BDO’s 2019 Real Estate and Construction Compass

About the Study

BDO’s Real Estate & Construction practice and Valuation Services & Business Analytics practice analyzed 10 years of CoStar data in the Industrial, Retail and Multifamily sectors. The data was collected on December 3, 2018, and the Study is an analysis of the data coupled with insights from BDO’s Real Estate & Construction practice leaders.

Explore the Compass:

Executive Summary

Ten years ago, the financial crisis wracked the U.S. economy—causing many major companies to fold and bringing others to the brink of collapse.

Across the country, Americans lost their jobs, defaulted on their mortgages and saw their retirement savings devalued. Since the crisis, however, the U.S. economy has undergone an unprecedented period of continuous economic expansion and business growth.

Technological innovation catalyzed this growth, impacting nearly every aspect of how people work, play and live.

Consumers’ preferences, financial status and behavior have also evolved significantly since 2009, reshaping their choices in everything from the cities in which they live to how they buy their groceries.

These forces, along with competition for consumer loyalty, have impacted nearly every aspect of business operations and strategy—ushering in an era where customer service is paramount to success. Even for sectors that aren’t directly consumer-facing—such as distribution and warehousing—consumer tastes and demand directly impact how and where they need to operate to succeed. New technologies allow REITS and other owners and operators to automate aspects of residential building management, while consumer demand for convenience has given rise to rapid delivery systems and flourishing of e-commerce. In addition to these forces, U.S. regulatory policy, most notably tax reform, has impacted business planning, too.

This “new norm” is far from settled—and businesses are waking up to the fact that continual disruption and change is the new status quo.

BDO’s inaugural Real Estate & Construction Compass analyzed 10 years of CoStar data in the Multifamily, Retail and Industrial sectors of real estate to uncover how these forces have shaped the real estate industry since 2009, and the actions real estate businesses need to take to survive and thrive in the new paradigm. Our analysis uncovered that real estate owners and operators will need to become digitally-savvy, consumer-centric and think like urbanists and economists.

“The lines between real estate subsectors are blurring amid disruption via technology and changing consumer preferences. For instance, some real estate operators are converting parts of their spaces into distribution centers or other facilities. We’ll need new names to define these evolving sectors, and new methods and metrics to measure their performance.”

Stuart Eisenberg, partner and national co-leader of BDO’s Real Estate and Construction Practice

For a deep-dive into our analysis and forecast for how the Retail, Multifamily and Industrial real estate sectors are going to evolve, and how real estate companies should respond, read on.

