Will Blockchain Revolutionize Insurance?

By Imran Makda

The buzz around blockchain seems to have hit fever pitch. Blockchain’s transformative potential has been compared to the invention of the Internet. Is it worthy of the hype? In late April 2018, Fitch Ratings published a report on blockchain in the insurance industry, stating that the sector was “fertile ground” for the technology’s capabilities. The report claims, “With the industry’s large number of complex transactions between multiple parties, blockchain could theoretically offer significant cost reductions, improved processing speed, and enhanced underwriting and pricing, while reducing fraud.” Its benefits have yet to be proven, and Fitch Ratings projects it will take another three to five years before a clear picture emerges of the advantages and risks.

| Blockchain Potential Benefits to Insurers |

|

| Source: https://www.fitchratings.com/site/pr/10027624 |

But the insurance industry isn’t necessarily waiting around to see what happens. The first half of 2018 has already proven to be an active period for testing and rolling out new blockchain insurance solutions.

How does blockchain work?

In simplified terms, blockchain is a decentralized digital ledger that continuously records and timestamps transactions (or “blocks”) chronologically, which are linked together securely using cryptography. There is no central authority; rather the information is managed by the peer network whose data is linked together via a large network of computers. The transparency and linked nature of the network makes it especially difficult for anyone to tamper with or change information.

Blockchain grows up

Blockchain’s first big claim to fame was the cryptocurrency Bitcoin, serving as the backbone for its digital currency transactions. Less than a decade later, big banks and major financial institutions are making significant investments in the technology. Bank of America has applied for or received more than 43 blockchain patents to date. A partnership between Citigroup and Nasdaq promises to deliver a faster and more transparent blockchain solution for internationally traded securities. More than 100 banks, insurance companies, financial institutions, regulators, trade associations and technology companies are members of a consortium called R3, which has developed a blockchain-platform operating system called Corda.

Technology companies are also betting big on the future of blockchain. Google is one of the most active blockchain investors. IBM is another major player, launching its own blockchain business and software platform in late 2016. An Xconomy interview with Ramesh Gopinath, vice president of blockchain solutions and research at IBM, noted that IBM has worked on more than 400 blockchain projects for a variety of major brands including Walmart.

While insurers have traditionally been slow to adopt new technologies, they aren’t waiting around to see what happens this time. Insurance companies are joining blockchain collaborations and partnering with tech providers like IBM and Microsoft to pilot new initiatives already hitting the market.

Insurance blockchain gains traction

The Blockchain Insurance Initiative (B3i), which incorporated as an independent entity in April 2018, is one of the biggest blockchain collaboratives of global insurers and reinsurers. It includes the likes of AIG, Swiss Re, Allianz, Zurich, Munich Re and Liberty Mutual. Now called B3i Services AG, the organization is working on developing and commercializing new services and solutions. Its first product was a blockchain prototype of a property catastrophe excess-of-loss reinsurance contract, designed to increase the speed, efficiency and security of transactions.

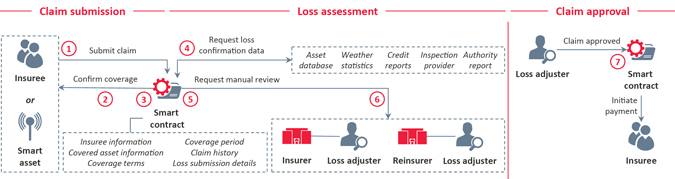

Smart contracts, which are essentially enforceable self-executing digital contracts that eliminate the need for a third-party, have been a major focal point for blockchain initiatives. As CB Insights describes it: “Smart contracts on the blockchain can turn paper contracts into programmable code that helps automate claims processing and calculates liabilities in insurance for all players involved.” Blockchain also creates a permanent audit trail.

A depiction of the insurance claims process run on the blockchain. Image credit: World Economic Forum

(Source: CB Insights)

In 2017, AIG worked with IBM to pilot a smart insurance policy that uses blockchain to manage complex international coverage. AXA also rolled out a new flight-delay insurance policy via smart contracts last year that automatically triggers payment when certain conditions are met.

The first six months of 2018 have seen a variety of insurance-specific blockchain solutions make their debut. For example, Marsh and IBM rolled out the industry’s first proof of commercial insurance blockchain in April 2018. ISN, which manages 67,000 contract employee records, is piloting the technology to automate confirmation that a contractor is insured.

Maersk and Microsoft recently piloted a shipping insurance policy using blockchain. Blockchain will allow commercial insurance policies to be executed using smart contracts that execute themselves during a property and casualty event or as shipped items are scanned at different points of the supply chain.

More than 30 insurance organizations are collaborating on blockchain’s potential via The Institutes RiskBlockTM Alliance. In April 2018, it unveiled a new tool that uses blockchain-enabled smart contract technology to automate the netting of payments to its members, improving efficiencies in the way that claims are processed and paid. It is expected to go live this summer. The group is also exploring solutions around proof-of-insurance verification and first notice of loss data sharing.

The true test lies ahead

Blockchain technology has the potential to significantly transform the complexities of insurance, creating more transparent processes, simplifying the coordination between different intermediaries, reducing costs and a myriad of other benefits.

However, caution hangs heavily in the air, as the tangible results have yet to play out. Regulators are still sorting through the implications of the technology. The National Association of Insurance Commissioners (NAIC) created an Innovation and Technology (EX) Task Force in 2017 to monitor and discuss emerging technologies like blockchain, and educate state regulators on its impact. And while blockchain offers a more secure way of housing data, it seems unrealistic to believe it will remain immune from tampering or hacking forever. Already, we’re seeing new methods of attack emerge, such as a 51% assault, in which a bad actor takes control of a blockchain by acquiring more than half of its mining hash rate, or computing power.

Is blockchain the next Internet? Early blockchain milestones and failures will teach the industry valuable lessons over the next year or two, but until there are more successful proofs of concept, it’s unlikely to achieve Internet-level ubiquity. If implemented effectively, however, distributed ledger technology can serve as a core component of a company’s digital transformation process. Blockchain doesn’t act alone—it’s a building block to catalyze enterprise-level transformation and unlock value across an entire business.

Of course, investing in blockchain has the potential to drive significant ROI for insurers—but it isn’t right for every organization. Some large carriers and InsurTech startups with sizeable capital bases have initiated research and development projects and aim to launch new blockchain-related products or processes in the next 12 to 18 months. Established small and medium size carriers with limited capital will likely stay on the sidelines and adopt a wait-and-see approach until the technology becomes more mainstream. Today, BDO is working with clients across industries to help them evaluate potential blockchain use-cases and determine viability as part of their broader digital transformation strategy.

To learn more about blockchain and its potential to transform your organization, please contact Imran Makda, assurance partner and Insurance practice leader at [email protected].

SHARE