Finding a Home for Your Multifamily Investments Amid a Cooling Market

BDO’s inaugural Real Estate & Construction Compass analyzed 10 years of CoStar data in the multifamily sector of real estate to uncover how the industry has evolved since 2009, and the actions real estate businesses need to take to survive and thrive in the new paradigm.

In the decade since the Great Recession, the multifamily market has been a bright spot for commercial real estate investors. Generational shifts in consumer behavior, shaped by the post-recession economy, have fueled high demand for rentals that is expected to continue. In recent years, however, multifamily supply has begun to outpace demand. In primary markets like New York City, the combination cap rate compression and slowing of rental rate growth caused by additional supply has created a need for investors to look elsewhere to discover new opportunities.

Though it’s more difficult to find multifamily investments that offer the same returns compared to previous years, opportunities remain in the sector. These prospects, however, are complicated by a potential recession or economic downturn. According to a survey by the National Association of Business Economics (NABE), more than three-fourths of U.S. economists think the country is headed for a recession by 2021. To take advantage of the greater returns that may exist in properties outside of primary markets, multifamily investors must balance the potential rewards with the heightened potential risk of a recession.

Our Analysis Uncovered:

Demand for multifamily is expected to continue, but the supply glut means investors must look deeper or potential explore newer markets for opportunity.

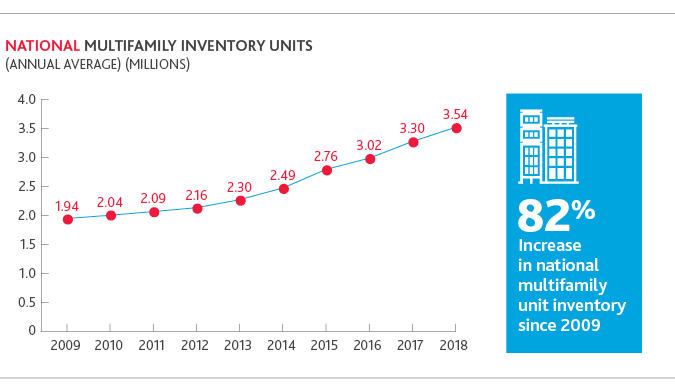

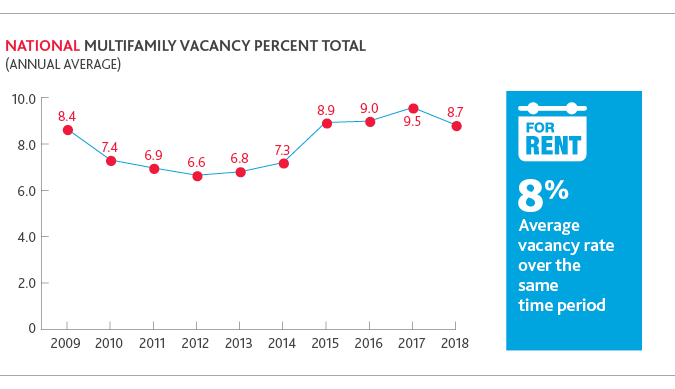

Multifamily inventory by units nearly doubled in the past decade while vacancy rates have remained relatively low.

With oversaturation in primary markets, there are opportunities for multifamily investors outside their comfort zones—but a potential economic downturn poses risks.

