The California State Controller’s Office (SCO) estimates that only 2% of California businesses properly report unclaimed property each year. The state has increased its focus on improving holder compliance among California taxpayers, thus California businesses should expect to see increased audit activity and/or additional inquiries from the SCO.

Targeting Companies for Audit

Effective for corporate income tax returns due in 2022 and thereafter, the Franchise Tax Board (FTB) has begun asking unclaimed property-related questions on certain business entity tax returns, including:

- Form 100 - CA Corporation Franchise or Income Tax Return

- Form 100S - CA S Corporation Franchise or Income Tax Return

- Form 100W - CA Corporation Franchise or Income Tax Return – Water’s Edge Filers

- Form 565 - Partnership Return of Income

- Form 568 - Limited Liability Company Return of Income

Filers are required to answer whether their business entity previously filed an unclaimed property Holder Remit Report with the SCO, and if so, when the last report was filed and the remitted amount. The FTB may share the taxpayer’s answers, entity status and revenue range with the SCO. As a result, the SCO may then identify companies for audit that are not in unclaimed property compliance.

checklist

Be Prepared! Review our California unclaimed property checklist.

Download Checklist

Fill out the form below to download the California unclaimed property checklist.

Unclaimed Property Explained

Also known as abandoned property, unclaimed property includes items that a business owes to its employees, customers, vendors, creditors or shareholders that have passed certain prescribed periods of abandonment (dormancy periods), typically one to five years in length depending on property types at issue. Items include, but are not limited to, the following:

- Uncashed payroll and/or accounts payable disbursement checks

- Voided payroll and/or accounts payable disbursement checks

- Unused or unredeemed gift certificates

- Accounts receivable credits and deposits

- Refunds and rebates

- Unclaimed securities/equity

- Other intangible property types owed to third parties

California Unclaimed Property Law Specifics

- Interest is assessed at a rate of 12% of the value of the property per year, from the date the property should have been reported.[i]

- Penalties and/or fines up to $50,000 may be assessed.[ii]

- A review generally covers a 10-year period, plus the applicable dormancy period.[iii]

- Holders are required to send notices to owners of property with a value of $50 or more prior to reporting the accounts to the state.[iv]

- Aggregate filing for property valued at less than $25 is allowed.[v]

- A “negative” filing or $0/no amount to be reported return is generally not required annually; however, the California Unclaimed Property Division can require it upon written request.[vi]

Looking for more details? Read our insights.

Note: Before a holder files the VCP they should consult with their advisor as there are strict deadlines and requirements for completion of the VCP.

Feasibility Study

Understand the scope of your unclaimed property exposure and internal control risks by conducting a feasibility study. From accounting systems review to the availability of records and documentation, the study can help you implement an effective unclaimed property strategy. You’ll be provided with a range of potential exposure by property type and legal entity. The results can be used to book ASC 450 accounting reserves and can help with remediation measures in California and other states. This may include voluntary disclosures, policy and procedure creation, and a formal compliance process.

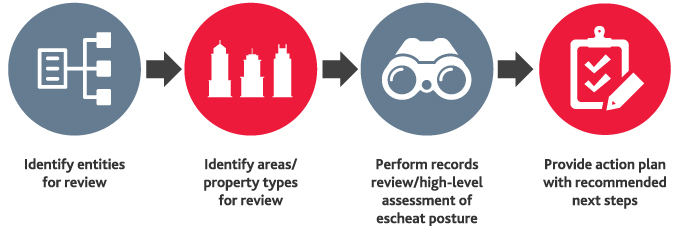

Our Process

BDO's Unclaimed Property professionals are here to assist you in preparing for California's new unclaimed property law.

[i] Cal. Civ. Proc. Code § 1577.

[ii] Id. at §1576.

[iii] Id. at §1513

[iv] See Cal. Civ. Proc. Code §§ 1513.5, 1514, 1516 and 1520.

[v] Cal. Civ. Proc. Code §§ 1530(5).

[vi] Cal. Code Regs. Tit. 2, § 1173.

SHARE