How Automotive CFOs are Revving up for Growth in 2021

From an outsider’s perspective, the automotive industry’s turnaround is remarkable. After a year characterized by crisis, including drops in consumer demand, supply chain disruptions and financial uncertainty, the automotive industry has made significant strides towards recovery. According to a report from Reuters, auto sales in 2021 are expected to continue the fourth quarter growth of 2020—as high as 10% for some dealers. Not all companies are in the same place regarding their recovery, however, and were not all impacted by disruption in 2020 equally.

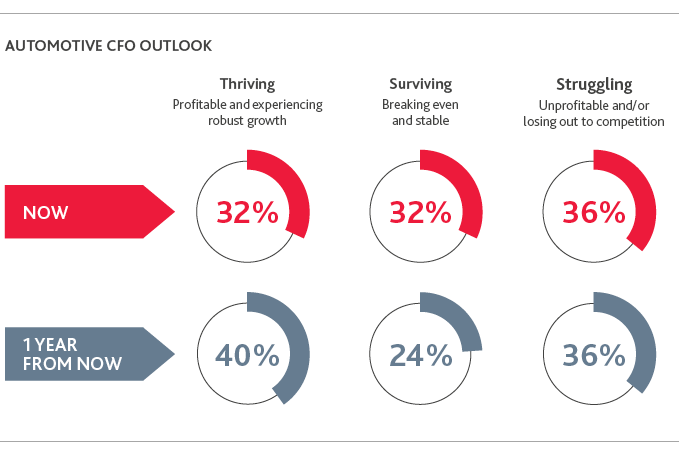

Earlier this year, BDO released its annual Manufacturing CFO Outlook Survey, which polled 100 manufacturing industry CFOs. Out of the respondents, 25% identified as being in the automotive and transportation subsector. The survey found that automotive CFOs’ outlook for their performance in the coming months is split between those expecting growth and those who anticipate continued challenges ahead.

Divided Business Outlook for the Next 12 Months

The automotive industry’s recovery is not uniform as, according to our survey data, automakers are nearly evenly split in currently self-identifying as thriving, surviving or struggling and in their outlook for where they will be a year from now. This is due to a combination of factors, including the degree to which demand for their products fell, individual financial standing, and their success to adapting to disruption.

For those who currently identify as thriving or expect to be thriving one year from now, part of their success could have been through shifting production to mitigate revenue losses. In 2020, some automotive companies were able to pivot production to support the development of much-needed personal protective equipment and medical devices. Their existing investments in Industry 4.0 technologies, such as 3D printing and automation, served as catalysts in their transitions. This enabled them to keep their facilities running and limit some of the financial damage they incurred due to demand for their usual products dropping.

For those who say they are currently or expect to be surviving or struggling one year from now, this may be at least partially due to COVID-19 related mandates that forced them to temporarily close their facilities. According to our survey data, 76% of automotive CFOs say they were required to temporarily halt production at their facilities in 2020, which may have had long-lasting impacts on their business. Although these shutdowns were temporary, companies lost revenue during this time for orders they could not fulfill, and they may have permanently lost customers who had to shift suppliers who were not focused to shut down due to state or local mandates.

Going forward, automakers are prioritizing investments to get back into growth mode. Specifically, they are increasing spending on information technology (72%) and operations (64%), which will help improve digital resilience and overall agility, enabling them to respond to disruption more quickly. Additionally, 48% will automate manual labor, which will provide long-term savings by reducing human capital costs.

Top Supply Chain and Customer Priorities

Among the top challenges faced by automakers in 2020 was supply chain instability, which was largely due to COVID-19 disruptions and continued trade policy turbulence, and led to swings in demand, shortages and other challenges. Going forward, automakers expect some of these issues to continue, as they rank supplier relationship management and accurate demand and inventory management as among their top supply chain challenges this year.

This year, however, most (36%) automotive CFOs say meeting higher customer expectations will be their top supply chain concern. The pandemic made it a necessity for all companies to have the ability to interact with their customers digitally, and it looks like this trend will continue. This will require automotive companies to continue building out their digital customer service capabilities to increase speed, quality and reliability of service, which may be difficult for businesses who haven’t traditionally prioritized a digital consumer experience.

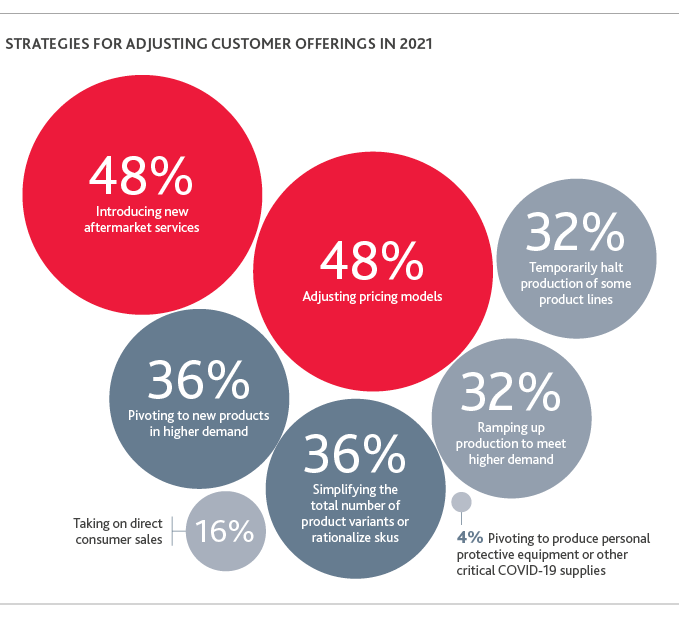

Apart from in their supply chains, manufacturers are making changes to their customer offerings more broadly.

All of these strategies have one thing in common: they are all focused on serving their existing customers better or in new ways, or going after a new set of customers altogether. By offering more competitive pricing models and new aftermarket services, auto companies can bolster their relationships with existing customers and improve retention. Pivoting to products in higher demand and adjusting their business model to be direct-to-consumer can help diversify or increase revenues, which will be key for accelerating the return to growth.

Priorities for Innovation

The past year illuminated the differences between automotive companies who are able to respond quickly to disruption and those who aren’t. For automakers who were able to navigate disruption best, their success can be attributed to their agile operations and ability to pivot quickly, which were enabled by Industry 4.0 technologies. Going forward, it’s clear all automakers recognize the importance of Industry 4.0. According to the survey data, investing in Industry 4.0 is tied with cutting costs as the top priority for automotive companies in 2021.

In addition to pursuing internal innovation, automotive companies will also need to contend with the impact of industry transformation, specifically the proliferation of non-traditional competitors. These include new third-party vendors and dealers who buy and sell parts or vehicles entirely online, and the emerging electric vehicle market. The International Energy Agency projects that electronic vehicles will account for 30% of passenger vehicle sales by 2030, which will may be accelerated up due to new environmental regulations on traditional fuel sources and incentives aimed at nurturing the market.

To compete, some major automakers are making their own investments to develop their own electric vehicles and associated products. No matter where they sit in the automotive supply chain, every automotive company should examine their products and/or services suite and determine whether they need to pivot or build out new capabilities to capture a share of this emerging market. Doing so may require entering into a strategic partnership with a company already in this space, or bringing on new talent with expertise in this area that can champion such an initiative.

Though automakers had to overcome numerous challenges in 2020, the future is looking brighter. As demand recovers and COVID-19 related restrictions continue to ease, automakers have bold plans for innovation and growth in the year ahead.

SHARE