Digital Transformation in Financial Services

Top Findings from BDO's 2019 Middle Market Digital Transformation Survey

Table of Contents

- Digital Transformation in Financial Services

- Top Financial Services Digital Transformation Trends

- Digital transformation is a top business imperative.

- Digital transformation brings proven—and highly anticipated—ROI.

- Improving customer experience & operational efficiency top financial services’ long & short-term business goals.

- IoT, AI & Blockchain investments heat up.

- Cultivating a strong “employee experience” is critical.

- Strong governance remains a challenge.

- Cyber and data privacy needs to be more of a priority.

- Conclusion

Digital Transformation in Financial Services

Digital transformation: Innovation’s holy grail. Today, it’s nearly impossible to walk into a boardroom, client meeting, or innovation brainstorm without hearing the phrase bandied about at least once, twice, or—more likely—a dozen times.

Wall Street is no exception. The rise of FinTech companies and solutions over the past five years has led to a completely new and transformed financial services landscape. Changing customer expectations, cutthroat competition, increasing regulatory complexity, the pressure to streamline operations, and other factors are driving the push for reinvention and innovation. A new era of open banking has enabled systems to quickly and seamlessly integrate with new platforms and applications. Physical banks and paper systems are quickly being replaced by robust networked digital ecosystems.

The types of organizations affected span the gamut—from 100-year-old banks and insurance providers to FinTech start-ups started less than a decade ago. Regardless of whether a business was born in the digital era or is now catching up to it, none remain unaffected.

The digital transformation journey can be challenging. While some organizations have digital transformation in their DNA, the majority will need considerable foresight and planning. They will need to shed old habits, update cultural norms, upskill their employees, and adjust their way of thinking to become a digital business. Learning to connect the dots between digital initiatives, strategy, and business enablement will be critical.

Middle market financial services companies, especially, have a unique challenge: They must learn to navigate the journey without the more robust resources of their larger peers, nor the same level of flexibility and agility as their smaller ones. They must start the journey today—or risk being outranked by the competition or losing industry relevancy.

About the BDO Middle Market Digital Transformation Survey

The 2019 BDO Middle Market Digital Transformation Survey was conducted by Rabin Research Company, an independent marketing research firm, utilizing Op4G’s panel of executives. The survey included 300 C-Level executives in a wide range of capacities for companies with annual revenues between $250 million and $3 billion in the retail and consumer products, natural resources and energy, financial services, and healthcare and pharmaceutical industries. This report specifically focuses on the 100 financial services executives surveyed. Organizations are categorized into two groups, according to their annual revenues: Lower Middle Market: $250-$500M Upper Middle Market: $1-$3B In this survey, the reference, “all organizations,” refers to the average of all 300 survey participants across all industries, while “all financial services organizations” refers only to the 100 survey participants in the financial services industry

