Section 199A Deduction Analysis

The information in BDO alerts is dependent on tax policies at the time they are published. The subject matter of this alert has since been updated. To find the latest information on this topic, read Final Regulations of Section 199A and Guidance Regarding Trade or Business Determination for Section 199A.

As a result of Tax Reform, owners of pass-through entities (e.g. partnerships, S corporations, and sole proprietors) may be entitled to the new section 199A deduction for qualified business income (“QBI”). Under section 199A, certain taxpayers may be entitled to a deduction up to 20% of QBI.

While this deduction potentially creates a substantial tax benefit for owners, it’s complicated. There are complex rules to determine qualification for the deduction and significant compliance and reporting requirements that must be evaluated and then satisfied in order to ensure the owners receive all the information necessary to properly calculate the deduction.

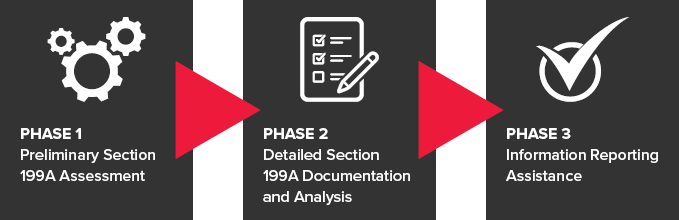

If you operate a pass-through entity or own one, and therefore are impacted by these new requirements, please reach out to us. Our phased approach will provide clarity during tax planning conversations.

Find Out if You Qualify

- Are you a pass-through entity such as a partnership, S corporation or sole proprietorship?

- Does your business have multiple revenue streams?

For more information about 199A and tax reform, read our insights:

- Tax Reform and Section 199A Deduction of Qualified Business Income of Pass-Through Entities

- Tax Reform & Choice of Entity Considerations

- Section 199A Deduction For Qualified Business Income & Domestic Production Activities

- IRS Issues Proposed Regulations for QBI under Section 199A

- Tax Reform and Section 199A: What the Qualified Business Income Deduction Means to Business

- Final Regulations of Section 199A

- Guidance Regarding Trade or Business Determination for Section 199A.

SHARE