A Value Perspective on the Auto Dealership Industry

The automotive industry is constantly evolving and is once again at a critical inflection point as businesses seek to adapt to changing consumer preferences, navigate supply chain uncertainty, and revolutionize their technology. Over the past couple of years, the automotive industry and its value chain have seen significant disruptions including the development of autonomous vehicles, the push towards electrification, and the rise of ride sharing apps. Companies like Tesla, Uber, and Waymo have invested billions in the charge towards a cleaner, more efficient future for automobiles and drivers alike. However, the path towards this brighter future may not be as simple as it seems.

Inflation, Supply Chain Issues and the Chipdemic

Apart from the global pandemic brought on by COVID-19, the auto industry has felt the effects of increasing oil prices, labor shortages, and worldwide supply chain issues. Despite all these challenges, dealerships are enjoying record earnings as demand increases and prices remain at all-time highs. However, this positive trend may be challenged by the recent slowdown of the economy and high inflation. GDP for Q1 2022 decreased at an annual rate of 1.5% according to the revised estimate released by the Bureau of Economic Analysis. Conversely, the annual inflation rate was 8.6% for the 12-month period ended May 2022, the largest annual increase since December 1981, according to the U.S. Labor Department’s data.

Perhaps one of the biggest hurdles facing the automotive industry in the coming months is the limited supply of semiconductors available. As supply chain pressures persist, and the possibility of an economic recession increases, the overall challenges facing the industry continue to compound. Before the pandemic, the broad consensus was that supply chains were fully optimized, and firms had control over how to keep inventories in-check without compromising the flow of inputs used for production. Today, China’s zero COVID-19 policy, the Russia-Ukraine conflict, and unpredictable fluctuations in demand have left overall supply chains battered, with no quick solution in sight for many of these issues.

Exacerbated by the pandemic, the worldwide shortage of semiconductor chips is continuing to be one of the biggest issues for firms around the globe. The critical function of semiconductors in modern automobiles allows for connectivity, electrification, and safety within the vehicle. This chip shortage, referred to as the “Chipdemic”, was caused by several factors including a rush to buy electronics during the pandemic, trade tensions between the US & China, and disruptions to a complex semiconductor supply network around the globe. At the beginning of the pandemic, car makers halted production and canceled orders for chips, before being hit with an unexpected uptick in demand. Now, at the back of the queue for chip orders, auto firms have been struggling to catch up. Fortunately, for dealerships, demand for new automobiles is expected to continue to increase in the coming years even as supply remains low. Customized models with the latest technology will boost consumer purchases and a shift towards hybrid or electric vehicles will bring more willing buyers into the market. In turn, it is projected that the big 3 manufacturers (GM, Ford, Fiat-Chrysler) will experience increased revenues due to more consistent demand, historically low interest rates, a rise in disposable income, and increasing consumer confidence. The most successful companies will be the ones who can balance customer expectations with their own inventory management to meet customer needs.

Consumer Expectations and Sales Impact

As previously mentioned, a major pain-point for new-vehicle dealers continues to be constrained inventory. Inventory levels at the end of 2021 totaled 1.12 million units, compared to 2.75 million units at the end of December 2020 (Source: NADA Data 2021). This 59% decrease highlights one of the biggest struggles the industry currently faces. Many of the major original equipment manufacturers (OEMs) use similar technology, meaning they are all competing against one another for an already limited quantity of parts. A transition to electric vehicles means this need for new parts will only continue to increase. Proper inventory management is becoming even more important because it saves companies money through appropriate control of operational costs and processes.

Traditionally, an automobile dealer serves as the link between the manufacturers and consumers, offering individuals a wide array of vehicles to meet their needs at different price points. Recently, the inventory has not met consumer expectations. According to Cox Automotive, “the supply of new vehicles at the end of April 2022 was 63% below April 2020, at just a 35-day supply.” (Source: Haig Report Q1 2022) Even then, many dealerships have inventory far below that level. The decrease in inventory has pushed many consumers to pre-order in the hopes of getting the vehicle they want.

