How the Pandemic-Recession is Reshaping Manufacturers' Industry 4.0 Futures

Manufacturers scramble to digitize in immediate response to pandemic strains, but the payoff could be greater down the road.

A version of this article originally ran in the October 2020 edition of the Manufacturing Leadership Journal.

COVID-19 has drastically increased the global pace of change. While manufacturing was already undergoing significant transformation due to Industry 4.0, COVID-19 and the ensuing recession have made it more critical than ever.

The pandemic and the recession have turned greater attention to aspects of manufacturing processes that Industry 4.0 seeks to improve. Production disruption and supply shortages in the early stages of the pandemic, for example, exposed the lack of visibility and agility in supply chains. The current downturn, exacerbated by COVID-19-related shutdowns, shifting consumer demands, the financial strain of ongoing trade wars and evolving global regulatory landscape, has made it crucial for manufacturers to reduce operating costs and diversify revenue.

The result is that manufacturers’ digitization plans and priorities have shifted, and the impact of these shifts will continue well into the future. For manufacturers to shift to growth mode, they will need to identify new trends that are and will continue impacting their businesses, and the technology solutions they can implement to address those challenges.

Current State of Industry 4.0

At the beginning of 2020, manufacturers were already gearing up for change, especially in the digital sphere. BDO’s 2020 Middle Market Industry 4.0 Benchmarking Survey gives insight into the middle market manufacturers’ Industry 4.0 priorities prior to the onset of the pandemic. Some key findings of the survey are as follows:

-

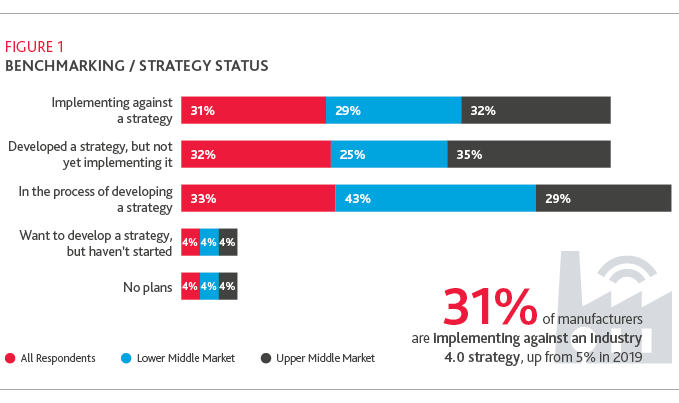

More manufacturers are engaging with an Industry 4.0 strategy. At the beginning of 2020, 31% of manufacturers were already implementing an Industry 4.0 strategy, up from 5% in 2019 (figure 1).

-

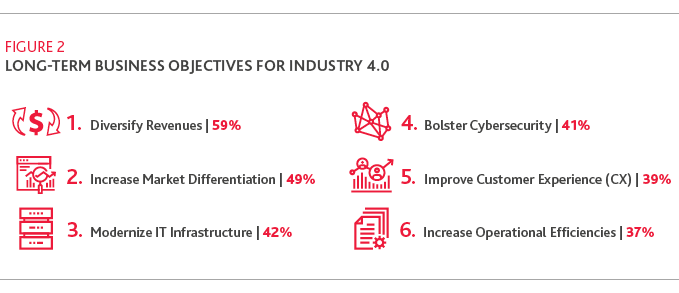

Long-term business priorities emphasize differentiation and diversification. 59% of respondents prioritized diversifying revenues and 49% focused on increasing market differentiation (figure 2).

-

Digital initiatives primarily fail due to outdated tech and lack of training. The top two reasons digital initiatives fail are interoperability issues with legacy tech (44%) and lack of skills and/or insufficient training (41%). Technology by itself isn’t enough; you need people with the right skills to wield it.

-

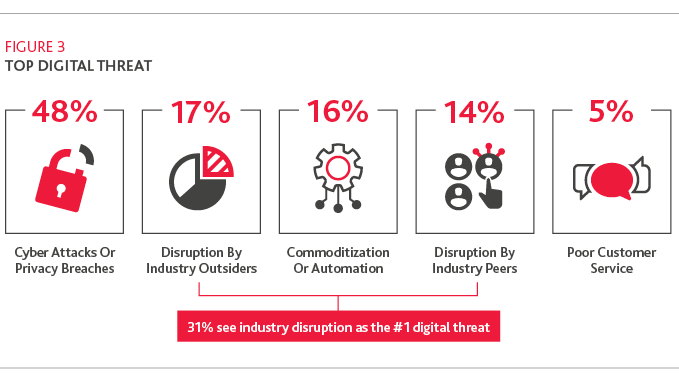

Cybersecurity fears are digital transformation’s greatest stumbling block. 48% of respondents saw cyberattacks or privacy breaches as their top digital threat. When it comes to moving forward with a new Industry 4.0 initiative, 39% of respondents cited cybersecurity as their top challenge (figure 3).

