2019 BDO IPO Outlook

Explore the 2019 BDO IPO Outlook:

Boom or Bust? What’s Ahead for IPOs in 2019

At the end of 2018, the stock market contracted, but capital markets executives seem…unfazed?

According to Renaissance Capital, 190 companies pursued IPOs in 2018, raising $46.8 billion. The number of filers increased 19 percent and proceeds increased 32 percent over 2017’s strong results. After a selloff in the fourth quarter, newly listed companies underperformed and IPO issuances slowed.

Between the market movement, trade war and public battles between the White House and the Federal Reserve, you’d think that a tepid IPO climate is ahead. But capital markets executives surveyed in December are resilient, even optimistic, in the face of volatility.

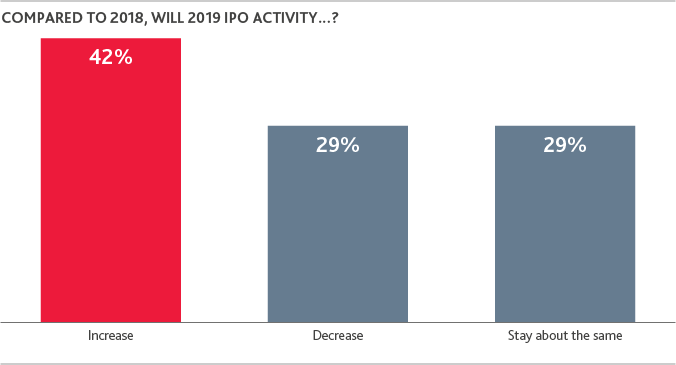

Forty-two percent say IPO activity will increase in 2019, even though a majority expect a further market correction will occur this year.

Why are bankers so bullish even when expecting further market moves? The 2019 BDO IPO Outlook Survey, which polled 100 capital markets executives at leading investment banks in December 2018, suggests that the pro-business climate, strong performance of most IPOs and potential for long-term growth was keeping market worries at bay.

Enter the shutdown. The partial government shutdown that began at the end of 2018 extended to the Securities and Exchange Commission, delaying IPO plans for many companies. While companies may be delayed in their IPO journey, we anticipate many will be undeterred in their plans; while still others may be forced to seek alternative capital-raising strategies.

“It’s fair to say there are mixed economic signals. Market dips are generally followed by a rally, employment figures continue to be strong, and major players - like ride-share companies - still appear to be moving along in their IPO plans. But the government shutdown that lasted through the beginning of 2019 is an X-factor. With the SEC delays in completing reviews, Q1 results may lag, but long-term growth opportunities could still drive a comeback.”

LEE DURAN

LEE DURAN

Capital Markets Partner

BDO USA, LLP

Will IPOs Build on a Banner 2018?

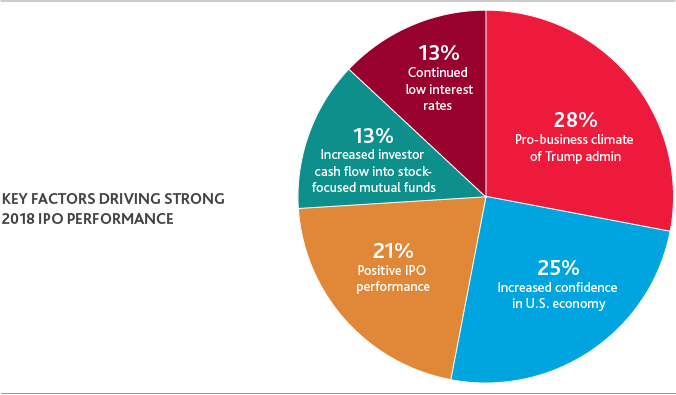

2018 was the best year for IPOs since 2014, and bankers point to a few key success factors. The pro-business climate of the Trump administration, increased confidence in the economy and positive IPO performance are most credited with last year’s strong returns. In last year’s BDO IPO Outlook Survey, more than two-thirds (68 percent) of the capital markets community predicted President Trump and the Republican-controlled Congress would have a positive impact on the U.S. IPO market, and this seems to have proven true up to this point. Tax rate cuts, passed in December 2017, drove strong earnings and a boost to economic performance in most industries.

