get their internal controls up to speed by working with their vendors/manufacturers to fully prepare for the new era of USMCA compliance.

Offensive Play:

In addition to confirming they are USMCA compliant, North American importers and exporters should also perform a holistic review of their tariff codes to ensure they are properly applying them to the USMCA rule of origin, i.e., the tariff code for the finished good being exported/imported determines which rule of origin applies. In addition, if the finished good does not qualify for the USMCA, there may be a silver lining if different tariff code applies and results in a lower normal duty rate. And for all goods—especially where duties apply—manufacturers should confirm that the proper value is being declared to the importer’s customs authority and explore options for legally lowering the declared value of imported items to reduce duty and/or fee liability where applicable.

Data Privacy

Privacy regulations are nothing new to most countries around the world and the United States seems to be following suit. While there is no federal privacy law—yet—there are industries and states that have privacy regulations in place. As an example, the California Consumer Privacy Act (CCPA) went into effect on January 1, 2020, and enforcement began on July 1, 2020. Modeled after the most wide-reaching privacy regulation, the EU’s General Data Protection Regulation (GDPR), California extended their ability to protect the rights and freedoms of their residents. The CCPA is just the start of privacy regulations in California with a new law on the ballot for November 2020—the California Privacy Rights Act (CPRA), which will extend individual rights even more than the CCPA.

The CCPA applies to for-profit companies doing business in California that have annual sales of $25 million or greater; or, buy, sell, or share information on 50,000 or more individuals, households, or devices. This means that if you are a manufacturing company that meets one of those criteria you need to be compliant, or penalties and potential private rights of action may follow in the wake of a complaint or a data breach. Manufacturers that do not sell directly to California consumers may not realize the CCPA applies to them, so they should carefully review the types of data they collect, store, share or sell to determine whether the law applies or not. Manufacturers that meet the criteria and receive any consumer data from California-based customers or track warranties or other information that links their products to California residents are subject to the CCPA. You can view our in-depth guide to help determine whether you need to comply with the CCPA and access resources for becoming compliant here.

Outside regulations like the CCPA, all U.S. states and territories have some form of data breach notification law. And, like California, other states have privacy legislation on the ballot or have enacted privacy regulations or laws like New Jersey’s Identity Theft Protection Act, Nevada’s Internet Privacy Act, or Maine’s Internet Privacy law. It is just a matter of time before a federal law is enacted. In the meantime, it is important for manufacturers to:

-

Understand the types of personal data you collect, manage, store, or share.

-

Develop a capability to respond to consumer requests (e.g., individual rights requests or data subject requests).

-

Ensure that you only collect the data that is necessary to run your business.

-

Retire data in a timely manner—don’t keep it forever.

-

Understand who has access to personal data throughout your organization.

-

Establish appropriate controls to respond to data leaks or privacy breaches.

-

Use data for its intended purpose and ensure that your policies and notices match the actual uses of personal data.

Offensive Play:

Even if you are not currently subject to CCPA or other new privacy laws that have been enacted, you should still consider adopting responsible information governance practices now. That way, you will be ahead of the curve when legislation passes that impacts you, and your reputation will be better protected.

SHARE