Retail

Beyond the headlines

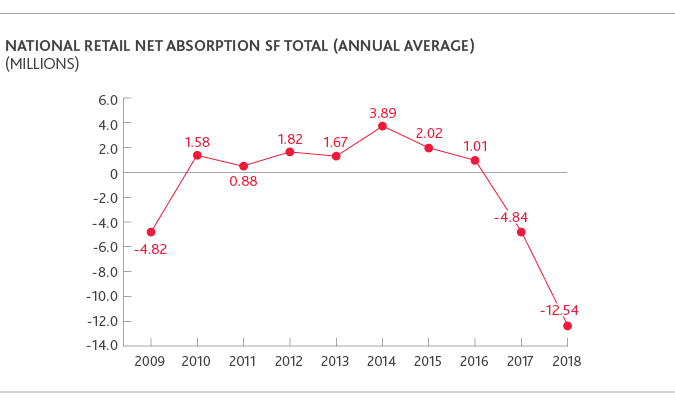

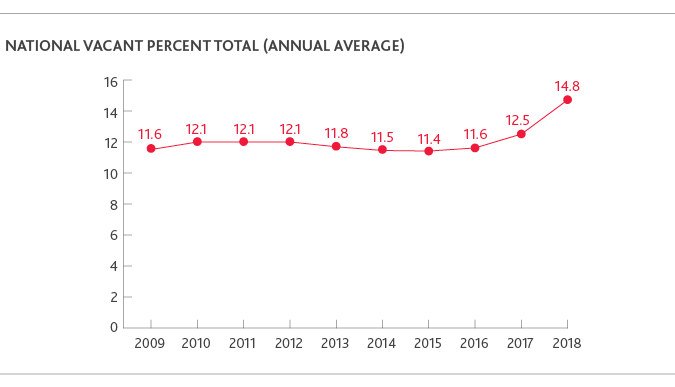

It’s no secret that the past few years have been rough for many brick-and-mortar retailers. As noted in BDO’s biannual Retail in the Red report, several high-profile retailers entered bankruptcy or liquidation in 2017 and 2018, leading to thousands of store closures nationwide. At a national level, vacancy levels are at a ten year high according to CoStar data. In the past two years, absorption rates have plummeted to historic lows and show little sign of recovery.

While some news headlines have described the current situation as a brick-and-mortar retail apocalypse, the reality is far more nuanced. Not all retail is suffering, and in fact, some operators and e-commerce brands are even opening new stores. Smaller, urban-centric startups and brands that have pivoted to unique experiential store design are performing better than the national average.

Spotlight on New York City

|

Retail NYC |

2017 |

2018 |

% change |

|---|---|---|---|

|

Rental rates (NNN per SqFt) |

$76.45 |

$75.58 |

-1.14% |

|

Average Sale Prices (Per SqFt) |

$897.88 |

$884.42 |

-1.50% |

|

Retail National |

2017 |

2018 |

% change |

|---|---|---|---|

|

Rental rates (NNN per SqFt) |

$18.27 |

$18.82 |

3.01% |

|

Average Sale Prices (Per SqFt) |

$198.85 |

$200.27 |

0.71% |

Nowhere is immune: New York City vs. National

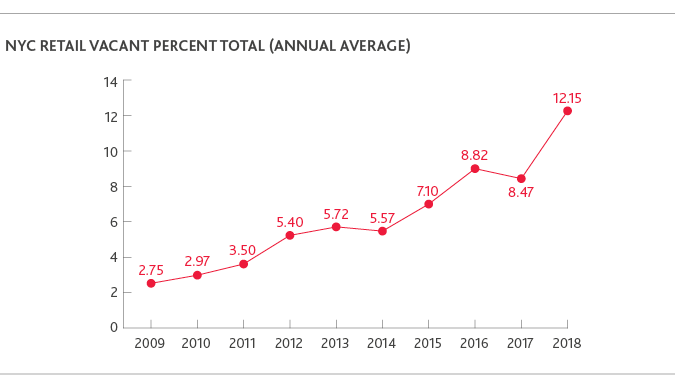

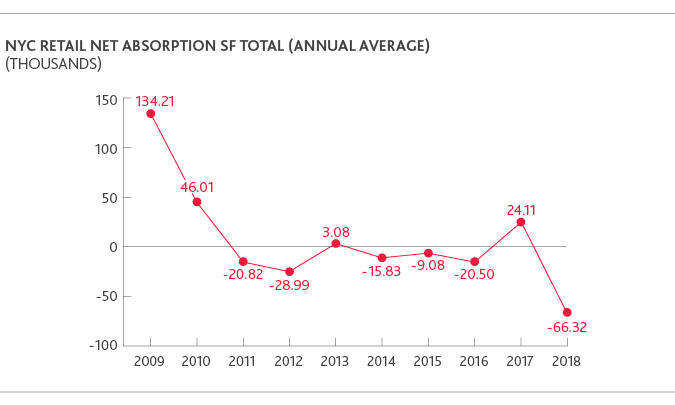

Even in cities like New York City, retail owners and operators are feeling the pain of declining traffic in brick-and-mortar stores. Nationally, between 2017-2018, rental rates rose only marginally, and sales prices fell. In New York City, both rental rates and sale prices fell slightly, while vacancies and absorption rates trend with the national average.