Consequently, the limited supply has affected overall new vehicle sales, which have continued to decrease over the last two years since the beginning of the pandemic. The average dealership sold just 895 new vehicles in 2021, compared to 1,026 in 2019. One might argue that these levels of sales are not sustainable, but an overall increase in the average retail selling price made up for the decrease in average units sold. As we look at even more recent data, franchised dealerships sold, on average, 15.7% fewer new units in Q1 2022 compared to Q1 2021 (Source: Haig Report Q1 2022). Due to the lack of inventory, charging a premium above MSRP has allowed many of the big auto dealers to continue to bring in record profits.

Extraordinary Market Conditions

It is important to note the recent increase in overall operating revenues and gross margins for dealerships has been a large deviation from historical averages. Not only have we seen an increase in the enterprise value of dealerships nationwide, but also the market has experienced a record number of M&A transactions in the past year. According to the most recent Haig report for the first quarter of 2022, buy-sell activity for domestic acquisitions reached an estimated value of $588M, 35% higher than Q1 2021. Throughout 2021, approximately 50 dealerships were sold per month, with a total of about 640 dealerships trading hands (Source: Haig Report Q1 2022). Although it’s not expected to reach similar record levels of deal activity in 2022, the market is expected to remain strong as dealerships look for ways to strategically gain market share in a competitive industry.

As we begin to take a closer look at some of the biggest companies in the automotive industry, a clear picture begins to form as a result of the disruptions happening both inside and outside of these businesses. First, an increase in industry profits, almost across the board, has driven up the enterprise value of many of these dealerships. One of the largest public auto dealerships in the US, AutoNation, Inc., saw gross profits rise from about $3.5 billion in 2019 to almost $5 billion in 2021. The large increase in profit was propelled by an increase in used vehicle sales, a secondary car market that has experienced tremendous growth in recent years. Similarly, the next five biggest auto dealerships had profits increase on average by 55% from 2019 through 2021.

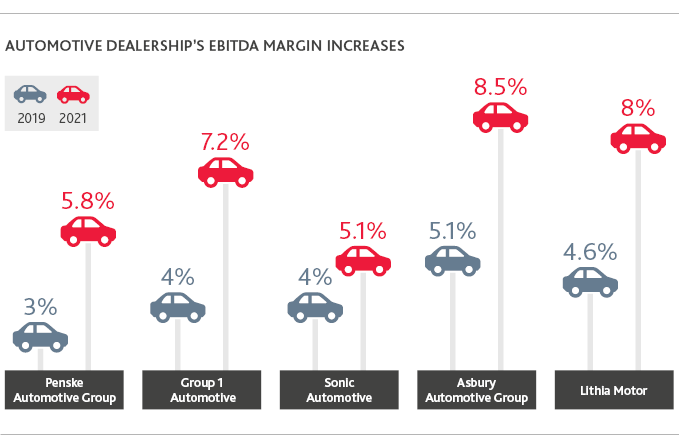

One factor that contributed to these record profits was the decreasing interest rate environment in the U.S. When rates were cut to nearly zero during the pandemic, auto dealerships took advantage of the borrowing opportunity. Floor plan interest expense decreased due to declining rates during the period, as well as a drop in outstanding amounts for floor plan arrangements as new vehicle inventory declined. AutoNation’s EBITDA margin has consistently hovered around 4.5% from 2010 to 2019, but in 2021 the company’s EBITDA margins skyrocketed to 8.0%. Over the last few years, many automotive groups saw similarly large increases in their own EBITDA margins (see side bar).

