Getting Started

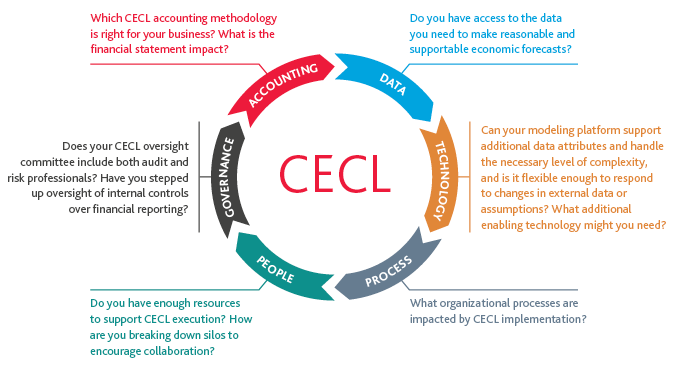

For CECL to succeed, financial institutions need to understand how the new standard affects systems, technology and processes and where interdependencies exist.

The new standard calls for an iterative approach where the cross-functional impacts are monitored closely. All departments throughout the institution must be aligned with the approach and collaborate to ensure stringent compliance with project plans and timelines.

It is helpful to start with a target state in mind to provide an organizational framework for testing various estimation approaches and to establish criteria for measuring success.

Success will look different for every institution, depending on business goals, current and desired level of sophistication and effort required.

The key elements of a successful CECL implementation include:

-

A cross-functional oversight committee with clearly defined roles and responsibilities.

-

An integrated process that joins the allowance estimate with data, disclosures and analytics in a controlled, scalable and repeatable manner.

-

A dynamic reporting framework that conveys a cohesive narrative explaining what happened and why, period over period.

-

A controls framework that includes full audit trails, role-based permissions, segregation of duties and data lineage.

PUTTING TOGETHER YOUR CECL TEAM

A cross-functional change management team will be essential to facilitating interdepartmental coordination and enterprise-wide accountability. Engagement teams will typically have anywhere from three to 10 people and should involve personnel from operations, risk management, credit and the head of accounting, such as a controller or CFO. Additionally, a representative from the IT department should be involved to address the data and technology needs, along with any potential integration and security considerations. Ensuring that you have representation from all business areas on your steering committee and getting input from each team member early on will help drive success. The team needs to understand what the ultimate goal is: developing a model that is sophisticated enough to capture the complexities of the underlying loan portfolio and provide necessary disclosures.

[Skip to our detailed breakdown of functional roles and responsibilities in the Implementation section]

SHARE