While cities may not escape the trends facing retail in the rest of the country, cities are prime testing grounds for experimental—and often experiential—store concepts. Both established retailers and scrappy start-ups are eager to test new concepts for experiential shopping models to a large number of consumers. For instance, the first Amazon Go stores—which features a cashierless check-out system for Amazon Prime members—were piloted in Seattle, San Francisco and Chicago. Additionally, urban retail space is inherently valuable for its proximity to consumers and potential redevelopment as distribution space.

“While we expect to see more retailers announce bankruptcies and plans to strategically reposition their real estate portfolios through store closures or space reductions, brick-and-mortar retail is far from dead. The developing industry wisdom is for retail operators, especially those of class A properties, to redevelop and reposition their properties to include lifestyle, experiential entertainment, office, or residential amenities. We’re likely to see that strategy continue to gain in popularity and see how it begins to pay dividends for some of the earliest adopters.”

David Berliner, partner and national leader of BDO’s Restructuring & Turnaround Services practice

Prioritize in-person experiences, but don’t get caught up in fads:

Photo booths, flower walls and other picture-perfect displays look pretty on social media, but they don’t often relate to the product being sold. In 2018 a plethora of Instagrammable stores, pop-ups and other gimmicks appeared that didn’t enhance the consumer experience or relate to the brand. While we believe that retailers need to emphasize experiential shopping to compete with online operators, brick-and-mortar operators will need to design experiences that bring value and enhance the shopping experience. For instance, a store that sells activewear might allocate space for a yoga studio and host free classes for members of a loyalty program.

Not all cities are destined for glory

In the past decade, a narrative of secondary and tertiary city revitalization has taken root as cities pour resources into upgrading their downtown areas and encouraging growth. Not all these rising stars are destined for long-term success, but they’re often lumped into the same category of cities experiencing a renaissance. Cities like Portland, Austin, Nashville and Milwaukee do have some characteristics in common, but owners and operators would be mistaken to bundle them together when making investment plans.

When planning business strategy, companies need to dive deep into the local forces shaping each market. Does the city have adequate public transportation options, or plans to build a network? How close is the city to other established urban areas? Are there popular universities, and are they growing? And, of course, companies need to examine cities under a state and local tax lens to compare their potential total tax liability between cities in different states. In the next ten years, we’re likely to see a divergence between these secondary or emerging cities as clear winners and losers arise from the fray.

Pivot to distribution

By virtue of location alone, retail real estate in urban areas is valuable for its proximity to consumers. Retail real estate investors in cities may consider pivoting some of their retail space to include distribution, either for existing retail tenants or other companies or startups. These new distribution spaces would be attractive for companies seeking to build out their rapid delivery capabilities without having to purchase new and expensive urban space.

