Preparing for Implementation of the New Revenue Recognition Standard

The deadline for implementation of ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606), is right around the corner!

With an effective date of Jan. 1, 2018, for calendar year publicly held companies and Jan. 1, 2019, for calendar year privately held companies, the time to begin planning for implementation is now.

In this article, we will provide a refresher on the standard’s main provisions. Additionally, we will review implementation methods and key issues that may arise for government contractors during implementation, including those addressed by the AICPA’s Industry Revenue Recognition Task Force for Aerospace & Defense. Finally, we will discuss the presentation and disclosure requirements under the new standard.

Main Provisions

Under the new standard, revenue from contracts with customers is recognized based on the application of a principle-based five-step model:

Step 1: Identify the Contract: A contract is defined as an agreement between two or more parties that creates enforceable rights and obligations. An entity should apply the requirements to each contract that meets the following criteria:

- Approval and commitment by parties,

- Identification of the rights of the parties,

- Identification of payment terms,

- Determine the contract has commercial substance, and

- Collection is probable.

Step 2: Identify Performance Obligations: A performance obligation is a promise in the contract with a customer to transfer a good or service to the customer. If more than one good or service is promised in the contract, the company will need to account for each distinct good or service or series of distinct goods or services as a separate performance obligation. The following criteria is used to determine if the good or service is distinct:

- The good or service must be capable of being distinct (the customer can benefit from the good or service either on its own, or together with other resources that are readily available to the customer), or

- The good or service must be distinct within the context of the contract (the promise to transfer the good or service is separately identifiable from other promises in the contract).

Step 3: Determine Transaction Price: The transaction price is the amount of consideration (i.e., payment) to which an entity is expected to be entitled in exchange for promised goods or services to a customer. The standard includes guidance as to when any variable consideration should be included in the transaction price. In addition, the standard includes a requirement to adjust the promised amount of consideration for the effects of time value of money when a financing component exists. As a practical expedient, there is no requirement to assess if there is a significant financing component when the period between payment by the customer and transfer of the promised goods or services is less than one year.

Step 4: Allocate Transaction Price to Performance Obligations: For a contract that has more than one performance obligation, the entity should allocate the transaction price to each performance obligation based on the stand-alone selling price. If the stand-alone selling price is not observable, it must be estimated.

Step 5: Recognize Revenue As Performance Obligations Are Satisfied: An entity should recognize revenue when the performance obligations are satisfied by the transfer of a good or service. A good or service is transferred when the customer obtains control of that good or service. For performance obligations that are satisfied over time, rather than at a point in time, revenue should be recognized over time by consistently applying a method of measuring the progress toward completion of the performance obligations. Appropriate methods of measuring progress include output methods and input methods.

Implementation Methods

- Full retrospective application: Recast of prior period financial statements (with an adjustment to opening retained earnings for the first year presented). For example, for a public company, 2016 and 2017 would be recast to reflect the adoption of the new standard presented in the 2018 financial statements. The cumulative adjustment would be reflected as of Jan. 1, 2016.

- Modified retrospective application: Cumulative effect of initially applying the standard is recorded as an adjustment to opening retained earnings of the period of initial application. Under the same example, 2016 and 2017 would not be recast in the 2018 financial statements. The cumulative adjustment would be reflective as of Jan. 1, 2018.

Implementation Issues and Guidance

For most government contracts, particularly time and materials and cost-plus-fixed-fee contracts, as well as services-based firm-fixed-price contracts, there will be minimal change to the total revenue recognized under the contract, as well as the timing of revenue recognition under the new revenue recognition standard. Accordingly, there will be minimal impact to the entity’s financial statements. However, under more complex contracts (i.e., award fees under cost-plus contracts, or firm-fixed-price contracts where the entity performs manufacturing, design, development, integration and/or production), applying the new standard will require careful analysis and consideration, and could impact the timing of revenue recognition.