Top Financial Services Digital Transformation Trends

1. Digital transformation is a top business imperative.

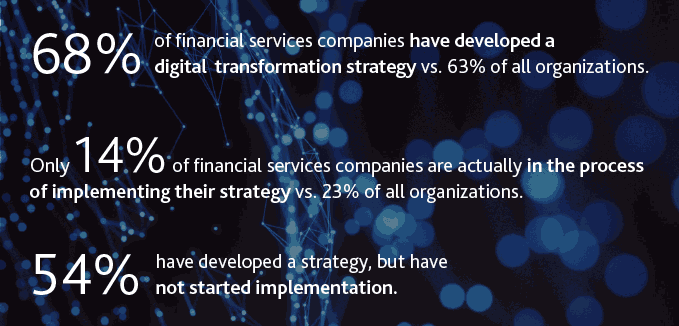

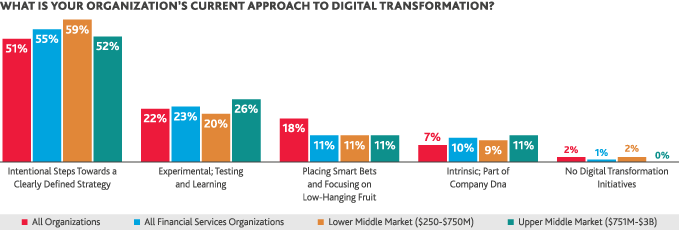

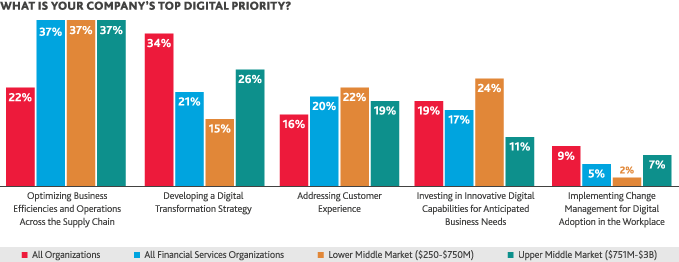

Digital transformation is a business imperative across all industries, and financial services is no exception. Nearly all (97 percent) of financial services firms are making some sort of inroads on digital transformation—whether they’re in the process of developing a strategy or already implementing one. More than a fifth (21 percent) list developing a digital transformation strategy as their top digital priority.

The driver behind it? The rapidly changing financial services landscape. Just take a look at one subsector—banking—for example. While many fundamental banking services (i.e., safekeeping, payments, loans, and investments) remain the same as they were 100 years ago, how banks manage these activities and transactions—as well as how customers expect to receive them—has changed significantly.

At the same time, competition within the sector has ramped up quickly. Once defined by a few well-known intuitions, the financial services world now consists of thousands of new players spanning all sizes, revenue ranges, and services. Big is no longer better or safer—and, in many cases, can even be a barrier to innovation.

Financial services companies know this—and know they have a lot of catching up to do—compared to other industries. While a majority of survey participants indicated they have a digital transformation strategy, many have yet to implement it.

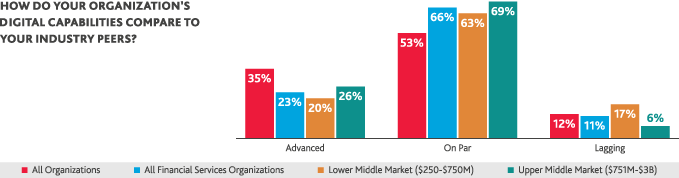

Nevertheless, while most financial services companies have many miles to go in their digital transformation journeys, most (66 percent) see themselves as being “on par” with their industry peers, compared to 53 percent of all organizations.

Meanwhile, only 23 percent view themselves as “advanced” of their peers, compared to 35 percent of all organizations. This perhaps indicates that financial services companies have a more realistic assessment of their own digital capabilities—or understand the significant investment and effort that’s needed for digital transformation to take place. It could also signify that they recognize they still have a long way to go.