Multifamily

Multifamily market: Hot to cooling

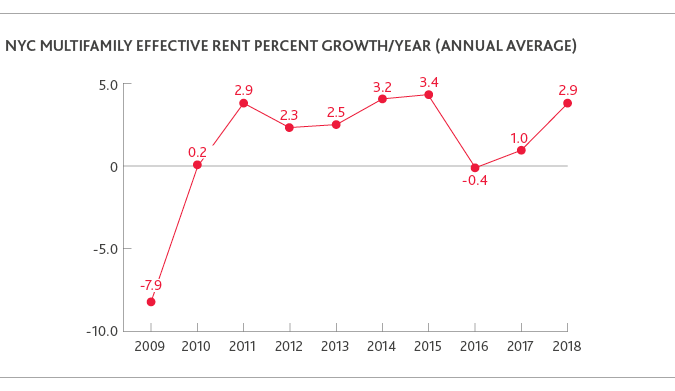

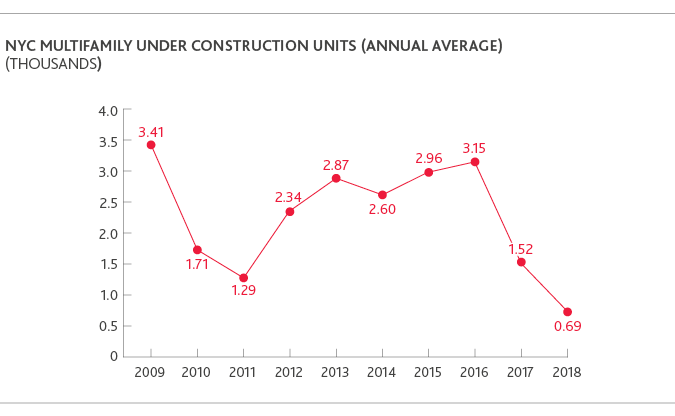

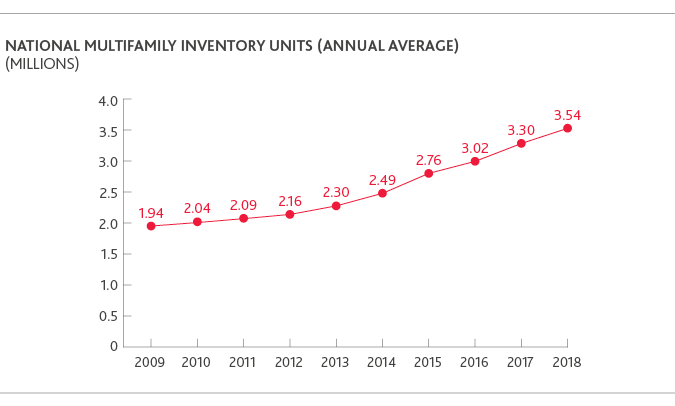

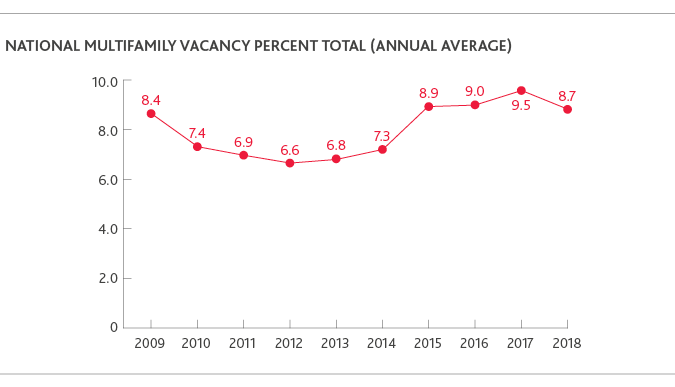

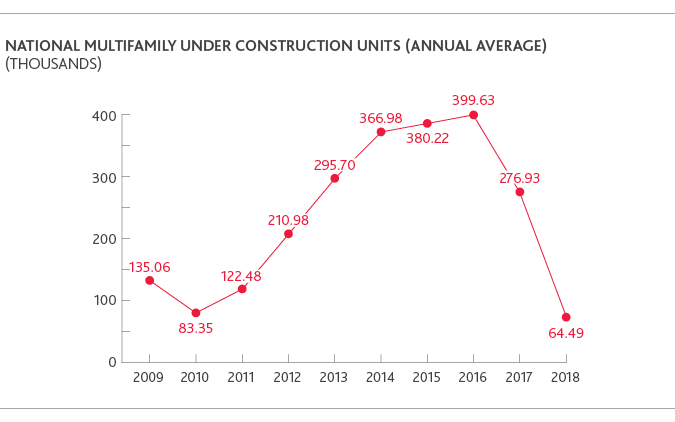

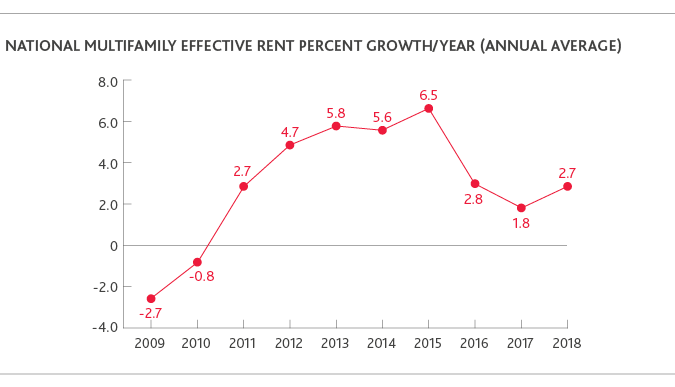

The multifamily market has performed extremely well over the past decade. As homeowning becomes more difficult for most Americans, demand for rentals is at an all-time high. Multifamily inventory by units nearly doubled in the past decade while vacancy rates have remained relatively low. According to CoStar data, it does appear that 2016 was the peak for the subsector regarding rent growth and new construction. After 2016, rental rates declined for the first time since 2009 both in New York City and nationally, and the number of new units under construction fell precipitously beginning in 2016 as well. While rental rates in New York City have recovered slightly, they aren’t likely to grow beyond their 2016 peak in the long-term. All signs point to a market that has passed its peak and is cooling off, in part due to a supply glut. Despite sustained demand for multifamily rentals, the oversaturation of primary markets has caused rental rate growth to cool and created a need to look elsewhere for opportunities.

Where to next?

At present, multifamily REITs, developers and investors are struggling to find viable new projects. Their ideal targets are markets where rents have room to grow and that are likely to attract new residents. However, most primary markets have topped out in rent growth and supply. Additionally, cap rates have generally compressed in these markets—resulting in lower return expectations. In New York City, rent growth and new units under construction closely track the national average, and other primary cities are seeing similar conditions. Demand is also shifting away from Class B properties in favor of Class A properties, raising investor concerns about the long-term outlook for Class B properties’ performance.