However, the World Bank forecasts a slowdown of growth in the U.S. as the impact of tax cuts wanes and the national debt weighs on expenditures. Meanwhile, change in control of the House of Representatives, ongoing trade tensions and battles over Federal Reserve policy has ramped up political and economic uncertainty.

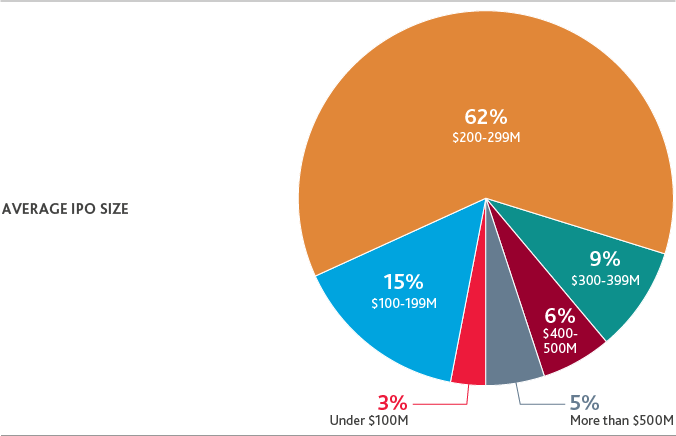

Despite the volatility, 71 percent of bankers surveyed in December predicted IPO activity will increase or stay about the same in 2019. A majority of capital markets executives (61 percent) expect the average size of U.S. IPOs will be in the $200 million to $299 million range, which is on par with 2018 averages. However, if a number of the highly-valued tech and biotech companies follow through with going public in 2019, it may be a record-breaking year for total capital raising.

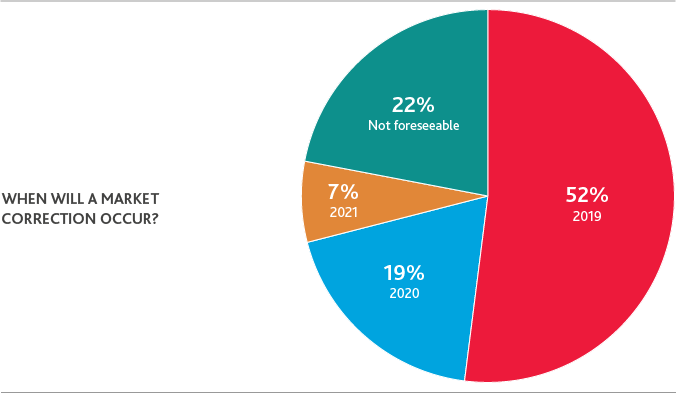

This optimism came even as 52 percent of bankers forecasted a market correction in 2019, and respondents were watching real-time declines throughout December. A correction did hit at the end of the month, and the S&P 500 ended 2018 with its worst annual performance since 2008.

Is the worst over? Interest rates rose four times in 2018, suggesting confidence in the economy at the Fed (even as President Trump blamed rate increases for the selloff), but bankers appear to believe there’s more market change ahead. Only about one-in-five executives did not foresee a market correction.

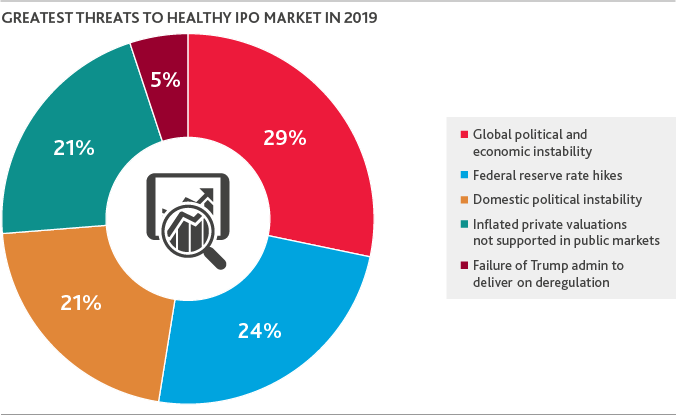

Bankers are divided, though, on whether market factors will be the biggest threat to a healthy IPO landscape this year. While 29 percent say that global political and economic instability is the greatest threat, executives also point to Federal Reserve rate hikes, domestic political instability and inflated private valuations at nearly the same levels. It’s critical to note that the global markets—impacted by Brexit, among other risks—are deeply intertwined with U.S. performance.