The AICPA has developed industry-based task forces to discuss emerging best practices for implementation of the new revenue recognition standard. The task forces consist primarily of industry professionals and auditors, including BDO professionals. Ultimately, the issues developed by the task forces will be used to develop the new AICPA accounting guide for revenue recognition.

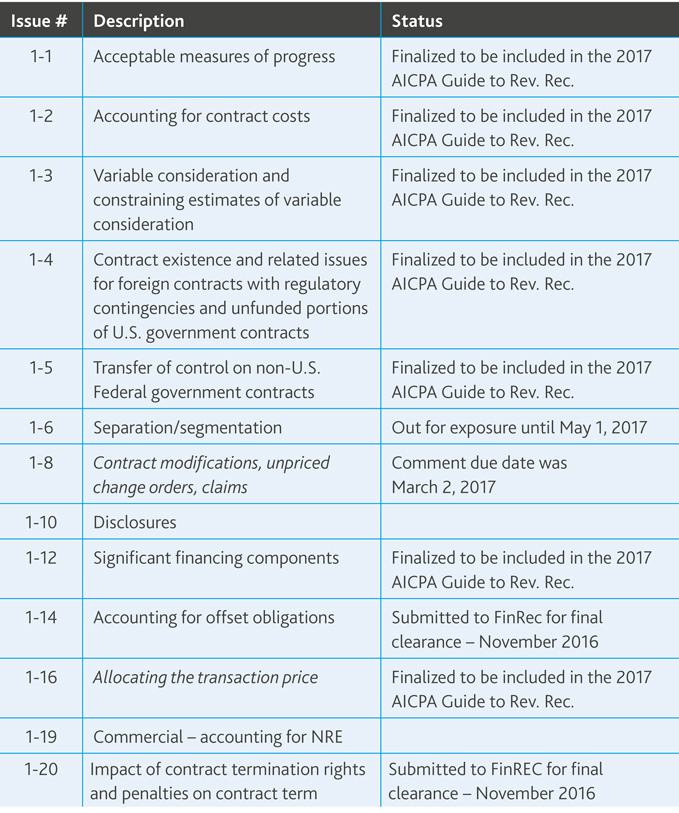

AICPA’s Industry Revenue Recognition Task Force for Aerospace & Defense has identified various revenue recognition implementation issues and continually updates the list of issues as discussions continue. As noted in the table below, some issues have been finalized for inclusion in the 2017 AICPA Guide to Revenue Recognition, while others are still under discussion and/or review.

Below is a summary of key implementation issues noted in the finalized Issues from AICPA’s Industry Revenue Recognition Task Force for Aerospace & Defense.

Issue #1-1: Acceptable Measure of Progress

This issue discusses items to consider when determining which method to use when measuring progress towards completion of performance obligations satisfied over time.

Method of progress toward completion

Under the new guidance, revenue recognition is tied to the concept of transferring control of goods or services promised to a customer—the satisfaction of an entity’s performance obligation. The fact that most contracts provide the federal government with the right to terminate for convenience, resulting in the contractor collecting all costs incurred and the federal government retaining the right to all goods produced and in process, is a key consideration when determining what method will be the best measure of progress toward completion of the performance obligation.

As stated in Issue #1-1, a termination for convenience clause that gives the customer the right to the goods produced and in process under the contract at the time of termination may indicate that the customer has effective control over the goods produced and the work in progress. Accordingly, Issue #1-1 states that the Financial Reporting Executive Committee (FinREC) believes that an output measure such as units of production or units of delivery may not be an appropriate measure of the progress toward completion of the performance obligation because it does not account for the fact that the work in process belongs to the customer, and production with significant amount of development, like most aerospace contracts, should not use the output method since each item produced or delivered may not transfer an equal amount of value to the customer. Accordingly, the entity should consider if an input method, such as cost-to-cost, would be a more appropriate measure of progress toward satisfaction of the performance obligation. It is further stated in Issue #1-1 that FinREC believes the output method is most appropriate for mass production of homogenous products.