“In a market with high supply, multifamily REITS and other owners and operators will need to deploy strategies aimed at retaining their current tenants and attracting new ones from competitors. To do this, they’ll need to upgrade or add lifestyle amenities to their properties based on their target demographics’ specific tastes. Gyms, community spaces, rooftop lounges, high-speed internet connectivity, and even rapid delivery kiosks are just a few amenities that multifamily operators might add to differentiate themselves to retain and attract tenants.”

Steven Kurtz, managing director in BDO’s Valuations Services & Business Analytics Practice

“Many investors are seeking to improve returns by accessing capital through formation of funds to develop properties located in opportunity zones. Opportunity zones incentivize investors to lock their capital away long-term, which might be a perfect match for the proposed holding period of a real estate development project.”

Marla Miller, tax managing director in BDO’s National Tax Office

To discover new opportunities, multifamily investors, REITS and developers will need to step outside their comfort zones and into markets where they may not have familiarity. They’ll need to turn their attention to fast-growing secondary cities or tertiary cities to achieve acceptable returns on investments.

Determining a viable opportunity in an unfamiliar market is no easy task. Multifamily developers, REITs and other investors will need to perform a holistic, urban analysis that considers demographics, infrastructure, concentration of corporate campuses or universities, and any local political initiatives underway to support or facilitate the city’s growth. This latter category is vitally important. While any city can label major public investments as “growth,” a bad investment remains a bad investment. Investors need to perform the same kind of due diligence on an emerging city or opportunity zone fund as they would for any transaction in a market they know well. There’s no single metric for what a “bad” revitalization plan looks like, but one major indicator is if a municipality has not done its own homework and is just attaching buzzword-projects like “bikeshare,” “walkable downtown” and “arts district” without demographic or data-driven evidence to support their efforts.

Spotlight on Construction

Hedge against tariffs and labor woes by investing in technology.

