2019 M&A Trends and Integration Considerations for Government Contractors

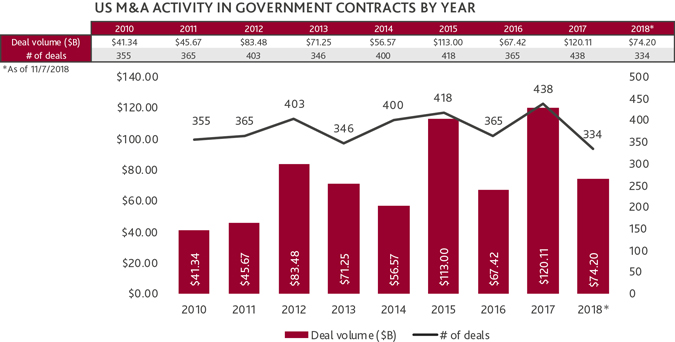

Since 2017, the Government Contracting market has seen a spike in M&A activity, with various factors driving mergers, acquisitions and divestitures.

Between corporate cash reserves, changes in tax law, the administration’s encouragement to reduce the total number of federal contracts by consolidating contracts into a fewer number of large contract vehicles, and the attractiveness of increased defense budgets, the market saw a record number of large deals in Q4 2017 and Q1 2018. It was not just the large, traditional organizations that were acquisitive; a diverse group were buying up niche capabilities and contract vehicles.

2018 overall saw a strong appetite for deals both on the sell and buy side. Strategic buyers are looking for products, services, sales channels, talent, customers and geographical presence that expand capabilities and make them more competitive. Buying strategies change depending upon sector or tier, but buying trends, especially in the mid-tier range of companies with revenue of $500 million to $5 billion, are for full and open revenue, vertical markets (AI, cyber, cloud, C4ISR) and customers (DOD, Intel, Space, DHS, HHS), access to the supply chain, direct customers, capabilities, IP, clearances and/or talent.

Source: Pitchbook

M&A Trends and Deal Volume

Since 2015, the market has been active with numerous deals and larger deal sizes. The top 10 firms in the sector now exceed $2 billion in revenue (with top 5 closer to $10B), changing the landscape and maturing the M&A process. Activity in the sector continues, but there are fewer pure commercial players entering the market and more consolidation amongst known players and targeted acquisitions of assets. Aside from the CSRA/GDIT deal and a few others, the largest number of transactions in 2018 were precision deals that brought specific capabilities or contracts that add revenue and margin. The majority of last year’s deals were less than $100 million in revenue. These transactions comprise a mix of corporate consolidations of various sizes across industry, NAICS codes and sector–defense, aerospace and government technology solutions. The consensus from recent conversations with buyers is that firms are seeking capabilities that drive growth and cash flow. Due to prior consolidation, the trend is fewer mega-deals, mid-market consolidation and platform creation by private equity and private firms.

Regardless of transaction or transaction size, consolidation, merger or acquisition, all require extensive due diligence and integration activities to ensure success and reap the desired deal value.

Sell-Side Considerations

As you prepare your organization for sale, it is important to think like a buyer. While there are hundreds of details that are reviewed during due diligence, some elements that will help drive valuation and a smoother sale include: a business with scalable operations and a solid leadership team; internal controls that mitigate risks and support long term viability; and performance that is on par with peers across a number of core metrics. Additionally, sellers must have the capabilities and services that buyers seek. In 2019, that continues to be niche IT services, cybersecurity, AI, software and other targeted, specialized solutions (IP) the buyer’s customers need to meet their growth goals.

Additionally, to prepare for sale, it is important to get your administrative house in order, resolve contracting, small business affiliations, IP ownership, teaming agreements, subcontracts and GSA schedule issues. Understand best practice policies, procedures, compliance mechanisms and reporting requirements of your customer and prime contractors in your sector. Make sure your HR processes and policies, contracts and subcontractor agreements match current best practices and meet the prime contract requirements. The below example helps illustrate the types of exit planning and preparation activities that improve quality of buyer conversations and increase valuation.