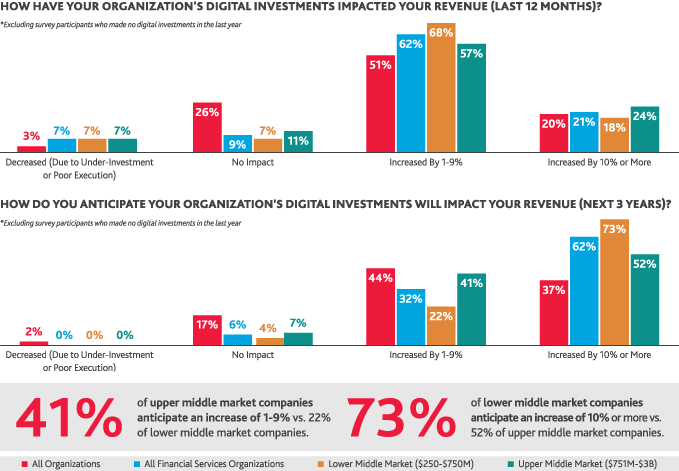

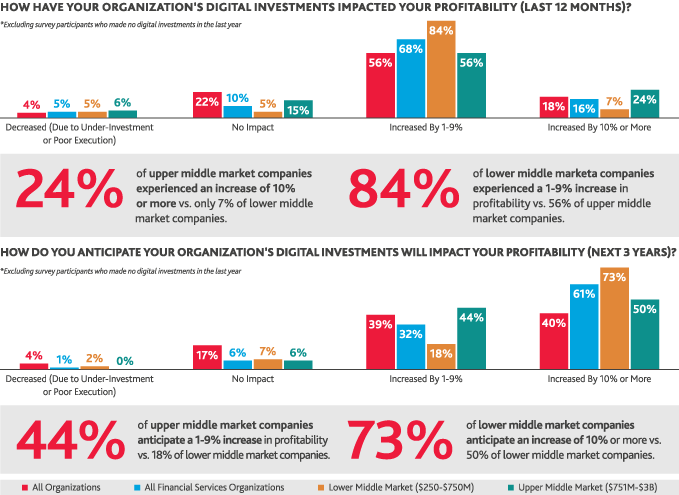

2. Digital transformation brings proven—and highly anticipated—ROI.

The benefits of digital transformation, including improved customer experience and operational efficiency, are clear. As a result, most financial services companies anticipate high returns on revenue and profitability from digital transformation—even more than those in other industries. Lower middle market companies, especially, anticipate the greatest increase in revenue and profitability (10 percent or more) over the next three years, and are thus willing to also increase their spending by the same percentage.

Revenue

Profitability

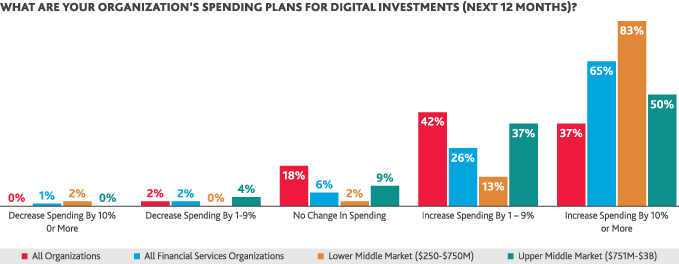

As a result of the proven and promising gains, financial services companies are making significant digital investments. More than half (65 percent) of all financial services organizations plan to increase spending by 10 percent or more (vs. 37 percent for all organizations). Lower middle market firms (83 percent), especially, are planning hefty investments of 10 percent or more.

3. Improving customer experience & operational efficiency top financial services’ long & short-term business goals.

Improving Customer Experience

Customer experience is much more than just customer service. While the latter is usually reactive (and just one component of the former), customer experience refers to a customer’s overall journey from start to finish, including every touchpoint and interaction along the way.

This is evolving rapidly. A few decades ago, the idea of having a good “customer experience” may mean having a pleasant experience at a physical bank or other financial services firm. Today, it may include anything from being able to access an account from multiple channels, to getting a question immediately answered by a chatbot or robo advisor, to receiving automated real-time notifications.

And yet, these are antiquated measures—customers will expect increasingly personalized financial services solutions in the future. They will want to manage all their finances—not just one component—in one place, on the devices convenient to them. They will expect nothing less than real-time engagement when they need it. They will value simplicity, efficiency, and transparency. And they will not tolerate even the slightest possibility of a data breach.

On top of all this, financial services companies are no longer just competing with other financial firms for consumers’ attention, but with any company that’s offering a positive customer experience—including other brands.

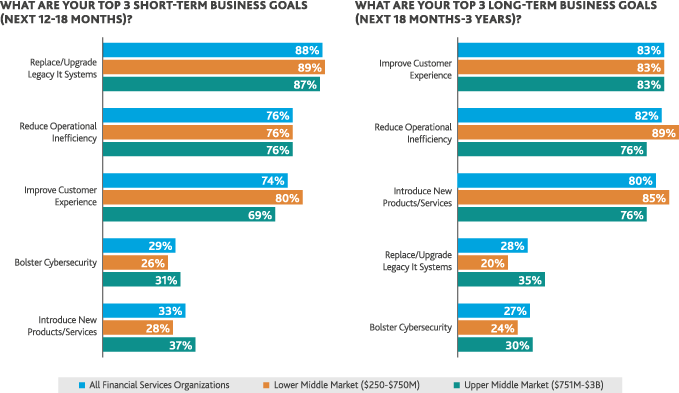

Thus, improving customer experience is 83 percent of financial executives’ top long-term business goal and one of their top three short-term goals (74 percent). Over a fourth (28 percent) cite poor customer experience as their biggest digital threat—significantly higher than all organizations at 17 percent.

