New R&D Tax Incentive for German Taxpayers

If you’re financing or plan to finance product or software-development projects in Germany that start or started after 2019, Germany may give you EUR 500,000.

Every year.

Even if you’re not paying taxes.

Introduction

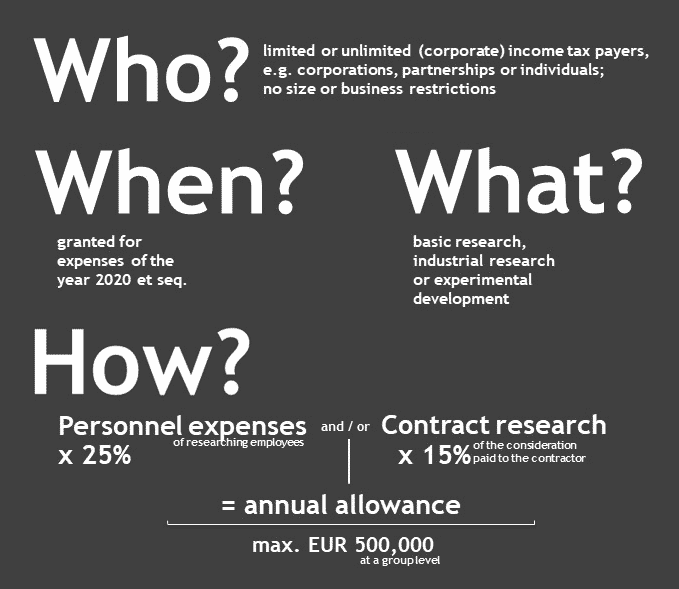

Generally equal to 25% of the sum an entity’s R&D salaries, wages, and eligible contract research expenses—up to EUR 500,000 per year—the new incentive was created by the Research Allowance Act (Forschungszulagengesetz). The act was approved November 29, 2019, by the German Federal Council (Bundesrat).

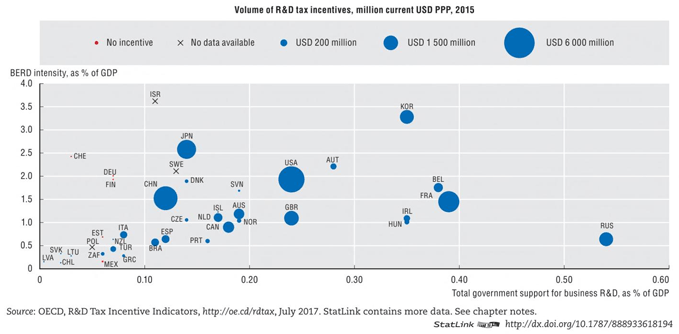

The act’s purpose is to spur increased business enterprise R&D (BERD) spending on technological development in Germany at a time when some are concerned that businesses are investing elsewhere, e.g., in the many other OECD countries where more generous R&D incentives exist:

If the new incentive exceeds a taxpayer’s tax liability, Germany will pay or refund the taxpayer the excess.

Loss companies, therefore, may benefit currently from the new incentive and, notably, may do so whatever their size. Typically, refundable tax credits are available only to small medium enterprises (SMEs).

This new incentive, coupled with Germany’s well-established public grant system for specific R&D initiatives and other EU grants, makes Germany more competitive for R&D investments.

Who’s Eligible

Taxpayers. All non-tax-exempt entities subject to Germany’s unlimited or limited income tax are eligible. Non-resident taxpayers are eligible if they have sufficient nexus to Germany, as would, e.g., a non-resident company with a permanent establishment in Germany.

Application: Taxpayers must (1) make a technical request for the issuance of an R&D certificate showing that the R&D project is eligible and then (2) submit electronically to the local tax office an application for the incentive. There is no fee for the first certificate requested in a fiscal year; a fee may be charged if more than one request is made in a fiscal year. The application must be supported by documentation of the eligible activities and expenses.

What’s Eligible

Projects. R&D projects are eligible if they are performed by a German-based entity: (1) itself, (2) with other German-based entities, e.g., universities, or (3) with third-party or affiliated contractors based in Germany or in any other EU/EEA member state. With regard to contract research, the new law offers enormous tax planning opportunities, particularly in a cross-border context. Furthermore, R&D activities can also be performed by a cooperation between one or more beneficiaries and at least one other company or an institution for research and dissemination of knowledge (e.g., a university).

Activities. Activities are eligible if they started after 2019 and represent (1) basic research, (2) industrial research, or (3) experimental development within the meaning of EU regulations. Activities related only to market acceptance or production-system improvements are not eligible.

Expenses:

Expenses are eligible if they are for eligible R&D projects and activities and are either (1) wages subject to German wage tax or expenses to secure their future, e.g., contributions to statutory pension funds, for and to the extent employees conduct eligible R&D and provided the taxpayer provides to the tax authority support for the expenses in the form of verifiable documentation showing, e.g., an allocation of employees’ wages between qualified activities, or (2) payments to eligible contractors. Itemized evidence of a contractor’s personnel expenses is not required.

Eligible expenses are capped at EUR 2 million. The incentive equals 25% of eligible expenses, so the maximum incentive each year is EUR 500,000. The act also limits the total amount of research allowances and other state aid granted for an R&D project to EUR 15 million per company (on an individual basis) and per R&D project over time.

Eligible expenses beyond the cap can, in certain cases, be given preferential treatment in the form of other support measures: The act expressly provides for the possibility of combining various forms of aid. Eligible expenses included in the R&D incentive may not be included other funding or grant programs in order to prevent double-dipping.

Payment Method

The incentive amount is formally stated in a separate notice of assessment and credited in full against the assessed tax amount at the next assessment of income and corporation tax. If the incentive amount is higher than the assessed tax amount, the difference is refunded, which makes it possible for loss companies to receive a 100% refund.

Key Dates & Deadlines

Eligible expenses must be incurred after December 31, 2019.

Entities must file an application for the tax incentive after the end of the fiscal year in which the expenses are incurred. Details regarding the application and filing deadlines has not yet been provided.

Next Steps

If you think you might be eligible you should:

- Review your current projects to determine which, if any, are eligible.

- For those that are or may be, gather information and documentation to be able to make the technical request for the issuance of the R&D certificate.

- Identify related eligible expenses. If your eligible expenses exceed the EUR 2,000,000 cap, (a) identify ones you can document most efficiently, e.g., eligible larger projects, and (b) consider whether the excess qualifies for grant funding or other EU incentives.

- For eligible expenses, gather financial information to support them on a project-by-project basis.

- Apply for R&D certificates. If the not-yet-released filing guidance allows and you’re able, consider applying for projects as they are starting to avoid last-minute challenges on your or the tax authority’s side. It is expected that applications must be in German.

- Consider developing and implementing policies and procedures to identify and document future projects and expenses. If your financial, accounting, or documentation systems can be leveraged to help with this, increase your ROI on future claims by doing so.

SHARE