How the Auto Industry Can Meet Disruption and Innovate with Industry 4.0

The automobile industry is undergoing widespread transformation. New players are disruptors — challenging the old business model of legacy companies, driving them to invest in the research and development (R&D) of electric and autonomous vehicles to stay relevant and competitive. This process means automakers will need to increasingly function like a tech company and hire tech talent, or partner with a tech company, in order to stay relevant for the future.

Beyond that, consumers have more transportation options than ever before, including ride-shares, e-scooter and moped shares. While the automobile industry was once about the product, it’s evolved to be about experience and connectivity. Automakers have started to consider mobility-as-a-service models, in the form of vehicle shares and partnerships with ride-sharing companies. Future models may include on-demand or subscription access to autonomous vehicles, as well as autonomous and electric buses or vans.

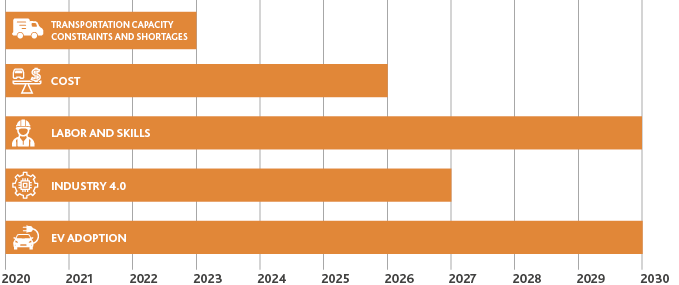

In addition to this ongoing disruption, automakers are facing a host of immediate challenges, including rising supply costs, the chip shortage, increasing demand for sustainable manufacturing, and global protectionist trade policy trends.

Earlier this year, BDO’s Industry 4.0 Survey polled 100 manufacturing executives (including automakers) about their Industry 4.0 priorities. While the future is unclear, having the right Industry 4.0 investments and strategy will put automakers in a better place to face immediate challenges while rising to the call to innovate.

Immediate challenges

Transportation capacity, constraints and shortages

Ports are backlogged and long lead times exist to get materials in to produce vehicles. In addition, tariffs on Chinese imports into the U.S. have made it more expensive for automakers to import parts, including chips; thus, automakers now have even fewer options for chip suppliers.

To combat the ongoing chip shortage, tariffs, port backlog and rising shipping costs, automakers will need to look to alternate suppliers closer to home.

Top supply chain targets for improvement

Customer order cycle time is a top target for improvement among automakers — ahead of inventory turnover and total delivered cost.

Adoption of business or operating models

The good news is that automakers seem to be addressing this challenge, as more than half have digitized their supply chain and almost a third plan to do so.

Digitizing the supply chain

|

Already Adopted |

Planning to Adopt |

|

52% |

32% |

The question remains: How will automakers plan to improve their customer order cycle time?

Automakers need to have a strategy in place to combat transportation constraints and shortages.

Cost

Shipping capacity constraints, as well as materials and parts shortages, are resulting in rising costs. Automakers may have no choice but to pass these costs on to consumers and focus on putting parts and materials to higher-ticket vehicles. Consumers may only tolerate so much rising costs, until they look for an alternative.

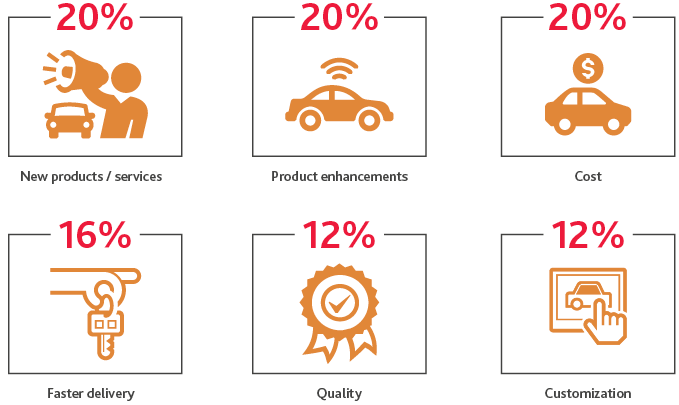

Top priorities for improving the customer experience

While controlling costs for consumers is a high priority for automakers, it’s tied with other priorities such as new products and product enhancements. Automakers will need to ensure they have a strategy for addressing rising costs.