This could lead to a substantial change in industry practice for both public and privately held companies, particularly for firm-fixed-price contracts where there is a clearly defined output (i.e., the delivery of a unit). However, there will be substantial development under the contract prior to production of the units. The new guidance (and the implementation guidance provided in this Issue) specifically states that the appropriate method of measuring progress toward completion under this type of contract is an input measure. Thus, many contractors may determine it is appropriate to change method from output measures to input measures for measuring progress toward completion.

Of course, it should be noted that government contracts vary widely, and determining the best method of measuring progress toward completion of the performance obligation requires not only knowledge of the services the customer provides, but also the contract terms of the performance obligation.

Costs associated with inefficiencies in performance and costs that are no indicative of performance

Using a cost-based input method may require an adjustment to measure progress in certain circumstances, like costs incurred that are attributable to significant inefficiencies or the incurrence of costs that are not indicative of performance, like the purchase of major subassemblies for which no value-added work has been performed. In these situations, it may be appropriate to only recognize revenue to the extent that cost is incurred (i.e., no profit on these costs) and the profit would be earned upon the incurrence of the remaining costs.

Issue #1-2: Accounting for Contract Costs

This issue discusses considerations for applying the guidance in Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 340 for incremental costs of obtaining a contract, costs to fulfill a contract and amortization and impairment, to costs typically incurred in aerospace and defense contracts including pre-contract costs and learning or start-up costs.

FASB ASC 340-40-25-8(c) states that costs incurred that relate to satisfied performance obligations (or partially satisfied performance obligations) in the contract (costs that relate to past performance) should be expensed when incurred.

In short, entities measuring progress towards complete satisfaction of a performance obligation satisfied over time using a cost-to-cost measure will generally not have inventoried costs. Costs incurred for materials are expensed, and revenue recognized, when control of the inventory transfers to the customer (i.e., when it is being used in the performance of the contract, which are most costs purchased specifically for a contract). Generic materials are inventoried until put into use for a contract.

Incremental costs (i.e., commissions awarded with the contract) and pre-contract costs (recoverable costs incurred in anticipation of an award) are recognized as assets and amortized as contract costs. These types of costs are very rare in practice.

Issue #1-3: Variable Consideration

This issue discusses considerations for estimating the amount of variable consideration (incentive fees, award fees, economic price adjustments) in aerospace and defense contracts, the impact of subsequent modifications and how to determine the amount of estimated variable consideration to include in the transaction price.

Variable consideration from the customer in the form of incentives and award fees require substantial judgment and experience with evaluations not unlike that used to estimate completion of long-term contracts. An entity should consider all the information (historical, current and forecast) that is reasonably available to the entity and should identify a reasonable number of possible consideration amounts.

The more appropriate of the two methods (i.e., whichever is more predictive) must be used. FASB ASC 606-10-32-8 discusses the two methods for estimating variable consideration. The expected value method (sum of probability-weighted outcomes) or the most likely method (the single most likely amount within a range of possible outcomes). FASB ASC 606-10-32-9 requires that one method is consistently used throughout the contract when estimating variable consideration. Additionally, FASB ASC 606-10-10-3 requires that the method selected should be applied consistently to contracts with similar characteristics and in similar circumstances.

The new ASC could have a material impact on revenue recognition for award fees and incentives fees, depending on what the entity’s existing policy is.

Issue #1-4: Contract Existence and Related Issues for Foreign Contracts with Regulatory Contingencies and Unfunded Portions of U.S. Government Contracts

This issue discusses how required regulatory approval impacts the determination of whether an executed/signed contract meets the criteria for existence of a contract under ASC 606, and how unfunded portions of U.S. government contracts should apply the guidance for variable consideration.

Regulatory approval

In this issue, FinREC states that contracts directly with foreign governments, as opposed to Foreign Military Sales, which are sponsored by the U.S. federal government, need to account for regulatory approval in their revenue recognition process. The entity should assess the contract under the previously discussed five-step criteria. Once concluded that the contract meets the five-step criteria in ASC 606-10-25-1, the entity should assess the likelihood of regulatory approval. The Issue further describes the criteria that may be considered in determining the likelihood of obtaining necessary approval. If regulatory approval is “virtually certain,” FinREC believes it is reasonable for an entity to begin accounting for the contract in accordance with FASB ASC 606.