Exit Planning: After steady growth delivering unique technology to one customer as a subcontractor, a company won a prime contract and tripled its footprint in a desirable agency. The company began to plan its exit by enhancing its corporate governance structure and leadership team; analyzing potential implications on cash-flow and taxes; implementing a full financial audit including a review of business systems and internal controls; and analyzing business processes against best practices in its peer group.

Buy-Side Considerations

You have identified the capabilities, technologies, customers and growth objectives you will achieve through acquisition–and found the perfect target. Due diligence, integration planning and post-merger integration are the activities to help ensure that the synergies are achieved and that those unique capabilities are deployed in the manner the board and senior leadership imagined. As you go through due diligence, your team will have a checklist that helps you identify any risks, concerns and outstanding litigation or contract issues. The team will also want to keep an eye open for cultural differences in pace, cadence, risk appetite, organizational levels, decision-making and authority, as well as business systems and practices. Understanding the differences will help with integration planning, as well as risk mitigation, as your team becomes responsible for the results of the acquired/merged firm or assets.

Specific items to keep in mind in addition to the financials and backlog are cost structures and overhead rates. What changes will be required to achieve cost synergies? How is work being performed today? What is required to improve efficiency or consolidate functions? Who has the better performing organization? How do you achieve overhead synergies without reducing revenue-generating activities in the process? It is important to develop and implement a structured integration plan that provides a roadmap articulating what will change and when–and remember to inform those key employees that drive revenue. They need to understand how they fit in the new organization and what is expected of them.

The below examples help illustrate the types of planning and post-merger integration activities that deliver people, process and system harmonization and accelerate value creation.

Integration Planning: A comprehensive integration plan was built to deliver the company’s strategic objectives and overall risk profile. As part of the plan, the company identified business processes and system impacts resulting from the integration, mapped those to required disclosure statement revisions and assessed program cost impact. Successful implementation of the remediation efforts were supported by comprehensive change management, including revising site specific policies and procedures, employee training and internal and external communication.

Post-Merger Integration: Following several significant acquisitions, a company needed restructuring and created new indirect cost allocations to identify advantageous, compliant indirect cost structures positioning them for continued growth and profitability. Additionally, as part of the restructure, the firm revised its disclosure statement and pay and workplace practices for paycheck transparency and SCA compliance.

Even organizations with the same systems and general business processes have unique ways of operating. It is important to articulate these changes through training and communication and more importantly, to have managers reinforce the changes in business practice, especially those driven by new compliance requirements.

Improved business conditions, more predictable federal funding and budget stability and the desire to become the next new player in the nation’s race to space, has created an entirely new landscape for contractors. This demand is increasing opportunities for both sellers and buyers. Government contractors should consider their position: Are they the hunter or prey? And then develop an exit, buy and build strategy with a detailed plan for preserving competitive advantage, mitigating risk and scaling business, integrating people, processes and systems as they grow.

Top 5 Merger Integration Pitfalls To Avoid

1. Unrealistic Integration Expectations

Leaders want to take advantage of synergies quickly. It can take a while to unwind operations and create efficiencies. Set aggressive, but realistic timelines.

2. Poor Communication / Transparency About Intentions

Be honest about the planned harmonization and what that really means for the acquired people, processes and culture. Tell people what will change and when.

3. Insufficient Resources To Manage the Integration

It takes time to integrate people and operations. People are doing their job, learning new processes and training staff. If they don’t adapt, you lose synergies. Bring in resources to help.

4. Failure to Retain Top Talent

Acquired staff didn’t choose you. If you don’t make it easy to succeed, they will leave. Strategically, recruit!

5. Delayed Leadership and Staffing Decisions

Let your strategy drive leadership and staffing decisions. Are you buying to upskill leadership capabilities or brining technical skills into a mature operation? Make quick assessments.

M&A Considerations

Corporate Governance

What is required to harmonize structure and internal controls across organizations?

Culture

Have you identified differences between the buyer and seller’s cultures?

Systems & Processes

How will you bring the new employees onto the existing systems and train them on process?

Employee Turnover & Retention

Who is responsible for identifying and successfully assimilating employees?

Compliance & Regulatory Exposure

Who is responsible for assessing risk and then aligning and integrating mitigation practices?

Rate Structures & Margin

What steps are being taken to rationalize and harmonize rate and cost structures to realize desired value and margin?

SHARE