Multifamily developers will also contend with skilled labor shortages and material price increases due to the U.S.’ steel and aluminum tariffs. For years, the construction industry has warned that skilled labor shortages are hindering productivity despite an otherwise positive industry outlook. In fact, the sector lost 2.3 million jobs between 2006 and 2011.

While the demand for skilled craftspeople has continually increased, fewer young people are entering the industry. Potential recruits just don’t see construction as an attractive and viable career option, especially when other sectors are considered more tech-savvy and offer perks that appeal to millennial workers. To navigate these conditions and hone their competitive edge, developers should adopt a bifurcated strategy: invest in new technologies to streamline operations and lower costs from blueprint to final product, and invest in the workforce through retraining initiatives and by bolstering their talent pipeline.

New technologies, such as 3D modeling, virtual reality, machine monitoring, big data and analytics, robotics and artificial intelligence, can provide significant value to developers. For instance, 3D modeling and virtual reality can be deployed to ensure crystal-clear communication between architects, engineers and project managers. Self-operating machinery could allow projects to continue work overnight with limited human oversight and remove workers from otherwise dangerous jobs.

Skilled workers will always be in high-demand, but autonomous machinery can augment human labor to increase safety, speed and efficiency. Construction companies need to ensure that they match their investment in technology with investment in their workforce. The construction industry has a workforce that skews older, so retraining initiatives will likely take priority. Construction companies also need to think about the future, and to attract the next generation of workers, they’ll need to make a compelling case for more people to pursue careers in the sector and demonstrate a commitment to new technology and innovation.

Ian Shapiro, partner and national co-leader of BDO’s Real Estate and Construction Practice