-

Manufacturers are using digital tools to improve the customer experience. 65% of respondents cited improving customer experience (CX) as one of their top short-term business goals at the start of 2020. Additionally, 56% of mid-market manufacturers sell direct-to-consumer, enabling them to provide a more personalized experience while capturing insights straight from the source. Improving CX is vital for retaining customers and building loyalty, and organizations are increasingly leveraging Industry 4.0 tools to meet their CX‑related goals.

Manufacturers’ New Priorities

The world has changed dramatically since this survey was conducted. Based on all that has happened between then and now, here is how we believe manufacturers’ Industry 4.0 priorities have shifted:

-

Back to basics by boosting operational efficiencies. Prior to the pandemic, just 21% of respondents cited increasing operational efficiencies as their top digital priority. In the wake of the pandemic and recession, manufacturers are returning to tried-and-true lean manufacturing, prioritizing technology investments that streamline processes and reduce waste. Riskier transformations like business model innovation may be on the back burner until the economy recovers.

-

Manufacturers are leveraging 3D printing to fight the pandemic. 3D printing has helped manufacturers pivot production, enabling them to make products that can help fight COVID-19. Prior to the pandemic, only 31% of middle-market manufacturers were deploying 3D printing technology. We can expect to see these numbers increase significantly as manufacturers adopt new technologies.

-

Automation is enabling safer work environments. Automation can help manufacturers enable social distancing in the workplace, such as by performing remote maintenance and management of machines. We expect implementation of RPA, which was at 42% prior to the pandemic, to increase during and after the pandemic.

-

Hyper focus on supply chain resiliency and responsiveness. We expect manufacturers to make supply chains a greater focus of their Industry 4.0 strategies moving forward to gain real-time insights into the status and location of products and materials and more visibility into current gaps while responding to disruption more quickly.

-

Cybersecurity is an even greater priority. The influx of cyberattacks during COVID-19 has pushed cybersecurity to the forefront of everyone’s attention, especially with so many employees working remotely. Industry 4.0 adoption is also increasing cyber risk by giving bad actors more points of ingress. In addition to training employees and shoring up security controls, product development teams need to embrace privacy by design principles, pursuing innovation with privacy and security considerations integrated into the process from the beginning.

Mitigating Disruptions from COVID-19

In the immediate future, manufacturers need to prioritize combating the effects and challenges of the pandemic and recession. Manufacturers face operational disruptions in three primary areas: supply chain, demand and revenue. How can Industry 4.0 help manufacturers navigate these challenges?

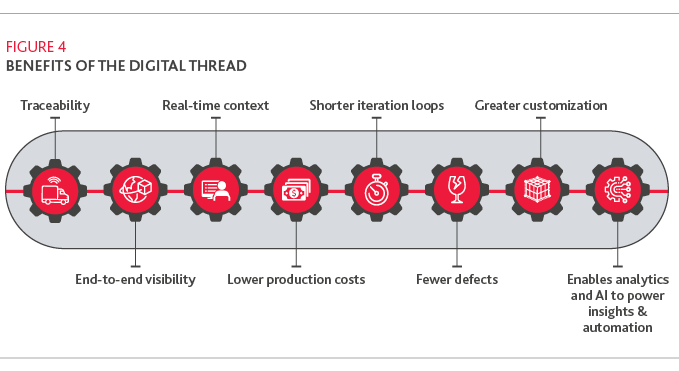

The Solution: Increasing supply chain transparency and collaboration through Industry 4.0. Cloud-based GPS and RFID can give real-time geographic updates to track the movement of products no matter where they are in the world. Internet-connected sensors, which can be attached to storage containers, raw materials, or even the products themselves, can use GPS to detect disruption earlier, enabling manufacturers to act more quickly in case of a crisis. Manufacturers should ultimately aim to form a digital thread, which is a communication framework that connects data flows across the supply chain ecosystem. The goal is to create an integrated view of an asset throughout the product lifecycle. The result? A supply chain that is resilient, transparent and agile.

Imagining the Industry 4.0 Future

The evolution of technological advancement happens more quickly with each passing year. Certain household items today didn’t even exist 10 or 20 years ago. This is especially true for Industry 4.0 technologies, which continue to advance at the speed of light, driving innovative business transformation at the same time.

Below, we’ve outlined some potential use cases for Industry 4.0 technologies and advancements that could see implementation in the next 3-5 years:

Digitization of the entire value chain using digital twins

In the past few years, the concept of smart factories, where digital and physical processes are integrated, has gained popularity. A digital twin, which is an exact digital replica of a physical object, can facilitate the creation of a smart factory. What if you could go further? What if you could create a digital twin of your entire value chain? In 2018, Dassault Systèmes, a European software company, created the first digital twin for an entire city: Singapore. According to NS Business, Singapore’s digital twin has given the city the ability to predict disasters, gather data on foot traffic to help shops open and close at optimal times and make energy consumption more efficient.