Opportunities for Innovation

Electric Vehicle (EV) deployment

With governments setting up ambitious targets for EV adoption by 2030, automakers will need to drastically ramp up their production of these vehicles, as well as production and deployment of charging stations. There is an opportunity here for producers to partner with municipalities, not only as buyers of charging infrastructure, but also to support the transition to electric vehicles for both the community and manufacturer. However, the ongoing chip shortage will make it difficult to develop enough for new EV vehicles. Not only do automakers have to tackle the challenge of EV development, but to do so they must resolve the chip shortage first.

To develop and deploy EVs quickly, along with Industry 4.0 solutions, automakers can look to R&D tax credits and incentives. Sixty percent of automakers say they are looking to R&D tax credits and incentives to finance future digital investments. This will be an important strategy, as EV development and adoption is a priority for the current presidential administration.

Pursuing Industry 4.0

While Industry 4.0 can be the solution to many of the challenges discussed, pursuing it correctly will itself be a challenge.

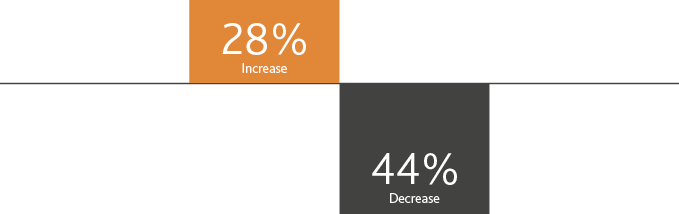

Automakers’ Spending Plans for Digital Investments in the Next 12 Months

Automakers are planning to decrease rather than increase their digital investments in the next 12 months.

One reason for this decrease could be convincing leadership that Industry 4.0 should be a priority right now — especially as the industry faces a host of other challenges, like material shortages, supply chain problems and labor shortages. Other challenges include executing on a corporate-wide Industry 4.0 overhaul versus just transforming certain segments of the business. Finding the right talent who can execute on an Industry 4.0 strategy also remains a challenge.

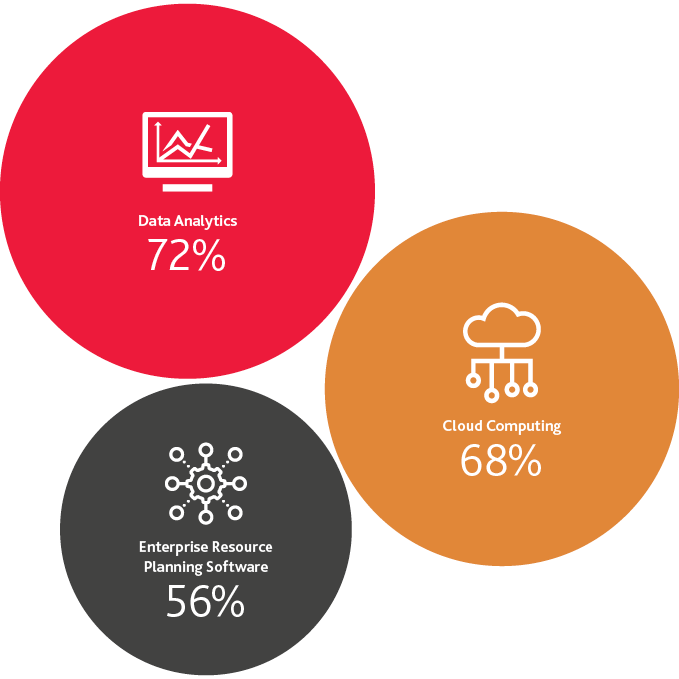

Current Technology Deployment

Automakers, however, are on track when it comes to deployment of the latest technology, with a majority already using data analytics, cloud computing and enterprise resource planning software.

Labor and skills

The automotive industry is currently facing a labor shortage, much like other industries. However, it’s unclear when, or if, they will find relief. Automotive manufacturers need talent with the technical skills to build the vehicles of the future (e.g., EVs). Automakers may need to engage in a joint venture with a technology company or invest in upskilling their current workforce to meet innovation and production goals.

What’s Next for Automakers

The auto industry has faced a host of disruptions in recent years and is now facing added challenges, including shortages and rising costs. At the same time, automakers are being called on to catalyze the economic transition to renewable energy — a massive responsibility that will require innovation, research and new ways of doing business. An Industry 4.0 strategy will help automakers meet these challenges. Now is the time for automakers to double down on Industry 4.0 investments, and not pull back, in order to meet current and future challenges.

How BDO Can Help

BDO has the deep auto industry experience and technology know-how to help you develop and implement all aspects of an Industry 4.0 strategy.

SHARE