If your company is like most technology companies, then you know speed is everything. The need to innovate is accelerating every day, and the timeline from start-up to IPO or strategic acquisition can feel more like a race than a journey.

As a result, having the resources to hire internal tax professionals, or even the financial justification to do so, is a luxury most tech companies cannot afford. However, having access to specialized tax knowledge as a business evolves is a necessity, not an option. Consequently, many companies are turning to managed services arrangements to help bridge this gap.

According to BDO’s 2025 Tax Strategist Survey, 94% of tech tax leaders plan to outsource or co-source parts of their company’s tax function in the next 12 months. Another 54% plan to increase their investment in outsourcing and co-sourcing in the same time frame.

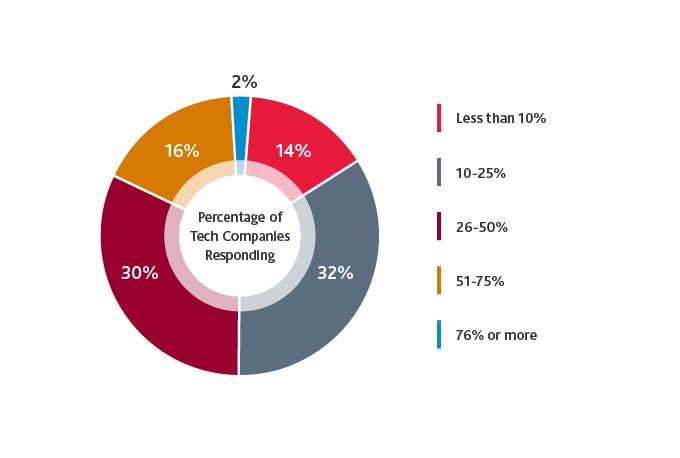

What percentage of your tax function will be co-sourced or outsourced in the next 12 months?

Outsourcing and co-sourcing are critical strategies that can help address growth pains and create more scalable and agile tax teams able to meet the needs of the business and help to inform decision-making. However, achieving success requires careful planning. Tech company leaders should understand how managed services can best support the businesses, leveraging these results to guide how best to select the right third-party provider.

Outsourcing and co-sourcing are critical strategies that can help address growth pains and create more scalable and agile tax teams able to meet the needs of the business and help to inform decision-making. However, achieving success requires careful planning. Tech company leaders should understand how managed services can best support the businesses, leveraging these results to guide how best to select the right third-party provider.

Tech’s Growth Pains

Twenty-six percent of the tech companies surveyed expect rapid growth, either organic or inorganic, to be their greatest source of tax risk in the next 12 months. However, expanding quickly in a short time can create several tax challenges.

Changes to the Existing Legal Structures

Inorganic growth frequently begets greater complexity in tax compliance as businesses change legal entity structures or become multi-entity organizations. Additionally, expansion into new states can create new nexus obligations, and international expansion adds even more layers of compliance complexity across jurisdictions.

Outgrowing Technology and Processes

As a company grows, the basic technologies and processes that support today’s tax function can quickly become unwieldy and outdated, despite significant investments in time and money.

Expansion of Tax Compliance Requirements

As companies expand into different markets, introduce\ new products, or grow through acquisitions, the related tax compliance requirements also change. In our survey, 18% of tech companies cited a lack of specialized knowledge among in-house talent as the primary reason driving the need for the business to co-source or outsource tax work. This represented the highest percentage among the industries surveyed.

Reactive Resource Allocation

Some businesses do not prioritize investing in tax teams to keep pace with overall company growth. As a result, those businesses often fail to recognize that the tax team lacks adequate resources. Generally, such shortfalls come to light when the business experiences the consequences of a critical tax error or incurs an unintended liability that requires significant investment to address.

The Role of Total Tax Managed Services

Managed services providers can play a vital role in managing, mitigating, and addressing new risks, especially when a company is undergoing a major shift, such as a transaction, a change in legal structure, or simply the experience of rapid growth.

By leveraging external support to handle time-intensive processes, in-house tax teams can prioritize high-value tasks such as weighing in on tax implications associated with strategic business decisions. External support can also help reduce strain on in-house professionals as the company’s tax requirements expand, providing an additional layer of controls to give tech companies more confidence that they are compliant with recent law or regulation changes.