Digital transformation can help financial services companies improve their customer experience in many ways—from attracting new customers to simplifying banking. During this process, customer centricity, or a clear focus on meeting customers’ needs, is key.

A significant factor in improving customer experience is introducing new products and services, cited by 80 percent of financial services companies as one of their top long-term goals. This often includes a blend of enhanced FinTech offerings (often developed through partnerships, collaborations, and joint ventures with start-ups, innovation hubs, and accelerators) and more traditional offerings.

Maximizing Operational Efficiency

All businesses want to cut costs, but financial services companies are especially feeling the pressure to tighten their belts. Optimizing business efficiencies and operations across the supply chain is financial services organizations’ top digital priority (cited by 37 percent). Eighty-two percent also cite reducing operational inefficiency as one of their top three long-term goals, and 76 percent point to it as one of their top three short-term goals.

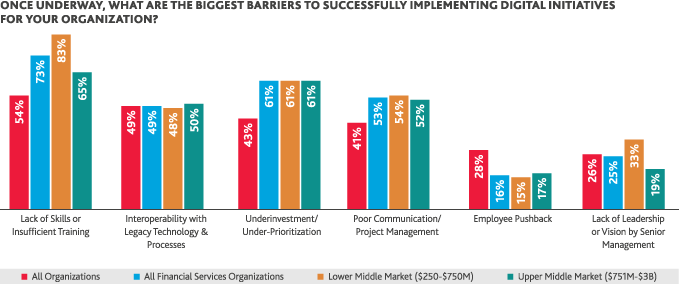

One component of streaming operations is updating legacy IT systems, cited by 88 percent as a top goal for next year. Nearly half (49 percent) state that interoperability with legacy technology is their biggest barrier to successfully implementing digital initiatives. This makes sense, considering that many large (and historic) institutions rely on core systems built 30-40 years ago—making it difficult to develop and integrate new products.

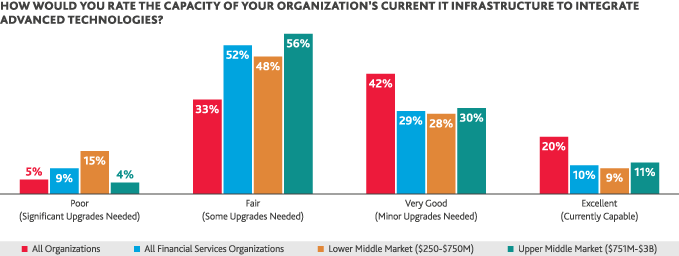

As a result, financial services companies worry more about their IT infrastructure’s capacity to integrate advanced technologies than those in other industries: The majority (61 percent) cite their IT system as “fair or poor,” compared to 31 percent of all organizations. Only 39 percent say it’s “excellent” or “very good” (vs. 63 percent of all organizations).

4. IoT, AI & Blockchain investments heat up.

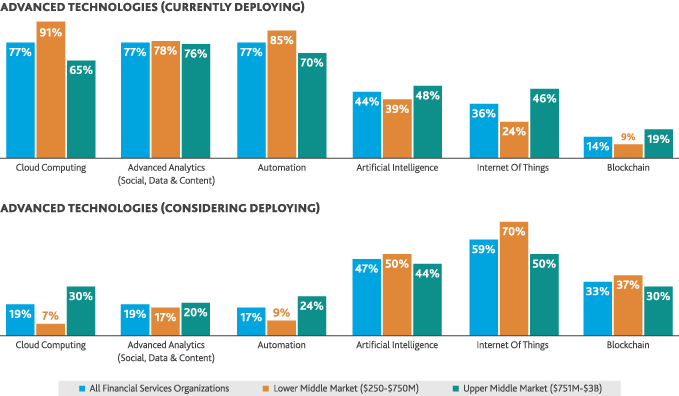

Nearly one fifth (17 percent) of financial services executives say that investing in innovative digital capabilities for anticipated business needs is a top digital priority. Among these include the internet of things (IoT), artificial intelligence (AI), and blockchain, in addition to the advanced technologies they’re already deploying (i.e., cloud computing, advanced analytics, and automation).

