Other Transaction Agreements – Practical Knowledge for Stepping In the Growing Government Sandbox

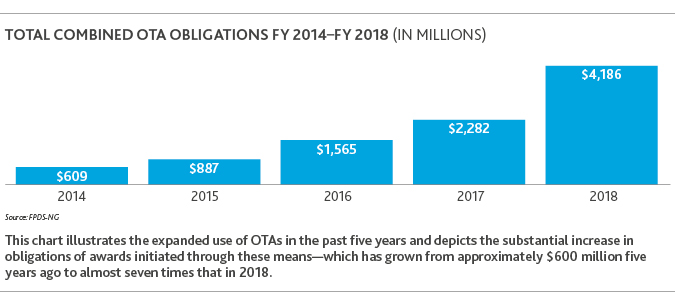

Those on the lookout for the latest trends in government contracting have probably heard that Other Transaction Agreements (OTAs) are all the rage for industry newcomers and veterans alike, as well as for some of the largest government agencies.

Initially formed to acquire new technology for the space race through the 1958 NASA Space Act, OTAs have seen great expansion in attracting both new market entrants and mainstay federal contractors anxious to capture a share of this growing source of federal funds.

Per 10 U.S.C. §2371, OTAs may be used to carry out, “basic, applied, and advanced research projects,” as well as, “prototype projects relevant to enhancing mission effectiveness of military personnel and supporting platforms.” In contrast to what some may fear, OTAs are not a replacement tool for the Federal Acquisition Regulation (FAR), nor are they designed solely for the non-traditional defense contractor (NDC). In fact, the overall intent of an OTA is to increase the speed and efficiency of getting mission-critical technology to the warfighter. It is the comparative speed of these transactions that make OTAs so attractive to the government buyer.

Congress has also played a part in the dramatic uptick of OTAs. Through sections from multiple annual defense appropriations bills over the past five years, Congress has:

1. Permanently codified OTA prototype authority

2. Broadened the use of OTAs for prototypes

3. Expanded the definition of the term “non-traditional defense contractor” to include small businesses and non-profits

4. Made it easier to issue follow-on production contracts

5. Established an actual preference for OTAs for prototyping

While OTAs are still contracts with the U.S. Government, they are not FAR-based procurements, cooperative agreements (CRADAs), or grants. As such, and consistent with the objective of obtaining mission critical technology quickly, the looser construct of the OTA agreement is much more flexible and generally free from onerous obligations, including:

1. Bayh-Dole Act

2. Buy American Act

3. Competition in Contracting Act

4. Contract Disputes Act

5. Cost Accounting Standards

6. Procurement Protest System

7. Service Contract Act

8. Truth in Negotiations Act

Organizations that typically run from federal procurements are more willing to come to the table due to the fast pace at which agencies with OTA authority can award these contracts, the freedom from competition requirements, protests generally, the ability to permit more advantageous IP and data rights, and the use of commercial accounting standards.

The consortia model for OTA awards has become especially popular and accounts for the majority of OTA spend in recent years. Under this framework, the government executes an agreement with an organized group of entities assembled around a common area of focus through a consortium management firm. That firm acts as the “prime” with the government agency, serving as a broker and mentor to its member organizations. Members may range from the traditional large-business defense contractors to commercial entities, non-profits, academic research organizations and universities.

The consortium management organization will, in many cases, compete and facilitate project awards down to its members as requirements develop. Depending on the consortium, such arrangements typically require a small membership fee as well as a percentage of revenue payment to the consortia (e.g., the Consortium for Command, Control, and Communications in Cyberspace, also known as C5) for any OTA awards received.

Despite the flexibility, there are still certain restrictions around who can receive an OTA, which varies by agency. For example, within the Department of Defense (DoD), only small businesses and NDCs have unrestricted access to OTA awards. A traditional defense contractor can only receive an OTA award if they partner with a small business or NDC that participates in the work to a significant extent or contributes at least a one-third cost share. In more rare cases, however, the senior procurement executive can make a written determination that the use of an OTA is warranted due to exceptional circumstances. Under the more recently expanded definition, to be an NDC, the organization must be an entity that has not performed any contracts subject to full Cost Accounting Standard (CAS) coverage for at least one year prior to the solicitation of the OTA. This naturally opens the doors to many who already perform federal contracts. However, if you think OTAs are only for the NDC, think again. The vast majority of OTAs reach some of the largest and most well-known government contractors in the marketplace.