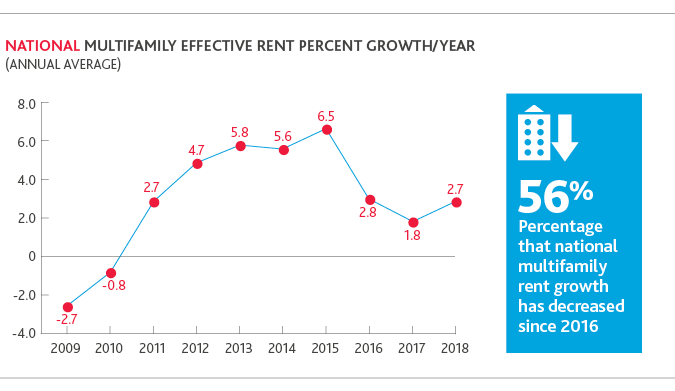

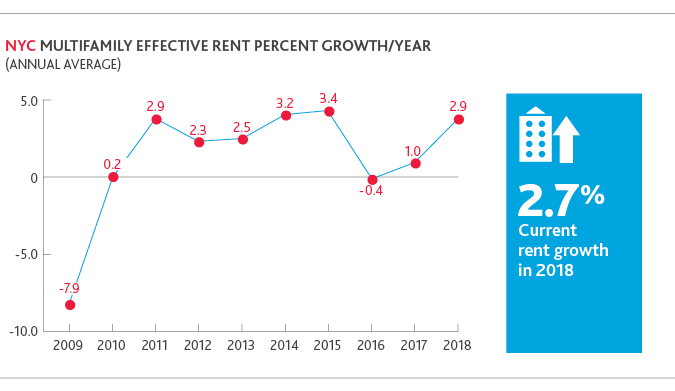

Despite sustained demand for multifamily rentals, the oversaturation of primary markets has caused rental rate growth to cool and created a need to look elsewhere for new opportunities.

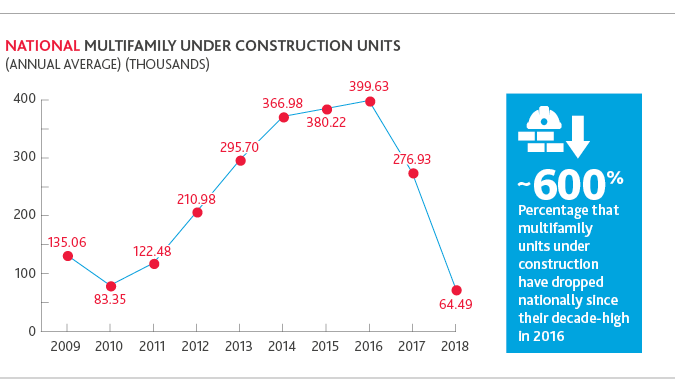

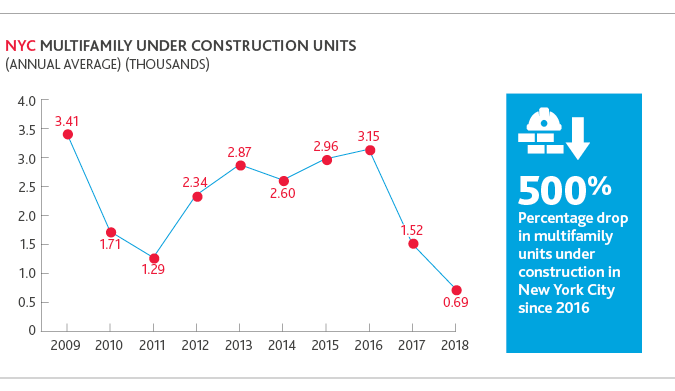

Construction has slowed both nationally and in New York City since 2016.

In the heavily competitive NYC market, the fluctuations have been less dramatic, though they still follow national trends:

To navigate these conditions and discover new opportunities, they’ll need to focus on fastgrowing secondary or tertiary cities.

This means entering untapped or unfamiliar markets—which is no easy undertaking. To identify the best opportunities, they’ll need to perform holistic urban analyses.

Here are some factors to take into consideration when entering a new market:

Investors need to perform the same kind of due diligence on an emerging city as they would for any transaction in a market they know well.

Conclusion

Though the market is cooling, the multifamily sector holds promise for those real estate investors open to exploring opportunities outside their comfort zones. In crowded markets, new technology and luxury amenities are key differentiators for landlords and management companies to attract and retain tenants. Whether the market continues its record period of growth or begins to contract, the multifamily sector may continue to serve as a resilient home for the savvy investor.

SHARE