Internet of Things (IoT)

The Internet of Things (IoT) has significant implications for financial services institutions. While IoT devices are often more commonly associated with consumer products, the benefits of having real-time data about clients’ physical assets are invaluable to financial services companies looking to improve their current products and services, capitalize on customer purchasing behavior, and create more personalized user experiences.

Common financial services IoT applications today range from providing usage-based insurance to analyzing biometrics data to improve the credit underwriting process. However, many more will emerge. Within an organization, IoT devices, such as smart sensors, can help improve workforce dynamics by tracking employees’ movements and working habits, and reduce building management and utility costs.

Artificial Intelligence (AI)

Advancements in AI have transformed every aspect of the financial services industry. Companies, by using AI to identify transaction anomalies, can better mitigate fraud and money laundering risk. Capital market firms can make faster, smarter trade decisions based on sophisticated analyses of past market performance data. Organizations can conduct customer sentiment and mood analyses and personalize customer experiences based on individual customer profiles—such as suggesting customized portfolio solutions based on each individual’s risk appetite.

Nevertheless, while financial services companies see AI and machine learning-based solutions as opportunities for growth, many are still worried about AI’s younger sibling: automation. Thirtynine percent cite commoditization and automation as their biggest digital threat, higher than 23 percent of all organizations. While robo-advisors, chatbots, and other automated processes can greatly increase operational efficiencies, it could be that job security fears—or the possibility of being replaced—remain.

Blockchain

The industry may still be in its early stages of adopting blockchain and distributed ledger technology, but few companies doubt its huge potential. While cryptocurrency may be the most widely known application to date, blockchain technology could also ensure more secure and automatic payments via the use of smart contracts; strengthen supply chains, trading systems, and claims processing; streamline back office operations; and mitigate fraud risk, among others, by removing friction from processes.

One example of a blockchain solution that’s beginning to revolutionize the industry is blockchain payment systems. Whereas many financial messaging services today take days to facilitate global payments and money transfers (and are often limited to business hours), blockchain-powered systems take a matter of seconds and run 24/7. While it may take some time for them to reach the same level of participation as current payment systems, it won’t be long until they catch up.

Blockchain’s significant promise has a third of all financial services organizations considering its deployment over the next year—a percentage expected to increase in the future. By 2024, the blockchain market is expected to be worth more than $16 billion, according to Global Market Insights, with applications related to identity management anticipated to be the most lucrative, with a greater than 90 percent compound annual growth rate (CAGR) from 2018-2024.

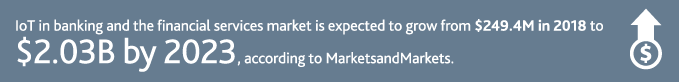

5. Cultivating a strong “employee experience” is critical.

Improving customer experience may be top of mind for most financial services institutions, but equally important is cultivating a strong employee culture. Digital transformation is less about revolutionary technology than it is about changing the way companies work. It’s a mindset shift that hinges not on digital capabilities but on the adoption of those digital capabilities by the end users—employees and customers—and business enablement.

Cultivating this shift—and inspiring organizational behavioral change—starts with tone at the top. The senior-most leaders of a company need to convincingly evangelize the vision and get their employees to understand why they need to leave the status quo behind, believe in the strategy, and engage in the process. They must also strive to cultivate a corporate culture that embraces constant experimentation and learning—one in which short-term mistakes and failures are expected and accepted in the pursuit of long-term innovation and value creation. This can be especially challenging for financial institutions that existed in the pre-digital age.