Industrial

Spotlight on Distribution

A rising tide lifts all boats

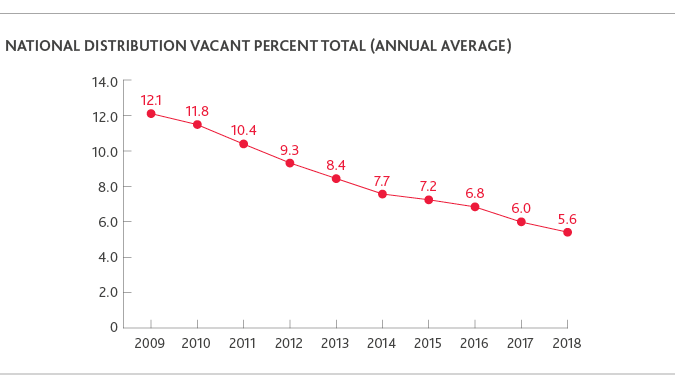

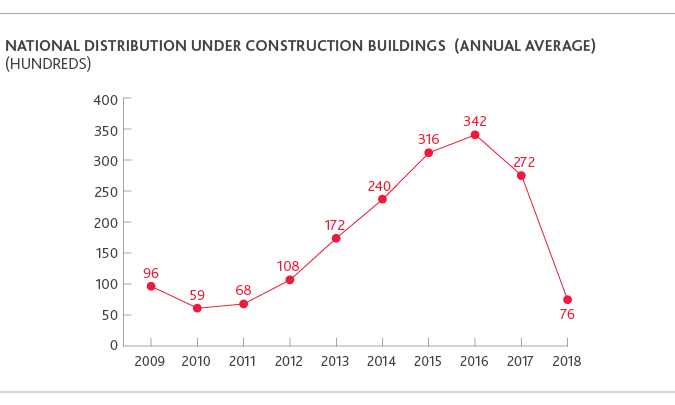

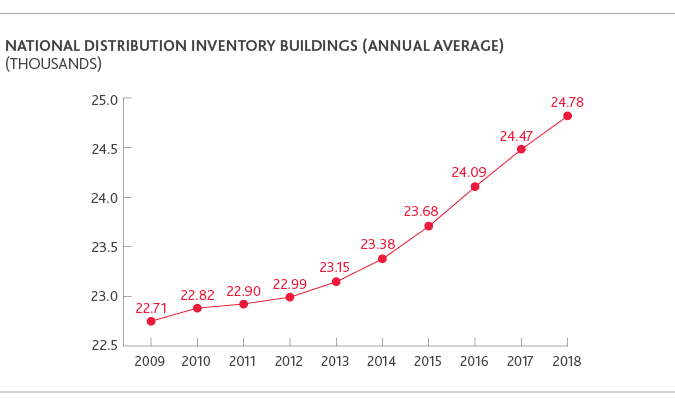

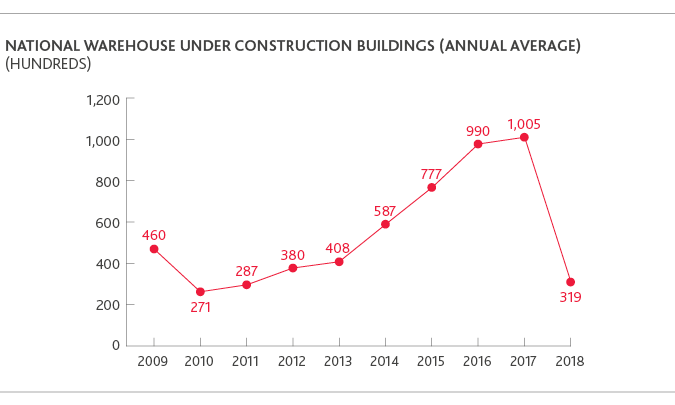

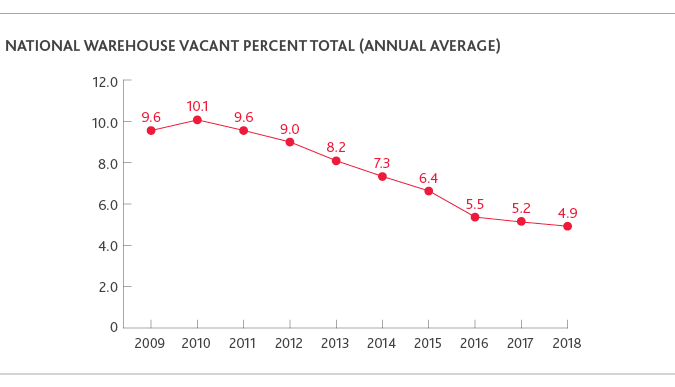

Since the 2009 crisis, distribution center inventories have increased every year, while vacancy rates have continuously declined. These trends indicate strong performance and underscore the impact online retail and last-mile delivery has had on this subsector of real estate. In the race to be as close to the consumer’s doorstep as possible, demand for distribution space near and in cities has increased significantly. New construction declined in 2018, however, likely a result of tariff and trade disruptions. Many distributors have adopted a cautious approach as the future of the U.S.-China trade relationship remains unclear. Until tariffs are settled, many distributors may hold on making new real estate investments.

Urban is the new opportunity

A result of the race for convenience, distribution real estate near cities is likely to remain in high demand. While there’s been a decline in new buildings under construction, pending the outcome of the U.S.-China tariffs, we’re likely to see inventories continue to increase and vacancies to remain low in the coming years. When determining where to invest next, REITs, developers and other investors will need to scout for cities that still have room to grow from a supply perspective and where competition among retailers for the quickest delivery systems is robust.

Invest in technology

Advancements in drone technologies, machine learning, robotics, artificial intelligence and other technologies present huge opportunities for owners and operators of distribution facilities. These technologies—all part of the fourth industrial revolution—can allow distributors to streamline processes, lower costs and even discover new efficiencies.

An overlooked opportunity?

