BDO's Private Capital Outlook Webinar Examines COVID-19 Implications on Private Equity, Venture Capital, and M&A

BDO’s Private Capital Outlook webinar on April 2, 2020, focused on what is top of mind for private equity, venture capital and M&A professionals amid the coronavirus outbreak, including the impact of the pandemic on deal making and valuation, sectors experiencing changes in deal activity, and strategies for mitigating loss in the weeks and months ahead.

While the webinar was initially developed with a focus on BDO’s Private Capital Outlook Survey, which was released at the end of 2019 and captured sentiments of PE and VC executives back in October 2019 on a spectrum of issues across the industry, the emphasis evolved as the coronavirus pandemic shifted the industry’s attention towards business resilience, continuity planning, and new opportunities.

Here are some highlights.

Overview of the Impact of COVID-19 on the PE Industry

The novel coronavirus, COVID-19, is one of the most significant global economic and societal events to take place within our lifetimes, and has vast implications for private equity, venture capital and the M&A market. The U.S. is now the epicenter of the coronavirus outbreak, as the growth in cases and deaths continues to accelerate.

COVID-19 has already had a devastating impact on the economy with more than 36 million unemployment claims over the past two months, more than wiping out all job gains since the Great Recession. There are widespread expectations of the unemployment rate hitting as high as 30% or more and predictions of a 10%+ drop in next quarter’s GDP. Between the travel restrictions, quarantines, social distancing, and mandated shutdowns, we are in what many are now calling the new “shut‑in economy.”

In terms of the private equity and private capital markets in particular, there are certainly going to be short-term impacts, including a delay in fundraising, impact on EBITDA, and a fall in production, as well as medium-term impacts as funds manage against the “new normal.” Medium-term considerations include taking steps to recession-proof portfolios and fortifying business resilience at the portfolio company level. There could also be more carve-outs and divestitures of non-core assets from larger companies, which would present a buying opportunity for private equity. And, after years of a relative dearth of quality assets on the market, we’ll likely see a huge uptick in quality distressed assets at discounted prices, which we expect savvy PE and VC funds to invest in or snap up.

Actions undertaken today—daily information and awareness briefings, crisis management and recovery efforts, investment strategy pivots, financial and operational planning—will help fund managers navigate through the COVID-19 crisis both at the fund level and at the portfolio level.

This is also a critically important time to check if portfolio companies are eligible for relief from the various stimulus packages—both newly enacted as well as preexisting programs. At $2.2 trillion, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, is the largest relief package in American history. Plus, in late April, an additional $484 billion was signed into law providing more funding for a coronavirus aid program for small businesses to replenish the Paycheck Protection Program (PPP). Several of the programs included in the CARES Act, and in particular the $500 billion economic stabilization plan, may be applicable to portfolio companies, however there are certain restrictions on private equity and venture capital funds. For more information, please read BDO’s insight, Portfolio Companies’ COVID-19 Economic Stimulus Relief Incentives.

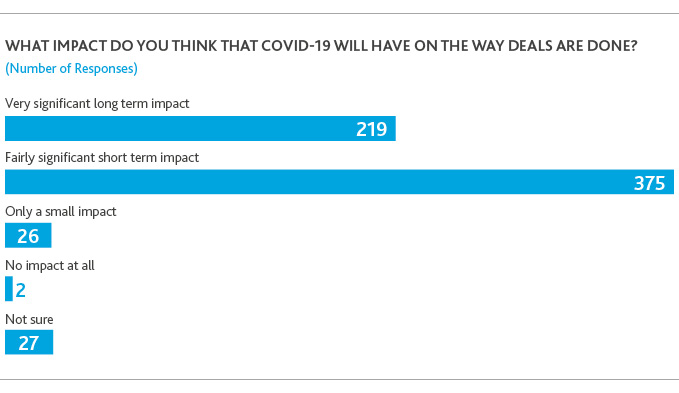

Temperature Check

During the webinar, we asked our audience of 600 private equity and venture capital professionals a few questions to get a sense of how they are feeling in this current environment.