Third-party providers frequently have access to more mature tax technology that a fast-growing tech company may not have in-house, enabling a company to leverage advanced capabilities without the substantial investment required to upgrade existing in-house systems and tools. An external provider can also help implement data analytics tools, enabling the company to quickly analyze the data needed to deliver insights that help inform future business decisions. A high volume of data can provide valuable insights beyond the tax function, including data related to customer behavior.

Determining the Appropriate Operating Model

When evaluating when the tax function could benefit from an external provider, tech companies should begin by identifying well-documented and standardized processes that are highly manual or require specialized knowledge not present in-house. In general, a few specific functions are often prime candidates:

Sales and Use Tax Compliance

Sales and use taxes can represent a common risk area for tech companies offering digital services across multiple states. Companies must navigate a wide variety of state and local regulations related to the digital economy, heightening the risk of making costly mistakes. They may also struggle to understand in which states they have a sales and use tax collection and related filing obligation, introducing additional opportunities for error absent access to specialized tax knowledge in this area.

Implementation and Maintenance of Tax Technology

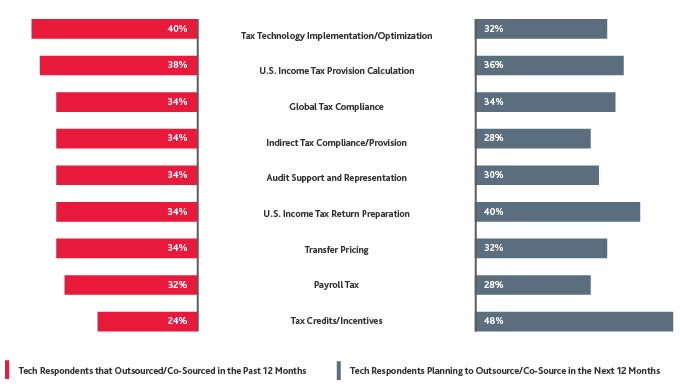

Many tech companies opt not to invest in in-house tax technology, instead leveraging the mature tech capabilities of a third-party provider. But those that do elect to acquire tax technology should still consider working with a third party that can support the implementation process and help manage ongoing maintenance and employee adoption. Over the past 12 months, 40% of the tech companies surveyed co-sourced or outsourced tax technology implementation. Another 32% plan to do so in the next 12 months.

Tax Credits and Incentives

Companies scaling quickly may not have the internal resources needed to identify and claim valuable tax credits and incentives. They may not even know that certain opportunities are available or may be in a situation where these opportunities are not yet a priority. A service provider with experience in credits and incentives can not only identify these opportunities in a timely manner but also prepare the appropriate documentation and applications.

U.S. Income Tax Compliance/Provision

To eliminate costly investments and necessary maintenance work to build internal tax technology capabilities, many tech companies leverage external providers’ mature technology services for compliance and return preparation. Of the tech companies in the survey, 34% outsourced this function in the past 12 months, with 40% planning to do so in the next 12 months.

Tech’s Approach to Outsourcing

Data Protection Considerations

Tech companies should prioritize data protection as they consider sharing their data with external providers. In the tech industry — and for highly regulated companies such as those in the health tech sector — data privacy is critical to maintaining stakeholder trust. While outsourcing or co-sourcing third-party service providers may be the ideal operating model, it does not release the company from its privacy obligations or risks. Thus, companies should verify that their service providers have sufficient data protection policies and security controls to maintain compliance and meet rigorous expectations of applicable data protection regulations.

How BDO Can Help

At BDO, we approach every client with a total tax mindset, enabling the client to make informed decisions, optimize outcomes, and uncover opportunities to enhance their total tax position in alignment with overall organizational objectives. To do so, we offer a range of services for tech companies looking to support their tax teams with external resources and knowledge. We can help by:

- Providing a dedicated team experienced in scaling a managed services approach that aligns with your business objectives, with the right mix of tax compliance, reporting, and planning to support your department, and access to advanced tax technology and a global network of tax advisors.

- Offering extensive tech industry experience and knowledge to help address your organization’s unique needs.

- Providing a selection of flexible services and support offerings that can evolve with your business.

- Enhancing tax leaders’ strategic value by helping identify key planning opportunities for their organization.

- Offering guidance to help companies navigate data protection requirements.

Want to learn more about how managed services can support you tax function?