Now, imagine your value chain, including your suppliers and clients, as a city. If one can create a smart city with digital twins, why not a smart value chain? Why not create a digital twin for every factory, product, and process that integrates across not just your own operations but those of your customers and suppliers? According to our survey, 21% of manufacturers shared some data with external suppliers at the start of 2020 and we expect that trend to continue. A smart value chain would enable more open data sharing and communication, while creating end-to-end visibility from the factory floor to the end-customer.

The digital maturity required of the stakeholders would need to be significant, but in the long run, smart value chains open up a wide range of opportunities. For example, much like Singapore’s digital twin enables more efficient city planning, a value chain digital twin could help you optimize factory and supplier locations. You could adjust your digital model and watch how a change in one area ripples outwards and has impacts you may not have considered or foreseen.

Production pivots for additive manufacturers

Additive manufacturing has been instrumental in fighting COVID-19. Manufacturers have built ventilators and other medical equipment via additive manufacturing, whether by pivoting or ramping up production. This feat is especially impressive given that many of these manufacturers had never produced these items in the past. It stands to reason that manufacturers could use 3D printing to build other components they have previously purchased from suppliers. The advantages of in-house production include potentially insulating themselves from future supply shocks and lowering their production costs, if they can 3D print components at a lower price than they previously purchased.

New business models capitalizing on Industry 4.0 revenue potential

Industry 4.0 technologies offer the ability to change how you offer your product. There are four emerging Industry 4.0 revenue models to watch in the coming years: subscription services, product-as-a-service, pay-per-use, and data-as-a-service. (figure 5)

Figure 5: Emerging Industry 4.0 Revenue Models

Subscription Services

The appeal of the subscription model, where customers pay a recurring fee for continued access to a product or service, isn’t hard to grasp. Recurring revenue offers more stability and predictability, and also fosters stronger relationships with customers through more frequent and consistent engagement. It’s also not an either/or—you can continue to sell your product in one-time transactions and create a new revenue stream via a subscription service.

Customer Benefits:

-

Convenience

-

Lower upfront investment

-

Faster access

Business Benefits:

-

Customer engagement

-

Recurring revenue

-

Behavioral insight

-

Vertical supply chain integration

Product-as-a-Service

“Product-as-a-service” reimagines value in terms of the benefits of a product rather than the product itself. In its purest form, the service replaces the product: instead of purchasing a car, the customer pays for the ride. Physical products can also become a platform for service delivery, vastly expanding the aftermarket opportunity to a whole new realm of digital services. Think of the Peloton stationary bike – customers don’t just buy the bike (a one-time upfront expense), they buy the monthly subscription to live-streamed and on-demand classes.

Customer Benefits:

-

Outcomes-based pricing

-

Frictionless

-

On-demand access

Business Benefits:

-

Improved customer engagement

-

Lower inventory

-

Recurring revenue

-

Upsell opportunities

Pay-Per-Use

Pay-per-use models provide a variable cost structure tailored to individual need: Customers are charged based on usage or consumption levels, offering them greater flexibility. Access to a product or service can be provided on an on-demand basis (like a Zipcar) or capacity can be scaled up or scaled down (like data storage or computing power—think Amazon Web Services). Billing is contingent on the ability to meter use—but with the advent of the Internet of Things, the universe of what can be metered is pretty much unlimited.

Customer Benefits:

-

Greater flexibility

-

Lower upfront investment

-

Faster access

Business Benefits:

-

Low-cost experimentation

-

Market expansion

-

Supplemental revenue

Data-as-a-Service

Data-as-a-service reimagines information as an asset that can be monetized by selling access via the cloud. What distinguishes DaaS from SaaS is that the data can be decoupled from a specific platform, though it doesn’t have to be. The value to the customer is in aggregating and distilling large data sets into meaningful information that can be published using an API. Additional data services, such as predictive modeling or custom reports, can also be sold to the customer.

Customer Benefits:

-

Higher data quality

-

Agility

-

Actionable insight

Business Benefits:

-

Cost-effective setup

-

Competitive differentiator

-

Supplemental revenue

It’s tempting to think that the pace of change will slow down in the future, that we’ll all have a quiet moment or two to catch up. That sort of wishful thinking is fatal for manufacturers. Change isn’t going to slow down, and the manufacturing industry will never be static. Even if the pandemic and the recession both end tomorrow, companies will still need to keep pace with technology changes that continue to shift the manufacturing paradigm. Manufacturers need to start thinking today how they plan to meet the Industry 4.0-enabled future. By taking concrete short-term steps to address immediate disruption, they can begin to leverage Industry 4.0 technology that will enable them to look further ahead in the future as they continue to weather the strains of the pandemic, ultimately re-emerging on the other side stronger than ever.

SHARE