How Deal Making is Changing Due to COVID-19

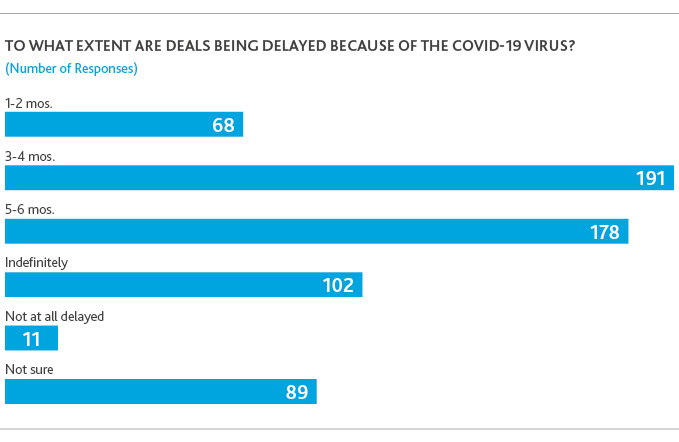

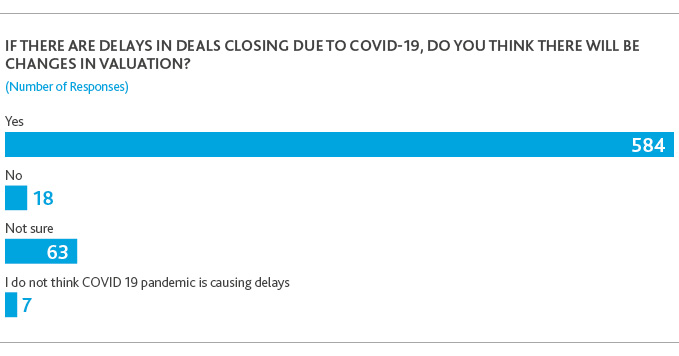

The key difficulty from a deal making perspective is the uncertainty the virus is causing—which has prompted major disruption to transactions in progress. The associated disruption to revenue and earnings and, perhaps most important, the uncertainty regarding projected performance, has brought valuation into question. Reliable projections are now difficult to come by, let alone the appropriate discount rate, so it can be fruitless to build valuation models right now. Consequently, dealmakers have been largely sidelined.

However, for many buyers and some private debt providers, this period has also provided new opportunities, leading to engagements for transaction due diligence teams. Additionally, many sellers want to move forward, subject in many cases to some assessment of their specific circumstances. Every situation is and will be different.

In a typical deal making environment, many constituencies have a say in whether a deal comes together. In addition to the buyer and seller coming to terms, constituencies such as boards, investment committees (in the case of PE firms), loan committees (in the case of lenders), and advisers all typically weigh in. It can be difficult to get everyone on the same page even in the best of circumstances. What these groups tend to agree on right now is the necessity to focus internally, to make sure operations are financially sound before M&A and credit facility bets can resume.

Given time, demand for deals will return. For private equity, dry powder levels are extremely high, at about $1 trillion for buyouts. Public company balance sheets have excess cash, and lenders will at some point need to expand portfolios. It is only a matter of time. The supply of deal targets should be healthy too – partly driven by demographics. Boomers now range in age from 55 to 75, some 76 million strong in the United States and, despite uncertainty in the economy, many who own businesses will be thinking about retiring soon. They will be looking to sell, regardless of the economic situation we find ourselves in. Dealmakers are trying to estimate the depth and length of the current slowdown and will be ready to act when fluidity returns to the M&A market.

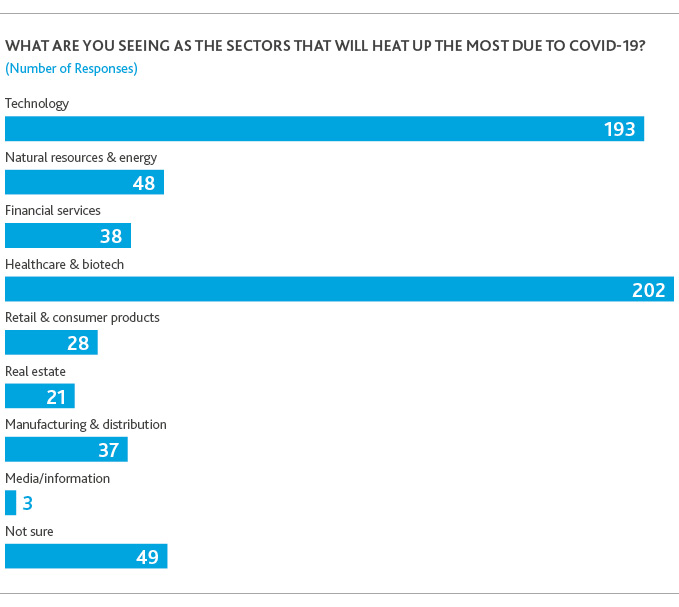

Broad consensus is that industries in favor in the short and medium term will be technology and healthcare—and evidently, our webinar audience agrees. We will likely see opportunity in the manufacturing space as well, as the onshoring of supply chains accelerates post-crisis. Now and in the periods to come, fund managers will be focused on recession proofing their portfolios to the greatest extent possible while seeking out opportunities to buy.

Temperature Check

Effects on the Venture Capital Market

Pre-pandemic, less than one-fifth of the U.S. workforce were remote and the unemployment rate was at historic lows. Today, white collar jobs have all had to go completely remote, unemployment has skyrocketed, and schools at every level are closed. Across the board, self-quarantine has forced people to change their behavior and rely increasingly on technology.

This has shifted some of the focus of traditional venture capital-backed companies. Technologies that promote teleworking in this new work-from-home environment have seen a surge in usage—and corresponding concerns about cybersecurity and data privacy. Food and grocery delivery services are hiring tens of thousands of employees and contractors in order to keep up with the surge in demand. Distance learning software is keeping the education sector operating.