Another aspect affecting dealership enterprise values is the effect of inventory on new vehicle sales. For the same period, 2019 to 2021, inventory turnover ratios increased by 60% on average for the industry’s six largest players. A high inventory turnover ratio implies either strong sales or insufficient inventory. Auto dealerships should strive for a higher inventory turnover ratio because it means they are selling through their inventory throughout the year. Highlighting the lower supply of inventory and increasing sales is the average number of days inventory outstanding. This ratio measures the number of days that a company holds inventory before turning it into sales. In 2019, the industry’s average days of inventory outstanding was around 70.5 days but today it is approximately 44.2 days, representing a 26.3 day decrease from the beginnings of the chip shortage to today.

The looming question for valuation specialists remains: when, and to what extent, will these extraordinary market conditions normalize? In the meantime, several different weighting methodologies are being applied to account for the most recent years as outliers in the overall historical data of dealerships.

Valuing Dealerships in Unprecedented Times

The three fundamental approaches that are considered in a business valuation are the Income Approach, the Market Approach, and the Asset-Based Approach.

Income Approach

The income approach is a valuation process in which the income expected to be generated by an asset or business is converted into a value estimate. It is applied in valuing operating businesses and income-producing businesses. The income approach applies a basic valuation principle that the value of an ownership interest in a company is equal to the present worth of the future benefits of ownership. It reflects the price an investor is willing to pay now for future earnings and earnings-growth opportunities. Two common methodologies applied in business valuation under the income approach are the capitalized earnings method and the discounted future earnings method.

Financial forecasts or projections are rarely prepared in the auto dealership industry. As a result, valuation professionals tend to rely on the capitalization method to value an auto dealership. However, based on recent industry developments driven by extraordinary circumstances, appraisers may need to re-assess the income approach methodologies to be applied. Additionally, auto dealerships are heavily reliant on the national and regional economies and, therefore, it is important for the valuation professional to have a deep understanding of the subject company’s business operations and the impact of macroeconomic factors on the dealership.

Market Approach

The market approach is a valuation technique predicated upon the principle of substitution. One can determine a value indication for a business, business ownership interest, security, or asset by using one or more methods that compare the subject company to similar businesses, business ownership interests, securities, or assets that have been sold. Three common methodologies applied in business valuation under the market approach are the guideline public company method, the guideline transaction method, and the subject company transaction method.

Asset-Based Approach

The automotive industry frequently values dealerships under this approach, under which, the value of an auto dealership is the sum of the market values of its net tangible and intangible assets. The net tangible asset value is obtained from the adjusted net asset value and the intangible asset value is based on the franchise value. Franchise value, known as blue sky value, represents the value of the dealership in excess of the value of its physical assets and is obtained from market multiples. This approach is considered a combination of the market approach and the asset approach.

In addition to the three approaches defined here, there are typically normalizing adjustments that a valuation professional considers when performing a valuation of auto dealerships. These normalization adjustments are designed to provide better comparability to similar types of businesses within the industry. Some additional normalization adjustments a valuation professional might consider when valuing an auto dealership include:

Today’s Competitive Landscape

Haig Partners is an investment bank that publishes an industry report tracking trends in auto retail and their impact on dealership values. The report publishes multiples for 23 leading auto dealerships across the nation ranging from Porsche and BMW to Honda and Toyota. These multiples allow valuators to obtain market values for comparable assets by converting to a standardized value relative to a key statistic. In this way, experts can weigh up two distinct values when absolute prices cannot be compared. Porsche retains the top spot for highest multiple with an on average adjusted pre-tax profit multiple of 9.0 - 10.0x. Porsche dealerships bring the highest blue-sky multiples thanks to “scarcity, high profits, and ease of operation.” (Source: Haig Report Q1 2022). BMW also served as an interesting study, being the only brand to increase sales in Q1 2022 versus Q1 2021. According to a recent NADA survey, BMW ranks just behind Porsche and Lexus in dealer optimism due to their incoming lineup of new electric vehicles. BMW’s multiple range on average adjusted pre-tax profit is 7.5x - 9.0x.

