The Medical Care Consumer Price Index (CPI), issued by the U.S. Bureau of Labor Statistics, measures inflation by tracking retail prices of a good or service of a constant quality and quantity over time. It is frequently used by providers and insurers for their financial forecasts and benchmarking, as well as policymakers to understand and respond to healthcare trends.

Despite its widespread use, the Medical Care CPI is not an accurate representation of rising healthcare costs for most consumers nor companies. The CPI’s basket of goods and services does not reflect cost changes most relevant to these populations and excludes major drivers of premium growth, such as high-cost specialty drugs and shifting utilization patterns. If payers and providers continue to anchor expectations to outdated or misaligned inflation benchmarks, they risk underestimating financial pressures and miscommunicating key trends.

Tracking the Medical Care CPI

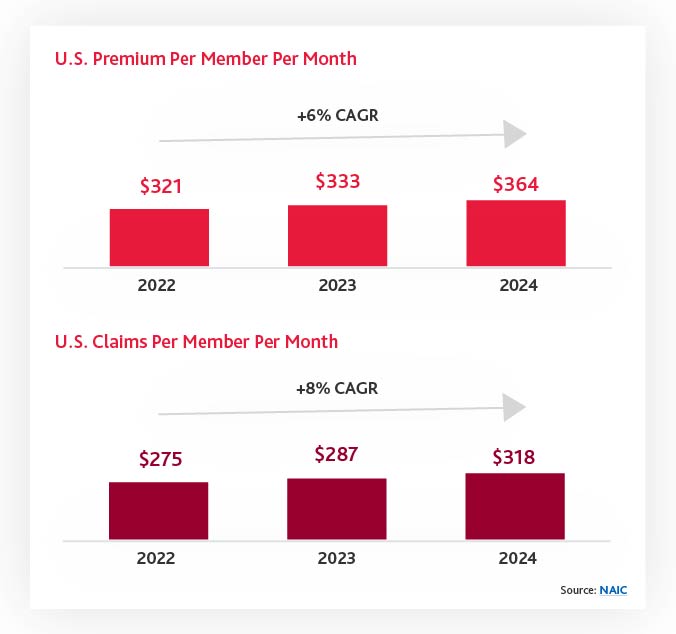

To understand the issues with the Medical Care CPI, it helps to first look at two other healthcare metrics: health insurance premiums Per Member Per Month (PMPM) and claims PMPM. Premiums PMPM have increased at a rate of 6% Compound Annual Growth Rate (CAGR) over the past three years while claims have increased by 8%. This gap illustrates fundamental challenges where premium increases are not keeping up with claims expenses, making the forecasts created with the Medical Care CPI inaccurate compared to actual spend.

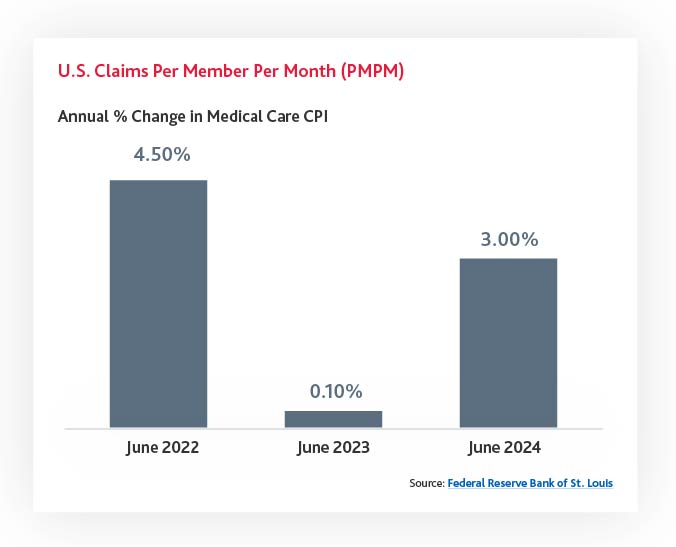

Furthermore, both premium PMPM and claims PMPM are significantly higher than the Medical Care CPI, which was only 3.0% in June 2024 from the previous year, 0.1% in 2023, and 4.5% in 2022. These numbers fall significantly below recorded premium and claims expenses.