Capital markets executives will continue to watch the dynamic between President Trump and the Federal Reserve. Last year, just 13 percent of bankers considered rate hikes the greatest threat to IPOs, compared to 24 percent of bankers this year. President Trump has voiced his desire for low rates, and tensions rose after Chair Jerome Powell raised rates for the fourth time in mid- December. Still, expectations are that the Fed will hold off on further rate hikes this year, which may stave off market volatility caused by a potential change in Fed leadership.

.png)

You Jump, I’ll…Watch?

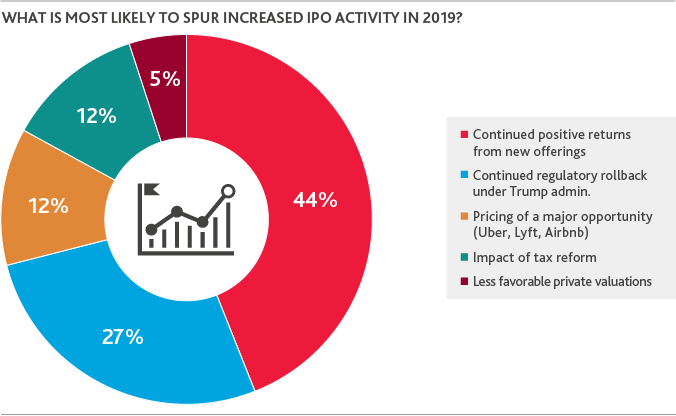

While bankers are divided on the biggest risks, they largely agree that the key for positive IPO activity in 2019 will be positive returns from new offerings. So, who will lead the way?

The biggest names in consideration are the ride-share companies, Airbnb, Pinterest and WeWork, as well as a few companies like Beyond Meat who delayed 2018 filings. Each of these unicorns have been valued at over $10B, with Uber valuations reaching as much as $90-120B, according to The Street. Twelve percent of bankers say the pricing of one of these highly-valued companies is most likely to spur increased IPO activity this year.

Both rideshare companies filed confidential IPO documents and appeared to be heading toward Spring debuts, though recent turbulence and the shutdown could delay those plans. Indeed, all of these large companies have a hard decision to make: proceed now, or wait and hope that conditions stabilize. If the market gets worse before it gets better, valuations could dip further. Recent earnings forecast revisions from companies like Apple could also be weighing on their minds.

What happens to the early filers of 2019 and the first company to price is likely to set the stage for the remainder of the year.

Bankers also suggest that continued regulatory rollback under the Trump administration could be a further boon to the IPO climate, but given the congressional agenda and priorities post-shutdown, positive changes there seem less likely.

Where are the Best Opportunities?

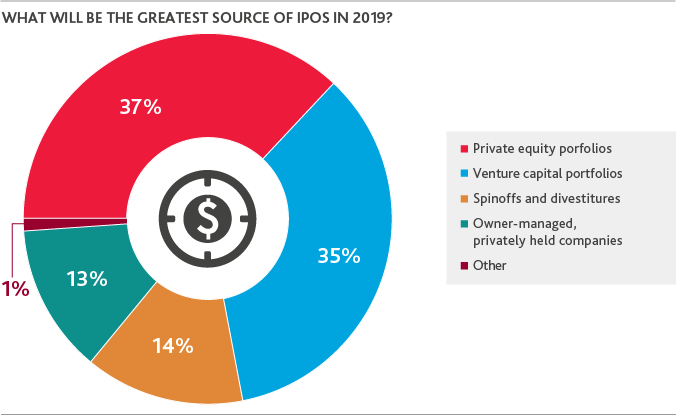

Bankers expect that private equity and venture capital portfolios will generate the most IPOs this year, with PE slightly edging VC for the top source. This would mark a change from 2018. Renaissance Capital reports that 44 companies went public with PE backing in 2018, a minor decline from 2017, but earning strong proceeds. Venture backed IPOs, however, accounted for 46 percent of 2018’s total IPOs, with 88 companies going public—the highest deal count and returns in four years.

But the IPO market has fundamentally changed from the flurried pace of the late 1990s. Offerings remain well below the all-time high of 486 in 1999 and are likely to stay that way in the near future. A clear majority of survey respondents (82 percent) said that wide availability of private financing at attractive valuations, high M&A activity and more discerning investors are behind the overall decrease in IPOs during recent years. While bankers agree deregulation has been important to the IPO environment, just 18 percent suggest that excessive SEC regulations are the chief factor behind the long-term change in volume.