There is a huge gap to be filled and a market opportunity to innovate to fill the industries that are seeing increased demand. The key for VC will be to strike a balance between mitigating the impact on existing investments and opportunistically investing in line with these emerging trends.

For the “winners” during this pandemic, digitization has come out ahead. COVID-19 has fast-forwarded trends that were already bubbling up—particularly technologies or companies that promote remote working, on-demand delivery, and online streaming. On the negative spectrum of COVID-19 impact, the hospitality, travel, restaurant and event tech sectors have been hit hard, and VCs in that space are looking at damage control.

Most VCs are looking internally, figuring out how to protect their portfolios from liquidity issues. The managers who will likely emerge from this crisis in the best shape will have maintained a disciplined approach and deployed available reserves strategically to protect investments.

Addressing working capital needs is a priority, but there may be an appetite on the part of VCs and their investors to capitalize on opportunities they see coming out of the current crisis. However, those who do not have sufficient capital reserves to protect their position will have to choose which investments to protect, and this is even more acute for sector-focused funds in retail, restaurants, and hospitality. In terms of the impact on funding, the COVID-19 crisis is directly impacting the global funding pipeline to private companies. We advise extending the cash runway based on concerns around the ability to raise financing over the short term, and potentially even the long term because ultimately, cash is king.

Value Creation and Liquidity Considerations

For most PE firms and VCs, the immediate focus has shifted to liquidity management and, frankly, survival. With revenue drops of anywhere between 25% to 100%, existing portfolio companies must be the priority because so many of them need urgent support and damage mitigation in the face of declining revenue and uncertain recovery timelines.

Determining liquidity needs—and where that liquidity will come from—is a new reality for fund managers and their portfolio management teams. Getting a handle quickly on the liquidity requirements of the business over the next 3-to-6 months is a necessity. Working with your lenders to identify solutions for the near term is priority one. Accessing federal, state and local grants and loan programs could be particularly helpful to many businesses and should be fully explored.

It is also important to consider possible opportunities for value creation. Some firms may look for distressed add-on acquisitions to tuck into their platform. These companies may have been unaffordable previously but are now facing a liquidity crisis themselves. Similarly, fund managers with portfolio companies that are relatively well-situated may be positioned to gain competitive advantage over peers that are not as well-capitalized. If you have a competitor that is hurting for cash, for example, you could drop the prices on your goods and take a margin hit for a period of time in order to gain market share.

Some PE firms are also looking at buying up their portfolio companies’ debt at attractive prices today. The debt markets are being dislocated so prices are going down, which potentially creates an opportunity for realizing positive returns. Those limited opportunities aside, the unfortunate reality is that virtually every fund has at least one company facing cash flow challenges. Even companies in good financial shape may be vulnerable, particularly if they are in industries that rely heavily on consumer spending. The focus has to be on near-term liquidity.

Best practices for mitigating a liquidity crisis include development of a COVID-19 Business Continuity Plan to counteract as much as possible the impact of slowdowns and unbudgeted costs. Ensure that your liquidity position can be maintained and provides enough run time to recover. Liquidity in a crisis is imperative so focusing on the profit and loss statement in a volatile situation when volumes drop can quickly deplete liquidity. As part of this plan, prioritize the business’s short-term survival and put a temporary hold on activities that relate to longer term, strategic progress. Prepare a robust six-month cash flow projection to proactively preserve or generate cash. Perform various financial scenario, sensitivity and ratio analyses, examining the overall threat to the organization should elective or non-urgent services decrease at various percentage rates. Identify measures for controlling budgets and increasing cost savings, such as assessing the possibility of outsourcing or reduction of non-critical business activities. Remember to seek working capital management quick wins, such as liquidating excess inventory to reduce inventory investment while maintaining service levels. Lastly, take advantage of available economic stimulus programs where possible.

While a lot of the focus is on near-term liquidity, do not lose sight of mitigating the operational impact of the coronavirus. This includes a pandemic plan both at the fund level and at all portfolio companies. Liquidity might be in crisis, but health and safety need to be a top priority. Another important operational consideration is third-party risk mitigation. Portfolio companies in the manufacturing industry, for example, need a proactive plan to insulate their supply chains from disruption. That means identifying immediate ways to diversify the supply chain if possible and assessing the cost-benefit of maintaining duplicate facilities or routes on an ongoing basis. There are also IT and cyber resilience considerations. Cyber criminals are looking to prey on the coronavirus situation and exploit workers and systems.

Temperature Check

If you were unable to attend our 2020 Private Capital Outlook Webinar, please access the recording online. Please visit our Crisis Response Resource Center of COVID-19 related content for new and updated guidance to help you and your business through this time of uncertainty.

BDO Capital Disclaimer:

Investment banking products and services within the United States are offered exclusively through BDO Capital Advisors, LLC, a separate legal entity and affiliated company of BDO USA, LLP, a Delaware limited liability partnership and national professional services firm. For more information, visit www.bdocap.com. Certain services may not be available to attest clients under the rules and regulations of public accounting. BDO Capital Advisors, LLC Member FINRA/SIPC

SHARE