Partial funding

It is common for a company to be awarded a long-term contract that is only partially funded at inception. The criteria for contract existence will be met for both the funded and unfunded portions of the contract if the entity has an approved enforceable contract that clearly states the contractual terms, including the parties’ rights and the payment terms related to the goods and services to be transferred, and the U.S. federal government has the intention and ability to pay the entity for the promised goods and services. However, the unfunded portion could be considered variable consideration, similar to award fees. As such, prior to recognizing revenue in excess of funding, an entity should perform an assessment to analyze the likelihood that the unfunded portion of the contract will not result in a significant revenue reversal. These factors include a short period before funding is expected, sole source/follow-on/high competition work, funding for the customer exists and funding to the entity is administrative and “mission critical” to the nature of the program.

Issue #1-5: Transfer of Control on Non-U.S. Federal Government Contracts

This issue discusses considerations for determining when non-U.S. government aerospace and defense contracts should be considered performance obligations satisfied over time, rather than at one point in time.

The assessment of whether revenue should be recognized over time or at a point in time (i.e., when does control of the good or service transfer) is performed at contract inception. An entity transfers control of a good or service over time (and, therefore, satisfies a performance obligation and recognizes revenue over time) if one of the following criteria is met:

-

The customer simultaneously receives and consumes the benefits provided by the entity’s performance as the entity performs;

-

The entity’s performance creates or enhances an asset (i.e., WIP) that the customer controls as the asset is created or enhanced; or

-

The entity’s performance does not create an asset with alternative use to the entity and the entity has an enforceable right to payment for performance completed to date.

Meeting the requirement of simultaneous receipt and consumption of the benefits of the entity’s performance will be easily met under routine services (maintenance or transportation services) or in instances where another entity would not need to re-perform the work that has been completed to date if another entity were to fulfill the remaining performance obligation.

In considering if the requirement for performance that creates or enhances an asset (i.e., WIP) that the customer controls, FASB ASC 606-10-25-25 states that control refers to the ability to direct the use of and obtain substantially all of the remaining benefits from the asset. This Issue discusses that the entity will need to analyze contracts to determine if terms such as right to payment for performance to date, legal title, physical possession and risks and rewards of ownership pass as the asset is created or enhanced.

If the entity’s performance does not create an asset with an alternative use, revenue may be recognized over time if the entity must demonstrate that it has an enforceable right to payment for performance completed to date if the contract were terminated early. While the termination for convenience clause in most U.S. federal government contracts would generally meet this requirement, it is important to note that non-U.S. federal government contracts may operate under different terms.

Issue #1-12: Significant Financing Component

This issue discusses considerations needed to assess whether a significant financing component exists in determining the transaction price for various types of aerospace and defense contracts.

In determining the transaction price, an entity shall adjust the promised amount of consideration for the effects of the time value of money if the timing of payments agreed to the parties to the contract provides the customer or the entity with a significant benefit of financing the transfer of goods or services to the customer. This assessment is performed at the contract level versus a portfolio, segment, or entity level.

An assessment of what constitutes significant requires judgment. Instances where the period between performance and payment is one year or less are excluded. One factor to consider in evaluating whether a contract includes a significant financing component is the difference, if any, between the amount of promised consideration and the cash selling price of the promised goods or services. However, this is just an indicator, as there are reasons other than financing, such as the achievement of certain milestones, which is paid to provide the customer with assurance that the entity will complete its obligations satisfactorily under the contract. Progress payments based upon percentage of costs incurred are not considered financing components.

Issue #1-16: Allocating the Transaction Price

This implementation Issue discusses considerations for determining how to allocate the transaction price to multiple performance obligations in aerospace and defense contracts.