“While PE funds will likely continue to see IPOs as an exit opportunity in 2019, funds are also swooping in to acquire pre-IPO companies, particularly in the tech sector. Though we still see ample opportunity ahead for IPOs, with the market in question and private financing still available, M&A may be another popular strategy.”

SCOTT HENDON

SCOTT HENDONNational Private Equity Practice Leader and Partner

BDO USA, LLP

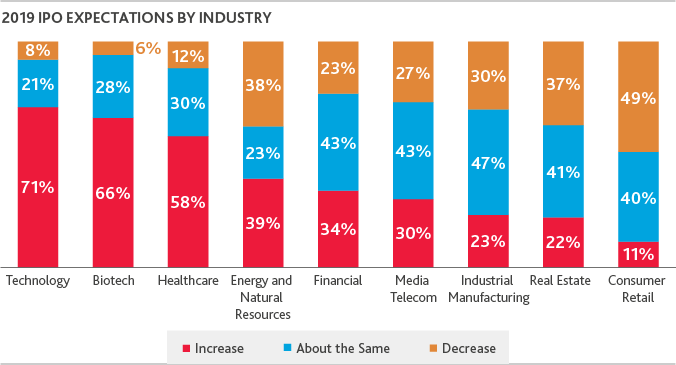

Bankers’ expectations also vary widely by industry. A vast majority of executives expect IPO activity will increase in the technology, biotech and healthcare industries, while consumer retail and energy filings could decline. In terms of 2018 deal count, healthcare topped IPOs with 76 companies raising $9.1 billion, while 52 tech offerings raised $18.4 billion, according to Renaissance Capital. Meanwhile, biotechs set industry records for capital raised, reaching $6.3 billion.

Technology and biotech will likely be the most closely watched in the year ahead. Most of the highly-valued companies expected to seek IPOs this year are in the tech sector, while the biotech sector is hoping to capitalize on a flurry of megadeal activity at the start of the year. Despite a selloff of biotech stocks at the end of 2018, Bristol-Myers Squibb and Eli Lilly announced acquisitions totaling $82 billion, suggesting that temporarily weaker stock value will not deter major strategic players who need to prioritize their pipeline. If IPO seekers shake off market volatility, as these large buyers did, it could bode well for another strong year. However, with the shutdown impacting SEC reviews in January, some biotechs who don’t have the luxury of waiting may look to alternative opportunities including M&A to fulfill capital needs.

Manufacturing and industrials could be another interesting industry to watch. Industrials accounted for five of the largest 2018 IPOs, according to 24/7 Wall Street, but expectations are tempered for 2019 likely due, in part, to trade and tariff costs and concerns.

.png)

“Across industries, companies with promising growth stories and solid operations still have multiple avenues for growth. If the tech unicorns advance in their plans to price this year, bankers expect they will dominate the market, but there is still healthy interest across most industries.”

TED VAUGHAN

TED VAUGHANCapital Markets Partner

BDO USA, LLP

Sector Spotlight: Technology

A year of unicorns?

Can 2019 match 2018’s strong year for IPOs?

On one hand, according to the BDO Technology Outlook Survey, 46 percent of tech executives expect U.S. tech IPO activity in 2019 will stay about the same as last year—in other words, quite high. A robust pipeline of mega-unicorns and growth-stage companies, set against the background of a strong economy, holds ample promise.

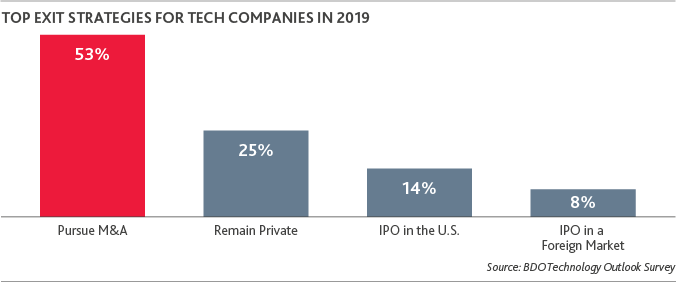

On the other hand, going public may no longer be the most attractive option for high growth companies looking to take the next step. As opposed to doing an IPO in the U.S. or a foreign market, most executives expect that pursuing M&A instead will be the most popular “exit strategy” among private U.S. tech companies in 2019, followed by staying private.