Understanding the Root Causes of the Disconnect

There are several systemic issues that explain why the Medical Care CPI diverges from the true cost trajectory of health insurance:

The Medical Care CPI includes a range of services, such as nursing home care, that are less relevant to the majority of employer-sponsored or marketplace insurance enrollees.

Increases in the volume and complexity of services — particularly expensive procedures — are a primary driver of premium hikes. The CPI doesn’t adjust adequately for changing utilization

The CPI does not capture rising administrative costs, from billing complexity to regulatory compliance, which can inflate premiums even if actual service costs remain stable.

The Medical Care CPI is weighted by out-of-pocket (OOP) expenses, which means it may under-represent costs borne by insurers, therefore underestimating premium pressures

The prescription drug component of the CPI does not fully capture the impact of high-cost specialty drugs, which can account for 40–50% of total drug costs despite representing less than 1% of total volume. This segment is also the fastest-growing area of spending. Given this bimodal distribution of drug costs, using averages is highly misleading.

Why the Medical Care CPI Falls Short

Relying on the Medical Care CPI to assess or communicate healthcare cost trends is fundamentally flawed for both payers and providers for several reasons:

Misleading Benchmarks

The Medical Care CPI does not reflect the true cost increases embedded in insurance premiums, causing healthcare leaders to underestimate the financial burden on consumers and insurers alike. Consumers become frustrated when their premiums per month increase 6% or more, given that the commonly reported medical inflation is only 3%. These premium increases are still insufficient to account for an 8% increase in claims expenses, suggesting the future premium expenses will be even greater than 6%. Recent health system tracking from the Peterson Center on Healthcare and KFF even reported that “ACA Marketplace insurers are raising premiums by about 20% in 2026.”

Disconnected Metrics

There is a growing gap between CPI-tracked cost growth and actual premium trends, which can obscure root causes of rising healthcare expenses.

Policy and Strategic Risks

Relying on the CPI can cause decision-makers to miss critical underlying trends, such as shifts in utilization or the rise of specialty drug costs, which in turn weakens strategic policy planning and response.

Error-Prone Forecasts

Many providers and payers rely on the Medical Care CPI as an input into their strategic planning process. Since this metric underestimates growth, relying on it in the absence of other metrics leads to highly unrealistic forecasts.

How Healthcare Leaders Can Improve Their Strategic Planning

To address these issues and gain a more accurate picture of healthcare cost growth, payers and providers should consider the following:

Broaden Benchmarking Metrics

Supplement the CPI with other indices and metrics, such as the NAIC premium expense index, specialty drug trend reports, and utilization/mix trend analyses.

Track Specialty Drug Impact

Build forecasting and strategy tools that incorporate the rising influence of specialty pharmaceuticals on total cost of care.

Analyze Internal Data

Leverage your organization’s own claims, utilization, and cost data to understand localized or plan-specific trends that the CPI cannot reflect.

Educate Stakeholders

Help internal teams, regulators, and members understand why premiums are rising faster than the CPI would suggest, resetting expectations and fostering transparency.

Accept and Plan for Reality

Acknowledge that this disconnect isn’t going away, and work with your teams to build financial models and communication strategies accordingly.

Questions for Employers, Providers and Payers

With healthcare under increasingly intense margin pressures, it’s critical that employers, providers, and payers are working from accurate and realistic financial forecasts and benchmarks. Relying on the Medical Care CPI alone is a critical error that can result in unmet financial expectations and undetected spending and utilization trends. To maintain financial health, organizations should adjust their approach to strategic planning, considering a broader variety of metrics to account for their unique needs and market positions.

Questions for employers

- How are you offering additional coverage / co-insurance for certain items to lower regular medical premiums?

- How can you communicate with your employees to help them understand the reasons and expectations for premium increases and / or other changes to plan features?

- How do your annual changes compare to competitors, local averages, and national trends?

Questions for providers

- Are there opportunities to bundle payments or implement risk-based arrangements to better

- manage the main drivers of costs?

- How can you improve forecasting?

- How can you improve pricing transparency to better improve patient trust and satisfaction?

Questions for payers

- How can you manage risks without merely passing along higher premiums to covered members?

- How can value-based care be implemented to better control outcomes and costs?

- Are you proactively controlling specialty medicine costs through site of care analysis, promotion of biosimilars and/or annual market checks with PBMs?