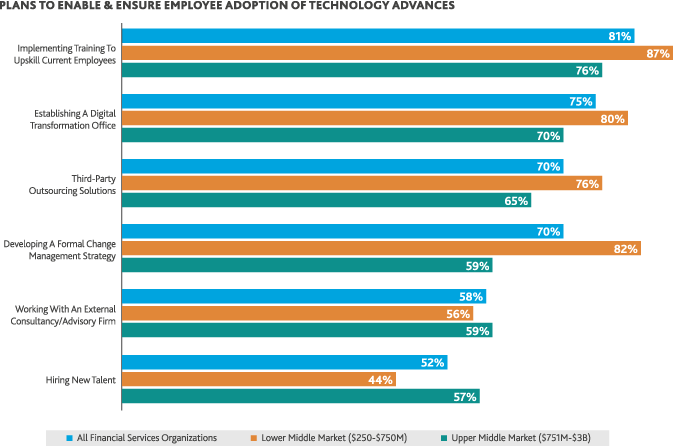

But getting stakeholder buy-in isn’t enough. Nearly three-fourths of financial services executives (73 percent) cite a lack of skills or insufficient training as the biggest challenge to moving forward with a new digital initiative—significantly higher than the 54 percent average for all organizations. While an injection of new talent can help improve overall digital competency, organizations also need to provide current employees with the resources, training, and development they need to be effective as their roles evolve. Companies should consider a formal digital upskilling program—ideally with personalized training modules based on preferred ways of learning—to future-proof their workforce.

6. Strong governance remains a challenge.

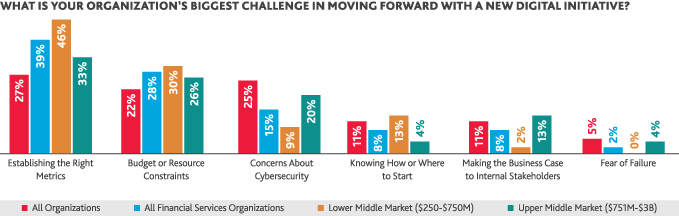

Good governance—encompassing everything from planning and forecasting to implementation and execution—is critical to any company-wide initiative, but isn’t easy. Establishing the right metrics to measure progress is financial services’ biggest challenge to moving forward with a new digital initiative (39 percent, compared to 27 percent for all organizations). This percentage rises to 46 percent among lower middle market companies that may not have as much experience managing initiatives of this scale.

Meanwhile, over half (53 percent) of financial services organizations cite poor communication and project management as a top barrier to successful digital implementation, once underway. A lack of leadership or vision by senior management is another big issue for a fourth of participants, especially for lower middle market organizations (33 percent).

The good news is that the challenges of making the business case to internal stakeholders and employee pushback are lower than the average for all industries—indicating that most financial services companies are aware that digital transformation is a must.

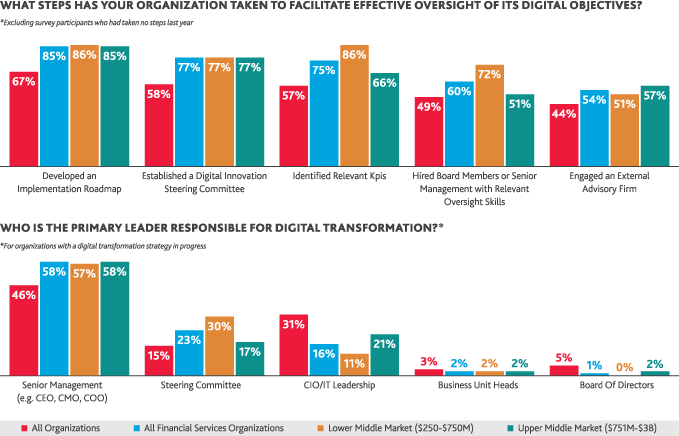

To make digital transformation effective, financial services companies should develop a distinct function within their organization to drive digital efforts—a crossdisciplinary “Digital Dream Team” of individuals to be their champions in the field. Fortunately, more than three-fourths (77 percent) of financial services executives have already established a digital innovation steering committee (compared to 58 percent of all organizations), and 60 percent have hired board members or senior management with relevant oversight skills (vs. 49 percent of all organizations).