It’s important to note, one of the reasons for higher multiples throughout the industry is that larger and larger transactions are occurring. When the buyer feels as if the transaction is strategic for future growth, they are willing to pay a larger multiple, to streamline years of work through other smaller acquisitions.

A Positive Outlook Amidst Challenges

Despite many of the challenges facing the automotive industry, there are many positive things occurring as well. First, there has been significant growth in the online presence of the major OEMs and traditional dealerships. Dealerships have been able to leverage new point of sale software that can increase sales by reducing purchase decision time and simplifying the information overload that can come throughout the car buying process. This type of technology has the potential to reduce costs by allowing for decreased inventory on-hand and consumers’ familiarity with technology will push the strongest proponents above their competitors. The objective for dealers should be to have an omni-channel sales presence that utilizes current sales channels in parallel with new technology, rather than eliminating one or the other.

Second, as demand in the industry rises, the necessity for new vehicle models will also increase. In August of 2021, the White House set a goal of 50% for electric vehicle sales, as a percentage of total new vehicle sales, by 2030. Cleaner, more energy-efficient vehicles are becoming more widely accepted as one of the big changes occurring in the industry. As consumer preferences, regulation, and technology shift towards the future, many experts believe that we are on the cusp of changes not seen since the Ford Model T. The direct influence these changes will have on assembly and production are yet to be seen but business expenditures in the space have shot up in the hopes of capitalizing on the needs of early technology adopters. In 2021, alternative-fuel powertrains accounted for 9.5% of all new vehicles sold during this year while battery electric vehicles, accounted for 2.9% of all new-vehicle sales (Source: NADA Data 2021).

With labor costs in the US continuing to increase, automation of the production process is becoming more and more attractive to cut company expenditures. Such efforts will continue to help bolster industry profit, despite unique volatility at times. Due to the great number of innovations occurring, the future for the automotive industry is going to be an interesting space to keep a close eye on over the next few years.

Third, top executives and industry experts alike predict the agency business model may become increasingly prevalent in the auto dealership industry. With a recent rise in demand, and limited supply availability, the agency model allows OEMs to thrive with less inventory on hand, and a more direct-to-consumer sales approach that has seen success in other industries. The agency model works by allowing the customer to place an order directly with the OEM (i.e. Ford) and subsequently choose their preferred delivery dealership. The preferred dealer becomes an agent of the manufacturer with no sales negotiation responsibility. The preferred dealer also serves as a test drive location, a transaction processor and delivery point while the sales price and commission are set by the actual manufacturer. Additionally, the dealer is no longer responsible for financing a fleet of inventory as all floorplan costs are upheld by the manufacturer.

According to head of VW sales in Germany, Holger B. Santel, “the agency model lays the contractual foundation for integrating online business and showroom-based business.” Utilizing the latest technology to their own advantage is going to bring success to many of the traditional OEMs. The strategy can also allow companies to focus on the customer experience by using their insights on consumer preferences to make informed, data-driven decisions. On the other hand, dealerships can grow into their role by offering a much broader line of services and ensuring the buying experience and follow-up process are seamless for every consumer. With an effective strategy in place, these cost-savings will greatly increase dealership enterprise values. Combined with a continuing rise in dealership M&A activity, the industry is amid “a perfect storm of profitability.”

Looking Forward

As with all current operating businesses, auto dealerships are attempting to better understand today’s economic climate to maximize revenue and provide the greatest amount of value to their respective customers. The auto dealership industry has seen tremendous disruption in the form of COVID-19, the Russia-Ukraine conflict, and supply chain issues. Despite these unique challenges facing executives today, the industry has seen margins balloon to all-time highs due to an increase in consumer demand and strategic pricing based on the lack of new car supply available in the overall market. For this reason, auto dealership valuations have increased significantly. Whether it be through external acquisitions or internal technological advancement, the major players in the space will be looking for new and creative ways to gain market share and maintain a lasting advantage over their competitors.

SHARE