When a contract contains more than one performance obligation (i.e., products and operations/maintenance), an entity will need to allocate the transaction price to each performance obligation based on the relative standalone selling prices of the products or services being provided to the customer. FASB ASC 606-10-32-32 states, “The best evidence of standalone selling price is the observable price of a good or service when the entity sells that good or service separately in the similar circumstances and to similar customers.”

As discussed in FASB ASC 606-10-32-33, entities should estimate the selling price of goods or services that do not have observable standalone selling prices. ASC 606-10-32-34 states that suitable methods include, but are not limited to, the following:

- Adjusted market assessment approach: Under this approach, the entity would determine the amount it believes the market would be willing to pay for a product or service. This Issue notes that this approach is expected to be used for standard products or services.

- Expected cost-plus-margin approach: Under this approach, the entity uses its cost basis plus the margin the market would be willing to pay (not the entity’s desired margin). This Issue explains that this approach may be used by government contractors, as costs of a performance obligation are generally determinable. In determining the reasonableness of the margin, the Issue suggests the entity may consider factors such as internal cost structure, nature of the proposal process (i.e., competitive or sole source), pricing practices, technological considerations and margins earned on similar contracts with difference customers.

- Residual approach: FASB ASC 606-10-32-34 explains that this approach should only be used for products or services that are sold to different customers for varying prices, or the entity has not yet established a price because the product or service has never been sold on a stand along basis.

Presentation and Disclosure Considerations

The statement of financial position will present contract assets and contract liabilities separately. Additionally, unconditional rights to consideration are presented separately as receivables. It should be noted that while the guidance uses the terms “contract asset” and “contract liability,” it does not prohibit the use of alternative descriptions in the statement of financial position for those items. However, there must be a distinction between receivables and contract assets (i.e., unbilled receivables and accounts receivable).

The statement of income will present revenue separately from impairment.

The standard requires that an entity disclose sufficient information to enable users of the financial statements to understand the nature, amount, timing and uncertainty of revenue and cash flows arising from the contracts with customers. Qualitative and quantitative information is required regarding:

- Contracts with customers including revenue and impairments recognized, disaggregation of revenue and information about contract balances and performance obligations (including the transaction price allocated to the remaining performance obligations);

- Significant judgments and changes in judgments, determining the timing of satisfaction of performance obligations (over time or at a point in time), and determining the transaction price and amounts allocated to performance obligations; and

- Assets recognized from the costs to obtain or fulfill a contract.

The disclosure to present the disaggregation of revenue should depict the nature, amount, timing and uncertainty of revenue and cash flows.

The disclosure requirements included in the new standard are significant changes to the presentation and disclosure requirements under existing guidance. As you consider the implementation of the new revenue recognition guidance, you will find that a substantial amount of effort will be required to implement processes and systems that accumulate the detailed information needed to facilitate preparation of required disclosures.

Next Steps

The AICPA Financial Report Center developed an Implementation Plan that you may find helpful as a starting point for developing your own implementation plan. Below are the high-level steps included in that plan, along with a link to the full document.

- Designate the individual(s) responsible for overseeing implementation.

- Evaluate how the changes will impact how your company accounts for different types of revenue streams/contracts. Consider how the new standard will impact current performance metrics and compensation plans. Work with your auditor to discuss the completeness and accuracy of your analysis.

- Determine an implementation method (full or modified retrospective approach).

- Determine changes that may be needed within systems and/or software applications to facilitate revenue recognition under the new standard.

- Determine what interim disclosures may be required prior to the effective date.

- Develop a plan for implementation to incorporate the above steps, as well as train your staff.

- Educate the company’s audit committee, board of directors, investors, etc. on the new standards and the impact you expect the changes to have on the company’s financial statements.

Additional resources

Visit the A&D Task force website here.

Visit the FASB Transition Resource Group here.

Read next article, "Quarterly Regulatory Update"

Return to BDO Knows Government Contracting Newsletter - Spring 2017

SHARE