THE RISE OF REGTECH: DIGITALIZING GOVERNANCE & REGULATION

If there’s one factor that all financial institutions can agree on, it’s that the number and complexity of rules, regulations, and compliance demands they’re subject to is endless. Not only has the number of regulations increased over the past decade, but so has the number of federal governing groups keeping watch and the costs of compliance (and non-compliance). Regardless of whether it’s the Financial Crimes Enforcement Network, the Financial Industry Regulatory Authority (FINRA), the Office of the Comptroller of Currency (OCC), or another entity, financial institutions can’t afford to let down their guard, even once.

To navigate this intricate network of demands, financial institutions have no choice but to turn to technology solutions for assistance. One notable field that has emerged as a result is regulation technology, or RegTech, designed to help organizations manage their financial compliance demands efficiently and inexpensively. By leveraging cloud computing, data analytics, AI, and other technologies to comb through their mountains of data, RegTech can help shine light on a financial institution’s more granular operations and spot potential areas of risk for non-compliance before the guillotine falls. By not relying on humans alone, RegTech allows institutions to make decisions faster and more accurately, with substantial cost savings to boot.

Again, it’s important to note that technology implementation alone isn’t digital transformation, but a part of the journey. As middle market financial services companies continue to develop and refine their digital strategy and goals, RegTech could be a critical part in helping them manage the day-to-day, so they can spend more time and resources on R&D and innovation.

7. Cyber and data privacy needs to be more of a priority.

Data privacy and cybersecurity will remain a serious problem for decades to come, as attackers use increasingly sophisticated methods and enter through a greater number of entry points due to the proliferation of technology platforms and IoT devices. Financial services companies, with their treasure trove of sensitive client and third-party information, are particularly susceptible to these attacks. Those that experience a breach will face serious consequences, including the loss of money and reputation, as well as legal claims and sanctions.

Unfortunately, many financial services companies are overconfident in their ability to withstand an attack, or are ignorant of the potential causes of their own security failure. Less than a fourth (24 percent) of survey participants cite cyberattacks or privacy breaches as their top digital threat—lower than the average for all organizations (33 percent). The percentage citing cyber concerns as their biggest challenge in moving forward with a new digital initiative is also less than average (15 percent vs. 25 percent).

This is troubling, especially considering the numerous widescale cyberattacks in recent years (i.e. Equifax, WannaCry, NotPetya, etc.). To avoid a similar fate as the victims of these attacks, financial services companies must focus more on detection and response (including real-time defense), shore up internal controls, and implement awareness training for all employees. This starts with defining and documenting potential threats and making that a part of their existing risk management framework. Internal controls, especially related to payment functions, should be in place to keep employees from going around the four-eyes principle and the separation of duties.

Conclusion

|

Growing regulatory pressures and geo-political tensions have increased the burden on companies to not only comply with current and upcoming regulations, but to more accurately predict what’s next on the horizon—and prepare months or years ahead of time. |

|

Evolving customer expectations—as well as increasing competition for their time and attention—have left many institutions scrambling to evolve antiquated business models, prioritize the customer experience, and invest in customerfacing solutions. |

|

Surging cybersecurity and data privacy concerns have left all companies no choice but to shore up internal controls and invest in more robust cyber and data privacy resources, to avoid compliance and reputational risk. |

How BDO Can Help

As your digital solutions partner, we will arm you for the future and help you navigate industry disruption to become a leader in your field.

At BDO, we advise and guide our clients to see digital transformation through to fruition, so they can reimagine the way they’re doing business, and then make it a reality—maximizing value with minimal disruption to their existing infrastructure. Applying our deep industry solutions and extensive experience, our group of talented professionals provide a holistic approach to middle market clients looking for successful digital transformation, using our Digital 3+1 approach..png)

Whether you want to focus on enhancing your customer interaction, increasing profitability through operational excellence, improving your employee experience, or deploying to the cloud for increased agility and flexibility, we’ll help you achieve your goals.

Visit our Technology & Business Transformation Services practice page, or read our related insights:

SHARE