The Panama Canal expansion

In 2016, the Panama Canal Expansion project was completed—adding a third lane to the vital shipping infrastructure. The expansion project was initiated to accommodate container and bulk ships that are too large for the canal’s original design, which have been dubbed “Neopanamax” size. The new lane was first opened in 2016, though it will still be some time before its effects fully manifest. REITs, investors and developers in the distribution sector should be factoring the anticipated increase in goods shipped through the canal into their long-term planning. If there are cities and ports that multiple companies begin to favor as a result of the expanded canal, they may be prime targets for new distribution infrastructure.

“As retailers look to enter the distribution game, owners & operators of distribution need to make sure they’re not left out of the equation. They need to make a convincing price and value-driven case for why retailers should choose them rather than converting their own space into a distribution center.”

Anthony La Malfa, partner in BDO’s Real Estate & Construction Practice

Industrial

Spotlight on Warehouses

E-commerce impact

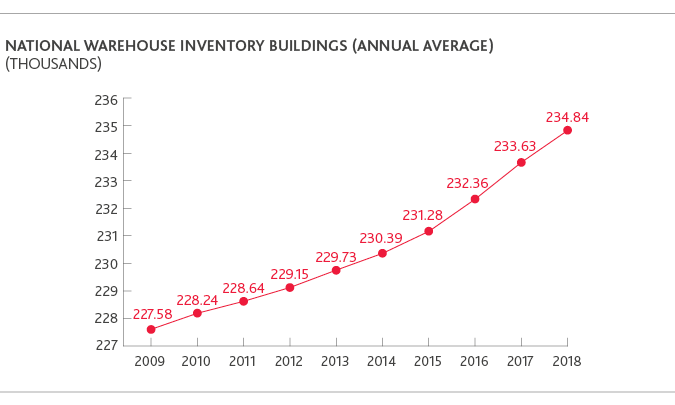

The rise of e-commerce and sustained economic growth has been a boon to warehouse owners and operators. Simply put: increased demand for items ordered online rather than bought in stores means there needs to be places to store those goods. Consequently, warehouse inventory has steadily increased since 2009 while vacancies have declined, indicating a strong market. Growth is smaller compared to the distribution sector, however.

Flexible warehousing

Unpredictable and quickly-changing buying patterns have given rise to a new trend: flexible warehousing. Rather than being locked into a multi-year contract, retailers are engaging with companies that rent out warehouses for shorter periods of time, the Wall Street Journal reports. This is particularly important for the holiday season, when companies want to have inventory as close to consumers as possible without having to invest in a property for a full year when demand may not be adequate.

Raise the roof

Rather than build entirely new structures, it’s often more cost-effective for warehouse owners and operators to retrofit warehouses with new technologies and expand their size. Warehouses are usually enlarged by raising the roof in six feet by six feet increments. When coupled with robotics, artificial intelligence, drones and other technologies, warehouse owners and operators can more effectively and safely manage a taller warehouse than if they relied on solely human labor. Industrial REITS and other owners and operators are likely to continue relying on expanding space upwards, rather than invest in entirely new properties or building new structures. This will especially be true in primary cities and growing secondary cities, where it may be pricier and more difficult to secure additional properties rather than expand existing assets in prime locations.

Conclusion

What lies ahead?

Amid a confluence of forces impacting the sector, real estate companies will need to analyze a variety of qualitative and quantitative data. They’ll need to monitor traditional economic indicators like interest rates, keep their fingers on the pulse of culture to monitor consumer tastes and factor in any major regulatory changes to tax or accounting.

They’ll also need to examine cities through a new lens: the consumer’s perspective, to determine whether a specific place is a viable investment. To accomplish this goal, they’ll need to look at the local political climate to determine if there is support for measures that would improve retention and attract new residents, such as a desired public bikeshare program or upgrades to public transportation. Among many other considerations, they’ll also need to assess if any major companies are opening or expanding their corporate campuses, and how the city might be impacted by an influx of new residents.

Real estate owners and operators need to adopt the mindset that the real estate landscape is in a continuous state of disruption and change at a rate faster than historically seen. And perhaps most importantly, know that staying still spells disaster.

SHARE