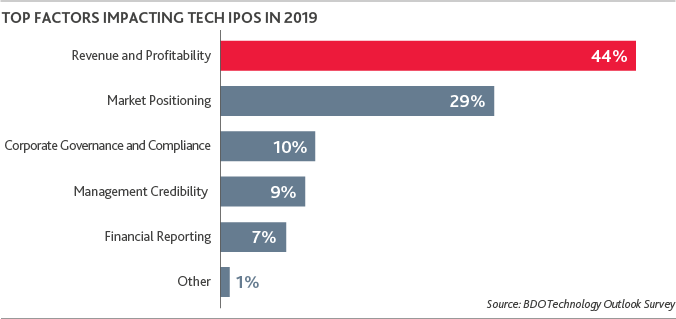

Meanwhile, other headwinds threaten to stall IPO growth. External factors, such as volatile markets and geopolitical tensions, may jeopardize companies’ public debuts, while internal factors, such as poor market positioning or profitability, may lead executives to harbor second thoughts.

Meanwhile, other headwinds threaten to stall IPO growth. External factors, such as volatile markets and geopolitical tensions, may jeopardize companies’ public debuts, while internal factors, such as poor market positioning or profitability, may lead executives to harbor second thoughts.

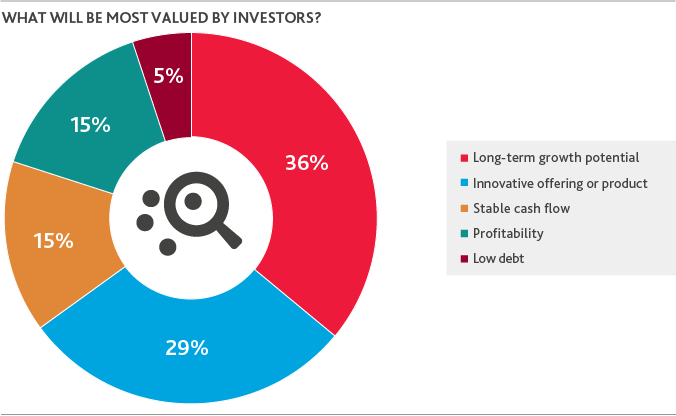

Investors in it for the long haul

Investors in it for the long haul

Outlook for Nontraditional Opportunities

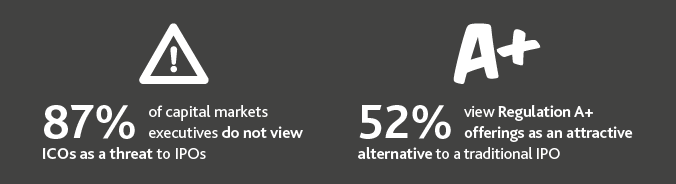

2018 saw more initial coin offerings (ICOs) than 2017, but with dwindling returns, according to ICObench. The high risk, high reward aspect of crypto was certainly on display in 2018. While some start-ups raised hundreds of millions in capital, crypto consulting firm Satis Group reports that roughly 80 percent of ICOs were scams, and the SEC and regulatory bodies are understandably taking a close look at the practice.

With these risks and declining performance in mind, it’s no surprise that the vast majority of bankers do not view ICOs as a threat to traditional IPOs. In fact, bankers’ concerns about ICOs have declined further from 2017 levels when 19 percent saw them as a threat; this year just 12 percent of bankers expressed concern.

On the flip side, more than half of capital markets executives see Regulation A+ offerings as an attractive alternative to a traditional IPO and expect to see more interest in that category for smaller companies in the year ahead.

“Despite additional clarity from the SEC on publicly traded cryptocurrencies, most ICOs pose a degree of regulatory uncertainty. Regulators are committed to be responsive to market innovations and evolve their oversight approach as new needs arise. However, new financial products are already in the marketplace and on the near horizon, and equally important, mainstream industry acceptance is accelerating.”