Future Outlook

The future outlook for OTAs seems bright and the use of these contracts is expected to continue to grow. However, notwithstanding the obvious benefits these contracts afford, the potential shift in the federal acquisition paradigm (at least with respect to R&D and prototyping) and the varying nature of these procurements, have created several challenges for federal contractors and government personnel. Last November, DoD issued a more detailed guide on OTAs for its department to help navigate this new field, and there have been rumblings that larger agencies may establish OTA centers of excellence to help concentrate and plug the gap in knowledge of these contract arrangements.

In light of the evolving challenges and questions arising from the growing number of OTAs in the market, we have compiled a list of key practical items for consideration and awareness amongst the contractor community:

Terms:

1. Why all the FAR Clauses?

Though OTAs are not subject to the FAR, agreement officers are not precluded from using FAR clauses and we have seen our fair share do just that. While education within the government may address this over time, contractors should feel empowered to help their agreement officer and push back where necessary. The same goes for subcontractors where primes tend to flow down their standard templates. Many find it easier to negotiate OTA awards as a prime than when in a subcontractor position.

2. The Consortium Agreement

The terms of OTAs at the consortium level can be restrictive. As a result, some member organizations may experience less flexibility in achieving their optimal outcome using this model, thereby negating some of the OTA appeal. Before signing up, contractors should take the time to understand the general terms and conditions of being a member, in addition to the terms and conditions of the OTAs under management in order to protect their interests (e.g., what data will be provided, how can it be shared, how is it protected, fees, etc.).

3. Defining Objectives

When the looser structure of an OTA is embraced, sometimes agreement officers have trouble defining the objectives and expected workflow. Where a stated vision and anticipated steps are beneficial, contractors should not be shy about offering to draft this language for their customers. Without some agreement on the goals and activities required by the OTA, the chances of a potential dispute rise.

Proposals and Negotiations:

4. Fast Awards, Faster Proposals

For the experienced government contractor accustomed to longer lead times and slow awards, OTAs are both a breath of fresh air and a stressor on the proposal team. As OTAs are often faster, it requires contractors to plan ahead, involve leadership early, obtain necessary approvals and engage with third-party consultants if needed to support surge efforts.

5. “Significant Extent”

For DoD OTA proposals involving traditional defense contractors, contractors need to clearly document the manner in which NDCs participate to a significant extent to maintain eligibility for award and limit the required cost share. While the current guides provide examples of significance, there is no stated threshold to apply and agreement officers are directed to evaluate the totality of the circumstances before making a determination.

6. Competition and Price Analysis

Current statutes permit agencies to determine what competition will look like, though it should be used to the maximum extent practical. Without it, government buyers are left with the challenge of justifying the price of innovation where market data may not yet be available. Again, it behooves the contractor to assist the procuring official in making its determination by providing supporting information in the proposal.

7. Intellectual Property and Data Rights

The ability to maintain proprietary IP is one of the primary draws of OTAs. However, requirements like Bayh Dole for IP, and data rights clauses in the FAR/DFARS are typically the starting point for these agreements. Contractors should know that there is some latitude in negotiating these terms and endeavor to do so where possible.

8. Position the Business with the RFP

Requirements often change throughout the whitepaper and later phases of the potential OTA award process. Contractors should track these changes and respond accordingly to ensure responsiveness. Additionally, if follow-on production work is anticipated as part of the procurement objective and available via sole source methods, contractors should position themselves to ensure such work is explicitly stated in the RFP to avoid a sustainable protest.

Post-Award:

9. Cost Accounting

Though OTAs may not be subject to CAS, the traditional defense contractors receiving OTAs are and must account for costs accordingly. As such, a frequent question is how to account for consortia membership and award fees. Membership fees are typically charged as allowable G&A expenses, whereas award fees may be most appropriately treated as contra-revenue accounts, decrementing revenue received and not affecting expense accounts.

10. Feedback and Past Performance

Unlike most government contracts, where unsuccessful bidders receive a debrief and successful bidders eventually have their performance captured in the Contractor Performance Assessment Reporting System (CPARS), such records are ostensibly absent in OTAs. Many market participants have complained about the lack of feedback when pursuing OTAs. However, at least one consortium reportedly is addressing this. Meanwhile, new market participants that develop a taste for federal awards are left without a past performance record to draw from in future awards.

11. Cashflow and Resource Management

Especially for the small businesses performing or pursuing OTAs, it is important to understand that these are not the more stable and predictable scopes of work the public sector is known for. Contractors frequently require three-to-six-month extensions for prolonged research projects that lead to cashflow and resource management challenges due to a lack of clarity around whether the research projects will last.

A version of this piece ran in the Spring 2019 Service Contractor Magazine published by the Professional Services Council.

To learn more about how your business can best leverage OTAs, visit BDO’s Center of Excellence for Government Contracting.

SHARE