GREG SCHU

GREG SCHU

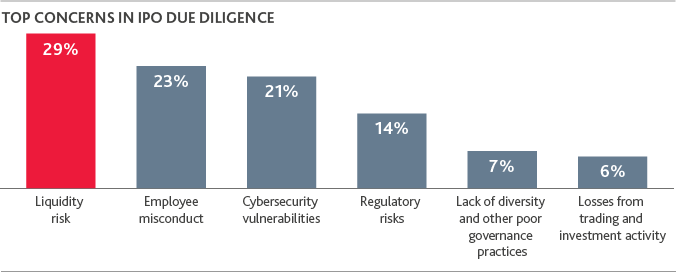

While external risks are unpredictable, IPO seekers should take heed of potential hurdles that can come up in the due diligence process. It’s common knowledge that companies will need strong governance and financial reporting functions to go public, but investment bankers also point to liquidity risks, employee misconduct, and cybersecurity vulnerabilities as three top concerns if uncovered in the due diligence process. Lack of diversity and other poor governance practices are also a concern, particularly in the wake of high-profile issues at major public and IPO-seeking companies.

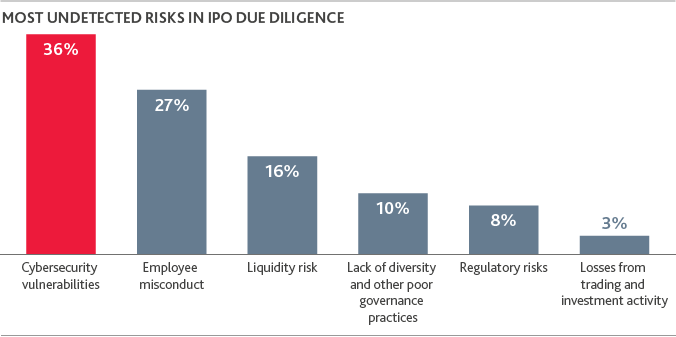

According to BDO’s 2018 Board Survey, when asked if their board was addressing the issue of board diversity, 81 percent of directors surveyed said yes—a marked increase from 2017, when only 66 percent of respondents said the same. Still, nearly one-fifth (19 percent) of directors believe their board has room to grow on this measure, and only 33 percent say their board uses formal diversity reviews to address the issue. As scrutiny from investors, stakeholders and consumers intensifies, companies would be wise to consider the health and sustainability of their whole enterprise, not just their financials. An analytics-based approach to due diligence has also changed the preparation process, but bankers say that undetected risks remain. Chiefly, 36 percent say cybersecurity vulnerabilities are most often undetected while 27 percent say employee misconduct can be missed in the process.

“In this highly competitive business environment, it’s more critical than ever to perform pre-IPO due diligence. A company’s reputation is vital to its value, and the consequence of not conducting a thorough investigation can potentially lead to financial repercussions, as well as damage to future business relationships and the brand.”

TIMOTHY MOHR

TIMOTHY MOHR

Forensic Investigation & Litigation Services National Practice Leader

BDO USA, LLP

Companies should be sure that cybersecurity is a key part of the IPO planning process, as well as their long-term strategy. Indeed, the SEC will insist upon it. Last year, the SEC released interpretive guidance to assist public companies in preparing disclosures about cybersecurity risks and incidents.

In the wake of this guidance, 58 percent of public board directors told BDO their company had conducted readiness testing of a cyber risk management program and 53 percent implemented new cyber risk management policies, but there’s more work to be done. A quarter of public boards said their organization had taken no steps to address the SEC cyber disclosure rules.

“Companies considering IPOs in 2019 and beyond need to plan for new scrutiny related to cyber risk management practices. Since the SEC guidance, public companies are taking action, and we expect further regulatory scrutiny of cyber risks and incident reporting given an inconsistent approach to date that has impacted shareholders and consumers alike. For cyber risk examinations, the AICPA’s SOC for Cybersecurity Framework provides a useful benchmark.”

JEFF WARD

JEFF WARD

National Third-Party Attestation Managing Partner

BDO USA, LLP

With market moving policy and economic changes happening at a fever clip, there may be more questions than answers for the IPO outlook this year. But, with strong contenders, bankers interested and capital available, signs point to a slower-than-expected start, followed by an opportunity to rally and right-size in the remainder of the year.

BDO IPO Outlook

These findings are from the 2019 BDO IPO Outlook survey, a national telephone survey conducted by Market Measurement, Inc. on behalf of the Capital Markets Practice of BDO USA. Executive interviewers spoke directly to 100 capital markets executives at leading investment banks regarding the market for initial public offerings in the United States in the coming year. The survey, which took place in December of 2018, was conducted within a scientifically developed, pure random sample of the nation’s leading investment banks.

SHARE